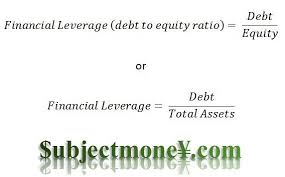

Basic objective of this article is to analysis the Risks of Leveraged Debt. Leveraged debt is used to increase returns with an investment; however, there tend to be serious risks involved. The most typical uses of leveraged debt include business, stock, and real estate investments. In business, this is the tool used to increase returns on large level operations. The term refers to your scenario when a person or business chooses to generate a large investment by making use of various financial resources, which includes borrowed capital. Leveraged debt can significantly increase your investment’s returns; however, it may also increase your losses.

Analysis the Risks of Leveraged Debt