Introduction:

This assignment is based on Ethical point of view. This is assignment provide us a great opportunity to get familiar with ethical issues that are practiced in Islamic Bank of Bangladesh. It is a privilege for as that we are given that scope for preparing such splendid assignment on a nice topic in this particular assign, the author is the assign of the previously mentioned program and the concerned organization is Islamic Bank Bangladesh Limited (IBBL). Which is a prominent private and the first Bank of Bangladesh that based on Islamic Shariah.

Ethical Practices of Islami Bank Bangladesh Limited

Islami Bank Bangladesh Limited introduced unconventional way of banking business in the country. It started its operation in 1983 and ended the initial year of operation with a total deposit of Tk 14.41 crore. The deposit amount rose to Tk 3533.44 crore on June 30, 2001 registering a substantial growth.

The investment portfolio of the bank is extended at 2.50 per cent for agriculture and rural investment, 18 per cent for industrial term investment, 13 per cent for industrial working capital, 10 per cent for housing and real estate, 4 per cent for transport and communication, 0.05 per cent for electricity, gas, water and sanitation services, 2 per cent for storage, 43 per cent for import, export and local trade and trade related activities, 1 ‘per cent for poultry and dairy, 2 percent for rural development scheme, 2.50 per cent for other special schemes, 0.50 per cent for micro-industry and one per cent for other productive purposes.

The overall recovery rate of the bank is 93 per cent. Islami Bank has introduced small business schemes micro industries finance, under the bank finances projects with limit upto Tk 30,000.

Islami Bank functions in a market where interest based conventional form of banking covers about 90 per cent of the banking sector. Islami Bank works with the concept of interest-free banking and it has proved that the new banking with interest free concept could be successful and expanded in the country.

The Bank introduced projects like Rural Development Scheme, an investment project that conforms to social responsibility for the downtrodden in rural areas as its prime priority. The Rural Development Scheme has been designed to help improve the living standard of people, particularly the women in rural areas. The Rural Development Scheme is an unprecedented success in social upliftment by means of empowering the downtrodden through economic emancipation. The bank uses depositors’ funds in interest-free ways in rural areas where downtrodden people are susceptible to several evil designs of interest groups.

About 86 thousand people in rural areas, 90 per cent of whom are women, are now being covered under the Rural Development Project. Among them, about 72 thousand have already fully adjusted the disbusred fund. The recovery rate is about 99.7 per cent. The bank disburses Tk 3000-15,000 under the project per person. More than Tk 90 crore have been disbursed so far under the Rural Development Scheme. The project is now being operated in about 2200 villages in 45 districts through 21 branches.

The bank is planning to open some new branches in rural areas to add further pace to its Rural Development Scheme. The scheme allows investment in production of 21 various agro and agro-related products, food, cereal and cash crops, off-farm activities like dairy, cow fattening, goat rearing, poultry, shopkeeping, peddling, rural transport like, rickshaw, rickshaw-van, cart etc, irrigation equipment, hand tube-well, housing materials etc.

The bank has a subsidiary, the Islami Bank Foundation. The Foundation is engaged in social welfare activities, side by side taking care of the requirement of sanitation, medicare and education of the villages through integrated area development approach.

The other schemes of the bank include housing investment scheme, car investments, investment for doctors, small business schemes, agriculture implements investment scheme, silk weavers investment schemes, micro industries investment scheme etc.

The bank is determined to practice Islamic banking which is an alternative to conventional banking. It prefers investing in productive initiatives by best utilisation of people’s savings. But Murabaha, title being pledged with the bank and Bai Muazzal, title being pledged with the client under hypothecation are the two major modes of Islamic banking. About 41 percent and 21 per cent of the Islami Bank’s total investment portfolio are ivnested in those modes respectively.

The bank achieved successes in mobilising deposits and distributing profits. The management of the bank maintains that there is still tremendous potential of expanding Islamic Banking in the country. It has already established that banking without interest is feasible in the country. The bank now expects to contribute to the development of an Islamic Money Market in the country.

An Overview of Business Ethics

Ethics

The word ethics comes from the Greek word “Ethos”, which means “character or customer” writes philosophy professor Robert C. Solomon. According to the author Solomon, the etymology of ethics suggests its basic concerns; (1) individual character, including what it means to be “a good person” and (2) the social rules that govern and limit our conduct, especially the ultimate rules concerning right and wrong, which we know as morality.

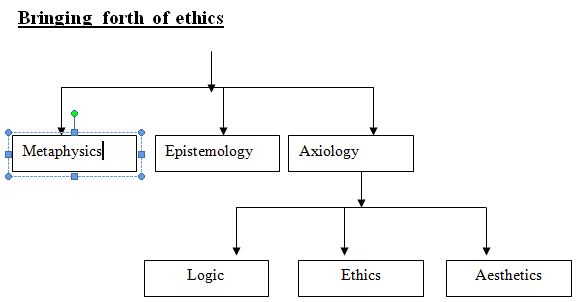

Garret Thomas says that ethics is concerned primarily with the relationship of business goals and objectives to specifically human ends. It studies the implications of acts on the good of the individuals, the firms, the business community and the society. Thus business ethics studies the special obligations which a man accepts when he becomes a part of business. For example, philosophical ethics, religious ethics, Social ethics, business ethics and above all normative and professional ethics.

- Metaphysics:

| Deals with the Truth about the Metaphysical Nature of the Universe, cause & Effect Relationship, the Functions & Nature of Mind |

- Epistemology:

| Deals with Nature and Worthiness of Knowledge, Methods of Knowledge, etc. |

- Axiology

| Deals with values, Types of Values, Methods of Value Realization, etc. |

- (a) Logic:

| Deals with Thoughts, Methods of Thoughts, etc. |

3 (b) Ethics:

| Deals Fundamentally with the rules of Human Conduct from Moral Point of View |

3 (c) Aesthetics:

| Deals fundamentally with the Theory of Beauty, Relation between Truth and Beauty, etc. |

Most Significant element of ethics in business:

a) Honesty and Fairness

Honesty refers to truthfulness, integrity, and trustworthiness; fairness is the quality of being just, equitable, and impartial. Honesty and fairness relate to the general moral attributes of decision makers. At a minimum, businesspeople are expected to follow all applicable laws and regulations. In addition, they should not knowingly harm customers, clients, employees, or even other competitors through deception, misrepresentation, or coercion. Although businesspeople often act in their own economic self-interest, ethical business relations should be grounded on fairness, justice rowers.

b) Conflicts of Interest:

A conflict of interest exists when an individual must choose whether to advance his or her own interests, those of the organization, or those of some other group. For example, federal investigators are looking into where a $1 million donation by Citigroup to the 92nd St. Y nursery school represents a conflict of interest. Jack Grumman, an analyst for Salomon Smith Barney, upgraded his rating for AT&T stock after San-ford Well, CEO of Citigroup (the parent company of Salomon Smith Barney), agreed to use his influence to help Grumman’s twins gain admission to the elite Manhattan nursery school. Grumman has denied elevating his rating for AT&T’s Stock for a quid pro quo, but his children were enrolled. 20 If Grumman placed his family’s interests ahead of his company’s and the investors who paid his company for imperial advice then those stakeholders are likely to consider his action a conflict of interest.

c) Fraud:

When an individual engages in deceptive practices to advance his or her own interests over those of his or her organization or some other group, changes of fraud may result. In general, fraud is any purposeful communication that deceives, manipulates, or conceals facts in order to create a false impression. It is considered a crime, and convictions may result in fines, imprisonment, or both. Fraud costs U.S. organizations more than $400 billion a year; the average company loses about 6 percent of total revenues to fraud and abuses committed by its own employees. Among the most common fraudulent activities employees report about their coworkers are stealing office supplies of shoplifting, claiming to have worked extra hours, and stealing money or products. In recent year, In recent years, accounting fraud has become a major ethical issue, but as we will see fraud may also relate to marketing and consumer issues.

D) Discrimination :

Although a person’s racial and sexual prejudices belong to the domain of individual ethics, racial and sexual discrimination in the workplace creates ethical issues within the business world. Once dominated by white men, the U.S. work force today in-clues significantly more women, African Americans, Hispanics, and other minorities, as well as disabled and older workers. Experts project that within the next fifty years, Hispanics will represent 24 percent of the population, while African Americans and Asians/Pacific Islander will comprise 13 percent and 9 percent, respectively. Theses groups have traditionally faced discrimination and higher unemployment rates and been denied opportunities to assume leadership roles in corporate America.

E) Information Technology:

The final category of ethical issues relates to technology and the numerous advances made in Internet and other forms of electronic communications in the last few years. As the number of people who use the Internet increases, the areas of concern related to its use increase as well. Some issues that must be addressed by business included the monitoring of employees’ use of available technology, consumer privacy, site development and online marketing, and legal protection of intellectual properties, such as music, books and movies.

Unfolding of Islamic Banking:

One important development in the field of banking since the seventies has been the emergence of Islamic Banking. It made an auspicious beginning in Egypt and quickly spread to other Muslim countries.

Bangladesh joined the caravan of Islamic banks in 1983 when a Sharia based bank Islamic Bank Bangladesh Ltd was established as a joint venture bank. Since then several banks have been established-Al-Arafah. Shahjalal Islamic and Social Investment etc. One commercial bank Exim Bank Ltd.- previously chartered as conventional interest based bank has switched to Islamic system of banking.

Conceptual Framework:

Islamic financial practices are built around the belief that money is not an earning asset in and of itself. The system can only be understood in the context of Islamic Attitudes towards ethics, wealth distribution, social and economic justice, and the role of the state. Principles encouraging risk sharing, individual rights and duties, property rights and the sanctity of contracts are all part of the Islamic code underlying the banking system.

It is important to make clear at the outset that Islam does not want people to turn away from what life has to offer in this world. Neither does it restrict freedom to undertake a business venture. While Islam tolerates personal freedom and the right to accumulate wealth, it abhors unbridled materialism, consumerism, greed and exploitation of human labour by owners of capital. The warnings against avarice have been reiterated in the holy Quran.

Islam discourages hoarding and enjoins spending “in the way of Allah”. Islam encourage sharing of wealth with the less fortunate members of the society and enjoins everyone to promote Islamic values in all spheres of human endeavors including banking.

Money is valuable only as a function or by-product of human effort, and human effort in its turn is the means by which a Muslim should serve his lord.

Emergence of Islamic Bank Concept:

The history of interest-free banking could be divided into two parts. At the embryonic stage the idea floated around for a while. In the next stage Islamic bank started to emerge through private initiative in some countries and by law in others in the seventies. The fervor that was seen in the initial stages seems to have somewhat abated during the last decade both in terms of establishment of new Islamic bank and inability of the established banks to live up to the expectations. This could be attributed to the growing American influence in the Arab world. Although the Islamic banking is relatively new the idea of Interest-free economy is as old as the religion of Islam. The concept of interest free banking is relatively new the idea of Interest-free economy is as old s the religion is Islam. The concept of interest free banking started to attract attention since the middle of the last century and gathered momentum from the middle of seventies coinciding with the oil boom.

The earliest references to the reorganization of Banking on the basis of profit sharing rather than interest are found in the writing of some of the Islamic scholars beginning from late forties. They recognized the ill effects of interest and proposed a banking system based on the concept of Mudarabha—profit and loss sharing.

Potentiality of Islamic Bank:

The Way Islamic Bank Operates is activities its rally admirable. Because of the most of financing easily it can attract the customers. Namely the modes of financing of Islamic Bank.

Investment Financing:

This is also done in several ways. The main ones are:

- Mark- up where the bank buys an item for a client and the client agrees to repay the bank the price and an agreed profit later on. The system may take two forms, Bai Murabah or Bai Muazzal,

- Leasing where the bank buys an item for a client and leases it to him for an agreed period and at the end of that period the lessee pays the balance on the price agreed at the beginning an becomes the owner of the item.

- Hire- purchase where the bank buys an item for the client and hires it to him for an agreed rent and period, and at the end of that period the client automatically becomes the owner of the item.

- Letters of credit where the bank guarantee the import of an item using its own funds for a client, on the basis of sharing the sharing the profit from the sale of this item or on a markup basis.

Charges on Lending

Main forms of Lending are:

- Loans with a service charge where the bank lends money without interest but they cover their expenses by levying a service charge. This charge may be subject to a maximum set by the authorities.

- No-cost loans where each bank is expected to set aside a part of their funds to grant no-cost loans to needy persons such as small farmers, entrepreneurs, producers, etc. and to needy consumers.

- Overdrafts also are to be provided, subject to a certain maximum, free of charge.

Problems of the Islamic Banks:

Islamic banks are equipped to provide nearly all the services that are available in the conventional banks. However, at the initial they encountered many obstacles to operate strictly on the sharpie principles. One impediment that continues to present varying degrees of problems is financing imports through letters of credit. Payments made by overseas correspondents often involve creation of overdrafts in what are called nostrum accounts. The banks abroad would normally apply interest on the overdrawn amounts. Over the years the Islamic banks have tried to find an escape route. Some have arranged with the correspondents to work out mutual compensation package under which interest is not charged either on the overdrafts or the credit balance in the nostrum accounts. Some of the banks maintain large enough balances in these accounts to obviate the need for overdrafts and for that matter payment of interest.

The main problem arises in respect of investment financing and trade financing. Islamic banks are expected to engage in these activities only on a profit and loss sharing (PLS) basis. Several writers have attempted to show, with varying degrees of success, that Islamic Banking based on the concept of profit and loss sharing (PLS) is theoretically superior to conventional banking from different angles.

There are four main areas where the Islamic banks find it difficult to finance under the PLS scheme: a) participating in long-term low-yield participating loans to running businesses, c) granting non-participating loans to running business, and d) financing government borrowing. Let us examine them in turn.

Long-term projects:

Medium-and long-term investment in large and medium term industries constitutes only about 17 percent of investment made by the interest free banks in Bangladesh. The amount of investment on this account to the small and cottage industry is negligible-only about 0.46 percent. In Pakistan the situation is worse. Obviously the banks are reluctant to participate in long-term projects.

The main reason of course is that participation in such ventures involve their employment of fund on PLS basis. The banks do not normally want to get involved in this system of financing on a long term basis because it involves time consuming complicated assessment procedures and negotiations, requiring expertise and experience. There are no commonly accepted criteria for project evaluation based on PLS partnerships. Each single case has to be treated separately with utmost care and each has to be assessed and negotiated on its own merits. Other obvious reasons are: a) such investments tie up capital for very long periods, unlike in conventional banking where the capital is recovered in regular installments almost right from the beginning, and the uncertainty and risk are that much higher, b), the longer the maturity of the project the longer it takes to realize the returns and the banks therefore cannot pay a return to their depositors as quick as the conventional banks can. Thus it is no wonder that the banks are averse to such investments.

Small businesses :

Small scale business from a major part of a country’s productive sector. Although numerically they constitute the majority of the bank’s clientele it seems difficult to provide them with the necessary financing under the PLS scheme, even though often the banks are seen to suffer from liquidity overhangs.

Due to the comprehensive criteria to be followed in granting loans and monitoring their use by banks, small-scale enterprise have, in general encountered greater difficulties in obtaining financing than their large-scale counterparts in the Islamic Republic of Iran. A similar situation is known to be prevailing in other countries.

Running business:

Running business frequently need short-term capital as well as working capital and ready cash for miscellaneous on-the-sport purchases and sundry expenses. This is the daily routine chore in the business world. The PLS scheme is not geared to cater to this need. Even if there is complete trust and exchange of information between the bank and the business it is nearly impossible or prohibitively costly to estimate the contribution of such short-term financing on the return of a given business. Neither is the much used mark-up system suitable in this case. It looks unlikely to be able to arrive at general rules to cover all the different situations. Added to this are the delays involved in authorizing emergency loans.

Government borrowing:

In all the countries the Government accounts for a major component of the demand for credit—both short-term and long-term. Unlike business loans there borrowings are not always for investment purpose, nor for investment in productive enterprise. Even when invested in productive enterprise they are generally of a longer-term type and of low yield.

Conclusion:

In spite of the present limitations, Islamic-banking system has tremendous potentiality and prospect in Bangladesh. Firstly, the successful launching and operation of Islamic banks in Bangladesh has established the fact that banking without interest is feasible. Secondly, Islamic banks have brought together many depositors and entrepreneurs under their fold and coverage. These depositors and entrepreneurs so long avoided interest – based banking on grounds of religious injunctions.