This report is all about “Foreign Exchange operations of Mutual Trust Bank Limited”. One of the largest businesses carried out by the Mutual Trust bank is foreign trading. Main transactions with overseas countries are respects of import; export and foreign remittance come under the preview of foreign exchange department of Mutual Trust Bank. International trade demands, a flow of goods from seller to buyer and of payment from buyer to seller. In this case Mutual Trust bank plays a vital role to bridge between the buyer and seller.

The first part of the report contains origin, objective, methodology, scope, limitations of preparing the report.

Secondly, it includes a general description about Mutual Trust Bank Limited to get a clear view about the bank. It contains overview, vision, mission, structure, organogram, services, etc of Mutual Trust Bank Limited.

Fourthly, this part explains three main functions of Foreign Exchange department in a detailed way. It contains import, import procedure, mechanism, source of finance, opening of import L/C, LTR, LIM, import payment, export, export procedure, export policy, mode of payment of export payments, export L/C, foreign remittance, inward remittance, outward remittance etc.

Lastly, there are performance analysis, SWOT analysis, findings and recommendations were given to evaluate the position of the bank and how it can perform better in the competition.

Objective of the study

- To complete the Internship as per requirement of MBA program of BRAC University

- To present an overview of foreign exchange division of MTBL

- To appraise performance of foreign exchange division of MTBL

- To appraise foreign exchange activities of’ MTBL

- To know about what kinds of risk the bank is facing in the foreign exchange transaction

- To develop practical knowledge about foreign exchange

- To have an overall concept about foreign exchange activities relating to import, export, outward and inward remittances, buying and selling of foreign commission etc. come under the purview of foreign exchange business

- To identify problems of foreign exchange division of MTBL

- To learn about the import and export dealing of business organization

Methodology of the Study

The study requires a systematic procedure from selection of the topic to final report preparation. To perform the study the data sources are to be identified and collected, they are to be classified, analyzed, interpreted and presented in a systematic manner and key points are to be found out. The overall process of methodology is given below:

Selection of the topic:

The topic of the study was suggested by our supervisor. Before assigning the topic it was discussed with me so that a well organized internship report can be prepared.

Identifying data sources:

Essential data sources both primary and secondary are identified which will be needed to complete and work out the study. To meet up the need of data primary data are used and study also requires interviewing the official and staffs were necessary. The report also required secondary data.

This report is mainly prepared by the secondary sources of information and some few primary sources of information like –

Primary data

- Discussion with officials of The Mutual Trust Bank Limited

- Face to face conversation with the clients

- Expert’s opinions and comments

- Direct involvement in the foreign exchange activities in MTBL

- Direct Observation

- Questioning the concerned persons

Secondary data

- Relevant books Newspaper, Journals etc.

- Annual report of MTBL

- Credit rating report of MTBL by CRISL (Credit Rating Information and Services Limited)

- Periodicals published byBangladesh Bank

- Monthly reports and published documents

- Office circular and other published papers, documents and reports

- Various brochures

- Daily summary sheet

- Various type of statement

- Various register books

- Various printed form

Overview of the Bank

Mutual Trust Bank Limited (MTBL) is a Public Limited Company by shares in Bangladesh, with commendable operating performance, Directed by the mission to provide with prompt and efficient services to clients. MTBL provides a wide range of commercial banking services also.

The bank has achieved success among its peer group within a short span of time with its professional and dedicated team of management having long experience, commendable knowledge and expertise in convention with modern banking. With all the resources, management of the bank firmly believes that the bank would be able to encounter problems that may arise both at micro and macroeconomic levels.

The Company was incorporated on September 29, 1999 under the Companies Act 1994 as a public company limited by shares for carrying out all kinds of banking activities with Authorized Capital of Tk. 38,00,000,000 divided into 38,000,000 ordinary shares of Tk.100 each.

The Company was also issued Certificate for Commencement of Business on the same day and was granted license on October 05, 1999 by Bangladesh Bank under the Banking Companies Act 1991 and started its banking operation on October 24, 1999. As envisaged in the Memorandum of Association and as licensed by Bangladesh Bank under the provisions of the Banking Companies Act 1991, the Company started its banking operation and entitled to carry out the following types of banking business:

(i) All types of commercial banking activities including Money Market operations.

(ii) Investment in Merchant Banking activities.

(iii) Investment in Company activities.

(iv) Financiers, Promoters, Capitalists etc.

(v) Financial Intermediary Services.

(vii) Any related Financial Services.

The Company (Bank) operates through its Head Office at Dhaka and 49 branches and 5 SME Service Centers. The Company/Bank carries out international business through a Global Network of Foreign Correspondent Banks.

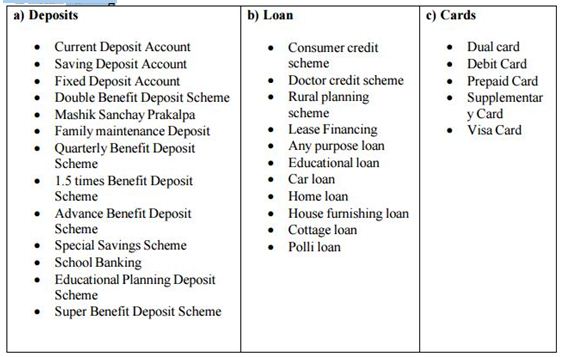

Product and Services

MTBL has launched a number of financial products and services since its inception. Among these, Monthly Savings Scheme, Family Maintenance Scheme, Double Benefit Deposit Scheme, Quarterly Benefit Deposit Scheme, 1.5 Times Benefit Deposit Scheme, Advance Benefit Deposit Scheme, Consumer Credit Scheme, Small Loan Scheme, Lease Finance Scheme, Overseas Employment Loan Scheme, Car Loan Scheme, Home Loan Scheme and SME Loan have received wide acceptance among the people.

(1) Retail Banking

(2) Corporate Banking

- Short term finance

- Long term finance

- Real estate finance

- Import finance

- Work order finance

- Export finance

- Structured finance

- Loan syndication

(3) SME Banking

- Chaka

- Annaynna

- Chalti Muldhan

- Single payment Loan

(4) Foreign Trade Business

- Foreign correspondents

- Nostro Accounts

(5) E-banking

- Online banking

- Mobile banking

- SMS banking

- SWIFT

- Locker Facility

Foreign Exchange

Every country has certain natural advantages and disadvantages in producing certain commodities while they have some natural disadvantages as well in other areas. As a result we find that some countries need to import certain commodities while others need to export their surpluses. These transactions are the basis upon which international trade is made. As more than one currency is involved in foreign trade, it gives rise to exchange of currencies which is known as Foreign Exchange.

As per Foreign Exchange Act., foreign exchange means and includes all deposits, credits and balances payable in foreign currency as well as foreign currency instruments such as drafts, TCs, Bill of Exchange, Promissory Notes and Letters of Credit payable in any foreign currency. This definition implies that all business activities relating to Import, Export, Outward & Inward Remittances, buying & selling of foreign commissions, etc. come under the purview of foreign exchange business.

Foreign exchange can simply be defined as a process of conversion of one national currency into another and of transferring money from one country into another.

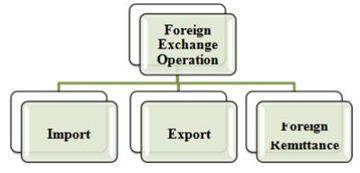

Foreign Exchange Division

One of the largest businesses carried out by the commercial bank is foreign trading. The trade among various countries falls for close link between the parties dealing in trade. The situation calls for expertise in the field of foreign operations. The bank, which provides such operation, is referred to as rending international banking operation. Mainly transactions with overseas countries are respects of import; export and foreign remittance come under the preview of foreign exchange transactions. International trade demands a flow of goods from seller to buyer and of payment from buyer to seller. In this case the bank plays a vital role to bridge between the buyer and seller.

In the MTBL Bashundhara City Branch there are six officials are working continuously with great effort and teamwork there are quite efficient skill and talented the above jobs are performed in this department. The Bangladesh Bank and the respected AVP of this section control them. There are more than 95 clients and 29 countries they are dealing with. They believe in teamwork and extreme hard work.

Foreign Exchange Department is an international department of the bank. It deals with globally and facilitates international trade through its various modes of services. It bridges between importers and exporters. Bangladesh Bank issues license to scheduled banks to deal with foreign exchange. These banks are known as Authorized Dealers. If the branch is authorized dealer in foreign exchange market, it can remit foreign exchange from local country to foreign country. This department mainly deals with foreign currency. This is why this department is called foreign exchange department.

Some national and international laws regulate functions of this department. Among these, Foreign Exchange Act, 1947 is for dealing in foreign exchange business, and Import and Export Control Act, 1950 is for Documentary Credits. Governments’ Import and Export policy is another important factor for import and export operation of banks.

Foreign Trade

Foreign trade can be easily defined as a business activity, which crosses national boundaries. These may be between parties or government ones. Trade among nations is a common occurrence and normally benefits both the exporter and importer. In many countries, international trade accounts for more than 25% of their national incomes.

Foreign trade can usually be justified on the principle of comparative advantage. According to this economic principle, it is economically profitable for the country to specialize in the production of that commodity in which the producer country has the grater comparative advantage and to allow the other country to produce that commodity in which it has the lesser comparative advantage. It includes the spectrum of goods, services, investment, technology transfer etc. This trade among various countries calls for loses linkage between the parties dealing in trade it has been dealing with more than 40 Countries. The banks, which provide such transactions, are referred to as rendering international banking operations. International trade demands a flow of goods from seller to buyer and of payment from buyer to seller. And this flow of goods and payment are done through Letter of Credit. MTBL follows the rules of Bangladesh government and Bangladesh bank strictly.

Functions of Foreign Exchange Department

Imports:

- Opening of letter of credit (L/C)

- Advance bills

- Bills for collection

- Import loan and guarantees

Export:

- Pre – Shipment advances

- Purchase of foreign bills

- Negotiating of foreign bills

- Export guarantees

- Advising/ confirming letters – letter of credit

- Advance for deferred payment exports

- Advance against bills for collection

Remittances:

- Issue of DD, MT, TT, etc.

- Payment of DD, MT, TT etc.

- Issue and enhancement of traveler’s cheque

- Sale and enhancement foreign currency note

- Nonresident accounts

Dealings:

- Rate computation

- Maintenance of foreign currency account

- Forward contracts

- Exchange position and cover operations

Most Commonly Used Documents in Foreign Exchange

- Documentary letter of credit

- Bill of exchange

- Bill of Landing

- CommercialInvoice

- Certificate of origin of goods

- Inspection certificate

- Packing List

- Insurance certificate

- Pro-forma invoice/ indent

- Master receipt

- GSP certificate

Import

Imports of goods into Bangladesh is regulated by the ministry of commerce and industry in terms of the Import and Export (Control) Act, 1950, with import policy orders issued by annually, and Import Registration Certificate (IRC) and Public Notices issued from time to time by the office of the Chief Controller of Import and Export (CCI & E). Through the process of import some vital but which are inadequate in our country products are imported to meet the local needs of the people. MTBL also plays an important role of importing goods.

To obtain Import Registration Certificate (IRC) the following certificates are required:

- Trade License

- Income tax clearance certificate

- National certificate

- Bankssolvency certificate

- Asset certificate

- Registration partnership deed (if any)

- Memorandum and article of association

- Certificate of incorporation (if any)

- Rent of the business premises

Requirements for Import:

To import through Mutual Trust Bank Limited a customer / client requires-

- Bank account

- Import Registration Certificate (IRC)

- Taxpaying Identification Number (TIN)

- Pro-forma invoice/ indent (PI)

- Membership certificate

- L/C application form duly attested

- Insurance cover note with money receipt

Export

In order to Creation of wealth in any country depends on the expansion of production and increasing participation in international trade. By increasing production in the export sector we can improve the employment level of such a highly populated country like Bangladesh. Bangladesh exports a large quantity of goods and services to foreign households. Readymade textile garments (both knitted and woven), Jute, Jute-made products, frozen shrimps, tea are the main goods that Bangladeshi exporters export to foreign countries. Garments sector is the largest sector that exports the lion share of the country’s export. Bangladesh exports most of its readymade garments products to U.S.A and European Community (EC) countries. Bangladesh exports about 40% of its readymade garments products to U.S.A. Most of the exporters who export through MTBL are readymade garments exporters. They open export L/Cs here to export their goods, which they open against the import L/Cs opened by their foreign importers.

Export Policy

Export policies formulated by the Ministry of Commerce, GOB provide the overall guideline and incentives for promotion of exports in Bangladesh. Export policies also set out commodity-wise annual target. It has been decided to formulate these policies to cover a fiveyear period to make them contemporaneous with the five-year plans and to provide the policy regime.

The export-oriented private sector, through their representative bodies and chambers are consulted in the formulation of export policies and are also represented in the various export promotion bodies set up by the government.

Export Financing

Financing exports constitutes an important part of a bank’s activities. Exporters require financial services at four different stages of their export operation. During each of these phases, exporters need different types of financial assistance depending on the nature of the export contract. MTBL plays a vital role in performing such jobs and help the businessmen’s to carry on their business operation the activities are –

- a) Pre-shipment credit

- b) Post-shipment credit

(a) Pre-shipment credit

Pre-shipment credit, as the name suggests, is given to finance the activities of an exporter prior to the actual shipment of the goods for export. The purpose of such credit is to meet working capital needs starting from the point of purchasing of raw materials to final shipment of goods for export to foreign country. Before allowing such credit to the exporters the bank takes into consideration about the credit worthiness, export performance of the exporters, together with all other necessary information required for sanctioning the credit in accordance with the existing rules and regulations. Pre-shipment credit is given for the following purposes:

- Cash for local procurement and meeting related expenses.

- Procuring and processing of goods for export.

- Packing and transporting of goods for export.

- Payment of insurance premium.

- Inspection fees.

- Freight charges etc.

An exporter can obtain credit facilities against lien on the irrevocable, confirmed and unrestricted export letter of credit in form of the followings:

- Export cash credit (Hypothecation)

- Export cash credit (Pledge)

iii. Export cash credit against trust receipt.

- Packing credit.

- Back to back letter of credit.

- Credit against Red-clause letter of credit.

Export cash credit (Hypothecation):

Under this arrangement, a credit is sanctioned against hypothecation of the raw materials or finished goods intended for export. Such facility is allowed to the first class exporters. As the bank has got no security in this case, except charge documents and lien on exports L/C or contract, bank normally insists on the exporter in furnishing collateral security. The letter of hypothecation creates a charge against merchandise in favor of the bank. But neither r the ownership nor the possession is passed to it.

Export cash Credit (Pledge):

Such Credit facility is allowed against pledge of exportable goods or raw materials. In this case cash credit facilities are extended against pledge of goods to be stored in the go down under bank’s control by signing letter of pledge and other pledge documents. The exporter surrenders the physical possession of the goods under banks effective control as security for payment of bank dues. In the event of failure of the exporter to honor his commitment, the bank can sell the pledged merchandise for recovery the advance.

Export Cash Credit against Trust Receipt:

In this case, credit limit is sanctioned against trust receipt (TR). Here also unlike pledge, the exportable goods remain in the custody of the exporter. He is required to execute a stamped export trust receipt in favor of the bank, he holds wherein a declaration is made that goods purchas4ed with financial assistance of bank in trust for the bank. This type of credit is granted when the exporter wants to utilize the credit for processing, packing and rendering the goods in exportable condition and when it seems that exportable goods cannot be taken into bank’s custody. This facility is allowed only to the first class party and collateral security is generally obtained in this case.

Packing Credit:

Packing Credit is essentially a short-term advance granted by a Bank to an exporter for assisting him to buy, process, manufacture, pack and ships the goods. Generally for movement of goods from the hinterland areas to the ports of shipment the Banks provide interim facilities by way of Packing Credit. This type of credit is sanctioned for the transitional period starting from dispatch of goods till the negotiation of the export documents. Practically except for single transaction, most of the pre-shipment credits are allowed in the form of limits duly sanctioned by Bank in favor of regular exporters for a particular period. The drawings are required to be adjusted fully once within a period of 3 to 6 months. Suiting to the breed and nature of export, sometimes an exporter may also be allowed to avail a combined Cash Credit and Packing Credit limit with fixed ceiling on revolving basis. But in no case the borrower would be allowed to exceed individual credit limit fixed for the purpose. The drawings under Export Cash Credit limits are generally adjusted by the drawing in packing credit limit, which is, in turn liquidated by the negotiation of export documents.

Banker should obtain the following charge documents duly stamped prior to disbursement:

- Demand Promissory Note

- Letter of Arrangement

- Letter of Lien of Packing Credit (On special adhesive stamp)

- Letter of Disbursement

- Packing Credit Letter

Additional Documents for P.C.:

- Letter of Partnership along with Registered Partnership Deed in case of Partnership Accounts.

- Resolution of the Board of Directors along with Memorandum & Articles of association in case of Accounts of Limited Companies. In case of Corporation, Resolution of the Board Meeting along with Charter.

- Personal Guarantee of all the Partners in case of Partnership Accounts and of all the Directors in case of Limited Companies.

- An undertaking from the Directors of the Public Limited Company to obtain prior clearance from the Bank before declaring any interim/final dividend.

Back-to-Back Letter of Credit (BTB):

Bangladesh is a developing country. After receiving order from the importer, very frequently exporters face problems of scarcity of raw material because some raw materials are not available in the country. These have to be collected from abroad. In that case, exporter gives lien of export L/C to bank as security and opens an L/C against it for importing raw materials.

This L/C is called Back To Back L/C. In back to back L/C, MTBL keeps no margin.

Sometimes there is provision in the export L/C that the importer can use the certain portion of the export L/C amount for importing accessories that are necessary for the making of the product. Only in that case, BTB is opened.

Payment of Back-to-Back L/C:

Client gives the payment of the BTB L/C after receiving the payment from the importers. But in some cases, client sells the bills to the MTBL. But if there is discrepancy, the MTBL sends it for collection.

In case of BTB L/C, MTBL gives the payment to the beneficiary after receiving the payment from the L/C of the finished product (i.e. exporter). Bank gives the payment from DFC Account (Deposit Foreign Currency Account) where Dollar is deposited in national rate. For BTB L/C, opener has to pay interest at LIBOR rate (London Inter Bank Offering Rate). Generally LIBOR rate fluctuates from 5% to 7%.

A schedule named Payment Order; Forwarding Schedule is prepared while making the payment. This schedule is prepared when the payment of L/C is made. This schedule contains the followings:

- Reference number of the beneficiary’s bank and date.

- Beneficiary’s name.

- Bill value.

- Payment order number and date.

- Equivalent amount in Taka.

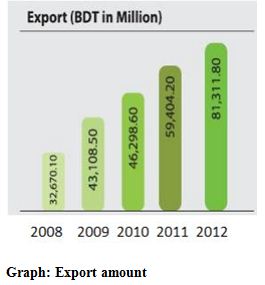

Export Earnings

The bank is very much supportive in export financing since its inception. As an outcome of its positive attitude, in export performance it is holding the top position among leading banks of new generation. The main export items of the bank were readymade garments, leather, products etc.

The sharp turnaround in world output growth in 2011, from negative growth of 2010, provided much needed stimulus to market exports. In Bangladesh Economy, surge in export growth emerged from July of FY 2011-11 and securing a record 41.47% growth in Export earnings. However in 2012 pace of export earnings growth moderated and amounted to USD 24.44 billion compared to USD 19.18 billion in 2011, indicating 27.38% growth in Export earnings in 2012 over 2011.

Foreign Remittance Section

Foreign Currency (FC) Accounts

Convertibility of Taka in current account transactions symbolized a turning point in the country’s exchange management and exchange rate system. Now the operation of foreign currency account has been more liberalized. Funds from this A/Cs are freely remittable to any country according to the needs of A/c holders. MTBL provides the service of foreign remittance through foreign currency accounts to the clients.

Types of Account:

a) FC Account

b) Resident Foreign Currency Deposit Account

c) Non-resident Foreign Currency Deposit Account.

Currency in which FC A/Cs can be opened

FC Accounts can be opened either in

a) Pound Sterling

b) US dollar

c) Euro

d) Japanese Yen

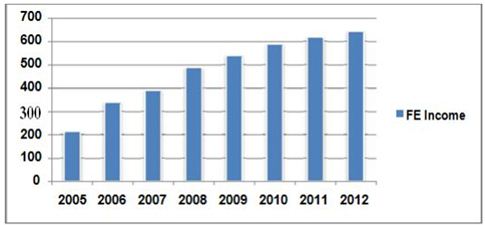

Foreign exchange income

Foreign exchange income is a great source of revenue for the bank. This revenue comes in two forms: commission and exchange gain. Here, six years data of foreign exchange income is presented on the following way

The different sources of income for foreign exchange business are revealed and the income is showing a continuous increasing trend. The most dominant variable in foreign exchange income is exchange gain. This is achieved from both export and remittance business. The graph is showing that foreign exchange income of MTBL is increasing every year.

Findings

By analyzing the various data the following finding have been found:

- Mutual Trust Bank Ltd has already established a favorable reputation in the banking industry in the country.

- Most of the clients in Mutual Trust Bank Ltd are satisfied with Foreign exchange service of giving statement.

- All the officers are so much helpful and have a friendly working environment. They help each other, when any officer falls in trouble.

- The Foreign Exchange Department is very much Strong. Because they use in dealing with the foreign Bank in term of L/C opening and amendment of L/C, are very much expedient to the foreign Bank. It is giving a competitive advantage to the Mutual Trust Bank Ltd. For this, businessmen like to deal their business with the Mutual Trust Bank Ltd.

- The top executives and officers are very helpful to the clients. Some of our businessmen do not know the exact procedures of international trade. The officers of Mutual Trust Bank Ltd help them to properly execute their business.

- Mutual Trust Bank Ltd provide little assistance in relation with foreign exchange to the small entrepreneur comparing to large business houses. Small entrepreneur has to keep higher margin, sometimes 100%, regarding opening a L/C.

- MTBL has limited promotional activities about foreign exchange services to increase motivate its present and potential investment client.

- Numbers of employees are fewer than the volume of works which creates problem in prompt service.

- The operations of international trade are conducted as per local and international laws, rules, customs and practices.

- Financing in the international trade is very crucial for the economy as well as it is risky.

Sometimes the government imposes restriction to import and export some products. As a result the rate of opening L/C become reduces.

Recommendations

This complementary study recommends that the Mutual Trust Bank Ltd to expand their foreign exchange Services in a planned and well articulated strategy for the long run, in order to have Customer satisfaction and increase in banks profitability. I had the practical exposure in Mutual Trust Bank Ltd. for just two months. On the basis of my observation I would like to present the following recommendations-

- Mutual Trust Bank Ltd should offer some services to attract the foreign remittance. As Bangladesh has a high number of non residential, collecting remittances can be a good way of generating revenue for the company.

- Need to revise the Foreign Exchange relate charges.

- Evening banking allowance may be increased.

- At MTBL decision making process should be free from ambiguity and be time conscious.

- MTBL should take various advertisement programs.

- Bank should properly aware to stable this type of amount L/C of Agriculture & Food Industry was very much increased and decreased.

- Garments Industry was very much strong Industry of MTBL but this sector has lowest L/C amount in September and bank should increase that month of L/C amount.

- Over all L/C growth rate of MTBL increased and decreased bank should be tried to accept maturity level.

- Reducing existing charges can successfully attract a huge number of customers to Mutual Trust Bank Ltd If charges are made considerable, Mutual Trust Bank Ltd can capture a big portion of middle class society who can be proved to be better customer than any other class of the society. Mutual Trust Bank Ltd should lower their charges immediately so as to prevent the loss of customers.

- The Bank should move to the fully automated banking system. This will save a lot of time of personnel working here and will increase their and the Bank’s performance thereby.

- In case of importing goods the Bank should aware about over invoicing so that nobody can get chance to send money abroad illegally.

- In case of exporting goods the Bank should aware about under invoicing so that nobody can get chance to avoid Tax, Vat, and Duty.

Finally, Bank mangers need to remain up to date with future trends; in other words, they need marketing intelligence. If automated service quality converges and becomes an automated service quality, customer satisfaction and their relationship with financial Performance standard and non-differentiated attribute among all banks, it will be easy for Customers to compare and switch from one bank to another. If so, it will be difficult for Banks to maximize their profits out of the quality aspects of automated services.

Conclusion

From the beginning of greater change in the world economic structure, Mutual Trust Bank Limited is trying to develop banking sector through welfare and servicing to the people. Mutual

Trust Bank Ltd is committed towards the excellence in the service with efficiency, accuracy and proficiency. Mutual Trust Bank, being a bank of twenty first century, is also extending such contributions as to the advancement of the socioeconomic condition of the country. Like of most of the commercial banks, foreign exchange department is one of the most important departments of Mutual Trust Bank Ltd. Perhaps, it is the most important department of the Bank. This department is driving the bank from the front.

MTBL actively takes place in foreign exchange especially in export and import. Every year bank earns a lot of money by issuing letter of credit and its growth rate increase at in increasing rate. Through the import, export and foreign operations, this department is making a great contribution to the bank and the economy as a whole. In this study it is found that MTBL has reached the position by its commitment, people’s love and dedicated human resource. Mutual Trust has been shown supremacy in all kind of banking operations in our country.

The competent management of Mutual Trust Bank Limited should come forward to pragmatic strategic decision like-easy procurement, one stop service, and time service customers’ services with sufficient logistics supports for future betterment of the bank. Despite problems and weaknesses, therefore, it is better for Mutual Trust Bank Ltd to think about their existing steps and take the necessary initiatives to fix up the problems and imply the recommended steps to be successful and become the market leader in near future.