PORTFOLIO MODELS

One of the most important improvements throughout ideal supervision during the 1970s and 1980s seemed to be the improvement and prevalent use associated with stock portfolio models to help you managers allocate corporate and business sources around a number of organizations. These models make it possible for man- ages to be able to classify and evaluate their particular present and prospective SBUs by simply watching all of them to be a stock portfolio associated with expense possibilities after which checking every single organizations competitive power and the attractiveness of the areas that assists.

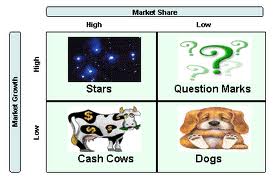

THE CELTICS CONTACTING GROUP’S (BCG) GROWTH-SHARE MATRIX

One of the first-and best known–of the stock portfolio models is the growth-share matrix manufactured by the Bos- heap Visiting Group from the late 60s. It assesses the impact associated with committing sources in numerous sections around the firm’s long term cash flow and funds passes. Just about every busi- ness product is put in a matrix, because demonstrated throughout Present two. This directory axis indi- cates the industry’s increase rate and the horizontal axis demonstrates the units’ relative current market talk about.

This growth-share matrix thinks that the corporation must make funds through organizations together with powerful competitive jobs throughout mature areas. Subsequently it could possibly account ventures and expen- ditures throughout industrial sectors of which characterize interesting long term possibilities. So, the marketplace increase rate around the directory axis is a proxy evaluate for that readiness and attractiveness of your business. This particular style signifies organizations throughout quickly developing industrial sectors because more attractive expense possibilities intended for long term increase and success. A great twelve-monthly current market increase rate associated with ten percent is the cut-off amount concerning fast- and slow-growing industrial sectors. This particular separating range can vary, even so, depending on some sort of firm’s targets and available possibilities.

In the same manner, some sort of organizations relative current market talk about is a proxy because of its competitive power within the business. It is calculated by simply separating their utter current market talk about throughout bucks or maybe devices by simply of which of the foremost rival on the market. Nevertheless it is actually competitively weakened should the foremost rival keeps a bigger talk about of the current market.

RESOURCE ALLOCATION AND STRATEGY IMPLICATIONS

Each of the four cells in the growth-share matrix represents a different type of business with different strategy and resource requirements.

Question marks. Businesses in high-growth industries with low relative market shares (those in the upper-right quadrant of Exhibit 2.8) are called question marks or problem children. Such businesses require large amounts of cash, not only for expansion to keep up with the rapidly growing market, but also for marketing activities (or reduced margins) to build market share and catch the industry leader. If management can successfully increase the share of a question mark business, it becomes a star. But if they fail, it eventually turns into a dog as the industry matures and the market growth rate slows.

Stars. A star is the market leader in a high-growth industry. Stars are critical to the continued future success of the firm. As their industries mature, they move into the bottom-left quadrant and become cash cows. Paradoxically, while stars are critically important, they often are net users rather than suppliers of cash in the short run (as indicated by the possibility of a negative cash flow shown in Exhibit 2.8). This is because the firm must continue to invest in such businesses to keep up with rapid market growth and to support the R&D and marketing activities necessary to stave off competitors’ attacks and maintain a leading market share. Indeed, share maintenance is crucial for star businesses to become cash cows rather than dogs as their industries mature.

Cash cows. Businesses with a high relative share of low-growth markets are called cash cows because they are the primary generators of profits and cash in a corporation. Such businesses do not require much additional capital investment. Their markets are stable, and their share leadership position usually means they enjoy economies of scale and relatively high profit margins. Consequently, the corporation can use the cash from these businesses to support its question marks and sws (as shown in Exhibit 2.8). However,

this does not mean the firm should necessarily maximize the business’s short-term cash flow by cutting R&D and marketing expenditures to the bone-particularly not in industries where the business might continue to generate substantial future sales. When firms attempt to harvest too much cash from such businesses, they risk suffering a premature decline from cash cow to dog status, thus losing profits in the long term.

Dogs. Low-share businesses in low-growth markets are called dogs because although

they may throw off some cash, they typically generate low profits, or losses. Divestiture

is one option for such businesses, although it can be difficult to find an interested buyer. Another common strategy is to harvest dog businesses. This involves maximizing short-term cash flow by paring investments and expenditures until the business is gradually phased out.

DISADVANTAGES WITH THE GROWTH-SHARE MATRIX

For the reason that growth-share matrix employs solely a couple of specifics to be a schedule intended for categorizing and analyzing some sort of firm’s organizations, it really is rela- tively obvious to see. However even though this kind of ease facilitates explain the reputation, what’s more, it ensures that the style offers limitations:

• Current market increase rate can be an substandard descriptor associated with overall business attractiveness. For one thing, current market increase is just not usually right associated with success or maybe cash flow. Several high-growth industrial sectors have never recently been very worthwhile due to the fact small accessibility barriers and funds high intensity get empowered offer to cultivate perhaps more rapidly, resulting in intensive price tag rivalry. Furthermore, speedy increase in one calendar year isn’t any assure of which increase will probably keep on from the using calendar year.

• Comparable current market talk about is actually substandard to be a information associated with overall competitive power. It will be based upon the presumption an knowledge necessities resulting from a mixture of size economies and other fficiencies gained by way of finding out and engineering improvements after a while contributes to carrying on with reductions throughout product expenses to be a organisations relative current market talk about increases. However a sizable current market talk about within an business isn’t going to usually give a enterprise a large price stage-especially if your product or service is a low-value-added merchandise, whenever various items in the enterprise involve various manufacturing or maybe marketing activities, where various opposition get various capability and operation prices, or maybe where several opposition are more vertically incorporated or maybe get lower-cost suppliers as compared to other people.

Furthermore, current market talk about is actually far more properly viewed as a good outcome of earlier attempts to be able to make and implement useful business-level and marketing strategies as opposed to being an signal associated with long lasting competitive power. If the additional setting adjustments, or maybe the SBU’s managers modify their particular method, their relative current market talk about can certainly shift considerably.