Concept of Partial Audit

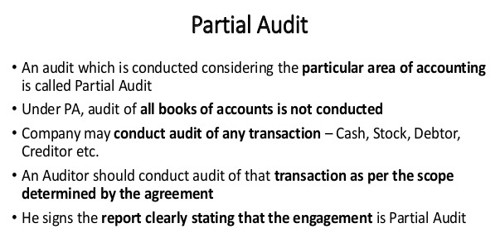

An audit which is conducted considering the particular area of accounting is known as a partial audit. It is an audit that is conducted considering the particular area of accounting. Under partial audit, audit of the whole account is not conducted. Audit of particular area where the owner thinks essential to conduct audit will be conducted. Generally, the transaction of business is related to cash, debtor, creditor, stock, etc. A business may conduct an audit of any of these transactions. Normally, a business transaction is concerned with cash, debtor, creditor, etc. These Audits are very useful for updating your In Stock Amount before large events, or for getting more frequent counts on your high-value items (e.g. counting proteins every week and counting your other items once a month). This audit is done only for a specific purpose; for example, to check the receipt side of the payment side of the cash book, to check cash sale, to check purchases or expenses only.

A partial audit is concerned with the part of accounting books and records or part of the year. An auditor should conduct an audit of that transaction as per the scope determined by the agreement. Method of conducting such audit is similar to other audit but an auditor should sign the report clearing stating the ‘partial audit’. There is one purpose only and in order to achieve it, the management can rely on a partial audit. If it is not done so, an auditor will be liable for the loss which is caused due to using the report as a complete audit. It is when an auditor is asked to audit only a part of the accounting system. Example: He may be asked to audit only the payment side of the cash book. The reason for calling out for a Partial Audit largely depends on the Management of the organization.