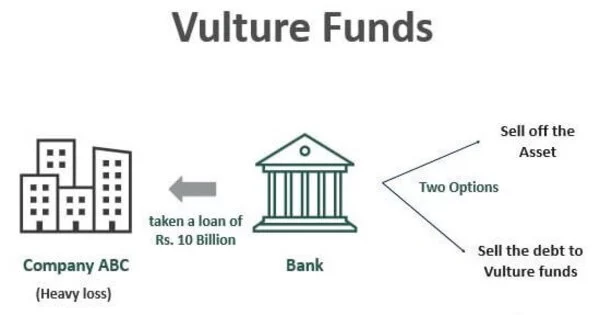

A vulture fund is a type of investment fund that invests in distressed debt, usually in the form of bonds or other debt securities, that are either in default or close to default. It is an investment fund that seeks out and purchases distressed securities, such as high-yield bonds in or near default or equities in or near bankruptcy.

Vulture funds are often characterized by their aggressive investment strategies and their willingness to buy debt at a steep discount, with the aim of profiting from the eventual recovery of the debt. The goal is to ‘swoop in’ and buy underpriced shares that are perceived to be oversold in order to make high-risk but potentially high-reward bets.

A vulture fund is a hedge fund, private equity fund, or distressed debt fund that invests in distressed securities, which are debt that is considered to be very weak or in default. Vulture funds often target debt issued by countries or companies that are experiencing financial difficulties, such as defaults or debt restructuring. Investors in the fund profit by purchasing debt at a discounted price on the secondary market and then selling the debt for a higher price than the purchase price. Debtors include corporations, governments, and individuals. They may also purchase debt from distressed investors or distressed debt funds that are looking to sell their positions.

Vulture funds are controversial because their investment strategies can sometimes be seen as predatory, taking advantage of vulnerable borrowers and communities. However, proponents argue that vulture funds play an important role in the global financial system by providing liquidity to distressed debt markets and encouraging lenders to be more responsible in their lending practices.

Vulture funds have successfully brought attachment and recovery actions against sovereign debtor governments, usually settling with them before realizing the attachments in forced sales. Settlements are typically made at a discount in hard or local currency or through the issuance of new debt. In one instance involving Peru, such a seizure threatened payments to other creditors of the sovereign obliger.

Due to the high default risks, portfolio managers seek deeply discounted investments with high potential rates of return. Fixed income instruments, such as high yield bonds and loans with fixed or variable interest rates, are generally the focus of investments. Often, the investments will be in distressed countries’ government debt, necessitating even more lobbying involvement in resolving unpaid debts.

A number of legacy cases involving hedge funds and sovereign debt highlight the processes and procedures that vulture funds must follow in order to receive payouts for assets invested.