A venture capital trust or “VCT” is a tax-efficient investment vehicle that provides resources to small, rising companies in the United Kingdom (UK). It is structured as a way for individual investors to gain access through capital markets to venture capital investments. VCTs are a type of traded on an open market private value, practically identical to venture confides in the UK or business advancement organizations in the United States. In comparison to private equity investing, where a majority stakeholder status is retained, VCTs tend to have a minority stake in the companies they invest in. The fund is managed by a specialized investment manager and the investors are mainly individuals. Various venture capital trusts are recorded on the London Stock Exchange (LSE), which puts resources into organizations that may not be recorded on the trade itself.

Prospective investors should be mindful that the value of shares and their earnings will fluctuate and that the sum they have invested may not be returned. Also, there is no conviction that the market cost of a VCT’s offers will completely mirror the basic net resource estimation of the VCT being referred to, that investors will have the option to understand their shareholding, or that profits will be paid. VCT managers have three years to choose businesses to invest in and often put the capital in cash or cash equivalents, gilts or bonds, or, in some cases, unit trusts/OEICs to try to maximize the return of investors during this period.

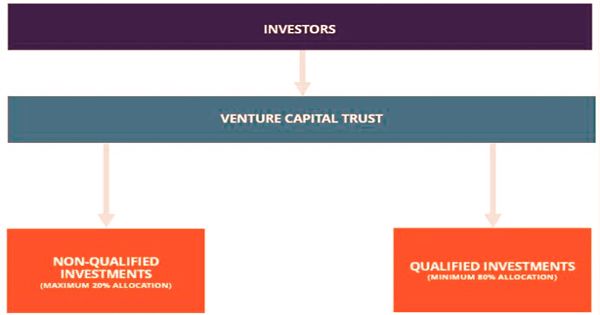

(Venture capital trust structure)

Venture capital trusts (VCTs) were first presented in 1995 by the UK government to support interest in new nearby organizations. VCTs are a famous vehicle for speculators trying to put resources into an expanded arrangement of funding ventures. These portfolios give investors access to investments in the private sector and also give them a minority interest in start-ups. Like business improvement organizations in the United States, venture capital trusts are a type of trading on an open market private value reserves. Speculators can buy units of the asset straightforwardly in an essential issue or the auxiliary market by means of the London Stock Exchange.

The U.K. shares In order to provide tax performance, venture capital trusts are specially designed. Shares may be acquired in a new bid directly from the fund manager or actively traded on a secondary market with various London Stock Exchange listings. These shares offer the potential for exceptional yields through an interest in high-development privately owned businesses. Interest in a VCT should be viewed as a drawn-out speculation. Speculators who are in uncertainty ought to counsel their free monetary consultant. VCTs can typically be categorized according to the requirements below:

- Generalist, AIM, or Specialist: A VCT generalist mainly invests in unquoted companies from a range of industries; a VCT specialist focuses on a single industry or field, such as healthcare or technology. Puts primarily in organizations recorded on the AIM trade. It can have a trained professional or generalist approach.

- Evergreen or Limited Life: VCTs set up to invest forever can be referred to as evergreen. A minimal holding period of at least five years is set for a limited-life VCT, at which stage the wind-down process begins and the manager allocates capital back to the investors.

Venture capital trusts are restricted by certain guidelines that oversee the level of asset assignments. Guidelines necessitate that 70% of speculations should be apportioned to qualifying ventures inside three years. Additionally, government securities, gilts, or blue-chip shares can be reserved for 30 percent of the assets. In a UK-based company that is either privately held or listed on the alternative investment exchange, an eligible investment entails taking a debt or equity role (a sub-market of the London Stock Exchange focused on smaller, less developed companies). Unlike other private equity firms, VCTs invest only in corporations’ minority shares.

The tax/duty rules or their translation comparable to an interest in a VCT as well as the paces of assessment, or other legal arrangements to which a VCT is subject, may change during the life of a VCT and such changes could be reviewed. For speculators who buy portions of the VCT in the optional market (by means of a trade), the accompanying tax reductions apply:

- Income tax exemption on VCT share dividends

- Capital gains tax exemption on disposal of the shares

Even if a VCT may obtain traditional venture capital rights in connection with some of its investments, it may not be in a position to completely defend its interests as a minority investor. The tax relief is conditional upon the investor owning five years of shares. Since shares bought in the auxiliary market don’t consider this extra advantage, they frequently exchange at a markdown to mirror this diminished appropriation. There can be no assurance that sufficient appropriate investment opportunities will be found to fulfill the investment goals of the criteria of a VCT or venture capital trust.

Information Sources: