Executive summary

This report aims toward providing an overview on the banking system in our country. The report is prepared within the broader framework of our program of the business administration . While preparing this report it has been tried to reveal the insights of the banking system of the bank. Simultaneously efforts have been made to provide an in depth analysis on the importance of overall bank in the light of theoretical aspects.

While discussing the different aspects and functions of the bank, priority has been given to depict the real situation as far as appraisal and management system in banking system are concerned by employing the experience gathered during the program. Analysis on the information’s is basically done to sort out the major aspects of the banking system and to drawn some significant inferences. At the same time for easier understanding of the report, supporting topic and terms are explained in light of textbook and regulatory guidelines.

Role of Banking in Bangladesh

Introduction

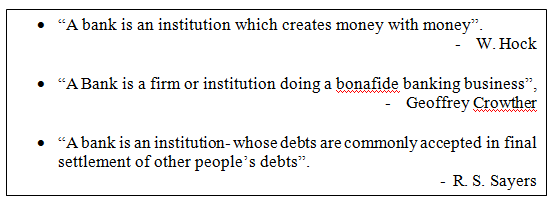

Bank

The word “Bank” is said to be derived from the Italian word “banco” i.e. bench. The early bankers, the Jews in Lombardy, transacted their business at benches in the market place. When a banker failed, his banco used to be broken up by the people. From such circumstance, the word “bankrupt” originated. There are others, who are of the opinion that the word “bank” is originally derived from the German word “back”, meaning a joint stock fund, which was, when most of the Italy was under German occupation, Italianized into “banco”. This appears to be more reasonable.

Whoever, being an individual, firm, company or corporation, generally deals in the business of money and credit is called a bank. In our country, any institution which accepts, from the public, repayable on demand or otherwise, and withdraw able by cheque, draft, order or otherwise, is called a bank.

A narrower and more common definition of a bank is a financial intermediary that accepts, transfers, and, most important, creates deposits. This includes such depository institutions as central banks, commercial banks, savings and loan associations, and mutual savings banks.

Banking

Ordinarily, all functions of a bank in the course of its business may be termed as banking. In the Banking Companies Act, 1991 (Act 14 of 1991), the word “banking” has been defined to mean the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdraw able by cheque, draft, order or otherwise. But any company which is engaged in the manufacture of goods or carries on any trade and which accepts deposits of money from the public merely for the purpose of financing its business is excluded from being deemed to transact the business of banking.

Banking, transactions carried on by any individual or firm engaged in providing financial services to consumers, businesses, or government enterprises. In the broadest sense, a bank is a financial intermediary that performs one or more of the following functions: safeguards and transfers funds, lends or facilitates lending, guarantees creditworthiness, and exchanges money. These services are provided by such institutions as commercial banks, central banks, savings banks, trust companies, finance companies, life insurers, and investment bankers.

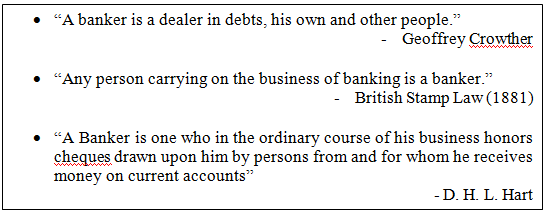

Banker

Beginning of Banking in Bangladesh

The people of Bangladesh, having proclaimed independence by the proclamation of independence of independence established the independent Sovereign peoples Republic of Bangladesh. After the surrender of the occupied forces on the 16th day of December, 1971, the Government of the peoples Republic of Bangladesh formally took over the charge of the administration of the territories now constitutes Bangladesh. In an attempt to rehabilitate the war devastated banking of Bangladesh, the Government promulgated a law called the Bangladesh Bank Order, 1971. By this order The State Bank Of Pakistan was declared to be deemed as Bangladesh Bank and the offices, branches, and assets of the said State Bank was declared to be deemed as offices, branches and assets of the Bangladesh Bank. It was also declared by the said acting presidents Order No.2 of 1972 that all currency notes and coins issued by the said state Bank and Government of Pakistan and were in circulation in Bangladesh shall be deemed to have issued by the Bangladesh and continue as legal tender in Bangladesh until otherwise directed. With what has been stated above, the banking life of Bangladesh started with a legal shape.

Role of Bank for social development of Bangladesh

Commercial Banks are the greatest mobilizer of domestic savings and suppliers of working capital to trade, commerce, industry and agriculture. Since major portion of their fund is either payable on demand or after a short period. There are different types of Commercial & Specialized Banks in our country that are playing a vital role in our economic and social conditions. Some examples of different Private Commercial & Specialized Banks are given below:

Grameen Bank

The literary meaning of Grameen Bank is ‘village bank’ which is a specialized micro-finance institution that has already received credible reputation for its successful approach to provide the rural poor with an institutional credit mechanism and has established the fact that rural poor are generally more sincere in repaying loans where the urban rich are, in many cases, defaulters.

Micro credit is the “extension of small loans to groups of poor people, especially women, for the purpose of investing in self-employment programs” to improve earning capacity and standard of living. It fills the “money gap” left by traditional banking that excludes non-conventional, poor borrowers. Micro credit programs either lend to individuals or create group lending whereby solidarity groups are formed. Group members receive individual loans but group support is available if the person is unable to make repayment. The group’s social collateral replaces the traditional economic collateral of assets and capital.

Objectives of Grameen Bank:

- To extend the banking facilities to the poor men and women.

- To eliminate the exploitation of the money lenders.

- To create opportunities for self-employment for the vast un-utilized and under-utilized manpower resource.

- To bring the disadvantaged people within the fields of some organizational format which they can understand and operate, and can find socio political and economic strength in it through mutual support.

- To reverse the age-old vicious circle of law income, low savings, low investment, low income into an expanding system of low income, credit, investment, more income.

Bangladesh Krishi Bank

It is 100% Government owned specialized bank engaged in agriculture financing. It provides loan with very low interest rate to the farmers for the development of agriculture. Krishi Bank is the successor of the agricultural Development Bank of Bangladesh. It may be pointed out that, in order to make better provision for affording credit facilities to agriculturists and persons engaged in cottage industries in the rural areas, the Agricultural Development Bank of Pakistan was established under the Agricultural Development Bank Ordinance, 1961. This Pakistani Bank had its regional office in Dhaka, which was after the independence of Bangladesh, renamed as Agricultural Development Bank of Bangladesh. It continued Function as a full-fledged bank for the aforesaid purposes till the establishment of the Bangladesh Krishi Bank under discussion.

Objectives of the Krishi Bank: the main objectives of Krishi bank may be classified under the heads namely-

- To provide credit facilities fro all kinds of agricultural and agro-based economic activities keeping in view the needs of small and marginal farmers.

- To promote cottage and other allied industries in rural and urban areas.

- To assist farmers in adopting appropriate technologies.

- To ensure availability of agricultural inputs e.g. seeds, agricultural machineries, equipments, fertilizers etc.

- To earn a normal profit for meeting the operational expenses, building of reserve and expansion of activities to cover wider geo-graphical area.

- To develop and introduce system of research and development to improve operational efficiency by policy planning and program review.

- To extend counseling and advisory services to the lances/entrepreneurs, etc. in utilizing credit facilities.

- To maintain a motivated work-force through an appropriate system of human resource management, training and development.

Social Investment Bank

Social Investment Bank Limited an interest-free Shariah bank in Bangladesh incorporated as a banking company on 5 July 1995 under the companies act 1994. It commenced banking operations on 22 November 1995 with an authorized capital of Tk. 1,000 million divided into 1 million ordinary shares of Tk. 1,000 each. The initial paid up capital was Tk. 118.36 million fully subscribed by its 38 sponsors including 3 Arab nationals. The paid up capital was enhanced several times and stood at Tk. 260 million on 31 December 2000. The bank is listed with the Dhaka Stock Exchange. In 2000, total liabilities and shareholders equity of the bank stood at Tk. 5,671.99 million.

The bank provides all types of commercial banking services and it conducts business on the Islamic principles of musharaka, murabaha, bai-muazzal and hire purchase transactions. The broad-spectrum operational aspects of the bank have been set out to encompass three sectors – formal, non-formal and voluntary – in a comprehensive program. In the formal corporate sector, the bank offers banking services through deposit and investment accounts, trade financing, collection of bills, money transfers, lease of equipment and consumers’ durable, hire purchase and installment sale of capital goods, investment in low-cost housing and real estate management, and financing projects in agriculture, transport, education and health sectors. In the non-formal non-corporate sector, it is involved in opening and introducing various savings and investment schemes for the unemployed poor and the educated. In the voluntary sector, it is involved in the development and management of waqf and mosque properties, management of inheritance properties, and joint venture projects relating to religious affairs and charitable activities.

Total deposits of the bank amounted to Tk. 4,863.21 million in 2000 compared to Tk. 124.73 million in 1995 and included currency and other deposits, bills payable, term deposits and savings deposits. On 31 December 2000, the loans and advances in various sectors stood at Tk. 3,522.24 million as against Tk. 0.22 million in 1995. On 31 December 2000, the classified investments (loans and investment) of the bank amounted to Tk. 173.1 million (4.91% of the total). Foreign exchange business handled by the bank in 2000 accounted for Tk. 4,250 million, which comprised export servicing, import financing and remittance facilities. That year the assets of the bank were valued at Tk. 5,672 million and the off-balance-sheet-items Tk. 1,060.04 million. The bank started having net profits since 1998 and the net profit after adjusting all provisions for taxation and classified loans amounted to Tk. 38.1 million. The profitability of the bank is severely affected by the fact that it has to maintain a substantial amount of provision for its classified loans each year.

The management of the bank is vested in a 27-member board of directors headed by a chairman. There is a 5-member Shariah Council of the bank to ensure the compliance of Islamic rules in its activities. The bank has also a 13-member honorary foreign members’ international advisory council to advice it on international business affairs, particularly in Islamic countries. In December 2000, the bank had 13 branches and in all, 310 employees including executives of different cadres.

Bangladesh Shilpa Bank

Bangladesh Shilpa Bank (BSB) established under the Bangladesh Shilpa Bank Order 1972 (Presidential Order No. 129 of 1972) on 31 October 1972, to provide credit facilities and equity support to industrial enterprises in Bangladesh. It is the prime development financing institution (DFI) in the country for extending financial assistance for industrialization. Initially, the authorized capital of the bank was Tk. 1,000 million in 1972 and the paid up capital was then Tk. 750 million, which was subscribed by the government of the People’s Republic of Bangladesh. Later, the authorized and paid up capital was enhanced. In 2000, the authorized capital was Tk. 2,000 million divided into 2 million shares of Tk. 1,000 each. Tk. 1,320 million (66%) was subscribed and paid up by the government while the rest were left for subscription by Bangladeshi nationals or by financial institutions at home and abroad.

The bank created a reserve fund of Tk. 7 million in its first year of operations. In 1999-2000, the total reserve fund and other reserves of the bank stood at Tk. 392.36 million. In 1982, the bank created a special equity fund titled ‘Quasi Equity’ by converting the 3rd, 5th, 6th and 8th UK credits received by it immediately after independence in 1971. The prime objective of the bank is to accelerate industrial growth in the country by financing industries, by providing advisory services in setting up new projects, and by assisting in balancing, modernization, replacement and expansion (BMRE) of existing industrial units.

The Bank provides long and medium-term loans both in local and foreign currencies, guarantees repayment of loans raised by investors from other sources, and provides equity support by way of outright purchase of shares and by underwriting the public issue of shares. It also extends short-term bridge financing and working capital loans on a limited scale. BSB provides free technical advice in respect of plant and machinery, product and process, raw materials, market for products, and other related aspects to prospective entrepreneurs. It prepares project profiles for private entrepreneurs. All industrial projects either in the public sector or in the private sector are eligible for financial assistance from the bank. It follows a policy of diversifying its lending portfolio for widespread geographical dispersal of industrial enterprises, especially in less-developed areas of the country. With the view to bringing more dynamism and diversity in its activities, BSB started full-fledged commercial banking in 1993-94. This enables bank-financed projects to obtain commercial banking services including working capital loans, import of raw materials, etc.

On 31 December 2000, the total deposits of the bank were Tk. 725.67 million comprising deposits received from banks (Tk. 154.67 million), current account (Tk. 72.24 million), bills payable (Tk. 3.34 million), savings bank accounts (Tk. 130.54 million), fixed deposits (Tk. 267.01 million), and other deposits (Tk. 97.87 million). Rates of interests offered by BSB on different deposit accounts varied between 7.75% and 9.75%, depending upon the duration of deposits. Lending rates of the bank varied between 10% and 18%. Up to end 1999, the bank financed a total of 1,573 industrial projects. The amount loaned to them was Tk. 27,342 million. Total loans and advances of the bank (after provision for bad and doubtful debts) were Tk. 7,136.26 million in 1999-2000. The distribution of the loans and advances by types were cash credit (Tk. 1,121.96 million), long-term loans (Tk. 19,242.87 million), overdraft (Tk. 140.73 million), bridge loan (Tk. 282.11 million), and staff loans (Tk. 533.89 million). At the end of 2000, the cumulative amounts of the bank’s non-performing stuck-up loans stood at Tk. 14,195.30 million, and were classified duly as substandard, doubtful, and bad, under the loans classification rules of Bangladesh bank.

Shilpa Bank borrowed an amount of Tk. 8,604.48 million during 1999-2000 from various internal and external sources. This includes F C Borrowing Accounts (Tk. 360.32 million), BSCIC (Tk. 3.94 million), Saudi Grant (Tk. 11.80 million), KFW Counterpart Fund (Tk. 165.93 million), Long-term loan from Bangladesh Bank (Tk. 6405.57 million), KFW Loan (Tk. 15.38 million), Danish Credit Counterpart Fund (Tk. 7.49 million), and overdue installment interest and exchange risk A/C (Tk. 1,634.04 million).

The foreign exchange business handled by Shilpa Bank in 1997-98 was Tk. 479 million, but dropped to Tk. 25 million in the next year. This business covers export servicing, import financing, and remittance facilities. In 2001, the bank had correspondent relationships with 35 foreign banks and other financial institutions. In June 2000, the BSB investments other than lending stood at Tk. 1289.54 million and its investment portfolio comprised short and long term treasury bills and bonds, prize bonds, shares and debentures and equity investments in industrial units. Total assets of the bank were valued at Tk. 24,002.90 million in June 2000.

The bank demonstrated a deteriorating trend in profitability since 1994. The cumulative loss of the bank stood at Tk. 3,285.60 million in 2000. The main reason for losses is the huge amount of non-performing stuck-up loans for which the bank has to maintain large amount of provision from its profit each year. Borrowed funds constitute a major source of the bank’s lending assets and posting of accrued interest in interest suspense account has lowered its net interest income.

The management of the bank is vested in a 9-member board of directors, including the chairman and the managing director appointed by the government. However, there is a provision that non-government shareholders of the bank shall elect 4 directors from amongst themselves. But till now, there is no private subscription in the bank’s capital, and all directors are appointed by the government. The managing director is the chief executive officer. The bank has 16 branches. The total number of employees in the bank is 997. The head office of the bank is at Dhaka and it has 3 zonal offices, one each at Chittagong, Rajshahi and Khulna. It has six divisions and 23 departments.

Karmasangsthan Bank

Employment Bank a specialized bank established in 1998 under the Act for Establishing Karmasangsthan (employment) Bank 1998. It commenced business on 30 June 1998 with the principal objective of providing credit to youths, especially the unemployed youths of the country, for the promotion of self-employment and economic activities. The bank provides credit financing for 33 income-generating activities. The authorized capital of the bank is Tk. 3,000 million divided into shares of Tk. 100 each. Of the total issued, subscribed and paid up capital of Tk. 955 million in 1998-99, the government of Bangladesh paid 75% and the remaining 25% is allocated to and paid by some commercial banks (janata, agrani, sonali, uttara, pubali, rupali, national, IFIC, basic and islami bank and some non-bank financial institutions and insurance companies.

The bank has its head office at Dhaka and 68 branches (up to 31 May 2001) in the district headquarters including Dhaka city. A total of 285 employees including 127 officers of different grades are now working in the bank.

Within the selected fields of economic activities, potential youths can undertake any income-generating project and receive financial support from the bank to run the approved projects. According to its lending policy, the Employment Bank does limit loan size to any minimum amount. The loan size depends upon the nature and size of projects but an individual may be given a maximum Tk. 0.5 million as loan for a project. The youths may form groups to undertake projects; a group-based project can avail itself of a maximum of Tk. 2 million in credit. The repayment schedule is varied depending upon the nature of activity, size of investments and flow of incomes from the projects. However a loan is to be repaid within a maximum period of 5 years. Interest rates had been variable and during the bank’s operational period up to December 2000; the maximum lending rate recorded was 14% per annum. Upon repayment of installments on or before the expiry date, one receives a 3% rebate on the total amount of interest accrued on a particular loan account.

Up to March 2000, the bank disbursed Tk. 42 million in loans to unemployed youths. During the same period, total recovery stood at Tk. 7 million. Deposits collected by the bank during 1999 were Tk. 0.22 million and comprised savings deposits (Tk. 14,596), staff provident fund (Tk. 66,808) and staff superannuation fund (Tk. 137,859).

The bank has no investment other than its lending. In 1999, its total assets were Tk. 1,007 million, total incomes Tk. 59 million, and total expenses Tk. 7 million. It earned a net profit of Tk. 30.69 million in the business year 1998-99.

The Role of World Bank for social development for Bangladesh

The World Bank is listening to the voices of the poor in Bangladesh more than ever before.

The World Bank is increasing support for projects that directly impact people at the grassroots level. It now follows a consultative process. This means it is going to stakeholders and talking to the people for whom the projects are meant to benefit. Their voices are then considered as policies are proposed.

One example is its’ Social Development Fund (SDF). Community groups are getting organized, assessing their own needs and writing their own proposals for SDF funding.

The World Bank has helped make Dhaka’s air more breathable.Dhaka has today become a much livable place with most of the toxic fumes from two-stroke vehicles removed from the air. This is the outcome of the Government of Bangladesh’s Dhaka Urban Transport Project (DUTP), funded by the World Bank.

It has been estimated that exposure of air pollution in Dhaka causes several million cases of sickness each year. There was no initiative undertaken in the county to improve the air quality prior to the DUTP. There has been much improvement in Dhaka’s air quality since implementation – and the effect can be felt by all. Over time, an improvement in environmental conditions can have a favorable impact on foreign investment, which will reduce poverty.

The World Bank is the largest external funder of micro credit in Bangladesh.

The total number of female micro credit borrowers in Bangladesh has now reached 12 million.

An important tool for empowering women, World Bank first entered into micro credit financing in December 2000 with $180 million which was channeled to the borrowers through a local NGO, Palli Karma Shahayak Foundation (PKSF). After success of the program, the Bank committed another $151 million, making the World Bank the largest external funder of micro credit programs in Bangladesh.

And to reach the poorest of the poor, its’ Financial Services to the Poor (FSP) project is one of its’ most successful initiatives. It includes hard-core poor people from all walks of life including beggars, sex workers and women.

The World Bank is Bangladesh’s largest external funder of education and has assisted Bangladesh in achieving gender parity in education.

The World Bank provides around $200 million annually to the Government to support education, making it the largest external funder of education in Bangladesh. It is playing an important role in textbook improvement, as well as enhancing the quality of instruction and increasing enrollment in schools through various incentives such as stipends. Our $150 million Primary Education Development Project II (PEDP II) is the main driver in this sector.

Its’ $100 million Education Sector Adjustment Credit aims to assist the Government in finding ways to increase quality, cost-effectiveness and access to secondary education.

It has also supported girls’ education. Girls’ secondary school enrollment as a percentage of total enrollment increased from 44.73 percent in 1994 to 54.68 percent in 2000.

The World Bank leads the donor consortium for health programs in Bangladesh that have contributed significantly to improving the health of Bangladeshis.

The World Bank is the largest development partner in the Government’s health program. Through its’ projects, it is working towards reducing malnutrition, mortality, and fertility and promoting healthy lifestyles in Bangladesh. For example, consider the Health and Population Sector Program (HPSP), a five-year nationwide effort that began in 1998. An innovative approach was adopted under which the poor received vouchers to buy health service from the health center of their choice. This project was followed by another $600 million.

In April 2005, it committed another $300 million through the Health, Nutrition and Population Sector Program II (HNPSP II)

The World Bank works in partnership and the civil society plays an ever larger role in the Bank’s work.

The World Bank has become a more open organization. A revised Policy on Disclosure of Information since January 2002 helped it reaffirm the importance of transparency and accountability in the development process. This is now its’ policy to be open about its’ activities and to welcome and seek out opportunities to explain its’ work to the widest possible audience.

The Country Assistance Strategy (CAS) for Bangladesh, which describes the type and amount of support for a country, is being prepared through extensive consultation with the civil society, NGOs and the private sector. The World Bank believe that such partnerships increase the acceptability and sustainability of its work. Pro-poor development, private sector growth and governance will be main areas of focus of the CAS. For the first time the CAS is being jointly done with other donors of Bangladesh – a process initiated to better harmonize donor efforts

The World Bank helped Bangladesh modernize its agricultural sector.

Bangladesh’s agriculture has undergone radical changes over the last decade with the introduction of new technology and liberalization. World Bank has financed projects that have laid the foundation of modern agriculture. In addition to research, these projects also focused on water management, irrigation, and drainage and flood control to reduce agricultural risk and make more land available for crop production.

One such example is the National Minor Irrigation Development Project in rural Bangladesh which promoted growth in agriculture through increased private investment in irrigation development.

World Bank also assisted in improving exports of Bangladesh’s agro products. Hortex, one of its’ funded projects, has helped growers produce high quality French beans, and tap markets in Europer.

The World Bank is deeply involved in building and improving roads and infrastructure in Bangladesh.

World Bank is deeply committed to developing Bangladesh’s infrastructure. The Jamuna Bridge and the Mohakhali Flyover are the two of our most frequently cited projects. But beyond these two projects, they are much more involved in Bangladesh’s transport sector.

They first became involved in this sector in the mid-70s by building the Feni by-pass road. In the mid-80s, they supported development of the highway to the northern region. Last year they completed a major project – Nalka-Bonpara highway – which shortened road communication to Rajshahi and Natore by 50 kilometers.

They also support infrastructure improvement in rural Bangladesh. Roads are the lifeline of village retailers as it gives them direct access to market places. They have constructed around 45,000 Culverts in rural areas.

The World Bank helps Bangladesh create a better investment climate.

They promote a sound investment climate for Bangladesh, sharing the knowledge that the World Bank has gained from working in countries around the globe. For industry to grow, infrastructure is vital – a stable power supply, reliable roads, and so on. They are closely involved in power sector development and supporting uninterrupted, quality power generation. They also support the development of Bangladesh’s road network. They are supporting the Government’s effort to modernize its customs department. A faster, more efficient customs clearance process is crucial to being globally competitive today.

The World Bank relies on local expertise.

Around 95 percent of the staff in their Dhaka office—plus additional staff in their Washington office—are Bangladeshi. While a large part of the World Bank’s value is in its global experience and expertise, local knowledge is indispensable to effective development. They also work closely with the government, civil society and communities in designing their support for the country. Most importantly, their overall assistance to the country was developed after broad consultations and is specifically designed to support the goals outlined by the government and the people of Bangladesh.

Conclusion

Banking sector in any country plays a pivotal role in setting the economy in motion and in its development process, while the banking structure-the number and size distribution of bank in a particular locality and the relative market power of specific banking institution- determines the degree of competition, efficiency and performance level of the banking system. Like product markets, the supply of and demand for the product of the banking system influence the banking market, and the banking system in Bangladesh is no expectation.

The Grammen bank, Bangladesh krishi Bank, Social Investment Bank, Bngladesh shilpa Bank, Karmasangsthan Bank and also World Bank are trying to social development of Bangladesh. The overall growth pattern of banking sector in Bangladesh is quit insignificant and inconsistent with the objectives and costs of its reform programs.

Bibliography

- www.wikipedia.org

- www.worldbank.com

- Microsoft Encarta 2007 Premium Encyclopedia

- www.google.com