The Return on Capital Employed (ROCE) is a financial measure that can be used to determine the profitability and productivity of a business. ROCE metric is considered to be one of the best profitability ratios and is widely used by investors to determine whether or not a business is suitable for investment. It is a useful metric for assessing the relative profitability of firms after taking the number of resources used into consideration. In other words, the ratio can help to know how well a corporation is generating profits from its capital.

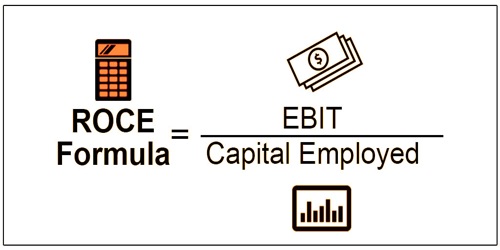

Return on Capital Employed (ROCE) may be described as a return rate received by the enterprise as a whole. The ROCE ratio is one of the profitability ratios that may be used by financial managers, stakeholders, and potential investors when assessing a firm for investment. The formula for computing ROCE is as follows:

ROCE = EBIT / Capital Employed

Where:

EBIT = Earnings before interest and tax

Capital Employed = Total assets − Current liabilities

ROCE calculation is simple and can be measured easily using a company’s financial statements. Some researchers, when measuring the return on capital working, would use net operating profit instead of earnings before interest and taxes.

EBIT (Earnings before interest and tax), otherwise called working salary, shows how much an organization gains from its tasks alone regardless of intrigue or expenses. EBIT is determined by taking away the expense of merchandise sold and working costs from incomes.

Capital employed is the aggregate sum of value put resources into a business. Capital employed is generally determined as either absolute resources less current liabilities or fixed resources in addition to working capital.

ROCE uses the recorded (year-end) capital numbers; if instead one uses the opening and closing capital average for the year, then the total capital employed (ROACE) returns. ROCE takes into account just the funds lent over the long term. Present liabilities are thus not counted in the estimation of working income. Some analysts and investors may favor calculating ROCE supported the common capital employed, which takes the typical of opening and shutting capital employed for the time.

Return on employed capital (ROCE) shows how much operating income is generated for each dollar of invested capital. ROCE is used to prove the value of its assets and liabilities which the company earns. A higher ROCE is often more favorable, as it means that more income per dollar of capital employed are produced. It tends to be particularly valuable when looking at the presentation of organizations in capital-escalated segments, for example, utilities and telecoms. Be that as it may, likewise with some other budgetary proportions, ascertaining only the ROCE of an organization isn’t sufficient. Other benefit proportions, for example, return on resources, return on contributed capital, and profit for value ought to be utilized related to ROCE to decide if an organization is likely a wise venture or not.

Whenever businesses are able to produce returns on capital above the weighted average cost of capital (WACC), they build value. A company that owns a lot of lands would have a lower ROCE than a company that owns little land but makes the same profit. In the end, ROCE’s equation informs investors how much profit a business produces per $1 of capital hired. Obviously, the better the more profit a firm can make per $1. Thus, a higher ROCE represents greater profitability through comparisons between the firms.

ROCE essentially can be utilized to show how much a business is picking up for its advantages, or the amount it is losing for its liabilities. The organization should pay enthusiasm to the obligation holders as they have first right on benefits and remaining benefits will be accessible for value investors and that won’t fulfill the necessary pace of profits by value and consequently, the financial specialist considers leaving the company or an organization. The ROCE trend over the years can also be a significant performance indicator for business. Investors typically prefer to favor firms with stable and increasing ROCE levels over firms where ROCE is volatile or lower in trend.

Information Sources: