Commodity valuation is the method of deriving, under optimum market conditions, the intrinsic value of a commodity. The product value of goodwill be expressed in a free market by its price. For instance, if a section of land can yield a net of 100 dollars shortfall by lying decrepit, 50 dollars gain by being planted with corn, and 100 dollars gain by being planted with wheat, at that point that section of land’s product esteem is 100 dollars; the rancher is accepted to put his territory to best utilize. A product’s price fluctuates across its commodity value.

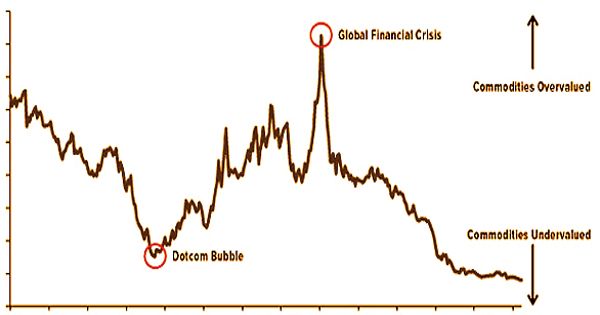

By observing the intersection of the demand and supply curves of a product, which is also called the break-even point, commodity valuation follows the classical economic theory of arriving at a price. Historical, social, and cultural factors of manufacturing and distribution decide a product value expressed as a price. Since product markets depend to a great extent on request and flexibly designs, foreseeing future value developments of said wares is the main way a speculator can benefit from the hypothesis. Price was defined by Karl Marx as the cash name for the labor realized in a commodity. Since commodity markets rely primarily on demand and supply trends, the only way an investor can benefit from speculation is to predict future price movements of said commodities.

Example of Commodity Valuation

Commodity value is reliant on its utility. A greater part of the interest in the item showcases is through future agreements. They are subsidiary instruments wherein the holders are committed to purchase or sell a predetermined item at a set cost and future date. Product esteem is of specific hugeness in the investigation of money. The product value of a coin, for instance, is the value of the metal it is made of. Gold and silver coins have an elevated commodity value, whereas fiat coins have a low commodity value, such as modern quarters. As examined in light of Gresham’s Rule, this is of specific historical significance.

In the fixed value technique, the cost of the item on the conveyance date is pre-chosen. It implies that paying little mind to the genuine market worth or spot cost of the product at the conveyance date, the two players are legally committed to exchange at the fixed cost. Not because of its content, that is, its commodity value, money becomes valuable, but rather because of its efficiency, currencies appear to become token. A ceiling is set for the maximum (ceiling price) and minimum (floor price) potential commodity prices in the floor and ceiling price system. The price window provides all parties with flexibility.

Commodity value is a significant thought in supporting expansion. Though fiat monetary forms can cheapen, regularly calamitously, monetary standards with extensive product esteem are known to more readily keep up their worth; an administration can print the same number of fiat bills as it needs effortlessly, the equivalent isn’t valid for mining valuable metals. The method of valuing a product business requires the “normalization” of its earnings. It implies measuring the cash flow of a company over time to span a standard economic cycle. Normalizing helps investors to consider a company’s sales, profits, and cash flow. It can be achieved either by measuring a commodity’s average price, after adjusting for inflation or by analyzing demand and supply, by arriving at a fair market price or spot price.

The valuation of commodities leads certain investors to buy high commodity value products and debts that are necessarily safer than others with low or no commodity value, mitigating risk by reducing potential returns. An alternative is to analyze potential opportunities and use market-based rates to forecast a company’s future cash flows. It is favored by examiners as it is certainly hazard guaranteed because of an inherent supporting system. A speculator stressed over the exhibition of an organization can buy fates and misleadingly drive the cost of the equivalent.

Information Sources: