CAMELS Rating System: In Accordance with BRAC Bank Limited

CAMELS Rating System is an international bank-rating system where bank supervisory authorities rate institutions according to six factors. It is encountered by six components named capital adequacy, asset quality, management competence, earnings, liquidity and sensitivity to market risk. It is used for banking companies to know about their financial condition, overall soundness of the banks, and predict different risk factors that may contribute to turn the bank into a problem. CAMEL first founded in 1979 and in 1996 CAMEL became CAMELS with the addition of a component grade for the Sensitivity of the bank to market risk. In Bangladesh, the five components of CAMEL have been used for evaluating the bank’s operations that reflect in a complete institution’s financial condition, compliance with banking regulations and statutes and overall operating soundness since the early nineties. In 2006, Bangladesh Bank has upgraded the CAMEL into CAMELS and included ‘Sensitivity to market risk’ or ‘S’ which make CAMEL into CAMELS. It has 1 through 5 rating for each of these components and a composite rating where the rating of 1 indicates strong performance or best rating, 2 reflects satisfactory performance, 3 represents performance that is flawed to some degree, 4 refers to marginal performance and is significantly below average and 5 is considered as unsatisfactory or worst rating.

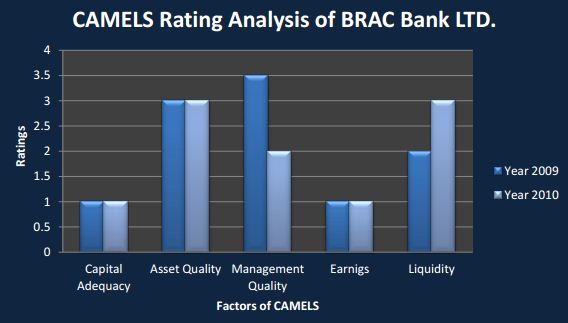

In Bangladesh, CAMELS rating is followed by all commercial as a recommendation of Bangladesh Bank. BRAC Bank Ltd. also makes report on CAMELS rating internally and externally. Bangladesh Bank evaluates CAMELS rating where BBL issue all necessary reports. BBL is a ‘B’ category bank in Bangladesh according to CAMELS rating system of Bangladesh Bank. It is in satisfactory position in 2010 by holding rating 2. Although it is in strong position in capital adequacy and earnings, but it is not in good position in asset quality, management quality and liquidity. So, it is ‘B’ category bank in Bangladesh. Now BBL is planning to include CAMELS’s new component named sensitivity to market in their CAMELS rating system which will make their rating system more efficient and effective.

They do not yet use any quantitative factors to evaluate the new components of CAMELS rating system named sensitivity to market.

Introduction

The report is all about BRAC Bank Ltd. It is discussed about the CAMELS rating system in accordance with BRAC Bank Ltd. The report is focused on about the overview of company, overview of the CAMELS rating system and also analysis of the CAMELS rating system of BRAC Bank Limited. It is a comparison report on CAMELS rating system of BBL in between the year of 2010 and 2009.

Objective of the Report

There are two types of objectives of this report. One is general objective and another is specific objective:

General Objective: The general objective of this report is to cover the degree requirement of BRAC University and is to discuss about the CAMELS rating system of Bangladesh Bank in accordance with BRAC Bank Ltd.

Specific objective:

- To explore about CAMELS frame work

- To know about the origin of CAMELS rating system

- To learn about the process of CAMELS reporting

- To analyze the comparison of BBL’s CAMELS rating system in between the year of 2010 and 2009

Scope of the Report

The report is all about the CAMELS rating system of Bangladesh Bank in accordance with BRAC Bank Ltd. The report has been prepared using highest concern, but the complexity of CAMELS rating system is very well known. It is a report which can be easy for all that a primary reader do not face any problem to know about the banking industry or about regulatory requirement or about the CAMELS rating system. This report can be absolute alternative for anyone who wants to know the ins and outs of CAMELS rating system of BBL and common rules and regulation of BB about CAMELS rating system. Graphical analysis and different chart of this report makes it easier and more acceptable to all.

Methodology

The report is based on primary and secondary sources. To make this report, I have neither attended any seminar/training regarding CAMELS Rating System nor worked with the reporting unit for CAMELS Rating.

Primary sources are collected through:

- Conducted face to face interview

- General discussion with reporting unit officers

Secondary sources are collected through:

- Bangladesh Bank capital adequacy guideline

- Bangladesh Bank CAMELS rating system guideline

- Websites

- Articles

- BRAC Bank Ltd. Annual Report 2010 & 2009

- Many Research Report on CAMELS rating system

Company Profile

BRAC Bank is one of country’s fastest growing banks. With 151 branches, 250 ATMs, 421 SME Unit Offices and 8,306 (as on 31st May 2011) human resources, BRAC Bank’s operation now cuts across all segments and services in financial industry. With more than 1 Million Customers, the bank has already proved to be the largest SME financier in just 9 years of its operation in Bangladesh and continues to broaden its horizon into Retail, Corporate, SME, Probashi and other arenas of banking. In the year: 2010, BRAC Bank has been recognized as Asia’s most Sustainable Bank in Emerging Markets by the Financial Times and IFC.

BRAC Bank is a financial hypermarket that offers financial solutions for all strata – be it retail, SME, wholesale banking, capital market, or remittance; but it always had a focus on SME. This bank was actually founded on a philosophy of keeping trust on the hopes and dreams of Bangladeshi entrepreneurs – and majority of these entrepreneurs have been beyond the conventional banking reach. The bank was the PIONEER to get into this segment of SME. Established in 2001, BRAC Bank is now ten years old and it has pioneered the small and medium enterprise (SME) banking. In the financial pyramid, there are corporate institutions (local and multinational) at the top of the pyramid and there are low income individuals at the bottom. Those at the top are served by banks and other financial institutions while those at the bottom are served by Micro Finance Institutions (MFIs), e.g. NGOs. But SME sector in the middle were missing access to necessary banking services and that’s where BRAC Bank has filled the gap.

Corporate Vision

Building profitable and socially responsible financial institution focused on Market and Business with Growth potential, thereby assisting BRAC and stakeholders to build a just, enlightened, healthy democratic and poverty free Bangladesh.

Corporate Mission

Corporate Missions are given below –

- Sustained growth in Small & Medium Enterprise sector

- Continuous low-cost deposit Growth with controlled growth in retail assets.

- Corporate Assets to be funded through self-liability mobilization. Growth in Assets through syndications and investment in faster growing sectors.

- Continuous endeavor to increase non-funded income

- Keep our debt charges at 2% to maintain a steady profitable growth

- Achieve efficient synergies between the bank’s branches, SME unit offices and BRAC field offices for delivery of remittance and Bank’s other products and services

- Manage various lines of business in a full controlled environment with no compromise on service quality

- Keep a divers, far flung team fully controlled environment with no compromise on service quality

- Keep a diverse, far flung team fully motivated and driven towards materializing the bank’s vision into reality

Core Values

Our Strength emanates from our owner – BRAC. This means, we will hold the following values and will be guided by BRAC as we do our work.

- Value the fact that one is a member of the BRAC family

- Creating an honest, open and enabling environment

- Have a strong customer focus and build relationships based on integrity, superior service and mutual benefit

- Strive for profit & sound growth

- Work as team to serve the best interest of our owners

- Relentless in pursuit of business innovation and improvement

- Value and respect people and make decisions based on merit

- Base recognition and reward on performance

- Responsible, trustworthy and law-abiding in all that we do.

Achievements

- BRAC Bank has achieved the International award for “Excellence in Retail Financial Services”

- BRAC Bank awarded prestigious FT Sustainable Bank of the Year 2010

- DHL–Daily Star Bangladesh Business Awards 2008

- BRAC Bank received National Award as the Highest VAT payer for the financial year 2007-2008

- BRAC Bank received ICAB National Award

Strengths

- Fastest growing bank in the country for the last two years

- Leader in SME financing through 350 offices

- Biggest suit of personal banking & SME products

- Large ATMs (Automated Teller Machine) & POS (Point of Sales) network

- Shareholding Structure

Overview of the Finance Department

Finance Division is performing the key roles of controllership, budgeting, forecasting, financial analysis, business performance monitoring, decision support, procurement, fixed asset management, insurance management and also looking into the functions of General Administration and Infrastructure Services (GA&IS).

Financial Control:

- Payment Processing and Compliance – The major activities of Payment Processing and Compliance wing of Finance Department are to check & process all vendors bills, all staff related bills (Travel, Local conveyance, various Reimbursement, Car allowance etc) and utility Bills for payment. The wing also prepares & processes CRO, ZM bills (Travel, Local conveyance, Staff welfare, Mobile, Fixed assets bill, etc) for payment, tracks and monitors Cap Ex budget of the whole bank.

- Asset Management & Payments Settlement: Asset Management & Payments Settlement is the central gate way of all kinds of financial payments, Fixed Asset Management and Insurance Management by proper accounting with the proper approval.

- GL & Cost Center Management – This wing is involved in the Maintenance of Office Accounts & Cost Center; development of new product/ parameter; providing advise/support of mapping COA and setup of transactions of new development/projects; identify, monitor & resolve mismatches of Office Accounts, Trial Balances and reconciliation of Sundry and Suspense Accounts.

- Regulatory Reporting – Regulatory Reporting wing is the central gate way of all kinds of reporting like BASEL II, Stress Testing, CAMELS, Capital Market Exposure, SBS I, II & III, DBI-35, CIB, CL 1-6, Recovery, For Example- Reporting etc. to Bangladesh Bank.

- Financial Reporting, Budgeting & Taxation – In Financial Reporting, focus is given on the core financial reports like Balance Sheet and Profit and Loss statements by business and of the entire bank.

Business Planning and Analysis:

- Business Reporting-SME – The main function of this wing is to prepare different types of analytical & static Reports and maintain MIS for SME Banking Division.

- Business Finance -Retail – Main objective of this wing is to provide Business Reports/Information to Retail Banking Team and management to keep them update with latest information about Retail banking position as well as decision making.

- Business Finance – Wholesale Banking – The main focus of this wing is to help management in making decisions by imparting the critical business facts and figures. This wing provides financial MIS reports related to Corporate Banking, Cash Management and Custodial Service, Probashi Banking Services.

Procurement

This team manages relationships with Vendors regarding Cap Ex and other items, negotiate and establish contract for the supply of goods, maintain a transparent and efficient procurement policy, maintain cost to the optimal level, maintain efficiency of the procurement process through faster execution of the process and settlement of the bills.

GA & IS

This department is responsible to ensure the smooth operation of all service related, premises maintenance and all kind of logistics support services across the Bank in all over Bangladesh.

They ensure the physical security of Bank’s premise and assets, employees and customers, the safe custody of Bank’s assets including repair and maintenance, and provide support in transport management.

Overview of CAMELS Rating System

Camels rating system is a common phenomenon for all banking system all over the world. It is used in all over the country in the world. It is mainly used to measure a ranking position of a bank on the basis of few criteria. Camels rating system is an international bank-rating system where bank supervisory authorities rate institutions according to six factors.

The six factors are represented by the acronym “CAMELS”.

The six factors examined are as follows:

C – Capital adequacy

A – Asset quality

M – Management quality

E – Earnings

L – Liquidity

S – Sensitivity to Market Risk

Bank supervisory authorities assign a score on a scale of one (best) to five (worst) for each factor to each bank. If a bank has an average score less than two it is considered to be a high quality institution, while banks with scores greater than three are considered to be less-than satisfactory establishments. The system helps the supervisory authority identify banks that are in need of attention.

Origin of CAMELS Rating System

There were many banks rating system available in the world. However, Camels rating system is the most successful bank rating system in the world. The ‘Uniform Financial Institutions Rating System (UFIRS)’ was created in 1979 by the bank regulatory agencies. Under the original UFIRS a bank was assigned ratings based on performance in five areas: the adequacy of Capital, the quality of Assets, the capability of Management, the quality and level of Earnings and the adequacy of Liquidity. Bank supervisors assigned a 1 through 5 rating for each of these components and a composite rating for the bank. This 1 through 5 composite rating was known primarily by the short form CAMEL.

A bank received the CAMEL rate 1 or 2 for their sound or good performance in every respect of criteria. The bank which exhibited unsafe and unsound practices or conditions, critically deficient performance received the CAMEL rate 5 and that bank was of the greatest supervisory concern.

While the CAMEL rating normally bore close relation to the five component ratings, it was not the result of averaging those five grades. Supervisors consider each institution’s specific situation when weighing component ratings and review all relevant factors when assigning ratings to a certain extent. The process and component and composite system exist similar for all banking companies.

In 1996, the UFIRS was revised and CAMEL became CAMELS with the addition of a component grade for the Sensitivity of the bank to market risk. Sensitivity is the degree to which changes in market prices such as interest rates adversely affect a financial institution.

The communication policy for bank ratings was also changed at end of 1996. Starting in 1997, the supervisors were to report the component rating to the bank. Prior to that, supervisors only reported the numeric composite rating to the bank.

CAMELS’ ratings in the Ninth District as of the third quarter of 1998 reflect the excellent banking conditions and performance over the last several years. Comparison between the distribution of ratings in the most recent quarter and 10 years ago during the height of the national banking crisis is illustrative (221 banks failed nationally in 1988 while 3 banks failed in 1998). Nearly 100 percent of Ninth District banks currently fall into the top two ratings with 40 percent receiving the top grade. Ten years ago one-third of Ninth District banks fell into the bottom three ratings and only about one of 10 banks received the highest grade.

Six Factors of CAMELS Rating System

Capital Adequacy

Capital adequacy focuses on the total position of bank capital. It assures the depositors that they are protected from the potential shocks of losses that a bank incurs. Financial managers maintain company’s adequate level of capitalization by following it. It is the key parameter of maintaining adequate levels of capitalization.

Asset Quality

Asset quality determines the robustness of financial institutions against loss of value in the assets. All commercial banks show the concentration of loans and advances in total assets.

The high concentration of loans and advances indicates vulnerability of assets to credit risk, especially since the portion of non-performing assets is significant.

Management Soundness

Management quality of any financial institution is evaluated in terms of Capital Adequacy, Asset Quality, Management, Earnings, Liquidity and Sensitivity to market risk. Moreover, it is also depended on compliance with set norm, planning ability; react to changing situation, technical competence, leadership and administrative quality. A Sound management is the most important pre-requisite for the strength and growth of any financial institution.

Earnings and Profitability

Earning and profitability is the prime sources of increasing capital of any financial institution. Strong earnings and profitability profile of a bank reflect its ability to support present and future operations. Increased earning ensure adequate capital and adequate capital can absorb all loses and give shareholder adequate dividends.

Liquidity

An adequate liquidity position refers to a situation, where an institution can obtain sufficient funds, either by increasing liabilities or by converting its assets quickly at a reasonable cost.

It access in terms of asset and liability management. Liquidity indicators measured as percentage of demand and time liabilities (excluding interbank items) of the banks. It means that the percentage of demand and time liabilities gets a bank as per its liquid assets.

Sensitivity to Market Risk

The sensitivity to market risk is evaluated from changes in market prices, notably interest rates; exchange rates, commodity prices, and equity prices adversely affect a bank’s earnings and capital.

Process of CAMELS Reporting

Process:

- Data collection of reschedule status of overdue loans from CRM, Retail, SME and Ops.

- Data collection of lending rates and deposit rates from Treasury.

- Data collection of average borrowed amount and rate of interest expenses from Treasury.

- Data collection of maturity wise investments from Treasury.

- Collect information of training programs arranged by the Bank’s training institute from Human Resources Division.

- Collection of other required reports and statements from other divisions.

- Preparation of CAMELS report as per guideline of BB & Core Risk Management Guidelines.

- Meeting arranged with MANCOM.

- Necessary changes are made and report is submitted to BB.

CAMELS Rating for Banking Companies

CAMELS rating system is encountered by six components named capital adequacy, asset quality, management competence, earnings, liquidity and sensitivity to market risk. It is used for banking companies to know about their financial condition, overall soundness of the banks, and predict different risk factors that may contribute to turn the bank into a problem.

To review the different aspects of the banks such as adequacy of risk-based capital, future sources of capital and dividend payment ratio, asset growth rate, loan growth rate, nonperforming loan trends, provision for loan loss and bad assets, maturity profile of assets, their classification-wise weight age, performance of off balance sheet items, return on assets, level and composition of earnings, volatility of deposits base and reliance position on the borrowed funds and its sources, technical competence in the rise of financial globalization and deregulation, uses of financial innovations, leadership ability, administrative and control ability, compliance with the rules and regulations and standard management information system etc CAMELS rating system is very important. It also recommends on which sector it should improve.

CAMELS Rating System of Bangladesh

All over the world, CAMELS rating is a common figure to all banking industry. Like all other countries, it is also used in Bangladesh. In Bangladesh, the five components of CAMEL have been used for evaluating the five crucial dimensions of a bank’s operations that reflect in a complete institution’s financial condition, compliance with banking regulations and statutes and overall operating soundness since the early nineties. In 2006, Bangladesh Bank has upgraded the CAMEL into CAMELS. ‘Sensitivity to market risk’ or ‘S’ is the new rating component which is included in CAMEL and make it into CAMELS. The new rating component makes the system more effective and efficient. The new system needs bank’s regular condition and performance according to predetermined stress testing on asset and liability and foreign exchange exposures, procedures, rules and criteria and on the basis of the results obtained through risk-based audits under core risk management guidelines. A bank’s single CAMELS rating has come from off-site monitoring, which uses monthly financial statement information, and an on-site examination, from which bank supervisors gather further “private information” not reflected in the financial reports. The development of “credit points” examination result is ranging from 0 to 100. The six key performance dimensions – capital adequacy, asset quality, management, earnings, liquidity and sensitivity to market risk – are to be evaluated on a scale of 1 to 5 in ascending order.

CAMEL Numerical Rating: Rating Description

- STRONG: It is the highest rating and is indicative of performance that is significantly higher than average.

- SATISFACTORY: It reflects performance that is average or above; it includes performance that adequately provides for the safe and sound operation of the banks.

- FAIR: Represent performance that is flawed to some degree. It is neither satisfactory nor unsatisfactory but is characterized by performance of below average quality.

- MARGINAL: Performance is significantly at below average; if not changed, such performance might evolve into weaknesses or conditions that could threaten the viability of the bank.

- UNSATISFACTORY: Is the lowest rating and indicative of performance that is critically deficient and in need of immediate remedial attention. Such performance by itself, or in combination with other weakness, threatens the viability of the institution.

Analysis on “CAMELS Rating System” of Bangladesh Bank in Accordance With BRAC Bank Limited –

Capital Adequacy

Capital adequacy focuses on the total position of bank capital. It focuses on the risk weighted assets which proposed to protect from the potential shocks of losses that a bank might incur. It is assessed according to: the volume of risk assets, the volume of marginal and inferior assets, bank growth experience, plans, and prospects; and the strength of management in relation to all the above factors. The major financial risk like credit risk, interest rate risk and risk involved in off-balance sheet operations are absorbed by it. The CAMELS components are also required for Basel Committee of Bangladesh Bank. As regards the capital adequacy, they grouped the factors like a) size of the bank, b) volume of inferior quality assets, c) bank’s growth experience, plans and prospects, d) quality of capital, e) retained earnings, f) access to capital markets, and g) non-ledger assets and sound values not shown on books (real property at nominal values, charge-offs with firm recovery values, tax adjustments). Capital to Risk-Weighted Assets ratio (CRWA) is the most widely used indicator for capital adequacy ratio. According to Bangladesh Bank, a bank has to maintain a minimum capital adequacy ratio (CAR) of not less than 10 percent of their risk weighted assets (RWA, with at least 5 percent in core capital) or Taka 2 billion, whichever is higher.

Basel II

Basel II is a capital adequacy management framework for banks. Basel II is the second of the Basel Accords, which are recommendations on banking laws and regulations issued by the Basel Committee on Banking Supervision; adopted by Bangladesh Bank.

The main objectives of Basel II are as follows:

- Promote safety and soundness in the financial systems

- Constitute a more comprehensive and more sensitive approach to addressing risks

- Better alignment of regulatory capital to underlying risk

- Encourages banks to improve risk management

These guidelines are structured on following three aspects:

- Minimum capital requirements to be maintained by a bank against credit, market, and operational risks.

- Process for assessing the overall capital adequacy aligned with risk profile of a bank as well as capital growth plan.

- Framework of public disclosure on the position of a bank’s risk profiles, capital adequacy, and risk management system.

Regulatory Capital is composed of:

- T-1 or Core Capital comprises of highest quality capital elements

- T-2 or Supplementary Capital represents other elements which fall short of some of the characteristics of the Core capital but contribute to the overall strength of a bank

- T-3 or Additional Supplementary Capital consists of short-term subordinated debt (original/residual maturity less than or equal to five years but greater than or equal to two years) would be solely for the purpose of meeting capital requirements for market risk

Conditions for Maintaining Regulatory Capital

- T-2 + T-3 cannot exceed T-1

- 250% of asset and security revaluation reserve shall be eligible for T-2

- 3At least 30% market risk to be supported by T-1

- T-3 is limited to 250% of T-1 after meeting credit risk

- General provisions is limited to maximum 1.25% of TRWA

- Subordinated debt shall be limited to maximum 30% of T-1

In capital adequacy, BRAC Bank Ltd. maintained adequate capital of 12.07% where the current regulatory requirement was 10.00%. In 2010, the bank’s core capital and total capital base were 7.43% and 12.07% respectively.

Asset Quality

Asset quality determines the robustness of financial institutions against loss of value in the assets. All commercial banks show the concentration of loans and advances in total assets. In the standard CAMELS framework, asset quality is assessed according to: the level, distribution, and severity of classified assets, the level and composition of nonaccrual and reduced rate assets, the adequacy of valuation reserves; and the demonstrated ability to administer and collect problem credits (Sundarajan and Errico, 2002). As regards the asset quality, Basel Committee on Banking Supervision highlights the factors a) volume of transactions, b) special mention loans—ratios and trends, c) level, trend and comparison of non-accrual and renegotiated loans, d) volume of concentrations, and e) volume and character of insider transactions (Sahajwala and Bergh, 2000). In Bangladesh, all banks show a high proportion of loans and advances in 2004-05 (60.7 percent) in total assets as regarding the asset composition. A high proportion of loans and advances indicate vulnerability of assets to credit risk, especially since the portion of non-performing assets is significant. A large nonperforming loan portfolio has been the major predicament of banks, particularly of the state owned banks. The most important indicator used to identify problems with asset quality in loan portfolio is the percentage of gross and net non-performing loans to total assets and total advances. In BRAC Bank Ltd. classified loan to capital and classified loan to total loans ratios are used to identify asset quality.

Management Soundness

Management quality of any financial institution is evaluated in terms of Capital Adequacy, Asset Quality, Management, Earnings, Liquidity and Sensitivity to market risk. Moreover, it is also depended on compliance with set norm, planning ability; react to changing situation, technical competence, leadership and administrative quality. To illustrate any conclusion regarding management soundness on the basis of monetary indicators, as characteristics of good management are generally qualitative in nature is very difficult. So a sound management is the most important pre-requisite for the strength and growth of any financial institution. The capabilities of the Board of Directors and internal management personnel to identify, measure, monitor and control different risks associated in the activities is very important for a sound management. A good manager also need to ensure a safe, sound and efficient operation in compliance with all applicable laws, regulations and especially the core risk management guidelines introduced by the central bank might be a measuring rod of that.

In the standard CAMELS framework, management is evaluated according to: technical competence, leadership, and administrative ability; compliance with banking regulations and statutes; ability to plan and respond to changing circumstances; adequacy of and compliance with internal policies; tendencies toward self-dealing; and demonstrated willingness to serve the legitimate needs of the community (Sundarajan and Errico, 2002).

Basel Committee on Banking Supervision highlights few aspects as regards the management factors (Sahajwala and Bergh, 2000)3

Adopt technical competence, leadership etc. of middle and senior management, which are given below:

- Compliance with banking laws and regulations,

- Adequacy and compliance with internal policies,

- Tendencies towards self-dealing,

- Ability to plan and respond to changing circumstances,

- Demonstrated willingness to serve the legitimate needs of the community,

- Adequacy of directors, and

- Existence and adequacy of qualified staff and programs.

Ratio such as total expenditure to total income, operating expenses to total expenses, earnings and operating expenses per employee, and interest rate/mark-up spread are generally used to gauge management soundness. In particular, a high and increasing expenditure to income ratio indicates the operating inefficiency that could be due to weaknesses in management.

However, BRAC Bank Ltd. and many other commercial use a different method to identify management quality ratio which is also accepted from Bangladesh Bank. Here, the management rating is an average of the four ratings given to capital, asset, earnings and liquidity. (C+A+E+L)/4. If other key factors are good then management quality will also be good.

Earnings and Profitability

Earning and profitability is the prime sources of increasing capital of any financial institution. Strong earnings and profitability profile of a bank reflect its ability to support present and future operations. Increased earning ensure adequate capital and adequate capital can absorb all loses and give shareholder adequate dividends. In the standard CAMELS framework, earnings are assessed according to: the ability to cover losses and provide for adequate capital; earnings trend; peer group comparisons; and quality and composition of net income (Sundarajan and Errico, 2002). As regards the earnings and profitability factors, Basel Committee on Banking Supervision highlights the aspects like a) return on assets compared to peer group averages and the bank’s own trends, b) material components and income and expenses— compared to peers and the bank’s own trends, c) adequacy of provisions for loan losses, d) quality of earnings, and e) dividend payout ratio in relation to the adequacy of bank capital (Sahajwala and Bergh, 2000). Return on Asset (ROA) is commonly used to identify earnings and profitability ratio of CAMELS rating system from other ratio. BRAC Bank Ltd. and many other commercial bank use ROA for calculating earnings and profitability ratio.

Liquidity

An adequate liquidity position refers to a situation, where an institution can obtain sufficient funds, either by increasing liabilities or by converting its assets quickly at a reasonable cost.

It access in terms of asset and liability management. Liquidity indicators measured as percentage of demand and time liabilities (excluding interbank items) of the banks. It means that the percentage of demand and time liabilities gets a bank as per its liquid assets. In the standard CAMELS framework, liquidity is assessed according to: volatility of deposits; reliance on interest-sensitive funds; technical competence relative to structure of liabilities; availability of assets readily convertible into cash; and access to inter-bank markets or other sources of cash, including lender-of-last-resort (LOLR) facilities at the central bank (Sundarajan and Errico, 2002). As regards the liquidity factors, Basel Committee on Banking Supervision highlights the aspects like

- Adequacy of liquidity sources compared to present and future needs,

- Availability of assets readily convertible to cash without undue loss,

- Access to money markets,

- Level of diversification of funding sources: on- and off-balance sheet,

- Degree of reliance on short-term volatile sources of funds,

- Trend and stability of deposits,

- Ability to securitize and sell certain pools of assets,

- Management competence to identify, measure, monitors and control liquidity position (Sahajwala and Bergh, 2000).

At present, commercial bank deposit 18 percent of statutory liquidity requirement (SLR) where cash reserve requirement (CRR) is 5 percent. SLR for the banks operating under the Islamic Shariah is 10 percent and the specialized banks are exempted from maintaining the SLR. Bangladesh Bank keeps the cash reserve requirement (CRR) and the remainder as qualifying secured assets under the SLR, uses either in cash or in government securities.

Liquidity indicators measured as percentage of demand and time liabilities (excluding interbank items) of the banks indicate whether the banks have excess or shortfall in maintenance of liquidity requirements. The basic indicators of sound liquidity position take place when deposits are readily available to meet the bank’s liquidity needs; assets are easily convertible into cash; compliance with SLR; and easy access to money markets etc. Liquid asset to total demand and time liability and total loan to total deposits are used in BRAC Bank Ltd. to identify liquidity.

Sensitivity to Market Risk

The sensitivity to market risk is a new component of CAMELS rating system. It makes it more effective and more efficient. The sensitivity to market risk is evaluated from changes in market prices, notably interest rates; exchange rates, commodity prices, and equity prices adversely affect a bank’s earnings and capital. The major consideration to measure the sensitivity to market risk is the sensitivity of the bank’s earnings or the economic value of its capital base or net equity value due to adverse effect in the interest rates of the market. The amount of market risk arising from trading and foreign operations. As regards the sensitivity to market risk, Basel Committee on Banking Supervision highlights the aspects like a) sensitivity of the financial institution’s net earnings or the economic value of its capital to changes in interest rates under various scenarios and stress environments, b) volume, composition and volatility of any foreign exchange or other trading positions taken by the financial institution, c) actual or potential volatility of earnings or capital because of any changes in market valuation of trading portfolios or financial instruments, and d) ability of management to identify, measure, monitor and control interest rate risk as well as price and foreign exchange risk where applicable and material to an institution (Sahajwala and Bergh, 2000). BRAC Bank Ltd. still not uses any quantitative factors for this component.

Analysis of the Comparison of CAMELS Rating System in BRAC Bank Limited

Analysis of the Comparison of CAMELS rating system is an important part of this research report. Here, the CAMELS rating position of BRAC Bank Ltd. in 2009 and 2010 has been clearly identified and it is also tried to identify that what are the difference between two years’ ratio and what the reason of these difference are.

In the analysis part, it is clearly identified that the financial condition of a bank is changing year to year. CAMELS rating system helps to identify these changing factors easily. From this chart, it is found that the financial condition of BRAC Bank Ltd. such as capital adequacy, asset quality, management quality, earnings and liquidity ratios were clearly different from year 2009 to year 2010. Capital adequacy ratio of BBL in the year 2009 was greater than the year 2010. Its Core capital adequacy ratio was 2.83% greater than from the year 2010 where supplementary capital adequacy ratio was 2.22% less than from the year 2010. It means that in the year 2009 core capital adequacy ratio was stronger and supplementary capital adequacy ratio was less strong from the year 2010. Although the supplementary capital adequacy ratio was less strong from the year 2010, the total capital adequacy ratio in 2009 was stronger than the total capital adequacy ratio in 2010. However, the rating of CAMELS was same in 2009 and in 2010 that means both were rating 1 or strong position. In the asset quality ratio, it is also found that the asset quality ratio of year 2009 was better than year 2010 although both were given same ratings or fair position. To identify management quality rating, there is a different system was followed which is more effective. The management quality rating is an average of the four ratings given to capital, asset, earnings and liquidity.

Actually the performance of capital adequacy, asset quality, earnings and liquidity is totally deepened on the performance of management. If the management quality is good then others will also be good. So, management quality rating comes from the average ratings of other four ratings. Earnings ratio of BBL was almost same in 2009 & 2010. It held strong position from 2009 to 2010. In liquidity, BBL’s credited loan ratio as per its deposit was increased in 2010 from 2009. However, its liquid asset ratio was less than the liquid asset ratio of 2009. So, it held fair position in 2010 where in 2009, it held satisfactory position as per as the rating system of CAMELS.

By analyzing the following CAMELS rating system of BRAC Bank Limited, there are many reasons is clearly identified which help it to be in satisfactory position. The reasons are briefly discussed below:

- In 2009 and 2010, BBL was in strong position in capital adequacy. It has adequate capital in 2009 and 2010.

- BBL was in fair position in asset quality during 2009 and 2010. Bank’s disburse loan is asset for it. BBL has many classified loan such as sub-standard loan, doubtful loan and bad loan which makes it to take in fair position. Because of having many SME centre, BBL have already gave a large amount of loan where they have few bad loan. So, it cannot maintain the strong asset quality position. It was in fair position because of its classified loan specially for bad loan. There is another reason of failing the maintenance of asset quality. BBL has a large number of SME centre in Bangladesh. So, it is also very hard to maintain a large number of SME centers where it has a huge amount of loan. So BBL cannot maintain its asset quality properly.

- In management quality, BBL was in satisfactory position in 2010 which was in marginal in 2009. It has been improved from 2009 to 2010. The management quality is mainly based on other key factors such as capital adequacy, asset quality, earnings and liquidity. If other key factors are good then management quality will also be good. Management quality is also depended on the management policy of a manager. If a manager performs good job then management quality will also become good. A good manager can control other factors and also can give a successful result which represents a good management quality. In 2010, management quality improved because of its good management and its other key factors. Management committee of BBL is good. They perform good job that’s why the management quality is improving day by day. In the cost cutting situation, they perform their best job which reduces the excessive expenditure of the bank.

- BBL held a strong position in earnings in 2009 and 2010. Its Return on Asset (ROA) was good in 2009 and 2010 which helps it be a strong position. Its net income to total asset was high which made it to earn more profit. Actually, it was possible because BBL utilized and managed properly its total assets to generate its net income. Asset utilization is a big factor to earn high profit to all financial organization which BBL perfectly performed.

- In 2010, BBL was in fair position in its liquidity but in 2009, it was in satisfactory In 2010, it failed to generate more liquid asset from 2009. Its liquidity asset ratio as per as total demand and time liability was less than the year of 2009 although it used 95.63% of its total deposit as total loan in 2010 which was greater than 2009.

All in all, BRAC Bank Limited was in satisfactory position in 2009 and 2010. It held this position even now. The CAMELS rating analysis interpretation of satisfactory position is that the organization is fundamentally sound with modest correctable weakness where supervisory response is limited. BRAC Bank Ltd. cannot improve its position because it cannot get better in asset quality, management quality and liquidity. If BBL will progress the current position of asset quality, management quality and liquidity and maintain its current position in capital adequacy and earnings in future, it would be in strong position in CAMELS rating system.

Recommendation

Many recommendation policies can be applied for BRAC Bank Ltd. which is given below:

- BBL has large capital which helps to keep it strong position in 2009 and 2010. It should maintain its large capital and continue its strong position in capital adequacy ratio of CAMELS rating in future.

- It should improve its asset quality position by utilizing assets in right way. It should reduce the possibility or risk of bad loan and give loan to those customers who are capable to repay loan.

- It should be more concern in their management quality to improve its satisfactory position.

- Management should be stricter on controlling the excessive cost.

- BBL had good return on asset during 2009 and 2010. They should maintain its strong position.

- The position of liquidity in 2010 was fair. BBL should be concern about it and improve its position. It should save more liquid asset to maintain liquidity ratio of CAMELS ratings.

- BBL should provide proper information to the Bangladesh Bank so that Bangladesh Bank can use professional judgment and consider both qualitative and quantitative factors when analyzing a BBL’s financial performance.

Conclusion

BRAC Bank Limited is a high standard Bangladeshi private commercial bank in our country. It is a commercial which has become popular in a very short time for its banking operation. It thrives to work better, harder everyday to bring new solutions, new opportunities. BBL is a ‘B’ category bank in Bangladesh according to CAMELS rating system of Bangladesh Bank.

It holds ‘B’ category for its satisfactory position in CAMELS rating system. Although it is in strong position in capital adequacy and earnings, but it is not in good position in asset quality, management quality and liquidity. So, it is ‘B’ category bank in Bangladesh. Now BBL is planning to include CAMELS’s new component named sensitivity to market in their CAMELS rating system which will make their rating system more efficient and effective.