Audit of Educational Institutions

Audit of books of educational institutions like school, college, universities, etc. or other such institutions which are engaged in the educational field is known as an audit of educational institutions. Check names entered in the Students Fee Register for each month or term, with the respective Class Registers, showing names of students on rolls and test amount of fees charged; and verify that there operates a system of internal check which ensures that demands against the students are properly raised. The auditor should check income and expenditure account and balance sheet of such institutes in order to verify and report the true and fairness of results presented by income statements and financial position presented by the balance sheet.

Generally, the methods and procedures for vouching and auditing is the same even though an auditor of an educational institution should perform the following tasks:

The auditor should go through the University Act. Examine the Trust Deed or Regulations, in the case of school or college and note all the provisions affecting accounts. Trust deeds and should note the rules and regulations relating to accounts. The governing body may pass resolutions from time to time with respect to accounts. A copy of minutes books should be made available to him so that he may be able to confirm whether the decision of the governing body has been compiled with.

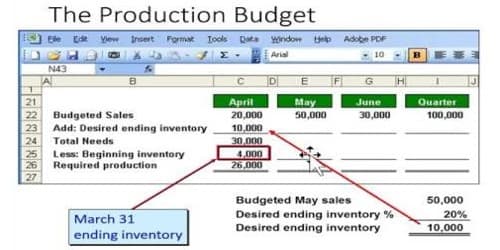

The auditor should obtain a copy of the budget or financial statements to study different heads of income and expenditure. Check fees received by comparing counterfoils of receipts granted with entries in the Cash Book and tracing the collections in the Fee Register to confirm that the revenue from this source has been duly accounted for.

The auditor should thoroughly assess the strength of an internal check. Confirm that fines for late payment or absence, etc. have been either collected or remitted under proper authority. The auditor should vouch for the grant-in-aid from the government carefully. Confirm those hostel dues were recovered before student’s accounts were closed and their deposits of caution money refunded.

The auditor should verify the receipts of monthly fees from students, from counterfoils or carbon copy of the receipts. He should also see whether cash received has been banked daily or not. Other charges from the students such as examination fees, laboratory fees, fines, etc. should be carefully verified.

Any fees received in advance should be properly adjusted. Report any old heavy arrears on account of fees, dormitory rents, etc. to the Managing Committee. The concession of fees and other charges should be duly authorized by the proper authority. Any charges becoming irrecoverable should be written off only after the proper authority has recommended.

Any grant-in-aid or funds received for a particular purpose must be utilized for the same. He should verify that the fees are collected from all the students and if there is any concession, the same is granted by a person who is so authorized. The donations and other subscriptions from the various authorities have been accounted for and acknowledged. The income from property, investment, etc., should be properly verified from the vouchers.

The auditor should vouch the number of salaries paid with the Salary Register. Any increment given to an employee shall be duly sanctioned. The staff provident fund should be verified and it should be seen that it is invested as per the rules.

The establishment expenses must be carefully vouched and it should be seen that capital expenditure has not been treated as revenue expenditure or vice versa. The payment of scholarship should be verified with the receipt from students and Scholarship Register.

The stock of equipment, stationery, furniture should be carefully verified. While making payment of staff salaries, income tax should be deducted at source and shall be duly deposited with the Income Tax Department.

Information Source: