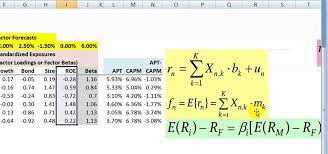

Arbitrage Pricing Theory is an asset pricing model in line with the idea that an asset’s returns might be predicted using the relationship between that same asset and many common risk variables. Created in 1976 through Stephen Ross, this theory predicts a relationship involving the returns of a portfolio and also the returns of just one asset through a linear combination of many independent macro-economic variables. Arbitrage pricing theory is a theory associated with asset pricing that holds how the expected return of a financial asset might be modeled as any linear function of assorted macro-economic factors.

Arbitrage Pricing Theory