Introduction:

The commercial banking system dominates Bangladesh’s financial sector. Bangladesh Bank is the Central Bank of Bangladesh and the chief regulatory authority in the sector. The banking system is composed of four state-owned commercial banks, five specialized development banks, thirty private commercial Banks and nine foreign commercial banks. National Bank is one of the popular banks in Bangladesh. The National Bank LTD is the first private sector Bank fully owned by Bangladeshi entrepreneurs. The bank was opened on March 28, 1983 but the first branch at 48, Dilkusha Commercial Area, Dhaka started commercial operation on March 23, 1983. The 2nd Branch was opened on 11 May 1983 at Khatungonj, Chittagong.

At present, NBL has been carrying on business through its 149 branches spread all over the country. Besides, the Bank has drawn arrangement with 415 correspondents in 75 countries of the world as well as with 32 overseas Exchange Companies. NBL was the first domestic bank to establish agency arrangement with the world famous Western Union in order to facilitate quick and safe remittance of the valuable foreign exchanges earned by the expatriate Bangladeshi nationals. NBL was also the first among domestic banks to introduce international Master Card in Bangladesh. In the meantime, NBL has also introduced the Visa Card and Power Card. The Bank has in its use the latest information technology services of SWIFT and REUTERS. NBL has been continuing its small credit programme for disbursement of collateral free agricultural loans among the poor farmers of Barindra area in Rajshahi district for improving their lot. Alongside banking activities, NBL is actively involved in sports and games as well as in various Socio-Cultural activities. Up to September 2006, the total number of workforce of NBL stood at 2239, which include 1689 officers and executives and 550 staff.Total assets of the Bank was Tk. 123,441,855,653 on September 30, 2010, equivalent to 1.7 billion U.S. dollars.

The Bank invested 25% equity in Gulf Overseas Exchange Company LLC, a joint venture Exchange Company in Oman, operating since November, 1985 under the management of our Bank. The Bank received Riyal Omani 11875 equivalent to Tk.2.10 million as dividend for the year 2006.

History and Heritage:

National Bank Limited Limited has its prosperous past, glorious present, prospective future and under processing projects and activities. Established as the first private sector bank fully owned by Bangladeshi entrepreneurs, NBL has been flourishing as the largest private sector Bank with the passage of time after facing many stress and strain. At present we have 145 branches under our branch network. In addition, our effective and diversified approach to seize the market opportunities is going on as continuous process to accommodate new customers by developing and expanding rural, SME financing and offshore banking facilities. We have opened 10 branches and 5 SME/Agri branches during 2010.

The emergence of National Bank Limited in the private sector was an important event in the Banking arena of Bangladesh. When the nation was in the grip of severe recession, the government took the farsighted decision to allow the private sector to revive the economy of the country. Several dynamic entrepreneurs came forward for establishing a bank with a motto to revitalize the economy of the country.

NBL focused on all key areas covering capital adequacy, maintaining good asset quality, sound management, satisfactory earning and liquidity. As a consequence, it was possible to a record growth of 175.51 percent with Tk. 8,809.40 million pre tax profit in the year under review over the preceding year. The net profit after tax and provision stood at Tk. 6,860.34 million which was Tk. 2,070.47 million in the previous year registering a 231.34 percent rise. The total deposits increased to Tk. 102,471.83 million being 33.37 percent increase over the preceding year. Loans and advances stood at Tk.92,003.56 million in the year under report which was Tk. 65,129.289 million representing 41.26 percent rise over the preceding year. Foreign trade stood at Tk. 144,255.00 million in 2010 compared to Tk. 115,939.00 million, increased by 24.42 percent compared to that of the previous year. During 2010, the bank handled inward remittance of Tk. 49,145.30 million, 10.73 percent higher than that of the previous year. Return on Equity (ROE) registered a 77.84 percent rise over the preceding year.

National Bank, has now acquired strength and expertise to support the banking needs of the foreign investors. NBL stepped into a new arena of business and opened its Off Shore Banking Unit at Mohakhali to serve the wage earners and the foreign investors better than before.

Since its inception, the bank was aware of complying with Corporate Social Responsibility. In this direction, we have remained associated with the development of education, healthcare and have sponsored sporting and cultural activities. During times of natural disasters like floods, cyclones, landslides, we have extended our hand to mitigate the sufferings of victims. It established the National Bank Foundation in 1989 to remain involved with social welfare activities. The foundation runs the NBL Public School & College at Moghbazar where present enrolment is 1140. Besides awarding scholarship to the meritorious children of the employees, the bank has also extended financial support for their education. It also provided financial assistance to the Asiatic Society of Bangladesh at the time of their publication of Banglapedia and observance of 400 years of DhakaCity. The Transparency and accountability of a financial institution are reflected in its Annual Report containing its Balance Sheet and Profit & Loss Account. In recognition of this, NBL was awarded Crest in 1999 and 2000, and Certificate of Appreciation in 2001 by the Institute of Chartered Accountants of Bangladesh. The bank has a strong team of highly qualified and experienced professionals, together with an efficient Board of Directors who play a vital role in formulating and implementing policies.

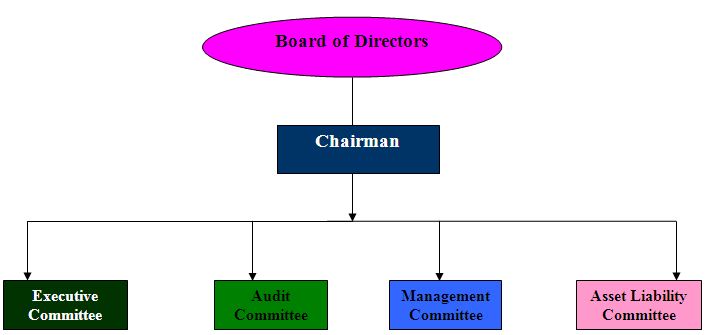

Organ gram of the National bank:

Mission:

Efforts for expansion of our activities at home and abroad by adding new dimensions to our banking services are being continued unabated. Alongside, we are also putting highest priority in ensuring transparency, account ability, improved clientele service as well as to our commitment to serve the society through which we want to get closer and closer to the people of all strata. Winning an everlasting seat in the hearts of the people as a caring companion in uplifting the national economic standard through continuous up gradation and diversification of our clientele services in line with national and international requirements is the desired goal we want to reach.

Vision:

Ensuring highest standard of clientele services through best application of latest information technology, making due contribution to the national economy and establishing ourselves firmly at home and abroad as a front ranking bank of the country are our cherished vision.

Methodology

Data Collection method:

- Primary sources: Face to face interview of companies AGM & Information center.

- Secondary sources:

- Ø Internet

Data analysis:

For the data analysis, computer software (e.g. Microsoft word) is used, which helped to make the analysis in a well-arranged manner for the research easier, more efficient, and more effective.

The National Bank’s products and Services:

The bank has not any physical products but it provides services by two units like, Deposit products & services or surplus units and Credit products & services or loan options or Deficit units.

Deposit products & services or surplus units:

The Nation Bank receives 60% deposit from FDR with 12% interest and other 40% deposit receives from different sectors. Other sectors are showed in below details.

Savings Deposit:

National Bank Limited offers customers a hassel free and low charges savings account through the branches all over bangladesh.

Benefits(Condition Apply)

Interest rate of 4.00% on minimum monthly balance.

Minimum balance Tk.5000.

Maintenance charge yealy Tk. 600.

No hidden costs.

Standing Instruction Arrangement are available for operating account.

Account Opening

2 copies of recent photograph of account holder.

Nominee’s Photograph.

Valid photocopy of Voter ID Card.

Current Deposit:

National Bank Limited offers customers current deposit facility for day-to-day business transactions without any restriction.

Benefits (Condition Apply)

Minimum balance Tk.2000.

Minimum maintenance charge half yearly Tk.400.

No hidden costs.

Standing Instruction Arrangement are available for operating account.

Easy access to our other facilities.

Account Opening

2 copies of recent photograph of account holder.

TIN certificate.

Nominee’s Photograph.

Valid photocopy of Voter ID Card.

Term deposit two types:

Special Notice Deposit:

National Bank Limited offers interest on customer’s special notice deposit account and gives facility to withdraw money any time.

Benefits (Condition Apply)

Minimum maintenance charge half yearly Tk.500.

Standing Instruction Arrangement are available for operating account.

Account Opening

2 copies of recent photograph of account holder.

Nominee’s Photograph.

Valid photocopy of Voter ID Card.

Fixed Deposit:

National Bank Limited offers fixed term savings that will scale up your savings amount wtih the time.

Benefits (Condition Apply)

Any amount can be deposited.

Premature encashment facility is available.

Overdraft facility available against term receipt.

Account Opening

1 copy of recent photograph of account holder.

Nominee’s Photograph.

Foreign currency deposit two types:

RFC Deposit:

National Bank Limited gives oppotunity to maintain foreign currency account thorugh it’s Authorized Delear Branches.Bangladesh nationals residing abroad or Foreign nationals residing abroad or Bangladesh and foreign firms operating in Bangladesh or abroad or Foreign missions and their expatriate employees.

Benefits (Condition Apply)

No initial deposit is required to open the account.

Interest will be offered 1.75% for US Dollar Account , 3.00 % for EURO Account and 3.25% for GBP Account.

They will get interest on daily product basis on the credit balance (minimum balance of US$ 1,000/- or GBP 500/- at least for 30 days) maintaining in the account.

Account Opening

2 copies of recent photograph of account holder.

Nominee’s Photograph.

Passport Copy.

ID of residence in abroad.

NFC Deposit:

National Bank Limited gives opportunity to maintain foreign currency account thorugh it’s Authorized Delear Branches. All non – resident Bangladeshi nationals and persons of Bangladesh origin including those having dual nationality and ordinarily residing abroad may maintain interest bearing NFCD Account.

Benefits (Condition Apply)

NFCD Account can be opened for One month, Three months, Six months and One Year through US Dollar, Pound Starling, Japanese Yen and Euro.

The initial minimum amount of $1000 or 500 Pound Starling or equivalent other designated currency.

Interest is paid on the balance maintain in the Account. This interest is tax free in Bangladesh.

Account Opening

2 copies of recent photograph of account holder.

Nominee’s Photograph.

Passport Copy.

ID of residence in abroad.

Monthly Savings scheme:

National Bank Limited offers monthly savings scheme for it’s retail customers.

Benefits (Condition Apply)

Monthly installments of deposit will be Tk.500/-, Tk.1,000/- , Tk.2,000/- ,Tk.3,000, Tk.4000/- , Tk.5,000/- and Tk. 10,0000

Account may be opened for any installment and term , which is not changeble.

A person is allowed to open more than one account for different installment in a Branch/ Bank.

| Sl no | Monthly Installments (Taka) | Amount to be paid on completion of Term | ||

| 3(Three) years @9.00% | 5(Five) years @9.25% | 8(Eight) years @9.50% | ||

| 01 | 500/- | 20,627/- | 37,896/- | 70,849/- |

| 02 | 1,000/- | 41,255/- | 75,791/- | 1,41,691/- |

| 03 | 2,000/- | 82,510/- | 1,51,583/- | 2,83,394/- |

| 04 | 3,000/- | 1,23,765/- | 2,27,374/- | 4,25,091/- |

| 05 | 4,000/- | 1,65,020/- | 3,03,166/- | 5,66,788/- |

| 06 | 5,000/- | 2,06,274/- | 3,78,957/- | 7,08,485/- |

| 07 | 10,000/- | 4,12,549/- | 7,57,914/- | 14,16,970/- |

Account Opening

1 copy of your recent photograph.

Nominee’s Photograph.

Monthly Income Scheme:

Under this scheme one will deposit a minimum of tk.1,00,000/- or its multiple for three years and will enjoy monthly benefit of Tk.1,000/- for every Tk.1,00,000/-.

Benefits:

Deposit of Tk.1,00,000/- and its multiple maximum of Tk 50,00,000/- shall be acceptable under this scheme.

The account may be opened either singly or jointly

Account Opening

1 copy of recent photograph of account holder.

Nominee’s Photograph.

Valid photocopy of Voter ID Card.

Double Benefit Scheme:

Dreams come true. National Bank Limited now offers Double Benefit Scheme for it’s customers. The benefits under this scheme shall become double after 6 years.

Benefits:

Deposit of Tk.50,000/- and its multiple maximum of Tk 50,00,000/- shall be acceptable under this scheme.

A person is allowed to open more than one DBS Account.

The account may be opened either singly or jointly.

All DBS account holder shall be offered with free Life Insurance Policy under this scheme.

Account Opening

1 copy of your recent photograph.

Nominee’s Photograph.

National Bank Limited |

| Revised Schedule of Interest Rate |

Percentage per annum |

Date: August 18, 2011 |

Deposit Interest Rate | ||||

| Sl. | Category Of Deposit | Revised rate of insertest (p.a.) | ||

| 1 | Savings | Below 1.00 Crore | 4.00 | |

| 1 Crore to below 25 Crore | 4.50 | |||

| 25 Crore & above | 8.50 | |||

| 100 crore & above | 9.00 | |||

| 2 | Special Notice Deposit | Below 1.00 Crore | 4.00 | |

| 1 Crore to below 25 Crore | 7.00 | |||

| 25 Crore to below 50 Crore | 7.50 | |||

| 50 Crore to below 100 Crore | 7.75 | |||

| 100 Crore & above | 9.00 | |||

| 3 | FDR for 1 month & above but less than 3 months | Any amount | 10.50 | |

| Up to 12.00* | ||||

| 4 | FDR for 3 months & above but less than 6 months | Any amount | 11.00 | |

| Up to 12.00* | ||||

| 5 | FDR for 6 months & above but less than 1 year | Any Amount | 11.00 | |

| Up to 12.00* | ||||

| 6 | FDR for 1 year and above | Any Amount | Up to 12.00 | |

Note:

i) Special rate to be offered through Head Office or Subject to prior written approval to Treasury, Head Office.

Deficit units or Loan options:

Overdraft

NBL offers overdraft facility for corporate customers for day-to day business operations .

Benefits:

Low charges in overdraft account maintenance.

Facility is available against deposit receipt or mortgage property.

Low interest rate 13-16%.

Account Opening

Inroductory current account .

Others necessary documents as per loan requirement.

Lease Finance:

National Bank Limited offers leasing facility for clients with easy installment facility.

Financing Area

Capital machinary.

Different equipments.

Gas, Diesel generator and Power plant.

Medical equipments.

Lift or elevator.

Inroformantion Technology equipments.

Construction equipments.

Consumer durables.

Benefits:

Competitive monthly rental.

Tax benefit.

Fast processing.

Easy handover after leasing period.

Home Loan:

NBL offers home loan facility for purchasing flats or construction of house .

Benefits:

Financing amount extends upto 70% or Tk. 75,00,000 which is highest of total consturction cost.

Grace period avilable upto 9 months in flat purchase or 12 months in consturction.

Competitive interest rate.

No application or processing fee.

Eligibility

Any bangladeshi citizen or NRB, who is capable of repayment can apply for this loan.

Small Medium Enterprise Loan:

NBL offers financial support to small businessmen/enterprise with new products named “Festival Small Business Loan” and “NBL Small Business Loan” has been introduced in the Bank.

Benefits:

Maximum Tk.3.00 lac (Festival Scheme) and Maximum Tk.5.00 lac (Small Business Scheme) .

3 Months (Festival Scheme) and 5 years (including 1 month grace period (Small Business Scheme))

Collateral Free Advance.

Eligibility

Any genuine and small businessmen/ entrepreneurs/enterprise having honesty, sincerity, and integrity

Consumer Credit Loan:

NBL offers consumer credit facility for retail customers.

Financing items

Electornics consumer products.

Computer or Computer acessories.

Benefits:

Fast processing.

Competitive interest rate.

No application or processing fee.

Easy monthly installment.

Trade Finance loan:

NBL provides comprehensive banking services to all. types of commercial concerns such as in the industrial sector for export-import purpose as working capital, packing credit, trade finance,Issuance of Import L/Cs,Advising and confirming Export L/Cs. – Bonds and Guarantees .

Benefits:

Low interest rate 13.00%-14.50%.

Minimum processing time.

Low service charges.

National Bank Limited |

| Revised Schedule of Interest Rate |

Percentage per annum |

| Effective Date: August 18, 2011 |

| Sl No | Category of Advances | Interest Rate Anually |

| 1 | Agriculture Loan | |

| (a) Advance against primary products including Agri-term loans (b) Other Agri | 13.00 %(maximum) | |

| 2 | Term Loan for Large & Medium Industries | 13.00 %(maximum) |

| 3 | Term Loan for Small & Cottage Industries non PPG Loan | 13.00 %(mid rate) |

| 4 | Working Capital for Industries | |

| a) Large and Medium loan b) Small & Cottage Industies non PPG Loan | 16.50 %(medium)15.50 %(mid rate) | |

| 5 | Export Credit (note : ii) | 7.00 % (Fixed) |

| 6 | Trade Finance | |

| a) Import Finance | ||

| i) Rate of on Import items as mentioned in BRPD Circular No. 06. & 07 dated 05/05/2009 and 10.05.2009 respectively. | 12.00% | |

| ii) Rate fo Interest on other import items | 14.00% | |

| b) Cash Credit (Hypo & Pledge) | 16.50% (maximum) | |

| c) SOD (Gen) against work order / SOD (Bid bond) | 16.50% (maximum) | |

| 7 | a) House Building Loan (Commercial ) excluding retail | 18.00% (maximum) |

| b) House Building Loan (Gen) excluding retail | 18.00% (maximum) | |

| 8 | Consumer Credit Sceme | 19% (fixed) |

| 9 | Credit Card | 2.25% per month (fixed) |

| 10 | Credit to Non-Banking Financial Institution | 18.00% (maximum) |

| 11 | Others: | |

| a) SOD (Exp) | 16.50% (Fixed) | |

| b) SOD/ Loan against FDR of other bank , ICB unit etc. | 16.50% (mid rate) | |

| c) SOD/ Loan against FDR of our bank. | 2.50% avobe the FDR rate of Interest | |

| d) Loan against NBL Scheme Deposit | 16.00 %(range) | |

| e) Others (not received above) | 16.00-18.00% (range) | |

| 12 | For Products PPG based: Festival small business Loan (Gen) Small House Loan Scheme NBL-small Business loan NBL-Housing loan NBL-Lease Financing NBL-Weaver Loan NBL-Micro Loan | 16.00-17.00 %(range) 16.00 (maximum) 16.00-17.00 % 16.00 (maximum) 15.00-17.00 (range) 15.00% (Fixed) 15.00% |

Note: We worked under the Surplus units or deposit units to find out the problems and recommendations.

Findings:

Problems Related to Macro Operation of the National bank:

- As a digital world it has no mobile banking service

- Liquidity and Capital

- Valuation of bank Assets

- Financial Stability

- The Ownership of Banks

- Lack of Capital Market and Interest-free Financial Instruments

- Insufficient Legal protection

- Controlling and Supervision by the Central bank

- New Banking Regulations

- Accounting principles and Procedures

- Shortage of Supportive and Link Institutions

- Shortage of Skilled and Trained Manpower

- Lack of Co-operation among the managers and employees

- Lack of Familiarity by International Financial and Non-financial Sector with National bank Products and procedures.

- Severe Competition in the Financial Sector with other Banks

- Economics slowdown and Political Situation of the Country

- Inadequate Track Record of National bank

- Defaulting Culture of the Borrowers

- Short-term Asset Concentration in the national bank

- Lack of Secondary Securitisation Market

- Lack of Coordinated Research Work on Banking and finance

- Lack of Apex Training Institute for the National Banks.

Problem Related to Micro Operation of the National Bank:

v Increased Cost of Information

v Control over Cost of Funds.

v Mark-up Financing and Corrupted Mark-up

v Excess Resort to the Murabaha Mode of Financing

v Utilization of Interest Rate of fixing the Profit Margin in Bai-Modes

v Financing Social Concerns.

v Lack of Positive Response to the Requirement of government Financing.

v Sacrifice of allocative Efficiency

v Loss of Distributive Efficiency.

v Depression of Profit.

v Minimum Budget for Research and Development.

v Working Environment.

The above problems are some of the burning problems confronting the National bank in Bangladesh. However it is felt that much operational work and in-depth research work has to be undertaken to allow the National bank to flourish with highest quality and strength.

Conclusion:

The National bank can provide efficient banking services to the nation if they are supported with appropriate banking laws, and regulations. This will help them introducing PLS modes of operations, which are very much conducive to economic development. It would be better if the National bank had the opportunity to work as a sole system in an economy. The deterioration is not because of The National bank’s own mechanical deficiencies. Determination of profit and loss in profit/loss sharing arrangement and treatment of costs and reserves in such accounting is a pertinent issue to be addressed with utmost importance and priority. However, The National bank is a very critical institution to materialize the economic objectives of the nation.

Finally, it may be mentioned that if the National bank’s financial system, is to become truly liquid and efficient it must develop more standardized and universall tradable financial instruments. The development of a secondary financial market for the National bank financial products is crucial if the industry is to achieve true comparison with the commercial banking system. It must also work hard to develop more transparency in financial reporting and accounting and ideally. Development if the whole sale and especially inter-bank and money markets, will be the key to national finance growing outside its current little sphere of influence, and becoming a truly national invigorating force.

Recommendations:

- To launch mobile Banking system

- Increase technological advancement

- Be informative in case of deposit units and credit units

- Increasing information center

- Enhancing products or services center

- Expansion of queuing spaces

- Need for Re-organization of the Whole financial System

- New banking philosophy for the National Bank

- Future Policy and Strategy

- Stepping for Distributional Efficiency.

- Promotion of Allocative Efficiency

- Modern banking Policies and practices

- Government and Central bank Responsibilities

- Inter-Islamic Bank Co-operation and Perspective Plan