Executive Summary:

This study attempts to identify deposit service performance of all the nationalized & private commercial banks of Bangladesh in a portfolio. It identifies the similarity, difference and diversification of the deposit services available for the consumers and their choice to take them. The nationalized commercial banks and private commercial banks provide different deposit services for the consumers. It identifies the relationship between age, educational background, profession, types of deposit services obtained by the consumers in the banks and preference of consumers. A Survey questions has been performed with a structured questions to identify the factors that differentiate the deposit service provided by Private commercial banks (PCB’s) & nationalized commercial banks (NCB’s).The sample clients were selected from Dhaka City. 30 respondents were interviewed from several banks. In selecting sample, it was assumed that the bank clients of Dhaka City are more sensitive compared to other cities of Bangladesh, as their education level is higher. The sample clients were selected randomly at the banks while interviewing. Descriptive statistics was used in the analysis. Again observational method also used while making service portfolio data gathered from respective bank websites & several journals. Factor analysis was done to identify the service quality factors of the banks. The suvey related with the factors and age, educational background, profession, and types of deposit service obtained were identified to know the relationships. In order to explore the differences with the deposit service performances, data analysis was performed. Results show that the most important service quality factor of banks is not only the deposit services but also services related with deposits that will pull personal attention to the clients. It is also found that there is a significant difference between the expected and perceived service quality between PCB’s & NCB’s. A significant opinion of the consumers is observed.

Introduction:

Bank is very old institution that toward the development of any economy and is treated as an important service industry in modern world. Now a day the function of bank is not limited within the same as before. Due to modernization and expanding situation of economy, the banking sector is facing severe competition in any country. The overall performance of bank does not only depend upon the banking industry itself but also on the performance of economy where it is operating. Now a day bank deposits are one of the most performed service in the banks. For financial efficiency of peoples deposits are increasing day by day and Bangladesh is no exemption. In Bangladesh, Banks are distributing their branches all over the country. Now there are four categorized banks in Bangladesh and the branches around the country is more then 6000. Now people are not depositing for the growth of his assets. The differentiated services are introduced to the consumers and facilities are effective for consumers. Different deposits are making the way easier and simpler for businesses, overseas operation, fund transfer, easy liquidity in instant needs. Now the Islamic banking system is an innovative deposit banking system in banking sector.

Objective of the study:

In this study there will be a comparison of deposit services between nationalized commercial banks & private commercial banks.

Specific objective:

- Measure the deposit service performance of NCB and PCB.

- Make a comparison among these Nationalized Commercial Banks and Private Commercial Banks.

- Create a portfolio of these commercial banks those are operating in Bangladesh.

- Find out the roles that can be played by these banks which can contribute more to the economic sector.

- Create a portfolio of different deposits, interest rate of deposits, consumer satisfaction on the terms and amounts of deposits.

Overall objective of this study:

In this study, primary and secondary data have been used to analyze the NCB’s and PCB’s. There will be a brief portfolio and comparison between Nationalized Commercial banks and Private Commercial banks. The criteria will be general and retail banking services, Deposits, Interest Rates of deposits, financial performances and provide better services to their consumers.

Methodology

In order to prepare of this project report more meaningful and comprehensive, there is two sources of data and information has been used.

Primary Data:

- Direct conversation with the respective officers, executives and staffs of the banks.

- Formal and informal discussion with the clients

- Taking interview bank executives

- Observing banks for perception.

Secondary Data:

- Annual reports of Nationalized and Private Commercial Banks

- Studying different books, research paper, banking functions

- Websites of the NCB’s and PCB’s.

Data Sources:

This thesis report is made by the client’s perception about deposit service performance about these banks. Primary data has been collected by questionnaire survey and secondary data has been collected from the annual report of the seven banks and annual report of the Bangladesh Bank.

This overall study represents Nationalized Commercial Banks and Private Commercial Banks based on seven banks of Bangladesh. They are as follows:

Nationalized Commercial Banks

- 1. Sonali Bank Ltd.

After the independence of our country Sonali Bank limited was been made by emerging National bank of Pakistan, Premier Bank and Bank of Bhawalpur. It is the largest and leading commercial bank of Bangladesh under proclamation of bank’s nationalization order 1972 (Presidential Order-26). Sonali Bank has been converted to a Public Limited Company with 100% ownership of the government and started functioning as Sonali Bank Limited from November 15 2007 taking over all assets, liabilities and business.

No. of Branches: Inland – 1198

Abroad- 2

- 2. Agrani Bank Ltd.

Agrani Bank Limited is a nationalized commercial bank with 879 outlets strategically located in almost all the commercial areas throughout Bangladesh, overseas Exchange Houses and hundreds of overseas Correspondents. Agrani Bank was emerged as a nationalized commercial bank in 1972 immediately after the emergence of Bangladesh as an independent state.

No. of Branches: Inland – 903

Abroad- 0

Private Commercial Bank

1. One bank Limited

One bank limited was incorporated in May 1999 as a private commercial bank with registrar under the Joint Stock company Act. 1994. The bank is entitled as The Third Generation Private Commercial bank. The bank dedicated in the business line of taking deposits from public through its various saving schemes and lending the fund in various sector at a higher margin.

Number of branches – 59

2. Jamuna bank limited

Under the Company Act, 1994 Jamuna Bank was registered as a Private commercial bank and started its banking operation on 3 June 2001. Jamuna Bank is a third generation bank of Bangladesh. The bank focuses on being with time, managing change, Developing human capital, creating true customer’s value. The bank gives various support fortrading, commerce, industry and businesses of the country. Beside the banking operations, banks finances are available for the local entrepreneurs for trading, business. Jamuna Bank offers both conventional and Islamic banking through designated branches.

Number of branches – 83

3. Social Islami bank Limited

The Social Islami Bank Limited was established in 22 November, 1995 based on Sharjah Principles till now keeping their banking operation as a second-generation bank. The bank has a concept of three sector banking model in one by targeting poverty. The bank focus on areas of SME and Agro-finance emphasized on alternative delivery channel under which SMS banking and mobile based remittance payment systems. The bank launched internet banking and some new products.

Number of branches – 76

4. Dutch Bangla Bank Limited

Dutch-Bangla Bank Limited (DBBL) is a private commercial bank of Bangladesh. DBBL is the most innovative and technically advanced bank. The bank has the largest Automated Teller Machine (ATM), the mobile banking services etc. Now DBBL is focusing on CSR. The bank is donating in the social causes of Bangladesh (Students Stipend). Dutch-Bangla Bank intends to pave the way for a new era in banking sector.

Number of branches – 125

5. AB Bank Limited

This is the first private commercial bank in banking sector of Bangladesh incorporated on 31st December 1981 and started operation effectively from April 12, 1982. AB bank has eighty five branches in Bangladesh and one foreign branch is situated in Mumbai, India. For overseas operation of banking related services, AB Bank has a correspondent relation in 58 countries of the world with more than 220 international banks. The bank has a strong growth for loan and deposit. Deposit amount of bank rose by Tk. 1518 cr ie. 28.45% while diversified Loan portfolio grew by over 30% during the year and recorded a Tk. 1579cr increase.

Number of branches – 86

Sampling Design & Framework:

In this report, both observation methods based on depository service provided by all Nationalized and private commercial banks and question survey on the clients. The sample clients were selected from the selected banks of Dhaka City. Stratified sampling has been used for sampling design. 30 Sample clients are selected from more than 10,00,000 clients who are keeping deposits in the banks.

Scope and Limitations:

The banking sector of Bangladesh is a large sector. I have tried my best to learn most of the functions of depository services. The banks diversified the deposit services different ways. It is tough to identify the similar products for the fulfillment of the report. I mostly covered the information. There is some several comparisons which shows the deposit schemes with similar products which shows the differentiation between same and semi-different services.

The banks are large financial institutions which are influence the economy of Bangladesh. Therefore it is not so easy and possible to make a fulfill project within a short time. The time for making this report is 3 months which is very short time. Banks deposit information is contradictory for publish. Because of this reason I had to collect information on the clients perception which are related to this project. The information of this report has collected on 30 clients opinion so the report could be bias by the survey. The recent years information is not available that why I have to use the information for past several years. During the unexpected political circumstances it became very difficult and impossible for me to collect the information’s for the project.

Overview study of Banks:

In Bangladesh, banks are main vehicles for mobilizing invisible funds and channel those funds to faster the growth of productive sectors of the economy in the absence of a healthy capital market. Hindustan Bank was the first bank at Calcutta (near Bangladesh) established in1784. The Bengal Bank was the first British-patronized bank in India. Dhaka Bank started to operate as a commercial bank in 1806. The Bengal Bank opened its first branch in Dhaka by purchasing Dhaka Bank in 1862. In 1873, it opened its two branches in sirajgonj and Chittagong. Another branch of Bengal Bank was opened in Chandpur in 1900. Six branches of Bengal Bank were in operation in the Bangladesh region until the partition of Bengal in 1947 and these branches were located at Dhaka, Chittagong, Mymensingh, Rongpur, Chandpur and Narayangonj. The banking system grew slowly during the British and Pakistan periods. There were only 25 bank branches in 1901 and the number grew to 668 in 1946.

Bangladesh Bank, The central bank of Bangladesh was set up on 16th December 1971 by the Bangladesh Bank Order 1972. The government accepted the assets and liabilities of the Deputy Governor’s office of the State Bank of Pakistan in Dhaka and declared the Bangladesh Bank as a fully effective and permanent central bank.

After the creation of Bangladesh, banking system started functioning with 1,130 branches of 12 banks inherited from Pakistan. These banks were renamed after being merged. The banks were The Sonali Bank (The National Bank of Pakistan, The Bank of Bawalpur, The Premier Bank), Agrani Bank (Habib Bank, Commerce Bank), Janata Bank (United Bank, Union Bank), Rupali Bank (Muslim Commercial Bank, Standard Bank), Pubali Bank (Australasia Bank, Eastern Mercantile Bank), Uttara Bank (Eastern Banking). The government nationalized all the commercial banks and financial institution. But during 1982-83 government allowed commercial bank to operate in private sector side by side with the public sector banks to start a meaningful and constructive competition in the banking sector. Several analyses have been done to identify which sector is able in the lead position. But it is commonly believed that the NCB’s are engulfed with the vicious problems of corruption, inefficiency, loan default etc although the private commercial banks are efficient in their commercial activities and solving the problem of loan default.

Number and Types of Banks

Bangladesh is a poor country, but the banking sector has improved a lot due to proper necessary and fastest action. The banking business is a profitable business in Bangladesh. All kind of secure and easy facilities of standard banking system is available in the banks of Bangladesh. This sector has improved a lot due to good policymakers, efficient manpower’s and proper steps by the Bangladesh government. Western Union, IME, Money Grams are the safest and easiest way for receiving the foreign currency. But all modern facilities are only available in the biggest cities.

There are 54 different commercial banks in Bangladesh. Among them, total number of Nationalized commercial banks are 03, Private commercial banks are 32, foreign banks are 10 and state-owned development banks are 09.

In urban area total numbers of branches of state-owned are 1,238 and rural 2,146 while specialized are accordingly 155 and 1,203. Although in urban area private bank’s branches are 1,295, in the rural area has only 490. It is very painful to say that there are 49 branches of different foreign banks in the urban area, but not a single branch till now for rural area till now. But, ratio of total banks for urban area is 41.62% and for rural 58.38%.

Numbers and Types of Banks |

Nationalized Commercial Banks (NCB’s) (03) | |

1. | Sonali Bank Limited |

2. | Agrani Bank Limited |

3. | Janata Bank Limited |

Private Commercial Banks (PCB’s) (32) | |

| Pubali Bank Limited | |

| Uttara Bank Limited | |

| National Bank Limited | |

| The City Bank Limited | |

| United Commercial Bank Limited | |

| Arab Bangladesh Bank Limited | |

| Islami Bank Limited | |

| BRAC Bank Limited | |

| Eastern Bank Limited | |

| Prime Bank Limited | |

| Southeast Bank Limited | |

| Dhaka Bank Limited | |

| Mutual Trust Bank Limited | |

| Dutch-Bangla Bank Limited | |

| Islami Bank Bangladesh Limited | |

| IFIC Bank Limited | |

| National Credit and Commerce Bank Limited | |

| Mercantile Bank Limited | |

| Al-Arafah Islami Bank Limited | |

| Social Islami Bank Limited | |

| Standard Bank Limited | |

| One Bank Limited | |

| Exim Bank Limited | |

| Bangladesh Commerce Bank Limited | |

| First Security Islami Bank Limited | |

| The Premium Bank Limited | |

| Bank Asia Limited | |

| Trust Bank Limited | |

| Trust Bank Limited | |

| Jamuna Bank Limited | |

| Social Investment Bank Limited | |

| Shahjalal Islami Bank Limited | |

Foreign Commercial Banks (FCB’s) (10) | |

| Citibank | |

| HSBC | |

| Standard Chartered Bank | |

| Commercial Bank of Ceylon | |

| State Bank of India | |

| Habib Bank Limited | |

| National Bank of Pakistan | |

| Woori Bank | |

| Bank Alfalah | |

| ICICI Bank | |

Specialized Development Banks (SDB’s) (9) | |

| Karmasangsthan Bank | |

| Bangladesh Krishi Bank | |

| Rajshahi Krishi Unnaayan Bank | |

| Progoti Co-operative Landmortgage Bank Limited(Progoti Bank) | |

| Grameen Bank | |

| Bangladesh Somobay Bank Limited(Cooperative Bank) | |

| Ansar VDP Unnyan Bank | |

| BASIC Bank Limited | |

| Bangladesh Development Bank Limited | |

Common Services provided by NCB’s and PCB’s

General Banking

The principle activities of the bank are banking and related business. The banking business includes deposits taking, extending credit to corporate organizations, retail and small & medium enterprises, trade financing project financing, lease and hire purchase financing, issuance of local and international credit cards, inward foreign remittance etc. The mode of banking includes conventional and Islamic banking. The NCB’s and PCB’s are uses several sections in general banking.

1. Account Opening Section

Account opening is the easiest way for creating a relationship between customers and the bank. This binds the banks and clients into a formal and contractual relationship. Banks always tries to get the highest customers then the others. But selection of consumers for opening an account is very crucial for banks because all kinds of fraud and forgery start in that time. That’s why the banks take extremely conscious and cautious measure during the consumer selection.

2. Cash Section

The cash Section of any branch plays very significant role in general banking department. It deals with most liquid assets that every bank has an equipped in cash section. This section receives cash from depositors and pay cash against cheque, draft, PO and pay in slip over the counter.

3. Remittance Section

Remittance of funds is ancillary services of banks. Its aids to remit fund form one place to another place on behalf of its customer as well as non-customers of bank. Most of the banks have its branches in the major cities of the country and therefore, its serves as one of the best mediums for remittance of funds from one place to another.

The main instruments used by banks are:

- Pay Order/ Banker’s cheque.

- Demand Draft.

- Telegraphic Transfer.

4. Closing of an Account

An account can be closed for two reasons.

- By Banks: if any customer doesn’t maintain any transaction within six years and the A/C balance becomes lower than the minimum balance, banker has the right to close the account.

- Willingness of Consumers: If any consumer wants to close his account, he write an application to the manager for closing the account.

General Bank Deposits

The general bank deposits are usually made of opening an account in the banks. The account holder can be an individual person, partners, sole business proprietor etc. The rightful owner of the account has the right to withdraw any particular deposited fund as the terms and conditions of the account. The accounts of deposit become liabilities for the bank and cash, cheque and online transfers of money become assets for the banks.

There are common bank deposits in all the banks. These deposits are found in the NCB’s and PCB’s. The banks are using these service deposit accounts for consumer services. Consumers are using these services by their own choice. The services are-

1. Current Account

This account is the common account in all the banks. The account is meant for facilitating day to day transactions of different business entities, non-profit organizations, Government, Semi Government, Autonomous bodies, Sector corporations and different other organizations/ institutions, club, societies, Trust etc. There are no interest facilities for current account. The customer can withdraw money when he wants.

The NCB’s and PCB’s provide facilities on current account:

Nationalized Commercial Banks | Private Commercial Banks |

|

2. Saving Account

Any citizen residing home or abroad may open savings account in every commercial bank. This account can be opened in any branch of banks by any citizen of the country in the name of an individual or a group of individuals which can be operated singly or jointly.

The NCB’s and PCB’s provide facilities on saving account:

Nationalized Commercial Banks | Private Commercial Banks |

|

3. Fixed Deposit Account (FDR)

Fixed Deposit Account is the third common accounts of the banks. This account provides a fixed time for deposit and pays the higher interest rate for the deposit. Interest rate for the fixed term deposit applicable is for the time period of 1 month and above, 3 months and above, 6 months and above, 1 year and above but less than 2 Years and the rates of interest ranges between 7% to 12.50%. Different bank gives several interest rates for different fixed deposit schemes.

The NCB’s and PCB’s provide facilities on fixed deposit account:

Nationalized Commercial Banks | Private Commercial Banks |

|

Special Bank Deposits (Nationalized Commercial Bank)

Nationalized commercial banks are now issuing various deposit scheme. Following depository schemes are provided by Sonali Bank Limited and Agrani Bank Limited.

1. Bank Deposit scheme:

This is a Savings Scheme in which a person gets the opportunity to build up savings by contributing monthly installments and receives an attractive fixed amount at the end of a specified term. This account is opened by any person of individual. The Scheme is designed to help the fixed income group to save money and build up sizable funds with which they can go for some income generating venture to improve the quality of their life and/or meet any future financial obligations.

2. Education Deposit Scheme:

This scheme provides a unique opportunity to the parents to make a future provision for the educational expenses of their children when they enter into Schools, Colleges and Universities out of the benefit of a small amount of savings with the Bank at an opportune moment. The time of the deposit is about 5 to 10 yrs.

3. Medicare Deposit Scheme:

This scheme provides a unique opportunity to the parents to make a future provision for the educational expenses of their children when they enter into Schools, Colleges and Universities out of the benefit of a small amount of savings with the Bank at an opportune moment.

4. Rural Deposit Scheme:

This rural deposit scheme provides a good opportunity for the rural people. The people earn and determine to save some money for future expenses. It is a long term deposit schem and the banks will pay higher interest following terms of rural people.

5. Marriage saving Scheme:

Marriage saving scheme provides a unique opportunity to the parents to make a future provision for the marriage expenses of their children when they will marriage and benefit of a small amount of savings with the Bank at an opportune moment.

6. Double Benefit Scheme:

Double benefit scheme is now a very popular scheme for the people. This deposit scheme is a different than others. The installment amount has to be paid once in the bank. Several years later the bank will return the double amount of deposited amount. In terms of saving in this scheme the nationalized commercial banks are giving a higher interest rate and some unique opportunity for this scheme.

7. School Banking Scheme:

This scheme provides a unique opportunity to the students to make a future provision for their educational and other expenses when they enter into Schools, Colleges and Universities. This scheme also makes contemplate for saving of the students.

8. Daily Profit Banking Scheme:

The daily profit banking scheme is a running account. A good level interest rate will be paid for daily saving. The minimum deposit rate is higher because of the account holder must keep a very generous amount of money for the account.

9. Hajj Saving:

Hajj Saving is for those people who are intend to go for Hajj. Because of the prevailing socio-economic situation in the country, the people interested to perform Hajj cannot arrange the required amount of money at a time to perform Hajj. Financial solvency is pre-requisites of performing Hajj. The majority of the people cannot arrange the required amount of money for Hajj.

10. Farmers Account:

The farmers account is to encourage farmers for savings in banks. The govt. provides various financial services to the farmers through banks. Banks are also giving other opportunity for remittance from abroad. More the 13 lacs farmers are opened this bank account.

Special Bank Deposits (Private Commercial Bank)

Private commercial banks are issuing various deposit schemes. Following saving scheme are provided by National Bank, Prime Bank, Jamuna Bank, AB bank and One Bank.

1. Contributory saving scheme:

This is a Savings Scheme in which a person gets the opportunity to build up savings by contributing monthly installments and receives an attractive fixed amount at the end of a specified term. The Scheme is designed to help the fixed income group to save money and build up sizable funds with which they can go for some income generating venture to improve the quality of their life and/or meet any future financial obligations.

2. Education Saving Scheme:

This scheme provides a unique opportunity to the parents to make a future provision for the educational expenses of their children when they enter into Schools, Colleges and Universities out of the benefit of a small amount of savings with the Bank at an opportune moment.

3. Short Term Deposit:

A short term deposit (STD) account is a running account with amounts being paid into and drawn out of the account continuously. These accounts are generally opened by Business Organization, Public Institution, and Corporate Bodies. It is an interest bearing deposit. Interest is calculated on daily basis as per Banks Prescribed Rate and is credited to account on half yearly basis.

4. Double Benefit Deposit Scheme:

A short term deposit (STD) account is a running account with amounts being paid into and drawn out of the account continuously.

5. Resident Foreign Currency Deposit Account:

Persons ordinarily resident in Bangladesh may open and maintain Resident Foreign Currency Deposit (RFCD) accounts with foreign exchange brought in at the time of their return from travel abroad.

6. Non Resident Taka Account:

R The Taka accounts maintained with banks in Bangladesh by private individuals, firms and companies resident outside Bangladesh are known as Non-resident Taka Accounts.

R The accounts of foreign nationals residing in Bangladesh and foreign firms and companies located and operating in Bangladesh and accounts of U.N. and its organizations are, however, treated as resident accounts and kept outside the scope of Exchange Control.

R The accounts of Bangladesh nationals who leave the country except those who hold office in the service of Bangladesh Government are required to be treated as non-resident Taka account so long they remain outside Bangladesh.

R Prior permission of Bangladesh Bank is necessary for opening non-resident Taka accounts.

R Non-resident Taka account may, however, be opened without prior permission of Bangladesh Bank for crediting the proceeds of remittances received from abroad through normal banking channel.

7. House Building Deposit Scheme:

R The depositor will have the option to choose any installment size at the time of opening of the A/C. and will not be allowed to change the size of installment afterwards. A person can also open more than one account but House Building Loan facility shall be on one account only.

R Account in the name of minors can be opened too under the Scheme but without insurance coverage.

8. Monthly Benefit Deposit Scheme:

This is a Deposit Scheme where the depositor gets monthly benefit out of his deposit. The scheme is designed for the benefit of the persons who intend to meet the monthly budget of their families from the income out of their deposit.

9. Lakhopoti Deposit Scheme:

Monthly Installment size, tenure and terminal value of the scheme will be as follows:

At present no income tax will be deducted from the interest earned. But in future for any change in the government policy Bank reserves the right to deduct income tax.

The depositor will have the option to choose any installment size and period at the time of opening of the account and will not be allowed to change the size of installment afterwards. A person can open more than one account for any size of installment in any branch of the Banks.

Account in the name of minors can be opened too under the Scheme as per standard procedure for minor accounts.

The specified amount on maturity at any slab shall be paid after one month from the date of deposit of the final installment.

The installment shall be payable by the 8th day (in case of holiday the next working day) of every month. Advance payment of any number of installments is acceptable.

R If a depositor fails to pay 3 (three) consecutive installments he will have to pay 5% fine of the overdue installments to regularize the account. If he fails to pay more than 3 (Three) installments he will cease to remain under the purview of the scheme and the deposit will be treated as Savings Bank deposit and interest will be paid on the deposited amount at prevailing SB A/C rate subject to completion of 1 (one) year of its opening.

10. Foreign Currency Account:

Bangladesh nationals residing abroad, foreign nationals residing abroad or in Bangladesh, foreign firms registered abroad and operating in Bangladesh or abroad, and foreign missions and their expatriate employees in Bangladesh can open Foreign Currency (FC) accounts. The salient features of the Scheme are given below:

Foreign exchange earned through business done or services rendered in Bangladesh cannot put into this account.

Credits to a foreign currency account may be made against inward remittances of foreign exchange in any form or by transfer from another FC account.

Local as well as foreign payments may be made freely from foreign currency accounts.

No payment in foreign exchange can be made to or on behalf of any resident in Bangladesh. Payments from these accounts received by residents, unless generally or specifically authorized by Bangladesh, must be converted into Taka.

Banks may pay interest on such accounts at rates determined from time to time.

Different types of Foreign Currency Account include the following:

- FC Accounts of Overseas Bangladesh Nationals

- FC Accounts of Duty Free Shops

- FC Accounts of Joint Venture Contracting Firms

- FC Accounts of Bangladeshis Working in Foreign organizations

11. Non Resident Foreign Currency Deposit Account:

All non-resident Bangladesh nationals and persons of Bangladesh origin including those having dual nationality and ordinarily residing abroad are entitled to maintain interest bearing time deposit account named “Non-Resident Foreign Currency Deposit (NFCD) Account” with the Authorized Dealers. These accounts may be maintained in US dollar, pound sterling, Euro or Japanese yen; initially with minimum amount of US$ 1000 or pound sterling 500 or equivalent.

12. Non Resident Investor’s Taka Account:

The non-resident investor shall open a Non-resident Investor’s Taka Account (NITA) with any branches of banks, with freely convertible foreign currency remitted from abroad through normal banking channel or by transfer of funds from the non-resident investor’s foreign currency account, if any, in Bangladesh. The salient features of the Scheme are given below:

No local funds from any sources other than those mentioned at (1), (4) and (5) above can be credited to NITA.

No loan facilities shall be allowed by the ADs in the Non-resident Investor’s Taka Accounts.

Millionaire schemes.

Islami Banking Deposits

Islamic banking activity consists with the principles of sharia law and its practical application through the development of Islamic economics. Sharia prohibits the fixed or floating payment or acceptance of specific interest or fees (known as riba, or usury) for loans of money. Investing in businesses that provide goods or services considered contrary to Islamic principles is also haraam (“sinful and prohibited”). Although these principles have been applied in varying degrees by historical Islamic economies due to lack of Islamic practice, only in the late 20th century were a number of Islamic banks formed to apply these principles to private or semi-private commercial institutions within the Muslim community.

Following islami deposits schemes are provided by the Social Islami Bank Limited

Mudaraba Term Deposit (MTD)

Mudaraba Term Deposits are accepted by the bank with a sum of Tk. 5000 or above (multiple of 1000) from individuals (single and joint), firms (propietorship/partnership), limited companies, autonomous bodies, charitable institutions, association, educational institution, local bodies, trusts, etc, against issuance of non transferable receipts in acknowledgement of MTD account may be opened in the names of minors jointly with their guardians. The mudaraba term deposits are accepted for periods of 12, 24, 36 months. Weightage on the rate of return is given to deposits of longer maturity.

Mudaraba Saving Account (MSD)

The Mudaraba Saving Account is the general saving account. By depositing a minimum amount any depositor or multiple depositors can open single or joint account. Any educational institute, club, association or social institutes can open this account. The rate of interest is 3.5% of Mudaraba Saving Account.

Al-Wadiah Current account (individual) (AWCD)

Al-Wadiah Current deposit accounts are opened on proper introduction with minimum initial deposit fixed by the Bank. Al-Wadiah deposit is accepted on Al-Wadiah principles which mean al Amanah with permission to use. According to this principle Bank can use the fund of the account along with other funds as per Shariah at bank’s own risk. Account holder(s) will not share any profit/loss.

Mudarabah Special Notice Account

Any private and public limited companys, business entity, partnership account, debt of gov. Organization, Non-Government educational institution, Madrasha/Muktab, club or society, and trust or any person can open this account. This account is operated under Mudaraba principle. Any amount can be withdrawn or transferred to all wadiah current account or any other accounts after placing a notice of seven days.The profit rate is comparatively lower.

Deposit Account

Mudaraba Saving Deposits (MSD)

This is profit bearing deposit account. The drawings are restricted in the respect of both the amount of withdrawal and the frequency three of so the payment of interest does not become any compensating for the banker. Some time the restrictions are ignored against the depositor’s written confirmation to forgo his claim for interest on the total balance for the whole month of withdrawal.

Special Saving Scheme

1. Mudaraba Hajj Saving Scheme

A person intended to perform Hajj within 1 to 10 years can open this account for a period at his convenience. A year is divided into 12 installments. Profit is given for the daily balance based on a weight of 1.1%. There is no provision for withdrawal.

2. Mudaraba Education Scheme

The success of the Mudaraba deposit account has introducer another saving Scheme namely “Mudaraba Education Scheme” Parents can secure their children’s proper education. At every stage of your children’s educational life this scheme remains by your side to lighten your burden. The scheme can be run for 3, 5 and 10 years. The scheme holders shall get up to 80 percent investment facility on total deposit.

3. Mudaraba Millionaire Scheme

People of Bangladesh are the Following of Islam. They are mostly interested to make interest free deposit. Taking these Facts into consideration of Islami banks introduced a monthly installment based “Mudaraba Millionaire Scheme”. The duration of this Scheme will be 15, 20 and 25 years.

4. Mudaraba Special Saving (pension) Scheme(MPS)

Any Bangladeshi person aged abode 18 years and having sound mental condition can may open this scheme. To open this account there must be a signature of a valued introducer. Parents or legal guardians can open this scheme in the name of their underage children.

5. Mudaraba Monthly Profit Deposit Scheme (MMPD)

To lead a tension free life as your monthly expenses can now easily be met by this scheme as you shall be entitled to a fixed amount of profit per month by depositing a fixed amount. It can be a relief for a retired person. The scheme holders shall be paid fixed amount of profit per month for several years while by depositing minimum amount. The amount of monthly receivable profit is equivalent to total deposit. The scheme holders shall get annual charge free Debit card and Credit card of the bank.

6.Mudaraba Lakhopati Deposit Scheme (MLDS)

In this scheme make lakhopati within short time. The duration of the year should be two, three, five and ten years.In this seheme, scheme holders are invested 80% money on total deposit amount after opening two years. Scheme holders open saving account in the bank. Scheme holders are take Debit and Credit card on the bank. Debit and Credit card annual charge full free. Before maturity the scheme holders withdraw deposit money then profit given as saving account.

Result and analysis from Questionnaire Survey

Demographic Factors

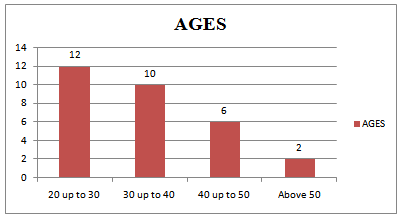

AGE:

The survey on 30 recipients and the most range between 20 to 30 and 30 to 40.

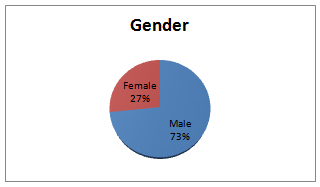

GENDER:

The survey on 30 recipients and the most range between 20 to 30 and 30 to 40.

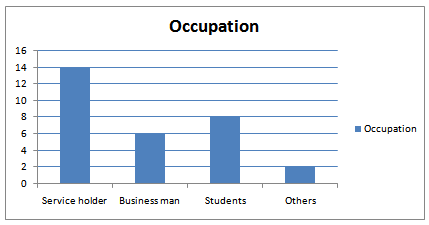

GENDER:

Among the 30 recipients most of them are service holder, students and businessman.

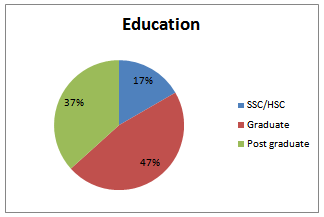

Education:

The education level of our surveyed recipients are mostly Graduate (47%) and Post Graduate (37% ).

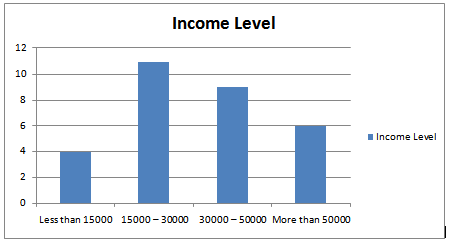

Income Level:

Recipients income level ranges mostly 15000-30000 Taka and 30000-50000 Taka.

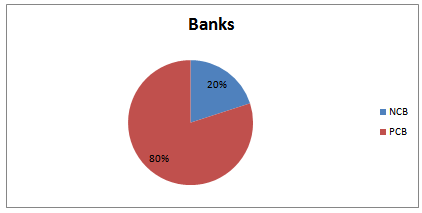

Clients preferred Bank deposit services

For deposit services the recipients prefer Nationalized Commercial Bank (80%) and private commercial(20%)

Deposit accounts/depository services owned by clients

| Accounts | Frequency | Percent(%) |

| Current A/C | 7 | 23 |

| Saving A/C | 17 | 57 |

| Fixed Deposit Account | 4 | 13 |

| Others | 2 | 7 |

| Total | 30 | 100 |

Reason for choosing this/these deposit services

Frequency | Percent (%) | |

| Interest Rate | 12 | 40 |

| Duration of time | 8 | 27 |

| Others | 10 | 33 |

| Total | 30 | 100 |

Client’s opinion about the depository services

Frequency | Percent (%) | |

| Good | 14 | 47 |

| Satisfactory | 16 | 53 |

| Total | 30 | 100 |

Opinion to keep deposit services more by clients

Frequency | Percent (%) | |

| For Long Time | 18 | 60 |

| For several Time | 10 | 33 |

| No More | 2 | 7 |

| Total | 30 | 100 |

Comparison between deposit services between NCB and PCB

Frequency | Percent (%) | |

| Good | 16 | 53 |

| Satisfactory | 14 | 47 |

| Total | 30 | 100 |

Consumers thinking to have more depository services in the other banks

Frequency | Percent (%) | |

| Not interested | 25 | 83 |

| Planning to take | 5 | 17 |

| Total | 30 | 100 |

Clients opinion to have no more accounts

Frequency | Percent (%) | |

| No more accounts | 20 | 67 |

| Other financial institution | 3 | 10 |

| others | 2 | 7 |

| Total | 25 | 83 |

Clients plan/preference for new deposit service in other bank

Frequency | Percent (%) | |

| NCB | 1 | 3 |

| PCB | 2 | 7 |

| Others | 2 | 7 |

| Total | 5 | 17 |

Deposit accounts clients are planning to take

| Accounts | Frequency | Percent(%) |

| Current A/C | 1 | 3 |

| Saving A/C | 2 | 7 |

| Fixed Deposit Account | 1 | 3 |

| Others | 1 | 3 |

| Total | 5 | 17 |

Special deposit schemes owned by consumers

| Accounts | Frequency | Percent(%) |

| Education Saving Scheme | 1 | 10 |

| Marriage Saving Scheme | 2 | 13 |

| Medical Saving Scheme | 1 | 17 |

| Other/ Don’t have any | 1 | 60 |

| Total | 30 | 100 |

Consumers perception about Nationalized/Private commercial banks can give you more financial support then their desired bank

Frequency | Percent (%) | |

| Yes | 7 | 23 |

| No | 23 | 77 |

| Total | 30 | 100 |

Comparison between Nationalized Commercial Bank’s and Private Commercial Bank’s

The deposits of the banks are not very much very different of any bank then the other banks. But the problems are related with the deposits are diversifying them for choosing by the consumers.

From the distribution perspective of branches we can say that PCB is for mainly urban area and NCB is for mainly rural area. If we think about PCB first then we can see they are mainly emphasis on differentiated deposits and its related services. To have this idea of differentiated product there is a need of sort of knowledge. Basically urban people have some sort of this knowledge because literacy rate is much higher in urban area than rural area. And also rural people don’t want to be familiar with all these technological staff. They much more rely on manual process not automated. For example transfer of money from one account to another account by telegraphic transfer (TT) not by online money transfer. Now if we think about NCB they are mainly for rural people because whatever the process they are using to open an account or taking a loan, that same process was also same in past few decades. Even though we can see that a number of branches of PCB are available in rural area and vice-versa a number of NCB is available in urban area. But NCB has got huge number of branches than PCB.

Now one of all the most important perspective that customer’s are looking for diversified products. Because diversified products offers a consumer number of different facilities. Now a day’s PCB is very effectively maintaining this business from this perspective. But we are not saying that Islami Bank or NCB does not have diversified products. They all have differentiated products all over Bangladesh but in terms of PCB it is less.

In terms of money we choose more productive (like more interest, bonus) deposit schemes in less time. But now there are many other terms are coming forward. Due to globalization many systems are introducing to us for easier lifestyle. Now a day a consumer wants to go that bank which can give him a better and quick service. The PCB’s are giving short and quick banking services. From this perspective PCB is maintaining its leading position because NCB is not that much efficient in providing better and quick service.

The well-known PCBs are providing online Banking, Internet Banking, Home Banking, Electronic Banking Services for Windows, Automated Teller Machine (ATM), Tele Banking, Mobile Banking, Debit and credit card banking. Through these technological facilities a client can easily pay, draw, fund transfer his money from instantly. So he doesn’t need to go to the bank and deposit money and waiting for the transfer process. For an example Dhaka Bank, Dutch Bangla Bank is providing this type of facility. So far it is not provided by any NCB or FB or IB. So customer prefers to go in PCB.

From the perspective of consumer perception, some customer has the perception that it is better to go in NCB than PCB. Even though they aware of the products and service of PCB, they still wants to be a client of NCB. In our country many customer has less reliability on NCB than PCB. They think that any time PCB could be bankrupted. If it happens then they will lost all their money and these money can be never recoverable. As there is no chance to be bankrupted in case of NCB, so they prefer to go NCB.

By observation, we have found that some customers like non-banking financial institution (NBFI) rather than banks. NBFI provides better facilities for those accounts. Those consumers are satisfied having those services. The services they get are much easier from them.

Findings and Analysis

After analyzing the performance evaluation of selected nationalized commercial banks of Bangladesh, we still find that there is some major results. Those are:

- PCB’s advantage is provides higher rate of interest in deposits and lower in loans.

- PCB are trustworthy bank for consumers.

- PCB are not charge for their service and provides interest on Current Deposit Rate.

- Political influence is very high in all PCB’s.

- Employees are not honest and sincere.

- PCB’s are affected by huge political turbulence situation

- Recovery the Defaulters loan is a prolonged procedure.

- There is lack of honest, sincere & capable entrepreneur.

- Nepotism & favoritism frequently occurs in terms of selection & promotion policy.

- In PCB’ there are lack of honesty, sincerity & commitment of bank officials.

- There are technological disadvantages in the PCB’s.

- In time of modernization, PCB’s have few ATM Booth, and some has no booths.

After analyzing the performance evaluation of selected private commercial banks of Bangladesh, we still find that there are some major results. Those are:

- Overall Environment of the bank is very nice and environment friendly for the clients.

- All NCB’s are trying to provide quick services.

- Employees of PCB’s are well behaved, Smart and Professional. For this reason clients become more influenced by PCB’s

- Every bank executives, officers and employees are well Knowledgeable about the services.

- PCB’s provides better Online banking, ATM Services for the clients.

- Director’s influence is a disadvantage for the NCB’s.

- Nepotism & favoritism happens in recruitment, selection & promotion policy.

- In PCB’s there are lack of honesty, sincerity & commitment of bank officials.

Recommendation:

To solve the private commercial bank’s problem we have some recommendation. The Recommendations are as follows:

- They should work without any influence of political leader & There directors.

- Government should create some law to recover defaulting loan.

- Nepotism & favoritism in recruitment, selection & promotion policy should be avoided.

- They should increase their service level.

- Their employees should be more honest, sincere& committed.

All those major challenges faced by NCB mentioned above are taken into consideration from the perspective of Sonali Bank and Janata Bank. To solve these problems some recommendation are given below:-

- One of the most positive sight of NCB is they have nationwide network which is not available among any private commercial bank. Sonali bank has around 1198 and Agrani has around 903 branches. If it is possible to generate profit from all of these branches it will highly increase their profit margin. Some of their branches are losing branch. If somehow they can close those branches or merge with another profitable branch then these banks can reduce their losses.

- As previously mentioned in one of the major problems that lack of skilled manpower but these banks has experienced manpower which is a big asset for them. If they could bring more experienced manpower for their top management than chances of taking wrong decision will be reduced and they can minimize their risk of having loss in many different projects.

- As we all know export and import business can’t run without L/C and L/C requires international reputation which is available among NCB. Basically Sonali bank has got the highest international reputation. For these reason they don’t need to submit their creditworthiness in the international market. If this system can be more flexible for other stated owned banks than their reputation will also is well-recognized.

Conclusion:

The aspiration with which this project paper has been prepared is to provide readers an overview regarding the deposit performance of the overall banking sector of our country. I have tried to find out all depository services of different bank are facing now a days. Then I tried to give some necessary recommendation from my point of view. Finally after describing comparative deposit performance of different banks I made a comparison between different banks in our country. As because development of a bank is a complex process requiring a strong dedication to learning, sharing of knowledge and being responsive to the needs of the people. So Banks need to place a strong emphasis on their organizational development. Hope that this effort will be beneficiary to the readers who are willing to know the problems and challenges that different banks are facing in our country and their performance aspects of banking sector and have a foresight based on that.

Reference:

Journal & Reports:

- Annual Report 2011, Sonali bank Limited

- Annual Report 2010, 2011 – Agrani Bank Limited

- Annual Report 2011 One Bank Limited

- Annual Report 2011, Jamuna Bank Limited

- Annual Report 2011, Dutch Bangla Bank Limited

- Annual Report 2011, Social Islami Bank Limited

- Annual Report 2011, AB Bank Limited