Plentina, a Philippines-based buy-now, pay-later business focusing on emerging markets, said today that it has secured $2.2 million in funding. This takes the fintech’s total fundraising to $5.7 million since its inception in 2019, including a seed round reported in April.

TMV led the current round of fundraising, which also included Global Founders Capital and return investors AV Ventures, Techstars, and Unpopular Ventures. Plentina will utilize the fresh funds to accelerate its expansion in the Philippines, extend its product, and begin investigating opportunities in other countries, including Vietnam. The startup plans to raise a Series A round next year and will add senior executives in the meantime.

Plentina intends to focus on other data-driven financial services in addition to its BNPL platform (its co-founders, Kevin Gabayan and Earl Valencia, are data scientists whose combined work experience include positions at Google and Charles Schwab). The two point out that the Philippines has a population of over 100 million people yet only around 5% of them use credit cards.

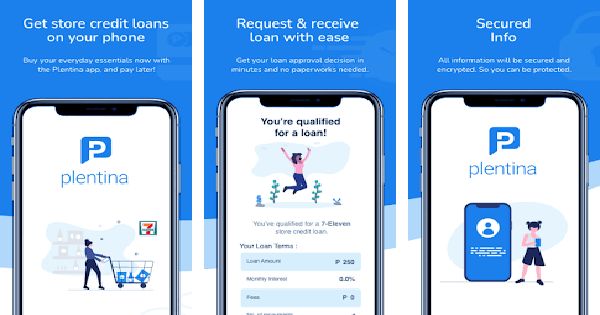

According to the firm, Plentina’s Android app downloads climbed by 500% in 2021, from 30,000 to over 150,000 users. It intends to release an iOS app in the first quarter of next year. When Plentina first began in the Philippines in October, it concentrated on everyday necessities, forming agreements with companies such as 7-Eleven and the telecommunications company Smart Communications. It has since added more than 20 brands and categories to its site. Food, groceries, and school supplies are examples, but there are also plane tickets, games, and e-commerce to consider.

Its merchants include Isetann Supermarket, Lazada, Zalora, Shopee, Agoda, and McDonald’s, Philippine Airlines, Razer E-Pins, and National Bookstores, as well as e-commerce platforms and offline businesses. According to the firm, there are more than 20 companies on the waiting list to join its platform. Plentina has also added new loan terms. The firm sought payback within 14 days when TechCrunch last reported it in April. Plentina has now extended its BNPL offers to three months, citing the availability of higher-value products such as plane tickets and e-commerce transactions.

Next year, the firm will begin its worldwide development. “Our objective is to democratize financial services in underdeveloped nations,” Valencia told TechCrunch. “We want to expand to Vietnam in 2022.” “In our first market, the Philippines, we will utilize lessons learned in launching and scaling.” Plentina has already assembled a leadership team in Vietnam to begin operations, he said. “Kevin and Earl are precisely the entrepreneurs we aim to back as investors,” TMV founder and general partner Soraya Darabi said in a statement. They have the domain discipline to be laser-focused on this bold prospect, as well as the perseverance to see it through to completion. We’re excited to work with them to deliver dependable financial services to the Philippines and beyond.”