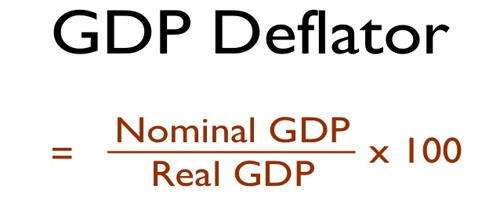

In economics, the GDP deflator is a measure of the level of prices of all-new, domestically produced, final goods and services in an economy in a year. It measures the changes in prices for all of the goods and services produced in an economy. GDP stands for gross domestic product, the total monetary value of all final goods and services produced within the territory of a country over a particular period of time (quarterly or annually). It is the ratio of the value of goods and services an economy produces in a particular year at current prices to that of prices that prevailed during the base year. It helps economists compare the levels of real economic activity from one year to another.

“The GDP deflator regularly updates the type of goods and services used to measure the implicit price deflator – depending on which goods are being bought.”

The GDP price deflator is a more comprehensive inflation measure than the CPI index because it isn’t based on a fixed basket of goods. Like the consumer price index (CPI), the GDP deflator is a measure of price inflation/deflation with respect to a specific base year; the GDP deflator of the base year itself is equal to 100. It helps show the extent to which the increase in the gross domestic product has happened on account of higher prices rather than an increase in output. It helps identify how much prices have inflated over a specific time period. The GDP deflator is used to convert nominal GDP statistics into real GDP.

The GDP deflator regularly updates the type of goods and services used to measure the implicit price deflator – depending on which goods are being bought. The Consumer price index CPI also tries to measure the average level of prices in an economy. However, it tends to use a more fixed basket of goods. Unlike the CPI, the GDP deflator is not based on a fixed basket of goods and services; the “basket” for the GDP deflator is allowed to change from year to year with people’s consumption and investment patterns. The basket of goods in CPI is often updated less frequently, than the GDP deflator. The CPI, which measures the level of retail prices of goods and services at a specific point in time, is one of the most commonly used inflation measures because it reflects changes to a consumer’s cost of living. Since the deflator covers the entire range of goods and services produced in the economy — as against the limited commodity baskets for the wholesale or consumer price indices — it is seen as a more comprehensive measure of inflation.