Crowdfunding gives startup entrepreneurs back control by allowing them to raise funds. Equity crowdfunding is a means of collecting capital for your business by soliciting small individual investments from a large number of individuals, or the “crowd,” using various channels such as the internet or social media. It differs from donation-based or rewards-based models in that the donors do not control the company.

Equity crowdfunding is helping a growing number of startups and small enterprises get off to a good start. Equity crowdfunding not only provides them with the required funds to build their firm, but it also opens the door to more options than may initially appear.

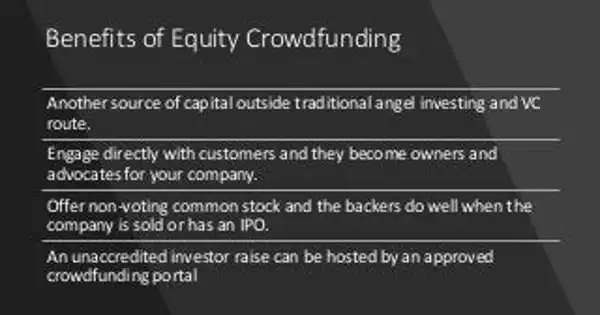

Benefits of Equity Crowdfunding –

Equity crowdfunding introduces a new approach to the investing and capital-raising process. It can offer several benefits to both companies and investors.

- Validation

A successful crowdfunding campaign can provide your company with momentum and a track record of raising funds. It might be a quick way to raise funds with no upfront costs.

- Easier access to capital

When opposed to traditional modes of capital raising, online crowdfunding platforms allow entrepreneurs and businesses to exhibit their initiatives to a larger number of possible investors. It is a good approach to test the public’s reaction to your product/concept – if people are eager to invest, it is a good indication that your idea has a good chance of succeeding in the market.

- Less pressure on the management

In contrast to traditional sources of financing, such as venture capital, equity crowdfunding does not result in a loss of authority within a company. Despite the fact that the number of shares is raised, the engagement of a wide number of investors implies that power is not concentrated in the hands of a small group of shareholders.

- Control

Instead than having the parameters of the offering discussed, entrepreneurs might demand them (which is typically the case when accepting large investments from institutional or angel investors). Investors can monitor your success, which may assist you in promoting your business through their networks.

- Lucrative returns

Although startups are inherently hazardous endeavors, there is still a chance that a company will become a unicorn and give investors extremely attractive returns. Through the funding process, your investors might frequently become your most devoted clients.

- Community

Equity crowdfunding investors may function as brand ambassadors, loyal customers, and members of an organic community invested in your success in addition to providing funds. If you have been unable to obtain bank loans or regular funding, this is an alternative financing option.

- Job Opportunities

Unique small businesses and startups that previously struggled to acquire finance through traditional channels such as banks and loans are now able to gain momentum through equity crowdfunding. The capacity of more entrepreneurs and small enterprises to realize and grow their visions has opened the market to new and exciting endeavors, perhaps producing more accessible jobs.

- Opportunities for Marketing

The more investors who get involved and believe in your product or service, the more potential for your messaging to spread over social media networks. Small businesses and startups benefit significantly from the additional exposure – retweets, blog posts, shares — a successful crowdfunding campaign is just noteworthy.

Equity crowdfunding is a great approach for startups and small businesses to build a support network, raise funds, and expand. It enables investors and entrepreneurs to collaborate in a centralized platform meant to generate momentum and propel their shared goal forward.