When an institute is not capable to honor its financial obligations or make payment to its creditors, it files for bankruptcy. A petition is filed in the court for the same where all the outstanding debts of the company are measured and paid out if not in full from the company’s assets.

Bankruptcy filing is a legal course undertaken by the company to free itself from debt obligations. Debts which are not paid to creditors in full are forgiven for the owners. Bankruptcy filing varies in different countries.

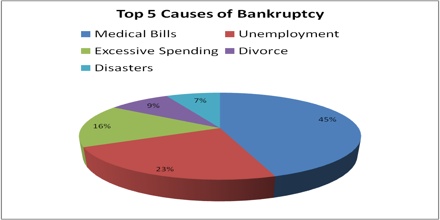

Causes of personal bankruptcy

Unexpected disaster

It is a myth that bankruptcy is always a result of something you can control. Often the causes of bankruptcy are not something we bargained for. This may include a major car or home repair, a house fire or even something as catastrophic as a death in the family. Without adequate savings and insurance, the cost of a major disaster can lead to bankruptcy.

Income Reduction or Job Loss

Losing your job can make it difficult for you to stay on top of your debt payments. Even if you are not at risk of losing your job, you may have experienced a reduction in overtime or a cut-back in your usual hours worked. Perhaps one family member has decided to leave the workforce for personal reasons. Whatever the reason, you are now forced to make ends meet on a reduced income.

Illness or Medical Problems

Stress over causes of bankruptcy. Even with government health care in Canada, a major illness, injury or other health related problems can affect both your income and your living expense.

Financial Mismanagement

Over-spending and excessive use of credit is the number one cause of bankruptcy. In truth, having more debt than you can handle may have started out by over-spending or by poor use of credit card debt however we often find that in most cases the tip over the edge occurs when combined with one of the above causes.

Protection

Bankruptcy protection is the status given to an individual or business that are unable to pay back their debts in full. The bankruptcy protection process can be initiated by either the debtor themselves or even a court in some circumstances.

Governmental laws regarding bankruptcy protection were created to assist people who are struggling financially to restructure the debt that’s owed to their creditors. The hope in this is, that after the subsequent restructuring, the entity at hand will be able to realistically pay back their debt, and move forward with their business.

Conclusion

The bankruptcy process begins with a petition filed by the debtor, which is most common, or on behalf of creditors, which is less common. All of the debtor’s assets are measured and evaluated, and the assets may be used to repay a portion of outstanding debt.