Early and late in the day, bank credit officers are more likely to accept loan applications, but ‘decision fatigue’ around midday is linked to reverting to the safer choice of saying no. These are the findings of a study published today in the journal Royal Society Open Science by researchers from the University of Cambridge’s Department of Psychology.

The exhaustion induced by having to make tough judgments over a lengthy period of time is known as decision fatigue. Previous research has indicated that persons suffering from decision fatigue prefer to make the ‘default decision,’ which is to choose the option that is the easiest or appears to be the safest.

Borrowers use a loan application to apply for a loan. Borrowers give important financial information to the lender during the loan application. The loan application is vital in determining whether or not the lender will grant the loan request.

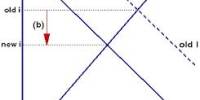

Credit officers were more willing to make the difficult decision of granting a customer more lenient loan repayment terms in the morning, but by midday, they showed decision fatigue and were less likely to agree to a loan restructuring request. After lunchtime, they probably felt more refreshed and were able to make better decisions again.

Professor Simone Schnall

Over the course of a month, the researchers looked at the choices made by 30 credit officers of a large bank on 26,501 credit loan applications. The officials were making judgments on ‘restructuring requests,’ which are requests from customers who already have a loan but are having trouble repaying it and want the bank to alter the installments.

Any sort of loan, whether a revolving loan like credit or a debt instrument like a mortgage or vehicle loan, requires a loan application. The application will ask for the loan amount and, in certain cases, a term from the borrower. Depending on where the borrower resides and if the borrower is married and applying jointly, the lender will charge varying rates of interest.

The researchers were able to determine the economic cost of decision fatigue in a specific setting for the first time by analyzing judgments made at a bank. They discovered that if all choices had been taken in the early morning, the bank might have earned an additional $500,000 in loan repayments.

“Credit officers were more willing to make the difficult decision of granting a customer more lenient loan repayment terms in the morning, but by midday, they showed decision fatigue and were less likely to agree to a loan restructuring request. After lunchtime they probably felt more refreshed and were able to make better decisions again,” said Professor Simone Schnall in the University of Cambridge’s Department of Psychology, senior author of the report.

Credit officers must balance the customer’s financial strength against risk indicators that diminish the possibility of repayment when making decisions on loan restructuring requests. Errors may cost a bank a lot of money.

Approving the request results in a loss in comparison to the initial payment schedule, although the loss is substantially lower than if the loan is not returned at all.

Customers who had their restructuring requests allowed were more likely to repay their loans than those who were told to keep to the original repayment conditions, according to the study. Around midday, credit officers’ inclination to refuse more requests was linked to a financial loss for the bank.

“Even decisions we might assume are very objective and driven by specific financial considerations are influenced by psychological factors. This is clear evidence that regular breaks during working hours are important for maintaining high levels of performance,” said Tobias Baer, a researcher in the University of Cambridge’s Department of Psychology and first author of the report.

Labor patterns in the modern era have been defined by longer hours and a larger amount of work. The findings show that reducing lengthy periods of intense mental stress may increase worker productivity.