What is Liquidity?

Liquidity is the availability of funds, or assurance that funds will be available, to honor all cash outflow commitments (both on- and off-balance sheet) as they fall due. These commitments are generally met through cash inflows, supplemented by assets readily convertible to cash or through the institution’s capacity to borrow. The risk of illiquidity may increase if principal and interest cash flows related to assets, liabilities and off-balance sheet items are mismatched.

Supply and Demand of liquidity in Islamic Banks

The following sources of liquidity and supply come together to determine each bank’s net liquidity position at any moment of time.

Supply and Demand of liquidity in Islamic Banks

Table

Supplies of liquidity come from

| Demand for Banks liquidity arise from |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

| |

| |

borrowings

| |

incurred in producing & selling services | |

| |

|

Importance of liquidity management

Managing liquidity is a fundamental component in the safe and sound management of all financial institutions. Sound liquidity management involves prudently managing assets and liabilities (on- and off-balance sheet), both as to cash flow and concentration, to ensure that cash inflows have an appropriate relationship to approaching cash outflows. This needs to be supported by a process of liquidity planning which assesses potential future liquidity needs, taking into account changes in economic, regulatory or other operating conditions. Such planning involves identifying known, expected and potential cash outflows and weighing alternative asset/liability management strategies to ensure that adequate cash inflows will be available to the institution to meet these needs.

Objectives:

The objectives of liquidity management are:

- Honoring all cash outflow commitments (both on- and off-balance sheet) on an ongoing, daily basis

- Maintaining public confidence on the bank

- Avoiding raising funds at market premiums or through the forced sale of assets; and

- Satisfying statutory liquidity and statutory reserve requirements

Sound Practices for Managing Liquidity in Banking

The ability to fund increases in assets and meet obligations as they become due – is crucial to the ongoing viability of any banking organization. But the importance of liquidity transcends the individual bank since a liquidity shortfall at a single organization can have systemic repercussions. The management of liquidity is therefore among the most important activities conducted at banks. Over time, there has been a declining ability to rely on core deposits and an increased reliance on wholesale funding. Recent technological and financial innovations have provided banks with new ways of funding their activities and managing their liquidity, but recent turmoil in global financial markets has posed new challenges for liquidity management. In light of these developments, there are some necessary practices for managing liquidity in banks which are indicated below:

- Developing a structure for managing liquidity

- Measuring and monitoring net funding requirements

- Managing market access

- Contingency planning

- Foreign currency liquidity management

- Internal controls for liquidity risk management

- Role of public disclosure in improving liquidity

Principles for Sound Liquidity Risk Management and Supervision

The principles underscore the importance of establishing a robust liquidity risk management framework that is well integrated into the bank-wide risk management process. The primary objective of this guidance is to raise banks’ resilience to liquidity stress. Among other things, the principles seek to raise standards in the following areas:

- Governance and the articulation of a firm-wide liquidity risk tolerance.

- Liquidity risk measurement, including the capture of off-balance sheet exposures, securitization activities, and other contingent liquidity risks that were not well managed during the financial market turmoil.

- Aligning the risk-taking incentives of individual business units with the liquidity risk exposures their activities create for the bank.

- Stress tests that cover a variety of institution-specific and market-wide scenarios, with a link to the development of effective contingency funding plans.

- Strong management of intraday liquidity risks and collateral positions.

- Maintenance of a robust cushion of unencumbered, high quality liquid assets to be in a position to survive protracted periods of liquidity stress.

- Regular public disclosures, both quantitative and qualitative, of a bank’s liquidity risk profile and management.

The principles also strengthen expectations about the role of supervisors, including the need to intervene in a timely manner to address deficiencies and the importance of communication with other supervisors and public authorities, both within and across national borders.

ROLE OF THE BOARD OF DIRECTORS

The Board of Directors of each institution is ultimately responsible for the institution’s liquidity. In discharging this responsibility, a Board of Directors usually charges management with developing liquidity and funding policies for the board’s approval and developing and implementing procedures to measure, manage and control liquidity within these policies.

At a minimum, a Board of Directors should:

- review and approve liquidity and funding policies based on recommendations by the institution’s management

- review periodically, but at least once a year, the liquidity management program

- ensure that an internal inspection/audit function reviews the liquidity and funding operations to ensure that the institution’s policies and procedures are appropriate and are being adhered to

- ensure the selection and appointment of qualified and competent management to administer the liquidity management function

ROLE OF MANAGEMENT

The management of each institution is responsible for managing and controlling the day-to-day liquidity of the institution according to the liquidity management program. Although specific liquidity management responsibilities will vary from one institution to another, management should be responsible for:

- Developing and recommending liquidity and funding policies for approval by the Board of Directors.

- Implementing the liquidity and funding policies.

- Ensuring that liquidity is managed and controlled within the liquidity management and funding management program.

- Ensuring the development and implementation of appropriate reporting systems with respect to the content, format and frequency of information concerning the institution’s liquidity position, in order to permit the effective analysis and the sound and prudent management and control of existing and potential liquidity needs.

- Establishing and utilizing a method for accurately measuring the institution’s current and projected future liquidity.

- Monitoring economic and other operating conditions to forecast potential liquidity needs.

- Ensuring that an internal inspection/audit function reviews and assesses the liquidity management program.

- Developing lines of communication to ensure the timely dissemination of the liquidity and funding policies and procedures to all individuals involved in the liquidity management and funding risk management process.

- Reporting comprehensively on the liquidity management program to the Board of Directors at least once a year.

The Liquidity Management Process

Effective liquidity management requires three-steps in which treasury identifies, manages and optimizes liquidity. These steps are interdependent, each requiring the successful implementation of the other two to optimally manage liquidity.

Identifying liquidity is the foundation from which the entire liquidity management process depends. It involves understanding the balances and positions of the institution on an enterprise-wide level. This requires the ability to access and gather information across the institution’s many lines of business, currencies, accounts and often multiple systems. Identifying liquidity is primarily a function of data gathering, and does not include the actual movement or usage of funds.

Managing liquidity within a bank’s corporate treasury involves using the identified liquidity to support the bank’s revenue generating activities. This may include consolidating funds, managing the release of funds to maximize their use, and tasks that “free up” lower-costing funds for lending or investment purposes to maximize their value to the institution.

Optimizing liquidity is an ongoing process with a focus on maximizing the value of the institution’s funds. As the strategic aspect of liquidity management, optimizing liquidity balances requires a strong and detailed understanding of the financial institution’s liquidity positions across all currencies, accounts, business lines and counterparties. With this information, the bank’s treasury is able to map the strategic aspects of the institution into the liquidity management process.

Limited time and resources availability is the biggest challenge in the liquidity management process to treasury. Although treasury groups are staffed with very capable personnel, a large amount of their time is spent on the task-based function of identifying liquidity instead of on the strategic elements necessary to optimize balances. This results in the entire liquidity management process being less efficient and affects the institution’s bottom line.

Guidelines of Liquidity Contingency Plans

Either within its Liquidity Management Policy (LMP) or separately, a bank is expected to have a liquidity Contingency Plan (LCP) covering the eventuality of it experiencing a liquidity crisis. The LCP should be designed to ensure that adequate liquidity is achieved at such times and should contain a number of key elements:

- The identification and definition of what constitutes a liquidity crisis.

- Early warning indicators, including the impact of external events not directly related to the financial condition of the bank.

- Actions to be taken.

- Roles and responsibilities.

- Management coordination and escalation of issues.

- Channels of communication.

- Communication with the Commission.

- Scenario planning and testing of the plan.

Impact of Central Bank Regulation

Bangladesh Bank has the specific guidelines regarding statutory reserve which ensures the minimum liquidity position of the bank and also safeguards the depositors. Every Islamic bank has to maintain 5.5% CRR with BB and 10.5% SLR. And every scheduled conventional bank must have to keep at least 18.5% statutory liquidity reserve. Under this 5.50% must be kept as CRR and rest of the 13% must be kept as LRR. IBBL always follows BB regulations strictly. We have already observed that IBBL maintains excess amount SLR and CRR beyond the actual requirement. Here the guideline for conducting the Islamic banks is given below-

Guidelines for Conducting Islamic Banking: November 2009 regarding Maintenance of CRR/SLR, Liquidity management by Bangladesh Bank

Section VI

Maintenance of CRR/SLR

All Islamic Banking Companies shall maintain Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) as per rates prescribed by Bangladesh Bank from time to time. Every commercial Bank having Islamic bank branches shall maintain SLR/CRR for its Islamic branches at the same rate as prescribed for the Islamic banks and shall, for the purpose, maintain a separate Current Account for the Islamic branches with Bangladesh Bank.

Addressing of liquidity crisis and utilization of surplus fund of the Islamic Banks:

In case of liquidity surplus and crisis the banks can take recourse to the following:

1. The excess liquidity of the Islamic banks/ Islamic branches of conventional Scheduled banks may be invested in the ‘Bangladesh Government Islamic Investment Bond’ (Islamic Bond introduced by the Government). In the same way, Islamic banks/branches facing liquidity crisis can tide over the crisis by availing of investment from Islamic Bond fund as per the prescribed rules.

2. In case Islamic banks/branches have surplus/ enough investment in the Islamic Investment Bond and subsequently faces liquidity crisis then the bank / branch may overcome the crisis by availing of investment facilities from Islamic Bond Fund against lien of their over purchased Islamic Bonds. To meet the crisis, REPO system may also be introduced for the Islamic Bonds.

3. The Islamic banks/branches having no surplus investment in ‘Bangladesh Govt. Islamic Investment Bond’ at the time of their liquidity crisis, if arises, may availed funds from Bangladesh Bank at a provisional rate on profit on its respective Mudaraba Short Notice Deposit Accounts which will be adjusted after finalization of Accounts and rate of profit of the concerned Islamic banks/branches. But till funds generated from sell of Islamic Investment Bonds remain available for investment such financial support may not be available from Bangladesh Bank.

4. The Islamic banks/branches may open/ maintain Mudaraba SND accounts with each other and can meet liquidity crisis by receiving deposits in the Mudaraba SND account at MSND rate from those having surplus liquidity.

5. To meet the liquidity crisis, if any, of the Islamic branches of the conventional commercial bank fund may be collected from sources which follow Islamic Shari’ah.

Asset Liability Management Policy

Asset Liability Management (ALM) is an integral part of Bank Management; and so, it is essential to have a structured and systematic process for manage the Balance Sheet. Banks must have a committee comprising of the senior management of the bank to make important decisions related to the Balance Sheet of the Bank. The committee, typically called the Asset Liability Committee (ALCO), should meet at least once every month to analysis, review and formulate strategy to manage the balance sheet.

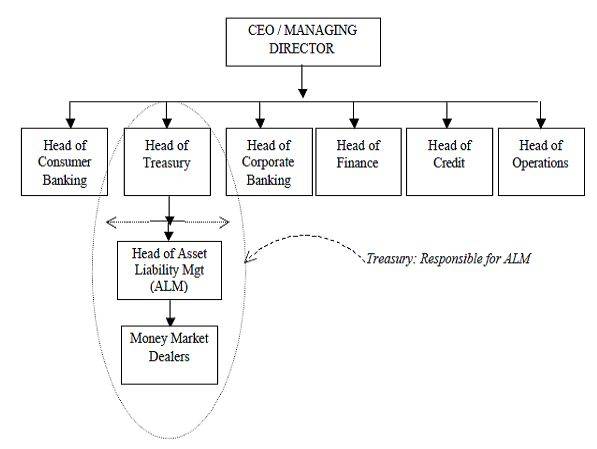

ORGANISATIONAL STRUCTURE OF ALM

The responsibility of Asset liability Management is on the Treasury Department of the bank. Specifically, the Asset liability Management (ALM) desk of the Treasury Department manages the balance sheet. The results of balance sheet analysis along with recommendation is placed in the ALCO meeting by the Treasurer where important decisions are made to minimize risk and maximize returns. Typically, the organizational structure looks like the following:

The key roles and responsibilities of the ALM Desk:

1) To assume overall responsibilities of Money Market activities.

2) To manage liquidity and interest rate risk of the bank.

3) To comply with the local central bank regulations in respect of bank’s statutory obligations as well as thorough understanding of the risk elements involved with the business.

4) Understanding of the market dynamics i.e competition, potential target markets etc.

5) Provide inputs to the Treasurer regarding market views and update the balance sheet movement.

6) Deal within the dealer’s authorized limit.

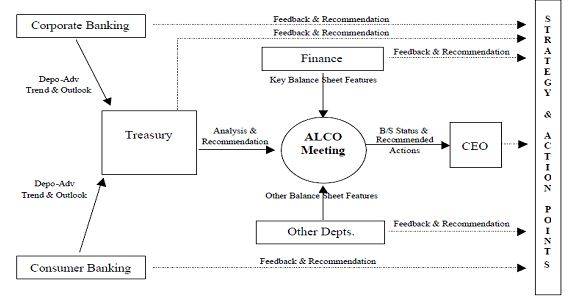

- PROCESS

The bank’s asset liability management is monitored through ALCO. The information flow in the ALCO can be diagramed as below:

- Liquidity Test for Contingencies

The major risk a bank runs is liquidity risk. Under any circumstances a bank has to honor its commitments. As a result, it has to make sure that enough liquidity is available to meet fund requirements in situations like liquidity crisis in the market, policy changes by central bank, a name problem of the bank etc. So, a bank’s balance sheet should have enough liquid assets for meeting contingencies. Liquid assets can be as follows:

- Reserve Assets.

- Cash in Tills.

- Specific Government Securities.

- Foreign Currency in open position.

- Specific FDRs.

A liquidity contingency plan should be in place to ensure a bank is prepared to combat any crisis situation. For the Islami Bank Bangladesh Ltd. these assets are maintained according to Islamic Shari’ah. The instruments involved with interest are banned here like T-bill, general bond.