The short interest ratio (SIR), also known as the days-to-cover ratio, is a basic calculation that divides the number of shares short in stock by its average daily trading volume. It shows how long it takes on average for short sellers to cover their bets, or repurchase all of the borrowed shares. Basically, the ratio can help a financial backer discover rapidly if a stock is intensely shorted or not shorted versus its normal day-by-day exchanging volume. The number of shares that will be repurchased in the open market after short selling is high when the short-interest ratio is high, and the number of shares that will be repurchased in the open market after short selling is low when the short-interest ratio is low.

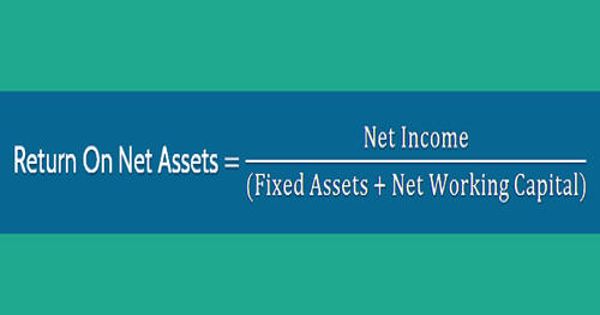

The short-interest ratio is determined by partitioning the quantity of offers undercut by the normal day-by-day exchanging volume, by and large in the course of the last 30 exchanging days. The proportion is utilized by the principal and specialized dealers to recognize patterns. The total number of shorted shares of a stock is divided by the average daily trading volume (ADTV) to get the short-interest ratio. To put it in a formula:

Short Interest Ratio (SIR) = Short Interest (SI) / Average Daily Trading Volume (ADTV)

The short interest ratio and short interest are not a similar short revenue estimates the all out number of offers that have been undercut on the lookout. This proportion can likewise be determined for a whole trade to decide the slant of the market all in all. A high days-to-cover ratio of about five or greater on an exchange can be viewed as a bearish warning, and vice versa. Since news or events may affect trading volumes and cause the ratio to grow or shrink, it should always be compared to real short interest and trading volumes.

In finance, the short interest ratio is a statistical measure. Short interest and average daily trading volume are two factors that influence this. It eventually dictates whether or not it is acceptable to short sell. The ratio tells an investor if the quantity of shares short is high or low versus the stock’s normal exchanging volume. The proportion can rise or fall dependent on the quantity of offers short. In any case, it can likewise increment or lessening as volume levels change.

The short interest ratio is low when the ADTV is high. The short interest ratio is high when the ADTV is poor. Similarly, the ratio is high when total short interest is high, and it is low when total short interest is low. The short interest ratio has a few imperfections, the first being that isn’t refreshed routinely. Short interest is accounted for at regular intervals and is ordinarily as of the fifteenth and the most recent day of the month. The information takes several days to be released, and by that time, the number of shares short in the market may have changed.

The number of shares that will be repurchased in the open market after short selling is high when the short interest ratio is high. Similarly, a low short interest ratio indicates that a small number of shares will be repurchased in the open market following short selling. A short squeeze can happen if the cost of stock with a high short interest starts to have expanded interest and a solid upward pattern. Short sellers can increase demand by buying shares to cover short positions in order to reduce their losses, causing the share price to temporarily rise.

The days to cover ratio and the short interest ratio are often interchanged. The days to cover ratio is similar to the short interest ratio in that it calculates the number of days it would take to cover a position on a company’s shorted shares. In business sectors with a functioning alternatives market short merchant can support against the danger of a short get by purchasing call choices. On the other hand, short crushes are bound to happen in stocks with little market capitalization and a little open buoy.

Furthermore, one must consider how news or events might affect trading volumes, causing the ratio to expand or contract. Often equate the ratio to the real short interest and trading volumes. The short-interest ratio is the proportion of short interest to the normal day-by-day exchanging volume. Short interest is a piece of the short interest proportion yet isn’t equivalent to the proportion. Short interest is the quantity of offers that are short sold separated by the all-out number of extraordinary offers.

Information Sources: