Inflation is defined as a sustained increase in the general level of prices for goods and services. It is measured as an annual percentage increase. As inflation rises, every dollar we own buys a smaller percentage of a good or service.

Economists generally believe that very high rates of inflation and hyperinflation are caused by excessive growth of the money supply. Views on which factors determine low to moderate rates of inflation are more varied. Low or moderate inflation may be attributed to fluctuations in real demand for goods and services or changes in available supplies such as during scarcities. However, the consensus view is that a long sustained period of inflation is caused by money supply growing faster than the rate of economic growth. Inflation affects economies in various positive and negative ways.

The main causes of inflation are either excess aggregate demand (AD) (economic growth too fast) or cost-push factors (supply-side factors). There are two main causes of inflation: Demand-pull and Cost-push. Both are responsible for a general rise in prices in an economy. But they work differently. Demand-pull conditions occur when demand from consumers pulls prices up. Cost-push occurs when supply cost force prices higher.

Demand-Pull Inflation –

Demand-pull inflation is the most common cause of rising prices. It occurs when consumer demand for goods and services increases so much that it outstrips supply. Producers can’t make enough to meet demand. They may not have time to build the manufacturing needed to boost supply. They may not have enough skilled workers to make it. Or the raw materials might be scarce.

If sellers don’t raise the price, they will sell out. They soon realize they now have the luxury of hiking up prices. If enough do this, they create inflation.

There are several circumstances that create demand-pull inflation. For example, a growing economy affects inflation because when people get better jobs and become more confident, they spend more. As prices rise, people start to expect inflation. That expectation motivates consumers to spend more now to avoid future price increases. That further boosts growth. For this reason, a little inflation is good. Most central banks recognize this. They set an inflation target to manage the public’s expectation of inflation.

Another circumstance is discretionary fiscal policy. That’s when the government either spends more or taxes less. Putting extra money in people’s pockets increases demand and spurs inflation.

Marketing and new technology create demand-pull inflation for specific products or asset classes. The asset inflation that results can drive widespread price increases. Asset and wage inflation are types of inflation. For example, Apple uses branding to create demand for its products. That allows it to command higher prices than the competition. New technology also occurred in the form of financial derivatives.

Over-expansion of the money supply can also create demand-pull inflation. The money supply is not just cash, but also credit, loans, and mortgages. When the money supply expands, it lowers the value of the dollar. When the dollar declines relative to the value of foreign currencies, the prices of imports rise. That increases prices in the general economy.

Cost-Push Inflation –

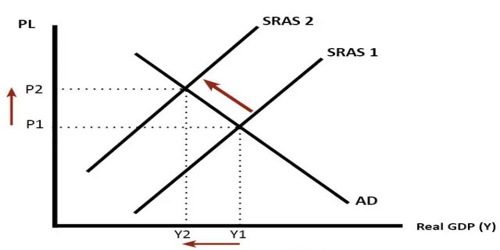

If there is an increase in the costs of firms, then businesses will pass this on to consumers. There will be a shift to the left in the AS.

Cost-push inflation can be caused by many factors.

- Rising wages – If trades unions can present a united front then they can bargain for higher wages. Rising wages are a key cause of cost-push inflation because wages are the most significant cost for many firms. (higher wages may also contribute to rising demand)

- Import prices – One-third of all goods are imported in the UK. If there is a devaluation, then import prices will become more expensive leading to an increase in inflation. A devaluation/depreciation means the Pound is worthless. Therefore we have to pay more to buy the same imported goods.

- Raw material prices – The best example is the price of oil. If the oil price increase by 20% then this will have a significant impact on most goods in the economy and this will lead to cost-push inflation. E.g., in 1974 there was a spike in the price of oil causing a period of high inflation around the world.

- Profit push inflation – When firms push up prices to get higher rates of inflation. This is more likely to occur during strong economic growth.

- Declining productivity – If firms become less productive and allow costs to rise, this invariably leads to higher prices.

- Higher taxes – If the government put up taxes, such as VAT and Excise duty, this will lead to higher prices, and therefore CPI will increase. However, these tax rises are likely to be one-off increases. There is even a measure of inflation (CPI-CT) which ignores the effect of temporary tax rises/decreases.

When a country lowers its currency’s exchange rates, it creates cost-push inflation in imports. That makes foreign goods more expensive compared to locally produced goods.

Effects of Inflation –

Almost everyone thinks inflation is evil, but it isn’t necessarily in. Inflation affects different people in different ways. It also depends on whether inflation is anticipated or unanticipated If the inflation rate corresponds to what the majority of people are tweeting (anticipated inflation), then we can compensate and the cost isn’t high. For example, banks can vary their interest rates and workers can negotiate contracts that include automatic wage hikes as the price level goes up.

Problems arise when there is unanticipated inflation:

- Creditors lose and debtors gain if the lender does not anticipate inflation correctly. For those who borrow, this is similar to getting an interest-free loan.

- Uncertainty about what will happen next makes corporations and consumers less likely to spend. This hurts economic output in the long run.

- People living off a fixed-income, such as retirees, see a decline in their purchasing power and consequently their standard of thing.

- The entire economy must absorb repricing costs (-menu costs) as price lists, labels, menus, and more have to be updated.

- If the inflation rate is greater than that of other countries, domestic products become less competitive.

If economic growth matches the growth of the money supply, inflation should not occur when all else is equal. A large variety of factors can affect the rate of both. For example, investment in market production, infrastructure, education, and preventive health care can all grow an economy in greater amounts than investment spending.

Inflation is a decrease in the purchasing power of currency due to a rise in prices across the economy. Within living memory, the average price of a cup of coffee was a dime. Today the price is closer to two dollars.

Such a price change could conceivably have resulted from a surge in the popularity of coffee, or price pooling by a cartel of coffee producers, or years of devastating drought/flooding/conflict in a key coffee-growing region. In those scenarios, the price of coffee products would rise, but the rest of the economy would carry on largely unaffected. That example would not qualify as inflation since only the most caffeine-addled consumers would experience significant depreciation in their overall purchasing power.

Favorable Impacts of Inflation –

The favorable impacts of inflation are as follows:

- Higher Profits – Inflation, usually, benefits the producers of products. They experience better profits since they can sell their products at higher prices.

- Better Investment Returns – During inflation, investors and entrepreneurs receive added incentives for investing in productive activities. Therefore, they receive better returns.

- Increase in Production – Once the producers receive the right investment, they create more goods and services. Hence, inflation leads to an increase in the production of products/services.

- More Employment and Better Income – Since production increases, there is an increased demand for the various factors of production, including manpower. Therefore, employment and income increases during inflation.

If inflation becomes too high, it can cause people to severely curtail their use of the currency, leading to an acceleration in the inflation rate. High and accelerating inflation grossly interferes with the normal workings of the economy, hurting its ability to supply goods. Hyperinflation can lead to the abandonment of the use of the country’s currency (for example as in North Korea) leading to the adoption of an external currency (dollarization). High inflation increases the opportunity cost of holding cash balances and can induce people to hold a greater portion of their assets in interest-paying accounts. However, since cash is still needed to carry out transactions this means that more “trips to the bank” are necessary to make withdrawals, proverbially wearing out the “shoe leather” with each trip. With high inflation, firms must change their prices often to keep up with economy-wide changes. But often changing prices is itself a costly activity whether explicitly, as with the need to print new menus, or implicitly, as with the extra time and effort needed to change prices constantly.

People like to complain about prices going up, but they often ignore the fact that wages should be rising as well. The question shouldn’t be whether inflation is rising, but whether it’s rising at a quicker pace than our wages.

Finally, inflation is a sign that an economy is growing. In some situations, little inflation (or even deflation) can be just as bad as high inflation. The lack of inflation may be an indication that the economy is weakening. As we can see, it’s not so easy to label inflation as either good a bad it depends on the overall economy as well as our personal situation.

Information Sources: