Working capital turnover is a ratio that evaluates the extent of net deals to working capital, and it estimates how effectively a business transforms its functioning capital into expanded marketing projections. Also known as net sales to working capital, it analyzes the link between the funds necessary to finance a company’s operations and the revenues generated to keep operations going and turn a profit. A high working capital turnover ratio indicates that the company’s short-term assets and liabilities are being used effectively to support sales.

This ratio uncovers the association between cash used to fund business tasks and the incomes a business produces therefore. Notwithstanding, if working capital turnover ascends excessively high, it could propose that an organization needs to raise extra money to help future development. A low inventory to working capital turnover ratio indicates that the company is not making enough sales with the available working capital. Analysts compare working capital ratios to those of other firms in the same industry and look at how the ratio has changed over time to determine how efficient a company is at using its working capital.

A working capital turnover ratio is most generally used to decide an organization’s monetary exhibition and dissect its general activities. It can likewise be utilized to check whether an organization will actually want to take care of obligation in a set period and try not to run out of money because of expanded creation prerequisites. Two variables are required for this ratio: net sales and average working capital. The ratio can be expressed in cash or in time. When working capital is negative, however, such comparisons are pointless because the working capital turnover ratio is also negative.

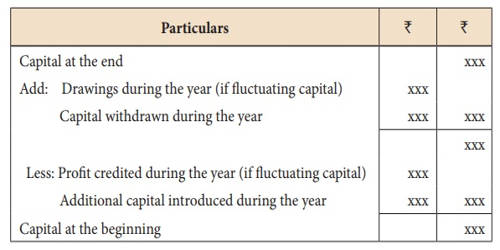

The formula for calculating working capital turnover ratio is:

Working capital turnover = Net annual sales / Working capital.

Working capital is computed by subtracting a company’s current liabilities from its current assets using this formula. It’s vital to remember that changes in liabilities or assets might have an impact on a company’s working capital turnover. Working capital management often entails tracking cash flow, current assets, and current liabilities by analyzing important operational expense ratios such as working capital turnover, collection ratio, and inventory turnover ratio.

Advantages of working capital turnover ratio –

There are several advantages to using a working capital turnover ratio in a corporation. The following are the most significant advantages of keeping track of an investor’s working capital turnover ratio:

- Guarantees liquidity – At the point when an organization doesn’t keep steady over its working capital turnover ratio, it might encounter lacking assets for everyday activities and transient obligations. Fusing working capital administration into our marketable strategy can help us stay mindful of the situation with our organization’s records payable, money due and obligation, and stock administration. This guarantees that we understand where our money is going and how to best distribute it for optimal efficiency and management.

- Increases overall financial health – In our business, using a working capital turnover ratio can help us better control our cash outflow and examine our cash inflow. Our company’s overall financial health can be improved by being able to efficiently determine how to use cash most profitably. It additionally assists with forestalling running out of working capital and accordingly going to outside sources and cause obligation. A generally higher working capital turnover ratio brings about a better yield on capital utilized, which can draw in financial backers and increment our organization’s shot at extending.

- Enhances a company’s value – A high working capital turnover ratio, like improved overall financial health, can boost a company’s overall worth within its industry. This will assist our company stands out among competitors, resulting in respect and value addition.

- Prevents operation interruptions – By providing managers with information that allows them to use cash most efficiently, staying aware of our company’s working capital turnover ratio can assist minimize any disruptions in day-to-day operations. Effectively utilizing working capital to keep up activities can lessen likely obstructions underway and stay with us as productive as could really be expected.

- Boosts profitability – Over time, managing our company’s working capital turnover may result in enhanced overall profitability. Our company can save money and use available cash more efficiently by decreasing or eliminating operation interruptions and maximizing how working capital is utilized.

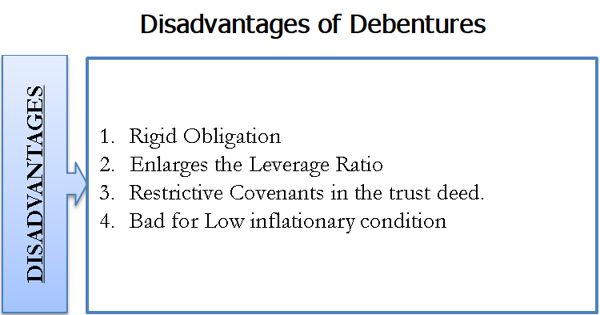

Disadvantages of working capital turnover ratio –

While there are various benefits to assessing an investor’s working capital turnover ratio, it’s crucial to remember that there are also some disadvantages. The following are some of the difficulties that business owners may face while employing working capital ratio turnover in their financial analysis:

- Only relies on monetary factors – A working capital turnover ratio just considers the money related parts of an organization. While money related components are unquestionably significant, non-financial impacts can likewise affect an organization’s monetary wellbeing. For example, the working capital turnover ratio calculation ignores disgruntled employees or economic downturns, both of which can have an impact on a company’s financial health.

- A high ratio can be negative – While having a high working capital turnover ratio may have all the earmarks of being something positive, this isn’t generally the situation. A high capital turnover might be a pointer that an organization needs more working cash-flow to keep up the business development it is encountering. If the company’s working capital to sales ratio is not adjusted, it may become insolvent in the future.

Working capital inventory ratios vary widely across industries and firms; consequently, compare a company’s working capital turnover ratio to the industry average or to its own historical statistics for comparative reasons. Financial insolvency can occur when a firm does not have adequate working capital to meet its obligations, resulting in legal issues, asset liquidation, and potential bankruptcy.

Information Sources: