Analysis of Activities of General Banking of Janata Bank Limited

Banking has a long and rich history. It started as a result of people’s need. And with ages it has been playing an important role in fulfilling the dire needs of businessmen and others. As the size and complexities of business is increasing day by day banking sector is also providing various innovative services with basic functions to increase size but to reduce the complexities. Modern banking is a result of evolution driven by changing economic activities and life styles. Entering in to a new millennium, banking needs have become more diverse and exotic than ever before. It is known now that commercial bank is a profit maximizing institution. Hence it should provide loans to those sectors in which its return is higher. But the nationalized commercial banks are conducting banking business with different purposes. The main purpose is not just to make profit but also to maximize the social benefit. Commercial banks provide a variety of other services to their customers as for example remittance facilities, credit information about customers, financial advice, collection of debts and dues etc. Banks also provide a number of trust services to their customers. These services may either corporate trust services, which arise in connection with the issue of bonds; personal trust services under which they manage property on behave of their clients or corporate pension funds that provide retirement benefit for their employees.

After the completion of four-years and twelve semesters academic BBA program I, Md. Toslim Hossain, student of BRAC University, Bangladesh was placed in Janata Bank Bangladesh Limited for the Internship Program. As a requirement for the completion of the program I need to submit a report, which includes “General Banking Activities of Janata Bank Ltd.”

Broad Objective:

The major objective of the report is to make an in depth analysis of activities of General Banking of Janata Bank Limited.

General Objective:

- To know about the management system of Janata Bank Limited as a public commercial bank, its formation, and its functional and financial aspects.

- To have a clear knowledge about all the division and departments of Janata Bank Limited Mirpur-10 Branch.

- To achieve the practical knowledge that will be helpful for future life.

- To apply theoretical knowledge in the practical field.

- To have exposure to the functions of general banking section.

- To observe the working environment in commercial banks.

- To study existing banker customer relationship.

- To be acquainted with the procedures of several schemes of deposits.

- To recommend some suggestions based on findings.

- To improve corresponding, report writing ability.

Beginning of Banking in Bangladesh

After independence the Government of Peoples Republic of Bangladesh was formally to cover the charge of the administration of the territory now constitute Bangladesh. In an attempt to rehabilitate the war-devastated banking of Bangladesh, the government promulgated a law called Bangladesh Bank (temporary) order, 1971 (Acting President’s Order No.2 of 1971). By this order, the State Bank of Pakistan was declared to be deemed as offices, branches and assets of Bangladesh Bank. On that date there existed 14 scheduled banks with about 3042 branches all over the country.

On the 16th December, 1971, there existed the following 12 banks in Bangladesh, namely:-

- National Bank of Pakistan

- Bank of Bahwalpur Ltd

- Premier Bank Ltd.

- Habib Bank Ltd.

- Commerce Bank Ltd.

- United Bank Ltd.

- Union Bank Ltd.

- Muslim Commercial Bank Ltd.

- Standard Bank Ltd.

- Australasia Bank Ltd.

- Eastern Mercantile Bank Ltd.

- Eastern Banking Corporation Ltd.

Nationalization of Banks in Bangladesh

Immediately after the liberation war in 1971, Government of Bangladesh consolidated banks authority and decided to adopt socialist pattern of society as its goal. Hence in order to implement the above mentioned state policy; the Government of Bangladesh decides to nationalize all the banks of the country accordingly on the 26th March, 1972, Bangladesh Banks (Nationalization) Order, 1972(President order No. 26 of 1972) was promulgated.

The undertakings of existing banks specified in the 1st column of the table below stands transferred to and vested in, the new banks mentioned in the 2nd column of the said table: Nationalization of Banks:

Profile of JBL

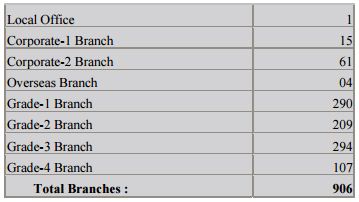

Janata Bank, one of the largest commercial bank in the country, was established under Bangladesh Bank (Nationalization) Order 1972 (Presidency Order of 1972). By taking over branches of former United Bank Limited and Union Bank Limited, were two private banks performing class banking over the country. After the birth of Bangladesh on 16th December 1971, newly formed Janata Bank for mass banking got special facilities from the government to work as nationalized commercial bank all over the country. With the increase of responsibility and by virtue of performance within a few years, it becomes the largest commercial bank of the country with 906 branches including 4 overseas branches at United Arab Emirates. It is linked with 1239 foreign correspondents all over the world. Total employees of JBL are more than 14 thousands (14,244). Its head office located at Janata Bhaban at Motijheel C/A, the heart of the capital city, Dhaka. Corporatization

In 15 November, 2007 Janata Bank got registered with the Joint Stock of Registrars and restructured it as a public limited company with the name Janata Bank Limited.

List of Branches:

Deposit schemes section

Bank is the largest organization of mobilizing surplus domestic savings. For poverty alleviation, we need self-employment, for self-employment we need investment and for investment we need savings. In the other words, savings help capital formations and the capital formations help investments in the country. The investment in its turn helps industrialization leading towards creation of wealth of the country. And the wealth finally takes the country on road to progress and prosperity. As such, savings is considered the very basis of prosperity of the country. The more the growth of savings, the more will be the prosperity of the nation.

The savings rate in Bangladesh is one of the lowest in the world rate of domestic saving being 17.78 %. In order to improve the savings rate, Financial Institutions responsible for mobilization of savings should offer attractive Savings Schemes so that the marginal propensity to save increases. The savings do not, of course, depend only on the quantum of income but largely depend on the habit of savings of the people.

Deposits are life-blood of a commercial bank. Without deposits there are no businesses for the commercial banks. Accepting deposits is one of the most important classic functions of commercial banks. Bank deposits can be broadly classified as follows:

Demand Deposits: Demand deposits can be withdrawn without any prior notice, e.g. current deposits. Janata Bank Mirpur-10 Corporate Branch accepts demand deposits through the opening of Current Account and Savings Bank Account. General conditions or rules in respect of operating Current/Saving A/C in Mirpur-10

Corporate Branch are as follows:

- A minimum balance of tk500 and tk1000 must be maintained in the Saving and Current A/C respectively.

- A suitable instruction by an introducer acceptable to the branch is required.

- Recent photographs of the A/C openers duly attested by the introducer must be produced

- Withdrawal of deposit can be made two times in a week in case of saving A/C

- For Saving A/C, an application must be submitted to the branch authority if withdrawal is tk50, 000 or more but customer rarely follow this rule.

- Interest rate for Saving bank A/C is 5% per year

Time Deposits: A deposit that is payable at a fixed date or after a period of notice is called ‘Time Deposit’. This branch accepts time deposit through-

- Fixed Deposit Recei (FDR)

- Short Term Deposit (STD)

- Janata Bank Deposit Scheme (JBDS)

- Sanchoy Pension Scheme (SPS)

Fixed Deposit Receipt (FDR)

Fixed deposits are deposits in which an amount of cash is deposited in bank for a fixed period specified in advance. Hence these deposits are time deposits or time liabilities. Normally, the money on a fixed deposit is not repayable before the expiry of the fixed period. At the time of opening the deposit account, the banker issues a receipt acknowledging the receipt of money on deposit account. It is popularly known as FDR.

Normally a customer is not allowed to withdraw money before the expiry of the fixed period in case of Fixed Deposit Account. However, Janata Bank Ltd. allows its customers to withdraw fixed deposit amount at any time after giving a short notice. In this case the customers will get interest rate by the following ways

- If withdrawal happens before 3 months, there will be no interest.

- If withdrawal happens before 6 months, 3 months’ interest rate.

- If withdrawal happens before 1 year, 6 months’ interest rate.

- If withdrawal happens before 2 years, 1 years’ interest rate.

- If withdrawal happens before 3 years, 2 years’ interest rate.

Janata Bank Deposit Scheme (JBDS)

According to this scheme, a person of minimum 18 years old can open any ‘Janata Bank Deposit Scheme A/C’ by depositing at least tk.500 or maximum tk.20000 in each month for 10 years term. After maturity of the term, the depositor can withdraw the total deposited amount with interest or can withdraw by monthly installment. The depositor has to deposit the specified amount for him/her by the 11th day of each month either in cash or cheque. In respect of JBDS account, the depositor can select more than one nominee for claiming the deposited money after his/her death. No joint account is allowed in this scheme.

The main characteristics of JBDS are as follows-

- A system of secured income has been confirmed by JBDS for the depositor in their old age who invested money from their early incomes.

- A scope of proper and exact utilization of money is possible by JBDS.

- The total deposited amount with interest will be given to the investors and this is certain.

- The JBDS gives the investors a chance of bearing the educational or marital expenses of their adult sons or daughters.

- The total invested money in JBDS is absolutely income tax free. The earning from JBDS is not considered while charging the annual income tax.

- In JBDS, an 8.5% compounding interest rate is applied and it is usually calculated on yearly basis.

- Account holder can take lone on JBDS and Interest rate for loan id 2% more than JBDS rate (8.5% + 2% = 10.5%)

Sonchoy Pension Scheme (SPS)

Janata Bank Ltd. initiated this ‘Janata Bank Ltd. Sonchoy Pension Scheme’ in order to improve the socio-economic conditions of the professionals of all levels. This system is based on a monthly basis. The main characteristics of SPS are as follows-

- Duration of the account in this scheme is either five or ten years.

- Amounts of installments are tk.100, tk.200, tk.300, tk.400 tk500, or tk.1000

- Any person of minimum 18 years old can open a SDPS account.

- A depositor should deposit his/her monthly installment by the 10th day of each month.

If the 10th day is a public holiday, then deposit in next working day is allowed. The installment can be deposited either by cash or by cheque.

- The interest rates are, for five years duration 8.5% compounding interest rate and for ten years duration 9% compounding interest rate. In both cases interest is calculated on yearly basis.

- The depositor can have one or more nominees. In case of more than one nominee, the depositor can determine the portion of amount of money for each nominee.

A customer can stop operation of his/her SPS A/C at any time according to his or her own discretion. In this respect, the bank charges tk.25 to the customer.

- If she/he stops the account within one year, no interest will be given.

- If he stops the account after one year but before three years, 5% simple interest will be given.

- If he cancels his account after three years but before five years, 7% simple interest will be given.

- If he withdraws his account after five years, then 8.5% simple interest will be given.

Utility Service

Besides normal banking operation, Janata Bank Limited offers special services to a large number of clients/agencies throughout the country. Under the network of utility service, customers of different govt. organizations, corporate bodies, local bodies, educational institutions, students, etc are continuously getting benefits from the Bank.

Bill Collection

- Gas bills of Titas, Bakhrabad and Jalalabad Gas Transmission and Distribution Companies.

- Electricity bills of Dhaka Electricity Supply Authority, Dhaka Electricity Company, Bangladesh Power Development Board and Rural Electrification Board.

- Telephone bills of Telegraph and Telephone Board.

- Water/Sewerage bills of Water and Sewerage Authority.

- Municipal holding tax of City Corporation/Municipalities.

- A pilot scheme is underway to provide personalized services to our clients.

Payments Made On Behalf Of Govt. To:

- Non- Govt. teachers salaries

- Girl Students scholarship/stipend & Primary Student Stipend.

- Army pension

- Widows , divorcees and destitute Women Allowances

- Old-age Allowances

- Food procurement Bills

The following branches of Janata Bank Limited have collected utility bills (e. g. Electricity, Telephone, Gas, WASA etc) from customers through agents for payments against fixed service charges:

(i) Dhanmandi

(ii) Gulshan Circle-II Corporate

(iii) Satmasjid Road Corporate

(iv) Dhaka College Gate

(v) Mirpur Section-10

(vi) Uttara Model Town Corporate and

(vii) Mohammadpur Corporate Branches.

One Stop Service

Janata Bank Limited, first among the Nationalized Commercial Banks in Bangladesh, has introduced One Stop Service. The salient features of this system are as under:

- A customer can deposit and withdraw money from a single counter.

- The system of Token and Scroll has been discontinued.

- Customers are getting prompt and personalized services from a single counter.

- Verification of signature is easy as the same is stored in the Computer.

Online and ATM Service

Times have changed and technological boom has given the businesses superlative edges over the manual and traditional functionalities of business operations. So the bank business in Bangladesh has overwhelmingly changed with the introduction of online banking in bank business. Janata Bank Limited has also stepped into the world of online banking and is rapidly progressing in implementation of online banking through Core Banking System (CBS). Up to January, 2015 total 174 branches out of 904 branches have been brought under CBS and as planned all the branches will be brought under this system by 2016. Introduction of CBS in 114 branches of the Bank has already had encouraging impact on its business and full implementation of it will definitely have tremendously positive impact on customer services and business growth.

Janata Bank Limited, first among the Nationalized Commercial Banks in Bangladesh, has introduced One Stop Service. To facilitate the foreign exchange service, Janata Bank has launched Janata bank first among the nationalized commercial bank, has introduce Janata bank Q-Cash ATM service system in its 25 branches. The bank charged 500 taka as annually fee.

Card holder can enjoy the facilities of all ATMs of Q-Cash Network member Banks and 2 Network Sharing Banks; BRAC Bank Limited and Dutch Bangla Bank Limited. The bank has taken a plan to launch shared ATM system in various important places.

Financing on Export

To boost up country’s Export, Janata Bank Limited has been providing different kinds of assistance to exporters. Some of which are as under:-

- Providing Pre-Shipment and Post-Shipment Finance, Export Guarantee and bonding facility etc.

- Concessional rate of interest for exports Finance.

- Export incentive Program.

- Banking at Export Processing Zone

- Scope for establishment of export oriented industry by 100% foreign investment and by joint-venture

- The sole bank to disburse Government Export Promotion Fund against export of Computer Software & Data Entry Processing

- Undergone to an agreement with Bangladesh Bank to obtain fund from Government EEF (Equity & Entrepreneurship Fund) to build up entrepreneur’s equity.

Facilitating Import

Through quite a good number of Authorized Dealer Branches and 1229 nos. foreign correspondents worldwide Janata Bank Limited has been extending full range import and relevant finance facilities.

- Opening of L/C at competitive/ reasonable margin and commission

- Interest at concession rate on import finance to the prime customers & interest rebate facilities.

Financing on SME’s

Janata Bank Limited has been financing Small and Medium Enterprises with a view to developing a balanced and dynamic industrial sector having a strong base of SMEs throughout the country. From the very inception of Industrial credit financing of Janata Bank (Currently Janata Bank Limited) SME division has sanctioned term loan in small and medium industries sector in 4535 projects of taka 941.36 cores. Among which taka 548.69 cores has been disbursed against 4310 projects. Outstanding as 31.12.2007 is taka 446.12 core and recovery of loan is 70%.

Foreign Remittance Service

Janata Bank Limited has a network of more than 906 domestic branches in Bangladesh covering whole of the country including the rural areas. Remittance services are available at all branches and foreign remittances may be sent to any branch by the remitters favoring their beneficiaries. Remittances are credited to the account of beneficiaries instantly or within shortest possible time. Janata Bank Limited has correspondent banking relationship with all major banks & exchange houses located in almost all the countries/cities. Expatriate Bangladeshis may send their hard earned foreign currencies through those banks & exchange houses or may contact any renowned banks nearby ( where they reside/work) to send their money to their dear ones in Bangladesh.

“To resolve the foreign remittance related problem/complain/enquiry, Janata Bank Limited has a ‘Complain cell’ at its Overseas Banking Division, Head Office, Dhaka. All Concerned are requested to contact at the following address to resolve any problem related to foreign Remittance.”

Facilities Offered To the Remitters

Commission for issuance of Taka Drafts from JBL UAE branches has been reduced and re fixed from AED 10.00 to AED 4.00 and commission for issuance of TTs drawn on Bangladesh and payable at any bank branches are re-fixed at AED 12.00 from AED 30.00. Commission for issuances of Taka drafts at UAE branches has been reduced irrespective of amount. 1% interest above the normal savings deposit rate is offered to SB accounts receiving foreign remittance.

SWOT analysis

Each and every organization should be aware of their strengths, weaknesses, opportunities and threats. This analysis is known as SWOT analysis. SWOT analysis explains environment of an organization in two broad ways. They are:

- Internal Environment Analysis: It includes strengths and weaknesses.

- External Environment Analysis: It includes opportunities and threats

The acronym for SWOT stands for

- STRENGTH

- WEAKNESS

- OPPURTUNITY

- THREAT

The SWOT analysis comprises of the organization’s internal strength and weaknesses and external opportunities and threats. SWOT analysis gives an organization an insight of what they can do in future and how they can compete with their existing competitors playing in the same field and also used in the strategic analysis of the organization.

STRENGTHS

- As a large bank, it has qualified and experienced manpower. Branch location is suitable for business.

- Bank’s assets position is quite satisfactory and now there is no fund crisis.

- Bank has requisite wealth to sustain in the various challenges of market economy

- Being a nationalized banking organization, it always gets government support in all of its operations.

WEAKNESS

- As many employers retired from the bank, there is a crisis for manpower in the bank. Bureaucrat official process hampered the daily internal workflow.

- Lack of motivation for the workers.

- Low salary structure for the employees.

- In some cases management-employee relation is not good.

OPPURTUNITIES

- Expansion of new investment areas.

- Scope for automation will open a big door of opportunity.

- In case of fund crisis Janata Bank gets government support. The bank undertakes need-based training program.

THREATS

- Newly developed privatized and foreign banks.

- Facing a great competition with other commercial banks and financial institutions. Loan recovery systems are very weak.

- Policies are not practiced properly.

Concluding Statements

Findings

Janata Bank has focused on enhancing the long term sustainability of the bank, building value for the shareholders, employees and the wider community. Its activities are driven by ethical business practices and sense of responsibilities to all stakeholders. Since the start of the global economic crisis, many felt that Bangladesh will not be adversely affected by the crisis. But now we can see that slowly and gradually we are also getting affected. Bangladesh is captive to what transpires in international market and economies of leading countries. Against the background Bangladesh cannot be immune from the global economic slowdown and is most likely to be affected sooner or later. The global financial crisis is likely to adversely affect principally in three sectors, namely exports, aid-flow and foreign direct investment.

During my report preparation I have gone through several departments of General Banking and detected some problems from my own practical experience as follows:

- The newly prescribed account opening form is very much informative. It takes about half an hour to properly fill in the form. When four or five people come at the same time to account opening purpose, it is very difficult for the relevant officer to provide satisfied service to the client.

- According to some clients, introducer is one of the problems to open an account. If a person who is new in the city wants to open account, it is a problem for him/her to arrange an introducer of SB or CD account holder.

- Lengthy process of issuing cheque book, Pay order, Bank draft cause. Job responsibilities are not specified to each and every employee of this division.

- Insufficient modern sophisticated technology change such as use of new software there are few staff who are lacking in computer knowledge and are not efficient chough to finish every task immediately. So, before utilizing new technology proper training should be arranged.

- Inadequate skilled manpower in Janata bank Ltd, because there is lack of proper training arrangement of employees in the general banking section. For example, most of the new recruited employees learn their job tasks by observing their senior employee.

- Some time the branch’s computers remain out of order and it is also true for the photocopiers.

- Insufficient forms and brochures will hamper customer service.

- Still heavily rely on traditional system specially in general banking department.

Recommendations

As per earnest observation some suggestions for the improvement of the situations are given below:

- The form should be precise with the quality information to the points of the client rather unnecessary or vague information. This can create the opportunity to serve more people in short time.

- If the interested clients have proper documentation in favor of his/her identity then there should be probation for avoiding introducer.

- Bank should formulate simple process for issuing cheque book, Pay order, and Bank draft.

- To hire and install sufficient modern sophisticated technology because of present market demand of the customer and the educated customers now want technology based banking but customs are confused about services.

- To recruit sufficient skilled manpower because the bank employees should communicate properly with customers about their deposit and other schemes.

- Low cost deposit should be increased by procuring more current account and savings account of the total deposit to reduce total cost of fund.

- Sufficient Forms and Brochures must be maintained in sufficient quantity.

- Ensure Proper Maintenance and cleanliness of Office Premises. Every branch is supposed to be very neat and clean and well decorated because it matters to attract customers.

- It is necessary to implement modern banking process instead of traditional system. It should be more computerized means dynamic.

- Branch should give requisition for new more printers and photocopy machines to improve their service.

- Ensuring transparency of its financial reports.

- Proper training should be given to all employees on regular basis to identify the suspicious transactions for Anti Money Laundering compliance policy.

Conclusion

Banks play a vital role in the economic development of the country. The popularity of banks is increasing day by day which leads to increase competition as well. All the public banks are offering almost the same products and services and almost same their operation system. Even, private banks too providing same services and products line. But the ways they provide the services are different from each other. So people choose their Bank according to their satisfaction and need. And they will prefer the bank of which service is easily accessible and understandable. One the other hand, Bank innovate new products and services to attract their desired customers. To conclude this report it can be said that it was a great opportunity to study the operational activities of JBL. Having passed three months in JBL Mirpu-10 Branch, I have learned many activities practiced in the bank. Since the working areas were in General banking the report may not cover all the practices of the branch. The work experience in JBL Mirpu-10 Branch was very interesting and this experience will help me in great deal in my future life. Janata Bank Limited also a pioneer in online customers services, foreign exchange and distinctive loan offerings among govt. banks. Without bank’s cooperation it is not possible to run any business or production activity in this age. The job environment is very good at JBL Mirpu- 10 Branch. At the same time the service which the bank provides to its customers are very prompt and quality ones compare to other private banks. In these ways JBL is helping in accumulating domestic savings, resource mobilization and creating job opportunities for many people which will gear up the economy as a whole.