Inflation can be defined as an increase in the level of prices in any economy. There are various causes of inflation. It is a rise in the general level of prices in any economy. The rate of inflation can be defined as changes in the general level of prices of commodities. There are mainly two types of inflation that we encounter in the industry, these are demand-pull inflation and cost-push inflation.

Unemployment is one of the major problems across the globe which almost all the countries of the world are facing. Unemployment produces unemployed people. Unemployed people are those people who are without jobs and looking for work. The labor force can be divided into two categories employed people and unemployed people. Both inflation and unemployment are macroeconomic concepts.

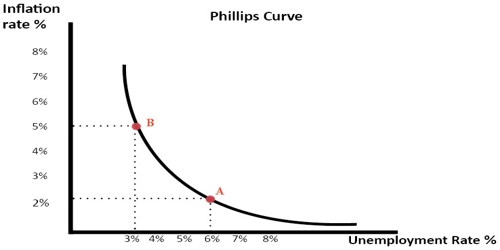

The trade-off between inflation and unemployment was first reported by A. W. Phillips in 1958 and so has been christened the Phillips curve. The simple intuition behind this trade-off is that as unemployment falls, workers are empowered to push for higher wages. Firms try to pass these higher wage costs on to consumers, resulting in higher prices and an inflationary buildup in the economy. The trade-off suggested by the Phillips curve implies that policymakers can target low inflation rates or low unemployment, but not both. During the 1960s, monetarists emphasized price stability (low inflation), while Keynesians more often emphasized job creation.

The relationship between inflation and unemployment has traditionally been an inverse correlation. However, this relationship is more complicated than it appears at first glance and has broken down on a number of occasions over the past 45 years.

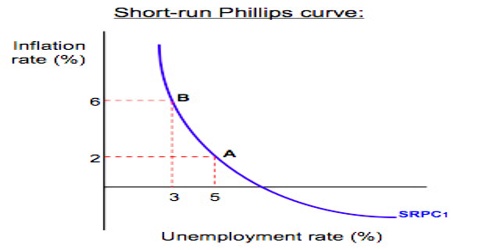

The Phillips curve relates the rate of inflation with the rate of unemployment. The Phillips curve argues that unemployment and inflation are inversely related: as levels of unemployment decrease, inflation increases. The relationship, however, is not linear. Phillips curve suggests as unemployment falls and the economy gets closer to full employment inflation rises. But, a fall in demand which causes inflation to fall, will cause a rise in the inflation rate.

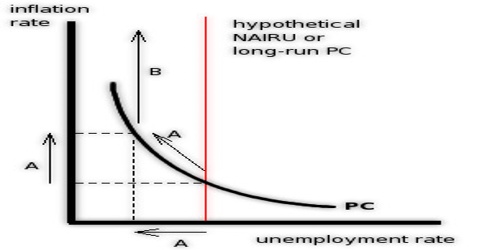

In place of the Phillips curve, many economists began to posit a “natural rate of unemployment.” If unemployment were to fall below this “natural rate”, however slightly, inflation would begin to accelerate. Under the “natural rate of unemployment” theory (also called the Non-Accelerating Inflation Rate of Unemployment, or NAIRU), instead of choosing between higher unemployment and higher inflation, policymakers were told to focus on ensuring that the economy remained at its “natural rate: the challenge was to accurately estimate its level and to steer the economy toward growth rates that maintain price stability, no matter what the corresponding level of unemployment.”

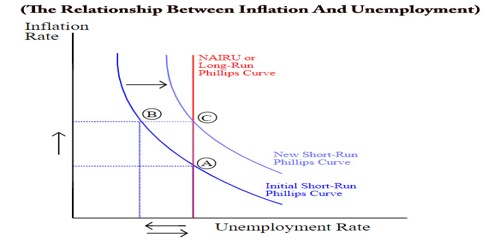

According to the classical theory in economics, there are two types of curves, long-run curve, and short-run curve. Hence Phillips curve consists of two types of curves, Long Run Phillips of Curve and Short-Run Phillips Curve. Long-Run Phillips curve and Short-Run Phillips Curves are shown as follows:

Short Run Phillips Curve indicates that there is an inverse relationship between the rate of inflation and unemployment. This was a model developed in the 1960s but later on some loopholes were found in this concept there came a situation in which there was a high rate of unemployment and a high rate of inflation simultaneously. This situation was known as stagflation. Hence in the 1970s, Long-Run Phillips Curve Model was recognized. (Inflation and Phillips Curve)

There is an appropriate reason why Long-Run Phillips Curve is vertical in nature. In the case of the long run, there is ignorance to the gain in productivity. Wages and their contracts are renegotiated in the long run and there is no money illusion in this scenario. Now let us suppose that there is an increase in the money supply at say x percent then there is an increase in the wages at x percent. Hence there is no chance in the long run for the firms to change the level of output or employment. Hence in the long run, there is no change in the net employment or unemployment of the economy i.e. there is no trade-off between inflation and unemployment in the case of the long run.

In the case of Short-Run Phillips Curve, there is an expected level of inflation according to a given level of unemployment, and this curve slopes downwards. The main reason for this curve to be downward sloping is that there is money illusion, in short-run wages are not renegotiated which means that there are same wage contracts which is not affected by the increase in the money supply and growth. We can consider a situation in which when there is an increase in the money supply, then there is an increase in the inflation rate but an increase in wages will be very low because the scenario is of the short run. This means that when there is a decrease in the inflation rate in the short-run then the level of unemployment is increased because of the reason that there is an increase in real wages. (Macroeconomics/International Economy)

Hence we can say that the Phillips Curve gives an exact relationship between the level of unemployment and rate of inflation through Long-Run Phillips Curve (LRPC) and Short-Run Phillips Curve (SRPC).

Historical application –

During the 1960s, the Phillips curve rose to prominence because it seemed to accurately depict real-world macroeconomics. However, the stagflation of the 1970s shattered any illusions that the Phillips curve was a stable and predictable policy tool. Nowadays, modern economists reject the idea of a stable Phillips curve, but they agree that there is a trade-off between inflation and unemployment in the short-run. Given a stationary aggregate supply curve, increases in aggregate demand create increases in real output. As output increases, unemployment decreases. With more people employed in the workforce, spending within the economy increases, and demand-pull inflation occurs rising price levels.

Therefore, the short-run Phillips curve illustrates a real, inverse correlation between inflation and unemployment, but this relationship can only exist in the short run. The idea of a stable trade-off between inflation and unemployment in the long-run has been disproved by economic history.

In the above diagram of the Phillips curve, there are three important points. A is the starting point of our consideration according to which there is an equilibrium unemployment and inflation rate, 8% according to the intersection of the graph LRPC and SRPC1. This means that there is an increase in the level of wages at the long run is 8%. Now a situation comes when there is a cut down in the rate of growth of money supply is decreased to 4% by the government but the still rate of inflation is 8%. This will lead to a decrease the real money supply in the economy. Now, when there is a decrease in real money, this causes an interest rate to increase. Hence there will be a decrease in investment and consumption of the private sector will cause an increase in unemployment.

As far as the situation remains when employees of the companies expect money supply to be at 8% till then economy remains at SRPC1, there is very little decrease in wage claims and hence there is a very little in the rate of inflation below 8% leading to a very little increase in unemployment. Under such conditions, inflation goes higher than the money supply which forces money supply to reduce as a result of which money supply and unemployment increase along SRPC1 until point B. Now, according to the self-adjusting nature of the economy, it will move to long-run equilibrium at point A or point C depending upon workers and government. If there is an increase in the wages by 5%, then there will be an increase in the money supply and hence point will move back to point A because there will be excessive unemployment which leads to an increase of money supply which increases the real money supply and decreases unemployment.

With inflation rising (albeit slowly, and still relatively mild at around 4.2%), some business sectors will no doubt begin clamoring for tighter monetary policies that sacrifice job-creation and wage growth by slowing economic growth. But these fears of inflation are probably misplaced. A moderate rate of inflation is conducive to the growth of real investment, and in the context of a decades-long squeeze on workers’ wage share, there is room to expand employment without setting off a wage-price spiral. What workers need is not greater fiscal and monetary austerity, but rather a revival of a Keynesian program of ”employment targeting“ that would sustain full employment and empower workers to push for higher wages. It’s not likely; however, that the owners of capital and their political allies would sit idly by where such a program to be enacted.

In recent years, the economy has experienced low unemployment, low inflation, and negligible wage gains. However, the Federal Reserve is currently engaged in tightening monetary policy or hiking interest rates to combat the potential of inflation. We have yet to see how these policy moves will have an impact on the economy, wages, and prices.

Phillips Curve is considered to be the best possible technique exploring this important relationship. There had been few changes that we had seen in the Phillips curve that earlier there was just a concept of Short-Run Phillips Curve but it had few restrictions that there may be an increase in wages and money illusion to the people. Hence in order to remove these loopholes, Long-Run Phillips Curve was generated which covers the situation of wage increase and money illusion as well. Unemployment and Inflation are two important macroeconomic techniques.

In order to have a look at the economic situation of any country, it is very much important to look forward the rate of inflation of its economy and the natural level of unemployment in the country. As far as the economic growth of any country is concerned, as the level of unemployment in its economy will be low, there will be a more growing economic condition in the country.

Hence at last we can simply conclude that unemployment and inflation are related and this relationship is explored by the Phillips curve which must be considered as one of a major victory in terms of macroeconomics.

Information Sources: