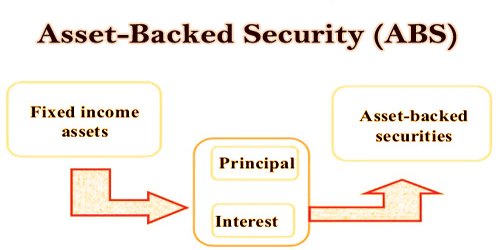

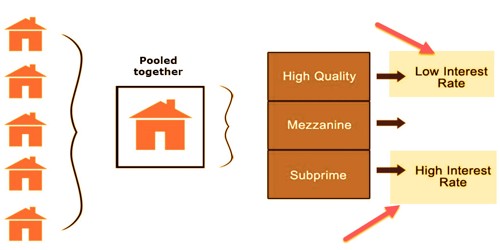

A bond or note that is collateralized by a pool of assets, such as loans, rentals, credit card debt, royalties, or receivables, is asset-backed security (ABS) investment security. Financial institutions pool multiple loans into single security for the production of asset-backed securities that are then sold to investors. Pooling the advantages into monetary instruments permits them to be offered to general speculators; a cycle called securitization and permits the danger of putting resources into the basic resources for be broadened in light of the fact that every security will speak to a small amount of the complete estimation of the various pool of basic resources.

Auto loans, student loans, home equity loans, rentals, credit card debt, and royalties are used by financial institutions such as banks, auto finance firms, and credit card providers as collateral for bonds. An ABS, except that the underlying securities are not mortgage-based, is similar to mortgage-backed security. The repayment of these loans is utilized to pay the enthusiasm to the financial specialists who purchase the securities, while the advances are changed over into attractive protections through securitization. s huge numbers of the advances can’t be sold independently, securitizing them into resource sponsored protections furnishes speculators with further venture openings, and permits money related organizations to eliminate dangerous resources from their accounting reports.

Example of Asset-Backed Security (ABS)

Asset-backed securities allow issuers to raise cash that can be used to raise more, thus giving ABS investors the ability to engage in a wide range of assets that produce income. The key advantage of asset-backed securities is that relative to assets with the same credit rating, they give investors the ability to invest in a diversified portfolio of income-generating assets with a yield premium. The vast majority of the benefits are advances given to people as home loans, MasterCard obligation, or car credits. Since the credits give the loan specialist intrigue and head installments, they are resources on the moneylender’s asset report.

An ABS’s underlying assets are always illiquid and cannot be sold by themselves. Thus, a tool called securitization enables the owner of the assets to make illiquid assets marketable to investors by pooling assets together and providing ABS financial security. In addition, they give lenders the ability, once the illiquid assets are transformed into cash, to issue additional loans. ABS issuers can be as innovative as they wish. On the drawback, ABSs bring about a prepayment hazard, which is the danger that borrowers may take care of their obligations prior, subsequently bringing down the incomes produced. For example, based on cash flows from movie sales, royalty payments, aircraft leases, and solar photovoltaics, asset-backed securities have been developed. It is possible to securitize an ABS in just about every cash-producing scenario. As well as the risk, the interest, and principal payments on the assets are also passed on to the investor.

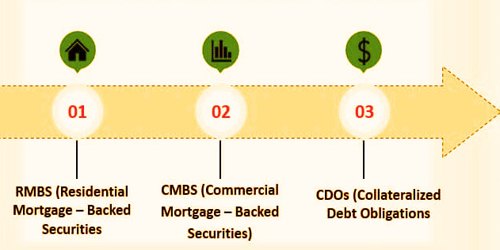

An asset-backed security is often used as an umbrella term for a form of security backed by an asset pool, and sometimes for a specific type of security backed by consumer loans or loans, leases, or receivables other than real estate. In a process known as securitization, loans and other types of debt are bundled together to create asset-backed securities. Securitization can happen with many sorts of loans, like commercial and residential mortgages, auto loans, personal lines of credit card debt, and student loans. Asset-backed securities will also include securities with a pre-financing duration of up to at least one year during which up to 50% of the proceeds of the offering (or, in the case of master trusts, up to 50% of the aggregate principal balance of the entire asset pool whose ABS supports cash flows) will also be used to buy pool assets afterward.

Structure of Asset-Backed Security (ABS)

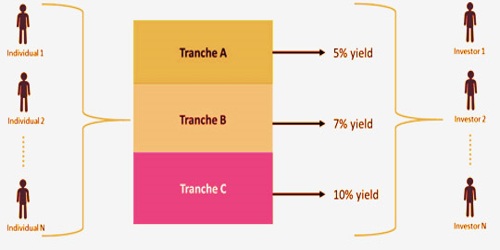

The original interest and principal payments are passed on to the investors, while the probability of default is reduced since only a fraction of each underlying asset is included in each asset-backed security. Depending on the level of risk, as well as the return, each pool is divided. Lower-risk assets may lead to lower interest payments, while higher yields can be generated by riskier assets.

Example: Assume that Company X is in the matter of making vehicle credits. On the off chance that an individual needs to get cash to purchase a vehicle, Company X gives that individual the money, and the individual is committed to reimburse the credit with a specific measure of premium. Maybe Company X makes endless credits that it runs out of money to keep making more advances. Organization X would then be able to bundle its present credits and offer them to Investment Firm X, in this way accepting the money, which it would then be able to use to make more advances.

Investment Firm X will at that point sort the bought credits into various gatherings called tranches. These tranches are gatherings of credits with comparable qualities, for example, development, loan cost, and expected wrongdoing rate. Next, Investment Firm X will give protections that are like regular bonds on every tranche it makes. Singular speculators at that point buy these protections and get the incomes from the fundamental pool of car advances, less an authoritative expense that Investment Firm X saves for itself.

Benefits of Asset-Backed Securities (ABSs) –

- Protects from potentially risky loans: For the lender that issues asset-backed securities, the advantage is that, once they have been securitized and sold to outside investors, potentially risky loans are excluded from their balance sheet. They are also able to obtain a fresh source of financing by selling the assets through asset-backed securities that can be used to issue further loans or for other business purposes.

- Provides an alternative and more stable investment vehicle: Asset-backed securities provide an alternative investment option for investors that offer higher returns and greater stability than government bonds. For investors looking to invest in other markets, asset-backed securities often offer portfolio diversification. Even, via mortgages or credit cards, not all borrowers will lend directly to customers.

- Reduces default risk and other credit risks: Investors can gain access to interest and principal payments of different assets by buying asset-backed securities without having to source them. As only a fraction of all the underlying assets are included in each protection, the risk of default and other credit risks are minimized.

An ABS will for the most part have three tranches: class A, B, and C. The senior tranche, A, is quite often the biggest tranche and is organized to have a speculation grade rating to make it appealing to financial specialists. For protections sponsored by receivables or other monetary resources that don’t emerge under spinning accounts, for example, car credits and home loan advances, a boundless rotating period will be allowed for as long as three years. Nonetheless, the new resources added to the pool during the spinning time frame must be of a similar general character as the first pool resources.

Information Sources: