The velocity of money is a measure of how quickly money is exchanged in an economy. It is the number of times the average unit of currency is used to buy goods and services in a given time period. It is the number of times money is transferred from one entity to another. The concept connects the size of economic activity to a given money supply, and one of the variables that determine inflation is the speed of money exchange. Simply put, it is the rate at which consumers and businesses in an economy spend money collectively. The ratio of a country’s GNP to its money supply is commonly used to calculate the velocity of money.

The velocity of money is important for determining the rate at which money in circulation is spent on goods and services. When the velocity of money rises, so do the number of transactions between individuals. It is used to assist economists and investors in determining an economy’s health and vitality. Money’s velocity varies over time and is influenced by a variety of factors. A healthy, expanding economy is usually associated with high money velocity. Recessions and contractions are typically associated with low money velocity.

Economists use the velocity of money to calculate the rate at which money is spent in an economy on goods and services. While it is not a key economic indicator in and of itself, it can be used in conjunction with other key indicators that help determine economic health, such as GDP, unemployment, and inflation.

Illustration

The rate at which people spend money is referred to as the velocity of money. Consider how hard each dollar works to boost economic output. When money’s velocity is high, it means that each dollar is moving quickly to purchase goods and services. It reflects high demand, which leads to increased output. If, in a very small economy, a farmer and a mechanic spend $50 on new goods and services from each other in just three transactions over the course of a year –

- A farmer spends $50 on tractor repair from a mechanic.

- The mechanic buys $40 of corn from the farmer.

- The mechanic spends $10 on barn cats from the farmer.

Then, over the course of a year, $100 changed hands, despite the fact that there are only $50 in this small economy. That $100 level is possible because each dollar was spent on new goods and services twice a year on average, implying a velocity of [2/year]. It is worth noting that if the farmer purchased a used tractor from the mechanic or made a gift to the mechanic, the transaction would not be included in the numerator of velocity because it would not be part of the gross domestic product of this tiny economy (GDP).

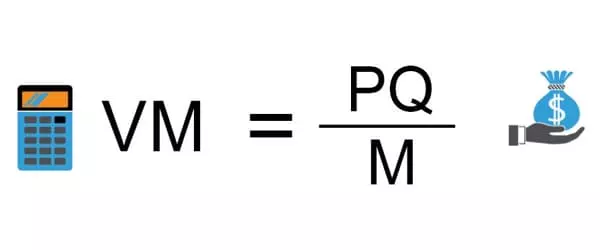

The velocity of money is calculated by dividing the country’s GDP by its money supply. This equation is used.

V = PQ/M

Where:

- V = VELOCITY OF MONEY

- PQ = NOMINAL GROSS DOMESTIC PRODUCT

- M = MONEY SUPPLY

Relation to money demand

The rate or pace at which money is exchanged is referred to as the velocity of money. It offers a different perspective on money demand. Given the nominal flow of money-based transactions, if the interest rate on alternative financial assets is high, people will not want to hold much money relative to the number of their transactions—they will try to exchange it quickly for goods or other financial assets, and money is said to “burn a hole in their pocket,” implying that velocity is high. If an economy has a higher velocity of money than others, it is likely to have a higher inflation rate as well, assuming all else remains constant.

This is a situation in which money demand is low. In contrast, when there is a low opportunity cost, velocity is low and money demand is high. Both of these circumstances contribute to the time-varying nature of money demand. Some economic variables (interest rates, income, or the price level) have been adjusted to equate money demand and money supply in money market equilibrium. Economists and investors use the velocity of money to assess an economy’s overall health and vitality.