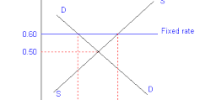

Domestic liability dollarization (DLD) refers to a situation where residents of a country borrow or hold debt in a foreign currency, typically the US dollar, rather than in their domestic currency. It is the conversion of banking system deposits and lending into a currency other than the currency of the country in which they are held.

This can happen for various reasons, such as a lack of confidence in the domestic currency, high inflation rates, or a history of currency devaluations. DLD does not only refer to accounts denominated in US dollars; DLD also includes accounts denominated in internationally traded “hard” currencies such as the British pound sterling, Swiss franc, Japanese yen, and Euro.

At the macroeconomic level, domestic liability dollarization can complicate monetary policy, as the central bank may have less control over interest rates and the money supply if a significant portion of the economy’s financial transactions are denominated in foreign currencies.

Measurement

DLD is defined as the Bank for International Settlements reporting banks’ local asset positions in foreign currency as a share of GDP in developed countries. A proxy measure of DLD in emerging-market economies (EMs) is calculated by adding dollar deposits and bank foreign borrowing as a share of GDP. This proxy assumes that banks match their assets and liabilities by currency type and pass on exchange rate risk to debtors. DLD is defined in other contexts as the proportion of foreign currency deposits to total deposits.

The implications of domestic liability dollarization can be significant for both individuals and the economy as a whole. For individuals, holding assets in a foreign currency can provide a hedge against inflation and other economic risks, but it can also expose them to exchange rate risk if the value of the domestic currency depreciates.

Advantages and Disadvantages

Domestic liability dollarization can have both advantages and disadvantages. On the one hand, borrowing in a foreign currency can provide access to lower interest rates and reduce currency risk for borrowers. On the other hand, it can increase vulnerability to exchange rate fluctuations and lead to financial instability in the domestic economy, especially if there is a sudden appreciation of the domestic currency.

In addition, domestic liability dollarization can make it more difficult for a country’s central bank to conduct monetary policy, as changes in interest rates or other policy measures may not have the desired effects on the economy if borrowers have borrowed in foreign currencies. It can also make it more challenging for the government to manage its debt, as a sudden currency depreciation could increase the cost of servicing foreign-currency denominated debt.

Therefore, policymakers in countries with high levels of domestic liability dollarization often seek to reduce this phenomenon by implementing policies that promote financial stability and encourage the use of the domestic currency.