Capital Adequacy Ratio Analysis of Top 10 Clients

of Citibank N.A. Bangladesh

This report contains the comparison based on the Capital Adequacy Ratios (CAR) of 10 chosen Private Commercial Banks (PCBs) of Bangladesh and the comparison between the Capital Adequacy Ratios of the chosen banks. As I have done my internship in the Financial Institutions Group of Citibank N.A. and these 10 banks are the top clients on the basis of revenue of the Financial Institutions Group of Citibank N.A. Bangladesh, I found it fascinating to work on these 10 banks.

This report also contains a brief description of Citibank N.A. Bangladesh and Citi’s achievement from its inception in this country.

To help out with the paper, I used information from the chosen banks’ website to find out the reasons of the dispersion of Capital Adequacy Ratio from the assigned margin of 10% by the Bangladesh Bank.

Origin of the Report

The following report, on the comparison of Capital Adequacy Ratio of 10 different Private Commercial Banks (PCBs), is assigned to me by my supervisor Ms. Samina Haque for the completion of my internship report. As I have done my internship in the Financial Institutions Department of Citibank N.A. and these 10 banks are the top clients on the basis of revenue of FIG department of Citi, I found it fascinating to work on these 10 banks. The 10 chosen banks for my report are:

- AB Bank Limited

- Bank Asia Limited

- Dhaka Bank Limited

- Dutch Bangla Bank Limited

- Eastern Bank Limited

- IFIC Bank Limited

- NCC Bank Limited

- Prime Bank Limited

- Shahjalal Islami Bank Limited

- The City Bank Limited

Objectives

- Find out the Capital Adequacy Ratio (CAR) for 10 chosen PCBs.

- Determine the reasons of variance of CARs from FY2009 to FY2013.

- Find out how the banks are taking necessary steps to maintain the required level of CAR.

Background of Citibank N.A. Bangladesh

As a well-developed Financial Institutions business, Citibank N.A. Bangladesh is supporting the cross-border transactions of nationalized and private sector banks in the country. Citi Transaction Services supports Bangladesh corporates, financial customers and public sector clients with its award-winning cash management, trade services, agency & trust, and direct custody & clearing solutions. To be noted that, Citi is also the foremost book-runner of capital-market solutions for our clients in Bangladesh. Among other services, Citi’s Corporate and Commercial Bank deals local corporates and multinationals across several industries and provides dynamic connection and an incorporated outlook throughout the Bangladesh supply chain and business operation.

In Bangladesh, Citi now has established a strong existence. It has four branches, four service outlets and employs more than 180 people. Citi’s clients encompass both public and private sector institutions in Bangladesh.

Moreover, Citi has led the way in Bangladesh with its groundbreaking solutions. Citi has helped to further develop Bangladesh’s financial market with the introduction of several ‘first ever’ deals in Bangladesh. Some of the Citi’s landmark achievements contain:

- As the Sole Independent Advisor to the Government of Bangladesh for sovereign rating advisory, Citibank, N.A. Bangladesh was selected.

- For BRAC, the largest NGO in the world, Citi Bangladesh arranged the world’s first AAA-rated micro-credit securitization transaction for US$180 MM.

- Citibank Bangladesh successfully arranged the country’s largest-ever local currency amortizing senior secured bond offering of BDT 7,070 million (or US$102 million).

- Citi was the exclusive financial advisor, sole private placement agent, sole initial public offering (IPO) issue manager, lead IPO underwriter, main banker to the issue and escrow agent for the largest IPO and pre-IPO placement in Bangladesh for US$141 million for Grameen-phone Ltd.

- Citibank, N.A. Bangladesh has successfully arranged the country’s first-ever syndicated agricultural term financing facility of BDT 1,500 million (or US$21.7 million).

- Citi was the sole placement agent for the country’s first unsecured, non-convertible, subordinated Tier-II Bond issue of BDT 2,500 million by Prime Bank Ltd.

- Citi Securities and Fund Services, a division of Citi Transaction Services, was mandated by Bangladesh Bank, the central bank of Bangladesh, to provide global custody services.

- Citi Bangladesh was named the Best Internet Bank by Global Finance for the second year in a row. The win in Bangladesh follows the clean sweep by Citi Asia Pacific in the Global Finance Magazine Internet awards.

Introduction of 10 Chosen Banks

AB Bank Limited

AB Bank Limited which is the first private sector bank was integrated in Bangladesh on 31st December 1981 as Arab Bangladesh Bank Limited and started its procedure with effect from April 12, 1982.

Since its inauguration 32 years ago, AB Bank is known as one of leading banks of the country. Its continuous focus transfers the best efforts to make available the latest products and services with knowledge, passion, commitment and excellence. Being the market leader in the private banking industry of Bangladesh, AB Bank has thus been able to keep its consumers’ and clients’ trust by keeping its reliability and strong footage.

Bank Asia

Introduced by a group of prosperous entrepreneurs with distinguished standing in the society, Bank Asia is a third generation public limited commercial bank. It has received the Certificate of Incorporation on September 28, 1999 and has come to operation on November 27, 1999. The supervision of the Bank consists of a team led by senior bankers with decades of experience in national and international markets. The senior management team is heavily supported by a group of professionals many of whom have acquaintance in the international market.

Bank Asia has set landmark by acquiring the business operations of the Bank of Nova Scotia in Dhaka, first in the banking history of Bangladesh. It again repeated the performance by acquiring the Bangladesh operations of Muslim Commercial Bank Ltd. (MCB), a Pakistani bank.

Dhaka Bank Limited

Dhaka Bank was incorporated as a Public Limited Company on April 6, 1995 under Companies Act, 1994. The company originated banking operations on July 5, 1995.

Dhaka Bank has truly appreciated and brought into emphasis the legacy and antiquity of Dhaka and Bangladesh from Mughal outpost to modern metropolis from the very year of its landmark journey. Most of its presentation, publications, brand initiatives, delivery channels, calendars and financial manifestations bear Bank’s commitment to this attachment. The Bank is extensively recognized today for its exceptional service, simplicity, proximity and cuttingedge way of delivery.

Dutch-Bangla Bank Limited

Dutch-Bangla Bank was the first bank in Bangladesh to be fully automated. The Electronic Banking

Division was established in 2002 to undertake rapid automation and bring modern banking services into this field. Full automation was completed in 2003 and hereby introduced plastic money to the Bangladeshi masses. Dutch-Bangla Bank also operates the nation’s largest ATM fleet and in the process drastically cut consumer costs and fees by 80%.

From the onset, the focus of the bank has been financing high-growth manufacturing industries in Bangladesh. The rationale being that the manufacturing sector exports Bangladeshi products worldwide. Thereby financing and concentrating on this sector allows Bangladesh to achieve the desired growth. Dutch-Bangla Bank other focus is Corporate Social Responsibility (CSR). Even though CSR is now a cliché, Dutch-Bangla Bank is the pioneer in this sector and termed the contribution simply as ‘social responsibility’. Due to its investment in this sector, Dutch-Bangla Bank has become one of the largest donors and the largest bank donor in Bangladesh. The bank has won numerous international awards because of its unique approach as a socially conscious bank.

Eastern Bank Limited

With a visualization to become the bank of excellence and to be the most valued financial brand in Bangladesh, Eastern Bank Ltd. (EBL) initiated its journey in 1992. EBL has established itself as a leading private commercial bank in the country with undisputed leadership in Corporate Banking and a strong Consumer and SME growth engines over the years. EBL’s determination is to be the number one financial services provider, creating lasting value for its clientele, shareholders, and employee and above all for the community it functions in.

IFIC Bank

International Finance Investment and Commerce Bank Limited (IFIC Bank) is a banking company integrated in the People’s Republic of Bangladesh with limited liability. It was set up at the occasion of the Government in 1976 as a joint venture between the Government of Bangladesh and promotes in the private sector with the objective of working as a finance company within the country and setting up joint venture banks/financial institutions aboard. IFIC was converted into a full-fledged commercial bank in 1983 when the Government allowed banks in the private sector.

NCC Bank

National Credit and Commerce Bank Ltd. bears a sole history of its own. The organization started its journey in the financial sector of the country as an investment company back in 1985. The aim of the company was to assemble resources from within and devote them in such way so as to progress country’s Industrial and Trade Sector and playing a catalyst role in the formation of capital market as well. Its membership with the browse helped the company to a great extent in these regard.

NCC Bank Ltd. has acquired praiseworthy reputation by providing sincere personalized service to its customers in a technology based environment since its inauguration.

Prime Bank Limited

In the backdrop of economic liberalization and financial sector reforms, a group of highly successful local entrepreneurs conceived an idea of floating a commercial bank with different outlook. For them, it was competence, excellence and consistent delivery of reliable service with superior value products. Accordingly, Prime Bank was created and commencement of business started on 17th April 1995.

The sponsors are reputed personalities in the field of trade and commerce and their stake ranges from shipping to textile and finance to energy etc.

As a fully licensed commercial bank, Prime Bank is being managed by a highly professional and dedicated team with long experience in banking. They constantly focus on understanding and anticipating customer needs. As the banking scenario undergoes changes so is the bank and it repositions itself in the changed market condition.

Shahjalal Islami Bank Limited

Shahjalal Islami Bank Limited (SJIBL) commenced its commercial operation in accordance with principle of Islamic Shariah on the 10th May 2001 under the Bank Companies Act, 1991. During last thirteen years SJIBL has differentiated its service coverage by opening new branches at different tactically important locations across the country offering various service products both investment & deposit. Islamic Banking, in essence, is not only interest-free banking business, it carries deal wise business product thereby generating real income and thus boosting GDP of the economy.

The City Bank Limited

City Bank is one of the oldest private Commercial Banks operating in Bangladesh. Started their operations in 1983, it is a top bank among the oldest five Commercial Banks in the country. The Bank started its journey on 27th March 1983 by opening its first branch at Bangladesh Bank Avenue Branch in the Dhaka city. It was the visionary entrepreneurship of around 13 local businessmen who braved the enormous uncertainties and risks with bravery and enthusiasm that made the institution possible.

Introduction of Basel & Capital Adequacy Ratio

The Basel Committee is the primary global standard-setter for the prudential regulation of banks and provides a forum for cooperation on banking supervisory matters. Its mandate is to strengthen the regulation, supervision and practices of banks worldwide with the purpose of enhancing financial stability.

Basel I

Basel I is the round of deliberations by central bankers from around the world, and in 1988, the Basel Committee on Banking Supervision (BCBS) in Basel, Switzerland, published a set of minimum capital requirements for banks. This is also known as the 1988 Basel Accord, and was enforced by law in the Group of Ten (G-10) countries in 1992. A new set of rules known as Basel II was later developed with the intent to supersede the Basel I accords.

Basel II

This was the fourth year for banks in Bangladesh under Basel II regime. In line with the Guidelines on Risk Based Capital Adequacy (RBCA) for Banks under Basel-II Accord each banks have to maintain Capital Adequacy Ratio (CAR) on solo basis and consolidated basis as per instructions given by Bangladesh Bank from time to time.

Basel II Capital Accord is the revised framework of ‘International Convergence of Capital Measurement and Capital Standards’ the comprehensive version of which was issued by the Basel Committee on Banking Supervision in June 2006. The framework of Basel II Capital Accord consists of three pillars:

1st Pillar – Minimum Capital Requirements

This provides approaches to the calculation of Minimum Capital Requirements (MCR). MCR is based on credit risk, market risk and operational risk to:

- reduce risks of failure by cushioning against losses;

- provide continuing access to financial markets to meet liquidity need; and

- provide incentives to prudent risk management

2nd Pillar – Supervisory Review Process

Provides the framework to ensure that each Bank has sound internal processes to enable it to perform a thorough evaluation of its risks and therefore assess the required capital. The Supervisory Review Process (SRP) recognizes the responsibility of Bank management in developing an internal capital assessment process and setting capital targets that are commensurate with the Bank’s risk profile and control environment. The Basel Committee has identified four key principles of supervisory review:

i. Banks should have a process for assessing their overall capital adequacy in relation to their risk profile and a strategy for maintaining their capital levels

ii. Supervisors should review and evaluate Bank’s internal capital adequacy assessments and strategies, as well as their ability to monitor and ensure their compliance with regulatory capital ratios

iii. Supervisors should expect Banks to operate above the minimum regulatory capital ratios and should have ability to require Banks to hold capital in excess of the minimum and

iv. Supervisors should seek to intervene at an early stage to prevent capital from falling below the minimum levels required to support the risk characteristics of a particular Bank and should require rapid remedial action if capital is not maintained or restored.

3rd Pillar – Market Discipline

The purpose of Pillar-3, market discipline, is to complement the minimum capital requirements (Pillar-1) and the supervisory review process (Pillar-2). The Basel Committee aims to encourage market discipline by developing a core set of disclosure requirements which will allow market participants to assess key pieces of information on the scope of application, capital, risk exposure, risk assessment process, Risk Management.

Capital Adequacy Ratio

Capital adequacy ratios are a measure of the amount of a bank’s capital expressed as a percentage of its risk weighted credit exposures. An international standard which recommends minimum capital adequacy ratios has been developed to ensure banks can absorb a reasonable level of losses before becoming insolvent.

Capital adequacy symbolizes the financial strength and stability of a bank. It limits the extent up to which banks can expand their business in terms of risk weighted assets. Like all commercial institutions, banks too constantly look at ways of expanding their operations by acquiring property, plant and equipment, opening branches, in addition to mobilizing deposits, providing loans and investing in other assets.

Applying minimum capital adequacy ratios serves to protect depositors and promote the stability and efficiency of the financial system. Two types of capital are measured – tier one capital which can absorb losses without a bank being required to cease trading, e.g. ordinary share capital, and tier two capital which can absorb losses in the event of a winding-up and so provides a lesser degree of protection to depositors, e.g. subordinated debt. The Minimum Capital Requirement (MCR) of banks in Bangladesh is 10.0 percent of the bank’s Risk Weighted Assets (RWA) or Taka 4.0 billion, whichever is higher.

In order to calculate CAR, banks are required to calculate their Risk Weighted Assets (RWA) on the basis of credit, market, and operational risks. Total RWA will be determined by multiplying the amount of capital charge for market risk and operational risk by the reciprocal of the minimum CAR and adding the resulting figures to the sum of risk weighted assets for credit risk. The CAR is then calculated by taking eligible regulatory capital as numerator and total RWA as denominator.

Discussion on Capital Adequacy Ratio of 10 PCBs

AB Bank Limited

Present Status

As of 31st December 2013, AB Bank’s Risk Weighted Asset was Tk. 173,871 million and Minimum Capital Requirement was Tk. 17,387.1 million which is 10% of given RWA. AB Bank Limited’s Total Capital stood at Tk. 18,772.3 million among which Tk. 15,570 million falls under Tier-1 Capital and Tk. 3,203 million under Tier-II Capital. The Surplus over Minimum Capital Requirement of EBL was tk. 1,385.1 million in FY2013.

Trend Analysis

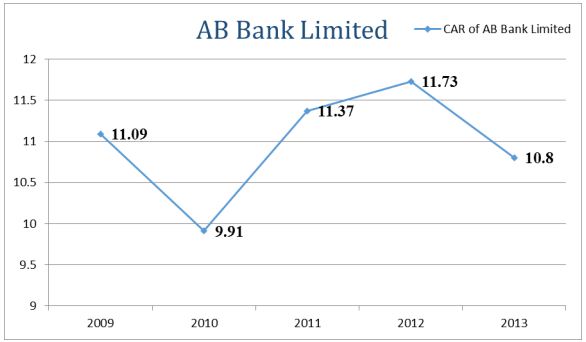

From the Table given below, we can see that the Classified Loan has increased over the past five years CL was Tk. 1,949 million in FY2009 whereas in FY2013, it became Tk. 4,720 million. This gradual increase in Classified Loans has a major role in decreasing the CAR which was 11.73% in FY2012 to 10.80% in FY2013.

From the graph below, it is also visible that from FY2009 to FY2013, CAR of AB Bank was the lowest in FY2010 which was 9.91%. The main reason behind this decrease is, FY2010 was the year when Basel-II was introduced in Bangladesh for the first time. The sudden change in Capital Base came as a shock and the banks were unable to maintain the decided Capital Base of 10% which was previously set as 8% under the Basel-I guideline provided by Bangladesh Bank. Not to mention, the economic instability, political turmoil and the crash of Stock Market of Bangladesh has played a significant role in the fluctuations of Capital Adequacy Ratio.

Steps Taken by AB Bank Limited

The Bank’s team worked to sustain the capital, as a result the year-end capital adequacy ratio stood in a strong position of 10.80% where the regulation is only to maintain 10%.

From the tightened guidelines and weak business sector-wise growth, it was very difficult to maintain asset quality for AB Bank. AB Bank has been generating most of its incremental capital from retained profit (stock dividend and statutory reserve transfer etc.) and occasional issue of right shares to support incremental growth of Risk Weighted Assets (RWA). Risk Management Unit (RMU) under guidance of the SRP team/BRMC (Bank’s Risk Management Committee), is taking active measures to identify, quantify, manage and monitor all risks to which the Bank is exposed to.

Figure: Capital Adequacy Ratio of AB Bank from FY2009 to FY2013

Diagram: Information Regarding Capital Adequacy of AB Bank Limited

Bank Asia

Present Status

As of balance sheet of 31st December 2013, Bank Asia’s Total Risk Weighted Assets was Tk. 140,977 million and its Minimum Capital Requirement was Tk. 14,097.70 million which is 10% of the given RWA. Total regulatory capital stood at Tk. 15,574.85 million segregated into Tk. 11,904.15 million or 76.45% in Tier-1 and Tk. 3,670.70 million or 23.55% in Tier-2. Tk. 631 million was added to Tier-1 capital through 10% stock dividend, Tk.182.80 million added to Tier-2 capital though maintaining general provision and revaluation of government security.

Bank Asia’s Capital adequacy ratio was 11.05% against regulatory requirement of 10% on Risk Weighted Assets.

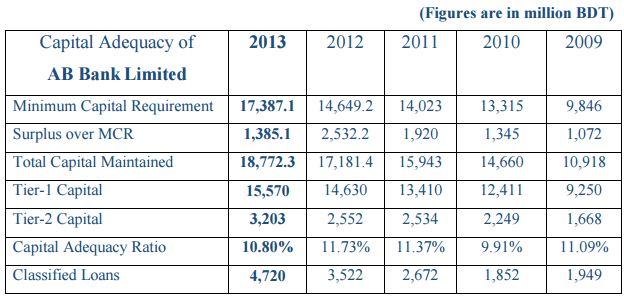

Trend Analysis

From the Table given below, we can see that the Classified Loan has increased over the past five years CL was Tk. 785.07 million in FY2009 whereas in FY2013, it became Tk. 5,878.79 million. This gradual increase in Classified Loans has a major role in decreasing the CAR which was 13.05% in FY2012 to 11.05% in FY2013.

From the graph below, it is also visible that from FY2009 to FY2013, CAR of Bank Asia was the lowest in FY2010 which was 8.11%. The main reason behind this decrease is, FY2010 was the year when Basel-II was introduced in Bangladesh for the first time. The sudden change in Capital Base came as a shock and the banks were unable to maintain the decided Capital Base of 10% which was previously set as 8% under the Basel-I guideline provided by Bangladesh Bank. Not to mention, the economic instability, political turmoil and the crash of Stock Market of Bangladesh has played a significant role in the fluctuations of Capital Adequacy Ratio.

Steps Taken by Bank Asia

Every year, The Bank works out 5 years of capital planning considering industry analysis under the purview of business and financial risk. The combination of a global financial crisis, increased uncertainty and greater revolutions has expanded dramatically the role of sound capital planning process at financial institutions around the world. Bank Asia is very serious to maintain adequate capital. As part of this, first priority is given on rating large loan borrowers to reduce capital requirement.

Additionally, curbing classified loan is a prerequisite for maintaining a healthy capital which the Bank has adopted by strengthening recovery initiatives and applying various risk management techniques. All these efforts help The Bank to maintain adequate capital for most of the periods.

Figure: Capital Adequacy Ratio of Bank Asia from FY2009 to FY2013

Dhaka Bank Limited

Present Status

Dhaka Bank’s Total capital is Tk. 14,817 million which has been divided into Tier-1 and Tier-II capitals. Tier-1 capital is Tk. 10,927 million (9.28% of eligible capital) and Tier II capital is Tk. 3,410 million (2.90% of eligible capital).

Bank’s strength in capital base is also significant in the fact that the ratio of eligible capital to Risk Weighted Assets (RWA) which is also called as Capital Adequacy Ratio was 12.18% as of Dec 31, 2013.

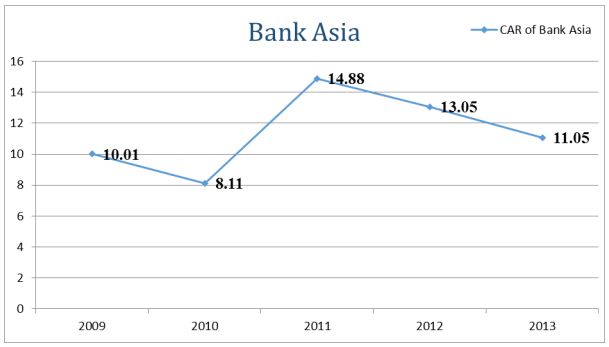

Trend Analysis

From the Table given below, we can see that the Classified Loan has increased over the past five years CL was Tk. 2,946 million in FY2009 whereas in FY2012, it became Tk. 5,656 million but in FY2013, it decreased to Tk. 4,317 million. This sudden decrease in Classified Loans has a major role in increasing the CAR which was 10.74% in FY2012 and became 12.18 % in FY2013.

From the graph below, it is also visible that from FY2009 to FY2013, CAR of Dhaka Bank was the lowest in FY2010 which was 10.09%. The main reason behind this decrease is, FY2010 was the year when Basel-II was introduced in Bangladesh for the first time. The sudden change in Capital Base came as a shock and the banks were unable to maintain the decided Capital Base of 10% which was previously set as 8% under the Basel-I guideline provided by Bangladesh Bank. Not to mention, the political turmoil, economic instability and the crash of Stock Market of Bangladesh has played a significant role in the fluctuations of Capital Adequacy Ratio.

Steps Taken by Dhaka Bank Limited

Dhaka Bank Limited strictly follows the guidelines of Bangladesh Bank regarding capital adequacy and its policy is to maintain regulatory capital at a level which is 1% – 2% higher than the minimum required capital. Dhaka Bank Limited has complied with the standards set out for the standardized approach for credit risk & the basic indicators approach for operational risk under Based-II as directed by Bangladesh Bank.

The Bank is well placed to maintain capital under Basel-II accord. Classified loans improved to 4.15% in FY2013 of total loan outstanding as on balance sheet date from 6.28% of FY2012.

Figure: Capital Adequacy Ratio of Dhaka Bank Limited from FY2009 to FY2013

Dutch-Bangla Bank Limited

Present Status

As of 31 December 2013, Dutch-Bangla Bank Limited’s Total Risk Weighted Assets stood at Tk. 112,770.7 million. The Bank maintained total capital (Tier 1 and Tier 2) of Taka 15,403.4 million against the Minimum Requirement of Tk. 11,277.07 million depicting a surplus of Tk. 4,126.3 million. In other term, this surplus capital both in term of absolute amount and ratio (CAR) is considered to be adequate to absorb all the material risks which the Bank may expose in future.

Bank’s Capital Adequacy Ratio (CAR) as of 31 December 2013 stood at 13.7% consisting of 9.5% in Tier 1 capital and 4.2% in Tier 2 capital, which is well above the regulatory requirement of minimum 10%.

Trend Analysis

From the Table given below, we can see that the Classified Loan has increased over the past five years CL was Tk. 1,193 million in FY2009 whereas in FY2013, it became Tk. 4,175.6 million. In spite of a gradual increase in CL, the CAR of DBBL kept growing over the last five years. As the Capital Base of Dutch-Bangla Bank Limited is comparatively bigger than other PCBs, the gradual increase in Classified Loans has not been able to make a significant impression over its CAR. The CAR of DBBL was 12.0% in FY2012 and became 13.7 % in FY2013.

From the graph below, it is also visible that from FY2009 to FY2013, CAR of Dutch-Bangla Bank was the lowest in FY2010 which was 9.6%. The main reason behind this decrease is, FY2010 was the year when Basel-II was introduced in Bangladesh for the first time. The sudden change in Capital Base came as a shock and the banks were unable to maintain the decided Capital Base of 10% which was previously set as 8% under the Basel-I guideline provided by Bangladesh Bank. Not to mention, the economic instability, political turmoil and the crash of Stock Market of Bangladesh has played a significant role in the fluctuations of Capital Adequacy Ratio.

Steps Taken by Dutch-Bangla Bank Limited

The Bank evaluates the adequacy of its capital in terms of Section 13 (1) of the Bank Company Act, 1991 (Amended up to 2013) and instruction contained in BRPD Circular No. 35 dated 29 December 2010 [Guidelines on ‘Risk Based Capital Adequacy for Banks’ (Revised regulatory capital framework in line with Basel II)].

The Bank assesses the capital requirement considering the existing size of portfolio, concentration of portfolio to different risk weight groups, asset quality, profit trend etc. on quarterly rest. The Bank also forecasts the adequacy of capital in terms of its capacity of internal capital generation, maintaining the size of the portfolio, asset quality, conducting credit rating of the borrowers, segregation of portfolio to different risk weight groups etc. The standard of Bank’s ability to maintain the capital against the regulatory requirement always focused to entail the confidence of its investors, depositors and other stakeholders.

Eastern Bank Limited

Present Status

As of 31st December 2013, EBL’s Risk Weighted Asset was Tk. 140,279 million and Minimum Capital Requirement was Tk. 14,027.9 million which is 10% of given RWA. Eastern Bank Limited’s Total Capital stood at Tk. 16,764 million among which Tk. 13,245 million falls under Tier-1 Capital and Tk. 3,519 million under Tier-II Capital. The Surplus over Minimum Capital Requirement of EBL was tk. 2,736.35 million in FY2013.

During the year 2013, the CAR of Eastern Bank Limited ranges 11.95% in FY2013 against minimum requirement of 10% of RWA.

Trend Analysis

From the Table given below, we can see that the Classified Loan has increased over the past five years. CL was Tk. 1,172 million in FY2009 whereas in FY2013, it became Tk. 3,697 million. However, the CAR of EBL has decreased in FY2013 from FY2012. The CAR of EBL was 12.05% in FY2012 and became 11.95% in FY2013.

From the graph below, it is also visible that from FY2009 to FY2013, CAR of Eastern Bank was the lowest in FY2011 which was 10.18%. The main reason behind this decrease is, FY2010 was the year when Basel-II was introduced in Bangladesh for the first time. The sudden change in Capital Base came as a shock and EBL became unable to maintain the decided Capital Base of 10% in FY2011 which was previously set as 8% under the Basel-I guideline provided by Bangladesh Bank. Not to mention, the economic instability, political turmoil and the crash of Stock Market of Bangladesh has played a significant role in the fluctuations of Capital Adequacy Ratio.

Steps Taken by Eastern Bank Limited

Assessing regulatory capital in relation to overall risk exposures of a bank is an integrated and comprehensive process. EBL follows the ‘asset based’ rather than ‘capital based’ approach in assessing the adequacy of capital to support current and projected business activities.

Eastern Bank Limited focuses on strengthening risk management and control environment rather than increasing capital to cover up weak risk management and control practices. EBL has been generating most of its incremental capital from retained profit (stock dividend and statutory reserve transfer etc.) and occasional issue of right shares to support incremental growth of Risk Weighted Assets (RWA). Risk Management Unit (RMU) under guidance of the SRP team/BRMC (Bank’s Risk Management Committee), is taking active measures to identify, quantify, manage and monitor all risks to which the Bank is exposed to. Besides meeting regulatory capital requirement, the Bank maintains adequate capital to absorb material risks foreseen. Therefore, the Bank’s Capital Adequacy Ratio (CAR) remains consistently within the comfort zone since the parallel run from 1 January 2009.

IFIC Bank Limited

Present Status

As of 31st December 2013, Total Capital stood at Tk. 9,630.85 million among which Tk. 8,324.15 million falls under Tier-1 Capital and Tk. 1,306.70 million falls under Tier-II Capital. Total Risk Weighted Asset of IFIC Bank was Tk. 92,915.4 million of which Tk. 9,291.54 million was Minimum Capital Requirement which is 10% of given RWA. The Bank has thus maintained some excess capital than the minimum requirement of 10%. The Surplus over Minimum Capital Requirement was Tk. 339.31 million in FY2013.

IFIC Bank has maintained Capital Adequacy Ratio of 10.37% as on 31 December 2013, whereas Minimum Capital Requirement (MCR) is 10% from 01 July 2011 as per BRPD circular No.10 dated 10 March 2010.

Trend Analysis

From the Table given below, we can see that the percentage of Classified Loan has been fluctuating over the past five years. CL to Total Loans and Advances was 3.73% in FY2009 whereas in FY2013, it became 3.94%. However, the CAR of IFIC Bank has increased in FY2013 from FY2012. The CAR was 10.87% in FY2012 and became 10.90% in FY2013.

From the graph below, it is also visible that from FY2009 to FY2013, CAR of IFIC Bank was the lowest in FY2012 which was 10.87%. The main reason behind this decrease is the economic instability, political turmoil and the crash of Stock Market of Bangladesh. These factors have played a significant role in the fluctuations of Capital Adequacy Ratio of IFIC Bank over the years.

Steps Taken by IFIC Bank Limited

According to BB Guidelines IFIC Bank is assessing Risk Based Capital Adequacy under Basel-II from 01 January 2010. Under Basel-II framework the capital requirement is determined for Credit Risk and Market Risk under Standardized Approach and Operational Risk under Basic Indicator Approach and summed-up to determine total Risk Weighted Assets and thereafter the Minimum Capital Requirement (MCR). However, the Bank is continuously evaluating its capital position in comparison to its risk weighted assets position and exploring ways and means to raise capital both internally and externally.

NCC Bank Limited

Present Status

As of 31st December 2013, NCC Bank has maintained a Total Risk Weighted Asset of Tk. 117,820.23 million of which Tk. 11,782.03 million is Minimum Capital Requirement guided by Bangladesh bank. The Bank’s Total Capital stood at Tk. 13,978.64 million among which Tk. 12,810.68 million falls under Tier-1 Capital and Tk. 1,167.96 million falls under Tier-II Capital. The Surplus over Minimum Capital Requirement was Tk. 2,196.61 million in FY2013.

National Credit and Commerce Bank (NCC Bank) has maintained capital adequacy ratio of 11.86% in FY2013 as against the total regulatory requirement of 10%.

Trend Analysis

From the Table given below, we can see that the Classified Loan has increased over the past five years. CL was Tk. 1,420.57 million in FY2009 whereas in FY2013, it became Tk. 4,862.41 million. Moreover, the CAR of NCC Bank has also increased gradually over the last five years. The CAR of NCC Bank was 11.47% in FY2012 and became 11.86% in FY2013.

From the graph below, it is also visible that from FY2009 to FY2013, CAR of NCC Bank was the lowest in FY2010 which was 10.91%. The main reason behind this decrease is, FY2010 was the year when Basel-II was introduced in Bangladesh for the first time. The sudden change in Capital Base came as a shock and the bank became unable to maintain the decided Capital Base of 10% in FY2010 which was previously set as 8% under the Basel-I guideline provided by Bangladesh Bank. Not to mention, the economic instability, political turmoil and the crash of Stock Market of Bangladesh has played a significant role in the fluctuations of Capital Adequacy Ratio.

Steps Taken by NCC Bank Limited

The Bank’s policy is to manage and maintain its capital with the objective of maintaining strong capital ratio and high rating. The Bank maintains capital levels that are sufficient to absorb all materials risk. NCC Bank also ensures that the capital levels comply with regulatory requirements and satisfy the external rating agencies and other stakeholders including depositors. The whole objective of the capital management process in the Bank is to ensure that the Bank remains adequately capitalized at all times.

Prime Bank Limited

Present Status

As of 31st December 2013, the Total Risk Weighted Asset was Tk. 222,791 million and the Minimum Capital Requirement guided by Bangladesh Bank was Tk. 22,279.1 million which is 10% of RWA. Total Capital of Prime Bank Limited was Tk. 26,812 million among which Tk. 21,708 million falls under Tier-1 Capital and Tk. 5,104 million falls under Tier-II Capital. The Surplus over Minimum Capital Requirement was Tk. 4,493.42 million in FY2013. Capital Adequacy of Prime Bank Limited stood at 12.03% against the regulatory requirement of 10.00%.

Trend Analysis

From the Table given below, we can see that the Classified Loan has increased over the past five years. CL was Tk. 1,149 million in FY2009 whereas in FY2013, it became Tk. 7,815 million. However, the CAR of PBL has decreased in FY2013 from FY2012. The CAR of PBL was 12.64% in FY2012 and became 12.03% in FY2013.

From the graph below, it is also visible that from FY2009 to FY2013, CAR of Prime Bank was the lowest in FY2010 which was 11.96%. The main reason behind this decrease is, FY2010 was the year when Basel-II was introduced in Bangladesh for the first time. The sudden change in Capital Base came as a shock and the bank became unable to maintain the decided Capital Base of 10% in FY2010 which was previously set as 8% under the Basel-I guideline provided by Bangladesh Bank. Not to mention, the economic instability, political turmoil and the crash of Stock Market of Bangladesh has played a significant role in the fluctuations of Capital Adequacy Ratio.

Steps Taken by Prime Bank Limited

Maintenance of adequate capital against overall risk exposure of the Bank is our guiding philosophy to strengthen risk management and internal control. With strong cash flows and falling debt PBL is well placed to fund future growth and retain its investment grade credit rating.

The Bank’s policy is to manage and maintain its capital with the objective of maintaining strong capital ratio and high rating. The Bank maintains capital levels that are sufficient to absorb all material risks. The Bank also ensures that the capital levels comply with regulatory requirements and satisfy the external rating agencies and other stakeholders including depositors. The whole objectives of the capital management process in the Bank are to ensure that the Bank remains adequately capitalized at all times.

It is worth mentioning that during the entire 2013 bank made numerous Stress Testing exercises to reaffirm its position assuming acute to most distressing circumstances. The process also included continuous persuasion of the business houses on the importance of Corporate Rating for a mutual win-win situation.

The City Bank Limited

Present Status

As of 31st December 2013, the Total Risk Weighted Asset of The City Bank Limited was Tk. 143,377 million and the Minimum Capital Requirement guided by Bangladesh Bank was Tk. 14,337.7 million which is 10% of RWA. Total Capital of CBL was Tk. 16,697 million among which Tk. 12,958 million falls under Tier-1 (Core) Capital and Tk. 3,739 million falls under Tier-II (Supplementary) Capital.

CBL has Capital Adequacy Ratio (CAR) of 11.65% in FY2013 as against the minimum regulatory requirement of 10%.

Trend Analysis

From the Table given below, we can see that the percentage of Classified Loan to Total Loans and Advances has increased over the past five years. Percentage of CL was 4.9% in FY2009 whereas in FY2013, it became 8.1%. However, the CAR of CBL has been fluctuating over the last five years and decreased in FY2013 from FY2012. The CAR of CBL was 11.7% in FY2012 and became 11.65% in FY2013.

From the graph below, it is also visible that from FY2009 to FY2013, CAR of CBL was the lowest in FY2010 which was 11.2%. The main reason behind this decrease is, FY2010 was the year when Basel-II was introduced in Bangladesh for the first time. The sudden change in Capital Base came as a shock and the bank became unable to maintain the decided Capital Base of 10% in FY2010 which was previously set as 8% under the Basel-I guideline provided by Bangladesh Bank. Not to mention, the economic instability, political turmoil and the crash of Stock Market of Bangladesh has played a significant role in the fluctuations of Capital Adequacy Ratio of The City Bank Limited.

Steps Taken by The City Bank Limited

Bangladesh has entered into the regime of Basel II implementation from Jan 01, 2010 after 1 year parallel run period in 2009. According to BRPD Circular # 10, dated March 10, 2010, Minimum Capital Requirement (MCR) has been fixed at 8% up to June 30, 2010, 9% up to June 30, 2011 and Minimum Capital Requirement (MCR) for the banks in Bangladesh is currently 10% of its total RWA as per Basel II guideline. The City Bank Limited is well ahead of this minimum target both in Consolidated and in Solo basis as of December, 2013.CBL remained fully capital compliant throughout the year, 2013. Core capital is maintained on the high side. The surplus capital maintained by CBL will act as buffer to absorb all material risks and to support the future activities. To ensure the adequacy of capital to support the future activities, the bank draws assessment of capital requirements periodically considering future business growth.

Conclusion

From the above discussions, we can get a clear idea about the Capital Adequacy Ratio of the 10 chosen Private Commercial Banks of Bangladesh. We can also get an impression of how these banks are regulating their Capital Base and maintaining the Minimum Requirement 10% of the Total Risk Weighted Assets under Basel-II, guided by Bangladesh Bank.

If we summarize the performance in Capital Adequacy Ratio of 10 PBCs, we can see a visible trend of decreasing CAR in FY2010. The main explanation of this combined decline in Capital Adequacy Ratio for a specific year is the major Stock Market Crash in Bangladesh at the end of FY2010. As Banks and other Financial Institutions had heavily invested in the Stock Market in FY2010 which initially resulted in a growth, the market ultimately came crashing down and resulted a downward slope in the CAR.

Overall we can say that the PCBs have been able to maintain the minimum required CAR of 10% since the introduction of Basel-II guideline. This achievement has only been possible due to following strict guidelines and maintaining business with high rating grade of investment clients.

Recommendation

As far giving any suggestions to Citibank N.A. for their internship program, I can only recommend that they should give more project based work to interns so that the interns can have a complete knowledge of a certain work, and not having incomplete knowledge of different types of works. Other than that, Citibank N.A. is a wonderful place to work and with some amazing people to work with. I really enjoyed the time I got to spent at one of the best foreign commercial banks of the country.