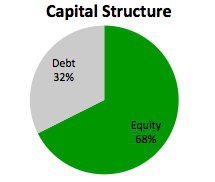

Throughout finance, capital structure describes the way some sort of corporation finances it’s assets through some combination of equity, debt, or hybrid securities. If capital design is irrelevant in a very perfect market, then imperfections which exist in actuality must trigger its relevance. The theories below try and address some imperfections, by relaxing assumptions produced in the M&M model.

Capital Structure