Executive Summary

Proximity of practical scenario is a must to make theoretical concept and learning fruitful. Practical orientation is an exciting to be well conversant with practical banking.

During the practical orientation period we work almost every department of Islami Bank Bangladesh Limited in Krishi Market Branch. This bank providing the general banking, credit, export, import services based on Islamic Shariah. This report comprised introduction, historical background, credit appraisal policies, procedure, and comparison of standard to existing appraisal process. One of vital department is introduction which comprises the general and specific objectives, scopes, methodology, limitations. The influential one is historical background which keeps a key role to organization, structure, management practices. Credit appraisal process comprises the standard policies, procedures, existing policies, existing procedures, comparison between standard and existing. Lastly this report includes findings, recommendation and conclusion.

All those based on the financial statements of Islami Bank Bangladesh Limited, data given by credit officials, books, articles and internet. We try to show the General Banking, Investment, Foreign Exchange of Islami Bank Bangladesh Limited.

INTRODUCTION

Origin of the report

This report is originated as the course requirement of BBA program, Department of Accounting of Stamford UniversityBangladesh. As practical orientation is integral part of BBA program requirement, I was sent to the Islami Bank Bangladesh Limited, At first I report to IBTRA (Islami Bank Training and Research Academy) for internship training on Islamic Banking System from January 27, 2011 to March 31, 2011, then they send me to take the real life exposure of the activities of banking financial institutions at Krishi Market Branch from 1.2.2011 to 31.3.2011. After that I submitted a report and presentation in IBTRA.

Background of the study

Any academic course of the study has a great value when it has practical application in the real life. Only a lot of theoretical knowledge will be little important unless it is applicable in the practical life. So we need proper application of our knowledge to get some benefit from our theoretical knowledge to make it more fruitful when we engage ourselves in such field to make proper use of our theoretical knowledge in our practical life, only then we come to know about the benefit of the theoretical knowledge. Such an application is made possible through internship. When theoretical knowledge is obtained from a course of study it is only the half way of the subject matter. Internship implies the full application of the methods and procedures through rich acquired knowledge of subject matter can be fruitfully applied in our daily life. Such a procedure of practical application is known as internship. The case study is titled “General Banking Operation of IBBL”. As a student of BBA this study will be more significant in my practical life. I have worked for two months at Krishi Market Branch of Islami Bank Bangladesh Limited to complete the internship program as an academic requirement.

Objective of the report

Objective of the study acts as a bridge between the starting point and the goals of the study. To illustrate the objectives properly, presented into two parts:

- General objective of the report :

The general objective of the report is to complete the internship. As per requirement of BBA program, a student need to work in a business organization for two months to acquire practical knowledge about real business operations of a company.

- Specific objective of the report :

- To observe the General Banking operation as an Islamic bank.

- To recommend solutions of or solving the problems faced by IBBL in operating as an Islamic Bank.

Scope of the report

This report will cover an organizational overview of Islami Bank Bangladesh Limited. It will give a wide view of the different stages of operational procedure of Islami Bank Bangladesh Limited, starting from the investment application to investment disbursement and the comparison between standard and existing credit appraisal system of a Bank. Then the report covers Foreign exchange operation and General Banking as an Islamic Bank.

Methodology

I have designed this paper as an expletory research paper. Here I have discussed the overall activity of Islami Bank Bangladesh as an Islamic Bank. I discussed the investment policy and disbursement procedure and foreign exchange operation and general banking as an Islamic bank which activities are based on Islamic Shoriah.

Limitations of the study

Under this study have some limitation which are given below:

1. Lack of sophisticated Knowledge: As a student in research field, I have no experience in data collection, processing, analyzing, interpreting and presenting.

2. Time lacks: There have no available time on my hand to properly complete this study program. So I cannot able to conduct with all function within available time.

3. Unavailability and inefficiency to interpret secondary data: From the secondary sources I have not get available relevant data. Moreover, I have no proper knowledge that to collect secondary data.

4. Every Company or Bank has some common strategy of secrecy. They didn’t want to provide available data, information, which are harmful for them. So I didn’t get sometimes essential data.

5. The employees were always busy on there tremendous workload. So they couldn’t extend there cooperation properly.

6. Finally 2 month is too short to know about the whole Banking system.

3. Historical background of islamic bank

The history of Islamic Banking could be dividing in two parts. First: When it still remained an idea, second: When it become a reality –by private initiative in some countries and by law in others. There has always been a desire to establish financial institutions to operate as per the tents of Islamic Shariah. The first attempt in this regard was made in Pakistan during 1950s as a pilot scheme, but unfortunately it didn’t succeed. It was followed by a more successful venture in the form of a local Bank in Egypt (Myt Gant Savings Bank, July, 1963). In 1969 Islamic Bank was got up Malaysia through passing an Act in parliament which is being conducted successfully today. In 1970, King Faisal, The Government of K.S.A, called a meeting to moderate the banking of Muslim countries in accordance with the loss of Islamic Shariah. In the light of this purpose, on 18th December 1973 the decision of setting up an international Islamic Bank was taken up in the finance ministry of O.I.C, which starts its work on 20th October 1975 in Jeddah. In 1977, Faisal Islamic bank in Sudan, Kuwait Finance Bank House in Kuwait, Faisal Islamic bank in Egypt and Jordan Islamic Bank in 1978 was founded. In 1977, International Association of Islamic bank was founded to create equality among the Islamic Banks of different countries.

Islamic Bank Bangladesh Limited was incorporated on 13.03.1983 as a public Company with Limited liability under the companies Act, 1913. The Bank obtained permission to commence business from 27.03.1983. Islamic Bank Ltd. Is the first interest free Bank in South-East Asia. The establishment of this Bank has ushered a new era in Bangladesh, the second largest Muslim country in the world. The bank is committed to help the people in Halal earnings and Halal investment. All of its activities are run as per Islamic Shariah. The Islamic Development Bank, some foreign financial institutions of Saudi Arabia, Kuwait, Bahrain, United Arab Emirate and Jordan also came forward to establish this bank.

The total number of branches of the bank as on 31st December 1988 stood at 27. The Bank has taken up an optimality expansion program to open a large number of branches during the year 1989 in urban and rural areas and it is expected that with the implementation of the expansion program almost all important commercial places will come under the operational activities of the Bank.

Mission of Islami Bank Bangladesh Limited

To establish Islamic Banking through the introduction of welfare oriented banking and also ensure equity and justice in the field of all economic activities, achieve balanced growth and equitable development through diversified investment operations particularly in the priority sectors and less development areas of the country, To encourage social-economic enlistment and financial services to the low-income community particularly in the rural area.

Islami Bank Bangladesh Limited has huge and vast mission and objective.

To conduct interest free banking.

Ensure equity and justice in the field of all economic activities.

To establish participatory banking instead of banking on debtor creditor relationship.

To establish a welfare-oriented banking system.

Vision of Islami Bank Bangladesh Limited

Vision of the organization is to always strive to achieve superior financial performance, be considered a leading Islamic Bank by reputation and performance.

Islamic bank vision to always strive to achieve superior financial performance is considered a leading Islamic bank reputation and performance. To establish and maintain the modern banking technology, to ensure the soundness and development of the financial system based on Islamic principles and to become the strong and efficient organization with highly motivated professional, working for the benefit of people, based upon accountability, transparency and integrity in order to ensure the stability of financial system.

Management of IBBL

Islami bank Bangladesh ltd. is being managed by a board of directors comprising foreigners and local. An executive committee is formed by the Board of Directors for efficient and smooth operation of the bank. Besides, a management committee looks after the affairs of the bank. The management and formulation of policy of the bank are vested in the board of directors, which is comprised of 14 local and 9 foreign directors by virtue of articles of association, A Bangladeshi director is to be elected as the chairman of the company. To assist them there is a high powered committee named exclusive committee. There are six members in this committee nominated by the board of directors. Besides, these are another committee named management committee consisting of senior most executives of the Bank. There is also a Shariah council consisting of prominent Alims, Economists and Banker who acts as a supervisory body over the day to day activities of the bank from the point of view of Islamic Shariah.

Capital and reserve of IBBL

The authorized capital of the bank is TK. 1000 cores divided into 100000000 ordinary shares of Tk. 100/ each. The reserve fund has increased during the year from 80 cores to Tk. 1.43 core. Total equity of IBBL is Tk. 17,932.00 million as on 30.09.08. Paid up capital of IBBL is Tk. 475.20 core (local shareholders 42.64% and foreign shareholders 57.36%).In order to strengthen the equity base of the bank commiserating with the deposit liability, the Board of directors very recently has decided to raise the paid-up capital to TK.20 core in two phases- primarily up to TK.15 core and ultimately to TK. 20 core preparation in this regard are in foot and it is expected that shares of public subscription shall be floated by June, 1989.

Objectives of IBBL

The objective of Islamic Banking is not only to earn profit but to do good and bring welfare to the people. Islam upholds the concept that money, income and property belongs to Allah and this wealth is to be used for the goods of the society. The main object of the Islami Bank Bangladesh Limited (IBBL) had been to offer an interest free banking system in the financial market. Apart from that, the bank started its operation in the country with a view to realizing the following objectives.

- To offer interest-free banking system in the financial market.

- To establish a partnership relationship with customers and to eliminate the idea of the debtor-creditor relationship of traditional banks.

- To establish welfare oriented banking system.

- To utilize mobilize savings towards productive sectors.

- To investment on profit and risk sharing basis.

- To invest to those business sectors those are found acceptable from Shariah point of view.

- To accept deposits on profit and loss sharing basis.

- To create employment opportunities by investing savings towards prospective economic sectors.

- To extend banking services towards the poor, helpless and low-income group of people in the society in order to uplift of their standard of living.

- To contribute to establishment of a society by equitable distribution of wealth.

- To establish justice in trade and commerce in the country.

- To develop morals among the people and to establish the shariah in the field of trade and commerce.

- To render services for the economic development of the nation.

- To contribute towards establishment of an Islamic Economic System in the Country.

Functions of IBBL

Islamic banks render almost similar services to their customers conventional banks do. However, differences exist in administering incentives for deposits and charging for capital investments, in so far as techniques of calculating the incentive or the cost of the capital is concerned.[1] Like a conventional bank, the Islami bank also accepts deposits from customers and advances investment. The bank invests its funds for short as well as long term deposits. The Islami bank also acts as a custodian of its customers and performs all foreign transactions on behalf of them. The IBBL perform mainly three different types of functions Banking services, Investment, and Foreign exchange services Banking services comprise three regular types of operations related to acceptance of deposits in the different customers accounts as mentioned earlier, as well as, different transactional services to the customers, safekeeping of personal valuables and securities, collection of bills, agency services, etc. The bank lends its funds for the rapid growth and development of industrial sectors and the promotion of trade and commerce in the country. The bank also invests its funds in various socio-economic schemes such as, Rural Investment Scheme, Small Traders Investment Scheme, Doctors Investment Scheme, Small Transport Scheme, Small and Cottage Industry Project, Hawker’s Investment Scheme, Household Durable Scheme and Low Cost Housing Scheme. The third important function of the bank is to render services to customers regarding foreign exchange transactions plus services to its customers for import and export of different industrial, commercial, agricultural and other items.

Deposits products

Islami Bank Bangladesh Ltd gives special importance on savings. The bank mobilizes deposits through the operation of following account.

| Islami Bank’s Product

|

Deposit schemes

|

| Al-Wadeeah Current Account |

| Mudaraba Savings Account |

| Mudaraba Term Deposit Receipt |

| Mudaraba Special Notice Account |

| Mudaraba Special Savings (Pension) Account |

| Mudaraba Hajj Savings Account |

| Mudaraba Savings Bond Scheme |

| Mudaraba Foreign Currency Deposit Scheme (Savings) |

| Mudaraba Waqf Cash Deposit Account |

| Mudaraba Monthly Profit Deposit Scheme |

| Mudaraba Muhor Savings Deposit Scheme |

Current account is operated on Al-wadeah principle and all other deposit accounts on mudaraba principle of Islamic Shariah. The bank distributes minimum 65% of its investment income earned through deployment of Mudaraba deposits among the Mudaraba depositors.

Weight ages of different Mudaraba accounts

Weight age means preference of one product in comparison to other product. It has giving the value or importance to the particular mater higher or less than that of other matter. Contact ratios is 65:35 i.e. depositors=65%, management fees= 20% & reserve fund for off-setting investment loss= 15%.

| SL No | Particulars of Deposits | Provisional Rate from 01.05.2009 to 31.07.2009 | Revised Provisional Rate w.e.f. 01.08.2009 | Revised Provisional Rate w.e.f. 01.09.2009 |

| 1 | Mudaraba Hajj Savings | |||

| From 11 years to 25 years Term | 9.50 % | 9.40 % | 8.50 % | |

| From 1 year to 10 years Term | 8.50 % | 8.40 % | 8.20 % | |

| 2 | Mudaraba Waqf Cash Deposit Account (MWCDA) | 9.50 % | 9.40 % | 8.50 % |

| 3 | Mudaraba Special Savings (Pension) | |||

| 10 Years Term | 9.00% | 8.90% | 8.20% | |

| 5 Years Term | 8.00% | 7.90% | 6.90% | |

| 4 | Mudaraba Muhor Savings Account | |||

| 10 Years Term | 8.00% | 7.90% | 8.20% | |

| 5 Years Term | 7.00% | 6.90% | 6.90% | |

| 5 | Mudaraba Savings Bond (MSB) | |||

| 8 Years Term | 9.00% | 8.90% | 8.00% | |

| 5 Years Term | 8.00% | 7.90% | 6.90% | |

| 6 | Mudaraba Monthly Profit Deposit Scheme (MMPDS) | |||

| 5 Years Term | 9.50% | 9.40% | 7.50% | |

| 3 Years Term | 8.50% | 8.40% | 6.50% | |

| 7 | Mudaraba Term Deposits | |||

| 36 Months | 9.50% | 9.40% | 8.00% | |

| 24 Months | 8.50% | 8.40% | 7.00% | |

| 12 Months | 7.50% | 7.40% | 6.00% | |

| 6 Months | 7.00% | 6.90% | 5.50% | |

| 3 Months | 6.50% | 6.40% | 5.00% | |

| 8 | Mudaraba Savings Account | |||

| For Customers | 5.50% | 5.40% | 4.50% | |

| For Banks | 2.00% | |||

| 9 | Mudaraba Special Notice Deposit | |||

| For Customers | 4.00% | 3.90% | 3.00% | |

| For Banks | 1.50% |

Updated on: 10th Sep 2010

Islami Bank Bangladesh Limited at a glance

Corporate Information

(As on June 30, 2010)

| Date of Incorporation | 13th March 1983 |

| Inauguration of 1st Branch (Local office, Dhaka) | 30th March 1983 |

| Formal Inauguration | 12th August 1983 |

| Share of Capital | |

| Local Shareholders | 41.77% |

| Foreign Shareholders | 58.23% |

| Authorized Capital | Tk. 10,000.00 million |

| Paid-up Capital | Tk. 7,413.00 million |

| Deposits | Tk. 265,193.00 million |

| Investment (including Investment in Shares) | Tk. 255,178.00 million |

| Foreign Exchange Business | Tk. 277,739.00 million |

| Branches | |

| Total number of Branches | 244 |

| -Regular Branches | 224 |

| -SME Service Centers | 20 |

| Number of AD Branches | 43 |

| Number of Shareholders | 52164 |

| Manpower | 9588 |

Some extra ordinary features of Islami Bank Bangladesh Limited

It is a first interest free commercial Bank based on Shariah in South-East Asia.

Pioneer of welfare banking. [2]

- It is a Multi-national Bank. The partnership of this Bank belongs to IDB, The Al-Rezi of Saudi Arabia and many socio economic Government and non Government institution of Middle East.

- It possesses the top level among the banks, which conduct foreign trade.

- It is proclaimed VIP standard because of paying more tax by the Government.

- It has been awarded the best bank of Bangladesh in 1999 and 2000 by the famous magazine of U.K “Global Finance”.

- It is one of the top banks among the 2000 international Bank.

- It is one of the best banks among the five hundred Asian banks.

- It is one of the top Banks in the rating of CAMEL.

- It is using computer swift, web site, e-mail, and other sophisticated modern technology.

- It has arranged to start ATM in the selected branch very soon.

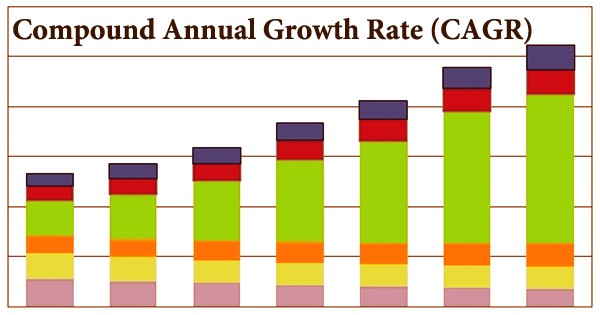

Total equity position

Particulars | 2006 | 2007 | 2008 | 2009 | 2010 |

Total Equity | 6,691.12 | 8,331.14 | 10,435.96 | 14,957.74 | 18,572.00 |

Analysis: Total equity position of the IBBL bank is good enough. From 2004 to 2005 it is an increasing trend. It indicates that bank uses more equity to meet the business needs which implies that shareholders provide more attention to improve the bank size.

Paid-up capital and reserve:

The Authorized Capital of the Bank is Taka 5000.00 million and Paid-up capital is Taka 3,456.00 million in 2006. The Paid-up Capital was Taka 67.50 million in 1983.

The Reserve Fund of the Bank has been increasing steadily. On 31st December 1983, it was Taka 0.36 million and stood at

| Taka 9642.64 million as on 31st December 2009. |

| Taka 8453.92 million as on 31st December 2008. |

| Taka 7624.85 million as on 31st December 2007. |

| Taka 6551.23 million as on 31st December 2006. |

| Taka 5450.94 million as on 31st December 2005. |

| Taka 4329.92 million as on 31st December 2004. |

| Taka 3280.80 million as on 31st December 2003. |

| Taka 23852.07 million as on 31st December 2002. |

| Taka 1998.04 million as on 31st December 2001. |

| Taka 1759.65 million as on 31st December 2000. |

| Taka 1115.61 million as on 31st December 1999. |

| Taka 1011.84 million as on 31st December 1998. |

| Taka 930.17 million as on 31st December 1997. |

| Taka 759.39 million as on 31st December 1996. |

| Taka 535.08 million as on 31st December 1995. |

| Taka 303.57 million as on 31st December 1994. |

Map of Bangladesh showing the branch of IBBL

Performance (Amount in Million Taka)

| Particulars | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Authorized Capital | 3,000.00 | 3,000.00 | 5,000.00 | 5,000.00 | 5,000.00 | 10,000.00 |

| Paid-up Capital | 1,920.00 | 2,304.00 | 2,764.80 | 3,456.00 | 3,801.60 | 4,752.00 |

| Reserves Fund | 3,280.37 | 4,329.92 | 5,450.94 | 6,551.23 | 7,418.04 | 9,308.00 |

| Total Equity | 5,266.47 | 6,691.12 | 8,331.14 | 10,435.96 | 14,957.74 | 18,572.00 |

| Total Deposits (Including bills payable) Gross | 70,552.65 | 88,452.18 | 108,261 | 132,814.00 | 166,812.78 | 200,725.00 |

| Total Investments (Including Inv in Share) Gross | 62,755.90 | 83,893.63 | 102,145 | 123,959.00 | 174,365.55 | 198,763.00 |

| Import Business | 46,237.00 | 59,804.00 | 74,525.00 | 96,870.00 | 137,086.00 | 168,329.00 |

| Export Business | 21,738.00 | 29,151.00 | 36,169.00 | 51,133.00 | 66,690.00 | 93,962.00 |

| Remittance | 16,668.00 | 23,669.00 | 36,948.00 | 53,819.00 | 84,143.00 | 140,404.00 |

| Total Foreign Exchange Business | 84,643.00 | 112,624.00 | 147,642.00 | 201,822.00 | 287,919.00 | 402,695.00 |

| Total Income | 6,710.44 | 8,262.73 | 10,586.78 | 14,038.30 | 17,699.51 | 23,454.00 |

| Total Expenditure | 5,908.42 | 6,419.74 | 8,424.36 | 11,129.63 | 13,918.70 | 15,151.00 |

| Net Profit before Tax | 802.02 | 1,842.99 | 2,162.42 | 2,908.67 | 3,780.82 | 6.348.00 |

| Payment to Government (Income Tax) | 426.61 | 829.35 | 973.09 | 1,490.12 | 2,322.46 | 3,647.00 |

| Dividend | 20% (Stock) | 20%(Stock) | 25% (Stock) | 15% (Cash) 10%(Stock) | 25%(Stock) | 30%(Stock) |

| Total Assets (including Contra) | 98,046.85 | 125,776.94 | 150,959.66 | 188,115.27 | 250,012.79 | 288,017.19 |

| Total Assets (Excluding Contra) | 81,704.75 | 102,149.28 | 122,880.35 | 150,252.82 | 191,362.35 | 230,879.14 |

| Fixed Assets | 2,036.66 | 2,552.70 | 3,067.99 | 3,724.69 | 3,987.23 | 4,407.00 |

| No. of deposit account holder | 1,994,266 | 2,291,269 | 2,705,180 | 3,207,131 | 3,802,709 | 4,361,896 |

| No. of investment account holder | 223,954 | 264,863 | 297,943 | 421,751 | 508,758 | 498,362 |

| Cumulative amount of disbursement from RDS | 2,923.60 | 4,216.77 | 6,033.36 | 9,303.12 | 13,969.01 | 18,768 |

| Outstanding Investment of RDS | 570.90 | 789.97 | 1,106.00 | 2,242.00 | 2,885.00 | 3,012 |

| RDS no. of A / C holder | 130,465 | 163,465 | 164,116 | 295,012 | 350,278 | 321,484 |

| RDS no. of village | 3,700 | 4,230 | 4,560 | 8,057 | 10,023 | 10,763 |

| Number of Foreign Correspondents | 840 | 850 | 860 | 870 | 884 | 906 |

| Number of Shareholders | 14,196 | 15,892 | 17,201 | 20,960 | 26,488 | 33,686 |

| Number of Employees | 4,673 | 5,306 | 6,202 | 7,459 | 8,426 | 9,397 |

| Number of Branches | 141 | 151 | 169 | 176 | 186 | 196 |

| Book value per Share ( Taka) | 2,743 | 2,904 | 3,013 | 3,020 | 4,147 | 238 |

| Earnings per Share (Taka) | 195.52 | 518.59 | 487.57 | 368.42 | 375.46 | 56.29 |

| Market Value per Share (Taka) (Highest) | 4,548.00 | 5,110.00 | 5,580.00 | 4,749.00 | 6,986.00 | 830 |

| Capital Adequacy Ratio | 9.43% | 9.21% | 9.44% | 9.43% | 10.61% | 10.72% |

(Note: One Million = Ten Lac)

Performance at a glance (Taka in Million)

Particulars | 2005 | 2006 | 2007 | 2008 | 2009 |

| Income Statement | |||||

| Interest Income | 1620 | 2159 | 2641 | 3446 | 5199 |

| Interest Expense | 1055 | 1408 | 1616 | 2271 | 3698 |

| Net Interest Income | 565 | 751 | 1025 | 1175 | 1500 |

| Non-interest Income | 631 | 841 | 946 | 1232 | 1732 |

| Non-interest Expense | 448 | 591 | 824 | 886 | 1101 |

| Net Non-interest Income | 183 | 250 | 121 | 346 | 631 |

| Profit before provision and tax | 748 | 1001 | 1146 | 1520 | 2131 |

| Provision for loans and assets | 51 | 232 | 82 | 320 | 390 |

| Profit after provision before tax | 697 | 770 | 1064 | 1201 | 1741 |

| Tax including deferred tax | 279 | 394 | 452 | 633 | 689 |

| Profit after tax | 418 | 375 | 612 | 568 | 105 |

| Balance Sheet | |||||

| Authorized Capital | 1000 | 1000 | 1000 | 4000 | 4000 |

| Paid-up Capital | 600 | 700 | 1000 | 1400 | 1750 |

| Total Shareholder’s equity | 1526 | 1732 | 2240 | 2808 | 3860 |

| Deposits | 16482 | 20483 | 28069 | 36022 | 54724 |

| Long-term liabilities | 5350 | 7052 | 7371 | 11406 | 16877 |

| Loans and advances | 12687 | 16492 | 23220 | 31916 | 45010 |

| Investments | 1996 | 2750 | 3084 | 3940 | 7844 |

| Property, Plant and Equipment | 219 | 256 | 322 | 372 | 412 |

| Earning Assets | 15125 | 19335 | 27131 | 36727 | 55458 |

| Net current assets | 437 | 583 | (1299) | 31 | 5286 |

| Total assets | 19359 | 24249 | 32362 | 41506 | 60899 |

| Current ratio | 1.00 | 0.96 | 1.06 | 1.00 | 0.88 |

| Debt equity ratio | 8.56% | 8% | 7% | 7% | 7% |

| Other Business | |||||

| Import | 19564 | 25441 | 36747 | 40303 | 52639 |

| Export | 12190 | 16490 | 19502 | 28882 | 41801 |

| Remittance | 1252 | 3063 | 2140 | 3688 | 15050 |

| Guarantee Business | 3659 | 4248 | 4085 | 5303 | 5386 |

| Inland letter of credit | 1523 | 3729 | 4267 | 5405 | 10174 |

| Capital Measures | |||||

| Total risk weighted assets | 13389 | 16455 | 23050 | 31890 | 44324 |

| Core capital (Tier-I) | 1526 | 1782 | 2240 | 2808 | 3860 |

| Supplementary capital (Tier-II) | 139 | 176 | 236 | 369 | 549 |

| Total Capital | 1665 | 1958 | 2476 | 3177 | 4409 |

| Tier-I capital ratio | 11.409 | 10.83 | 9.72 | 8.80 | 8.71 |

| Tier-II capital ratio | 1.04 | 1.07% | 1.02 | 1.16 | 1.24 |

| Total capital ratio | 12.44 | 11.90% | 10.74 | 9.96 | 9.95 |

| Credit Quality | |||||

| Nonperforming loans (NPLs) | 188.22 | 326.53 | 352.73 | 308.21 | 367.15 |

| % of NPLs to total loans and advances | 1.48% | 1.98% | 1.52% | 0.96% | 0.82% |

| Provision for unclassified loans | 131.73 | 171.73% | 231.73 | 364.80 | 544.80 |

| Provision for classified loans | 122.81 | 249.44 | 174 | 127.00 | 308.52 |

| Share Information | |||||

| Market price per share (Taka) | 307.51 | 374.25 | 879.50 | 681.50 | 528.75 |

| No. of shares outstanding (million) | 6 | 7 | 10 | 14 | 17.50 |

| No. of shareholders at actual | 1727 | 1993 | 2620 | 4467 | 5262 |

| Earning per share (Taka) | 59.73 | 37.55 | 43.71 | 40.59 | 60.11 |

| Dividend | 36.67% | 62.86% | 40.00% | 25.00 | 30%(proposed) |

| Cash | 20% | 20.00% | – | – | – |

| Bonus | 16.37% | 42.86% | 40.00% | 25.00% | 30% |

| Effective dividend ratio | 40% | 67.70% | 47.06% | 29.17% | 33% |

| Market capitalization | 1845.06 | 2619.75 | 8795.00 | 9541.00 | 9253.13 |

| Net assets per share (Taka) | 234.81 | 233.12 | 223.98 | 200.57 | 220.57% |

| Price earning ratio (times) | 5.15 | 9.97 | 20.12 | 16.79 | 8.80% |

| Operating Performance Ratio | |||||

| Net interest margin on average earning assets | 4.26% | 4.36% | 4.41% | 3.68% | 3.23% |

| Net non-interest margin on average earning assets | 1.38% | 1.45% | 0.52% | 1.08% | 1.37% |

| Earning base in assets (average) | 75.53% | 79.02% | 82.08% | 86.45% | 90.02% |

| Cost income raito | 37.48% | 37.11% | 41.83% | 36.82% | 34.07% |

| Cost deposit raito | 76.98% | 80.52% | 80.72% | 88.60% | 82.25% |

| Cost of funds on average deposits | 7.13% | 7.62% | 6.66% | 7.09% | 8.15% |

| Return on average assets | 2.38% | 1.72% | 2.16% | 1.54% | 20.5% |

| Return on average equity | 30.03% | 22.70% | 30.43% | 22.51% | 31.55% |

| Other information | |||||

| No of Branches | 27 | 30 | 36 | 41 | 50 |

| No of employees | 730 | 777 | 894 | 1024 | 1172 |

| No of foreign correspondents | 422 | 441 | 501 | 517 | 528 |

| Average earning assets | 13254.64 | 17230.13 | 23233.08 | 31929.08 | 46092.85 |

| Average total assets | 17547.94 | 21804.03 | 28305.38 | 36933.96 | 51202.88 |

| Average deposits | 14795.74 | 18482.42 | 24276.24 | 32045.85 | 45373.27 |

| Average equity | 1392.34 | 1654.14 | 2010.83 | 2523.90 | 3333.94 |

GENERAL BANKING OPERATING OF IBBL

Types of accounts in IBBL

A bank is essentially an intermediary of short-term investment/fund. It cans carryout extensive lending / investment operations only when it can effectively mobilizes the saving of the community. A good bank is on who effectively mobilizes the saving of the community as well as makes such use of savings by making it available to productive and priority sector of the economy thereby fostering the growth and development of the nation’s economy.

Accounts are open under the following two models:

Al – Wadeeah (Current Account)

Al – Mudarabah (Deposit Account)

1. Al –Wadeeah (Current account):

The word ‘AL –Wadeeah’ has been derive from the Arabic word ‘ Wadeeah which means to keep/ to deposit / to give up/ Amanat. As per shariah , Amanat means to keep something (goods/money/others) to any reliable person / intuition for safe and secured preservation of the same keeping its ownership unchanged and which will be returned to the owners of the fund on demand as it is /in original shape. In case of Amanat Bank/ any other institution can not use, invest and amalgamate the funds without the prior permission of the owner of the Amanat.

The depositor can deposit any amount in this account

The deposit can withdraw any amount by cheque

No profit is allowed in this account

The depositor shall also no bear any loss

Cheques, bills etc collected in this account against commission

Govt. excise and incidental charge realize from this A/C as per rule

2. Al – Mudaraba (Deposit account):

The word Mudaraba derive from the Arabic word ‘Darb/ Darabun, Literally it means movement to earn profit (munafa). It is a form of partnership where one of the parties called the ‘ Shahib Al – Mal’ provide a specified amount of capital and acts like a sleeping or dormant partner, while the other party called the Mudarib (entrepreneur), provide the entrepreneurship and management for caring on any venture , trade, industry or service with the objective the earning profit. The Mudarib is required to work with honesty and sincerity and to exert the maximum possible care and precaution in the exercise of the function.

Mudaraba Deposit Product

Short notice Account

Saving Account

Term Deposit Account

Special saving (pension)

Monthly profit deposit

Muhor Saving

Waqf Cash

Hajj Saving

Foreign currency Deposit

Special saving (pension)

Islami Bank Bangladesh Limited, in keeping with its welfare-oriented ideals based on Shariah Principles, has developed a deposit pension scheme named “Mudaraba Special Savings (Pension) Scheme”, in order to mobilize and encourage the middle and lower middle class professional and service holders to save as per their capacity for their old age when they will normally retire from their active service life who otherwise do not like to keep and invest their savings and funds in interest bearing deposit pension schemes. Due to lack of or limited scope for savings and investment in non-interest bearing schemes, most of these individuals either consume their savings/funds or spend the same unproductive expenditures. Thus a substantial amount of Savings/funds remain out of the production cycle.

The savings/funds of these people can play a vital role in capital formation and as a source of invisible fund for generation of income and increase of wealth of the individuals and of the nation. The scheme developed by Islami Bank Bangladesh Ltd. has already been accepted cordially by the lower and middle income group of people and thus it is expected to have great prospect in mobilization of small savings and funds for deployment in income and employment generating activities and business. In view of the above the Bank has introduced “Mudaraba Special Savings (Pension) Scheme”.

Amount of deposit installments

Accounts under this scheme may be opened for monthly deposits of Tk. 100/-, Tk. 200/-, Tk. 300/-, Tk. 400/-, Tk. 500/-, Tk. 1000/-, Tk. 1500/-, Tk. 2500/- and Tk. 5000/- only. The deposit will be received on Mudaraba Principle.

Opening of account

Any bonafide citizen of Bangladesh of eighteen years or above with sound mind may open account in his name under this scheme by application in Bank’s printed application form designed for this purpose. The applicant shall have to be introduced by a bonafide account holder of the Branch where he intends to open account or any client of any Branch of IBBL or any respectable person known to the Bank and shall have to give two passport size photographs at the time of opening the account. This account can be opened in the name of minor by his/her father/mother/legal guardian giving necessary instruction for the operation of the account. Account may be transferred from one branch to another branch of the Bank at the written request of the account holder. Separate account number shall be allotted for each account. At the time of Opening of the account the client has to give his specimen signature in a separate card. Account may be also opened by thumb impression in case of illiterate person. In such a case the introducer has to submit a suitable declaration to the effect in a form prescribed for this purpose. No cheque book shall be issued against this account.

Deposit of installment

Under this scheme the depositor has to deposit fixed installment at the rate of his choice from the options as mentioned above (i.e. Tk. 100, Tk. 200, Tk. 300, Tk. 400, Tk. 500, Tk. 1000, Tk. 1500, Tk. 2500 and Tk. 5000) each month regularly.

Installment must be deposited within 6th to 25th of each month. If the 25th of any month is a Govt. holiday then installment may be deposited on following working day.

Installment may be also deposited by cheque. In such case proceeds against the cheque must be collected within the 10th day of the month. If the cheque is dishonored then the cheque shall be returned to the depositor observing due formalities and the installment shall be treated as overdue.

Advance Installments may be allowed to be deposited with proper arrangement between the Bank and the client in this regard.

The depositor may issue written standing instruction for monthly transfer of installment amount from any other account maintained with the same branch for credit to his MSS account. In that case the client must ensure sufficient credit balance in his/her Savings or Current account and he/she has to pay a charge of Tk. 5 only for each such transfer.

Profit sharing and weight age

The Mudaraba Special Savings (Pension) Scheme account holders shall share income derived from investment i.e., income from the use of the Mudaraba funds in economic activities permitted by Islamic Shariah. This includes profit, dividend, capital gains, rent and any other income derived from investment.

The account holders under this scheme along with other Mudaraba depositors shall get minimum 65% of the income derived from the deployment of Mudaraba Fund in the investment during any accounting year according to their proportion in the total investment on daily product basis applying the following weight age:

05 years Mudaraba Special Savings (Pension) Scheme: 1.10

10 years Mudaraba Special Savings (Pension) Scheme: 1.30

Benefits of full weight age with yearly cumulating of profit shall become payable if withdrawn on maturity. No profit shall accrue if the account is closed within one year. In cases of premature withdrawal after one year profit shall be payable at the rate applicable for Mudaraba Savings Deposit. In case of 10 year term MSS Account encashed after 5 years but before 10 years, profit shall be payable at the rate applicable to 5 year term MSS Account for 5 (five) years and at the rate of Mudaraba Savings deposit for the subsequent period.

Mudaraba hajj saving:

Hajj is one of the fundamental worship (Ibadah) of Islam. However, because of the prevailing socio-economic situation in the country, the people interested to perform Hajj cannot arrange the

required amount of money at a time to perform Hajj. The desire of many to perform Hajj is thus never fulfilled. Over twenty five thousand devoted Muslims from Bangladesh perform holy Hajj every year. Financial solvency and physical fitness are the pre-requisites of performing Hajj. The majority of the people, however, reach the fag end of their life in arranging the required amount of money for Hajj. Islami Bank Bangladesh Limited has, therefore, introduced “Hajj Savings Scheme” so that persons eager to perform holy Hajj may build-up savings through ‘Mudaraba Hajj Savings Account’.

Salient features

- Mudaraba Hajj Savings Account can be opened in the name of the individual only.

- Deposits in this account are received on the basis of Mudaraba principle of Islamic Shariah.

- No photography is required to open this account.

- The Bank issues pass-book against this account. After the deposit of each installment, the depositor must ensure that such deposit is recorded in the pass-book. If the pass-book is lost, the Bank shall charge Taka 10/- for issuance of new pass-book.

- The account holder must immediately communicate to the Bank of any change of the address.

- Persons eager to perform Hajj within the period of one to twenty five years may build-up savings to perform Hajj by depositing monthly installment.

- Profit shall be disbursed over the deposit on the basis of daily balance by giving 1.10 weight age, which is more than that of 3 year term deposit.

- If any depositor intends to perform Hajj before the maturity of deposit, then he can do so by depositing the balance amount fixed for the year along with his savings in the Mudaraba Hajj Savings Account.

- If any depositor, for some reasons, is unable to perform Hajj and wants to withdraw the deposited money, he shall get profit over the deposit at the rate of profit applicable for Mudaraba Savings Account.

- Mudaraba Hajj Savings Account can be transferred from one Branch to another upon application from the depositor on genuine ground.

- Money cannot be withdrawn from Mudaraba Hajj Savings Account and as such no cheque-book is issued.

- In a year there shall be 12 installments, 60 installments in 5 years and 300 installments in 25 years.

- Regular installment shall have to be deposited within first 10 days of the month. Advance deposit of investment is acceptable.

- If any depositor fails to deposit 3 installments consecutively then his Mudaraba Hajj Savings Account shall be void and such depositor shall get profit at the rate of profit given to Mudaraba Savings Account. But if the areas of one or two installments are deposited along with the next regular installment, the account shall remain operative. But if such irregular practice is repeated within the same year the account shall become void.

- At the end of the period if the total deposited amount including profit becomes less than the actual expenditure for Hajj in that particular year then the depositor may perform Hajj by depositing the balance amount.

- At the end of the period, if it appears that the actual expenditure for Hajj in that particular year is less than the deposited amount including profit, then the excess amount shall be refunded.

- In case any depositor under Hajj Savings Scheme fails to perform Hajj in the year of maturity and desires to perform Hajj subsequently, he may be allowed the benefit of Hajj Savings Account up-to the date of maturity and for the subsequent period till performance of Hajj at Mudaraba Account rate of profit.

- All categories of employees of Islami Bank Bangladesh Limited are eligible to participate in this Scheme.

- The Bank, at any time, may modify, revise and cancel, amend and rescind any rule of this account and the depositor shall be bound to abide by them.

Mudaraba monthly profit deposit scheme:

There is a substantial demand of monthly profit paying long term deposit schemes among the retired service holders and wage earners residing abroad who want to help their dependants and relatives by contributing a certain amount of money on monthly basis from the profits of their one-time deposit with the bank. Again there are persons who want to meet the day to day expenses of their families out of the monthly profits that may be received on their long-term deposits. Trusts and Foundations who desire to offer monthly scholarship and stipends to the students from the monthly generated profits of their funds deposited on long term basis with banks and parents who want to bear the educational expenses of children from the monthly profits of their savings are also very much interested for such a monthly profit paying deposit scheme.

Islami Bank Bangladesh Limited, as a pioneer of welfare banking, is receiving demands from the vast majority of our clientele and many other Shariah abiding people for introduction of attractive monthly profit based deposit schemes on the basis of Islamic Shariah so as to encourage them to meet their above needs out of the earnings of their deposits.

Considering the above aspects and prospects Islami Bank Bangladesh limited has launched a new deposit product under the name and style “Mudaraba Monthly Profit Deposit Scheme” in accordance with the principles of Islamic Shariah.

Term:

The Deposit shall be for a period of 5(five) years. The amount is refundable on maturity as per Mudaraba principle.

Ceiling of deposit:

Under this Scheme Deposits shall be received on Mudaraba principles in the amounts of Tk.100, 000/- and multiples thereof. Specially designed Monthly Mudaraba Profit Deposit Receipt will be issued there-against.

Payment of profit:

The deposits shall receive estimated monthly profit out of the share of investment income calculated on the basis of the weight age determined for such deposits and to be adjusted on completion of each accounting year and declaration of final rate of profit.

Opening of account:

- Any bonafide adult citizen of Bangladesh with sound mind may open this account in his/her name or in the name of his/her dependants in any of the Branches of the Bank by application in Bank’s printed Account Opening Form designed for this purpose. The depositor will be issued a specially designed Receipt for the deposit under the Scheme in the same manner as is issued in case of MTDR. This receipt shall not be transferable.

- The depositor shall have to maintain a separate Mudaraba Savings/Al-Wadeeah Current Account at the concerned branch where the monthly profits on his deposit shall be credited as per his written request. No separate introducer and photograph shall be required to open account under the scheme.

- At the time of the opening of the account besides filling in the relative Account Opening Form the client has to give his/her specimen signature in the specific place of the AOF as provided for the purpose.

- No cheque book shall be issued against this account.

Profit sharing & weight age:

The depositor of Mudaraba Monthly Profit Deposit Scheme shall share income derived from investment i.e. income from the use of the funds in economic activities permitted by Islamic Shariah. This includes profit, dividend, capital gains, rent and any other income derived from investment.

The depositor under this scheme along with other Mudaraba depositors shall get the share of minimum 65% of the income derived from the deployment of all Categories of Mudaraba Fund in the investment during any accounting year according to their proportion applying the weight age of 1.05.

Benefits of full weight age shall become payable if withdrawn on maturity. In case of premature withdrawal before 1(one) year, no profit shall be payable.

In case of pre-mature withdrawal after 1(one) year profit shall be payable at the rate applicable for Mudaraba Savings Deposit. In such cases excess monthly profits so far paid shall be adjusted.

Estimated profit calculated on the basis of weight age fixed for deposits under this scheme shall be payable on monthly basis.

The payment of monthly profit shall start from the subsequent month after a clear minimum gap of 30(thirty) days from the date of deposit. The monthly profit shall be credited each month to a separate Mudaraba Savings/Al-Wadeeah Current Account of the depositor to be opened at the concerned branch for this purpose if not maintained earlier.

Other terms & conditions:

- Deposits under Mudaraba Monthly Profit Deposit Scheme shall be accepted strictly on Mudaraba principles of Islamic Shariah and accordingly the deposits so received shall also be invested as per Shariah principles.

- The depositors must preserve the Receipts properly and carefully. In case of loss or damage of the Receipts, the depositor must inform the Bank immediately for taking necessary precautions. Duplicate receipt may be issued after observing necessary formalities in that regard as per Bank’s existing rules.

- Profits of any accounting year will be declared after certifying the Accounts of the Bank by the auditors appointed by the shareholders in the Annual General Meeting.

- If the deposit is withdrawn on maturity of the account but before finalization of the Annual accounts of the Bank, profit will be paid as per provisional rates. However, on declaration of final rates of profit for that year, the difference amount between the provisional and final rates, if any payable, will be allowed to the account holder on submission of written claim there against.

- Profits will be calculated on the basis of weight age pertaining to the particular deposit.

- The Bank reserves the right to change, amend, modify or cancel any rules, terms and conditions and the client shall have to abide by the same.

Mudaraba muhor savings deposit scheme:

Savings play an important role in capital formation, income-generation and creation of employment opportunities and contribute towards the increase in wealth of the individual and nation through profitable investment. The people generally try to save a portion of their income with a view to protecting themselves from future financial hardship and also to enhance their earnings for their own benefit and the benefit of their family and the nation as a whole.

The people of Bangladesh are deeply religious and committed to Islamic way of life and determined to conduct their economic activities in accordance with the tenets of Islamic Shariah. Islami Bank Bangladesh Limited, has therefore, introduced the savings deposit accounts viz. Mudaraba Savings Account, Mudaraba Term Deposit Account, Mudaraba Hajj Savings Account, Mudaraba Savings Bond, Mudaraba Special Savings (Pension) Scheme Mudaraba Monthly Profit Deposit Account, Mudaraba Foreign Currency Deposit (Savings) Account, Mudaraba Special Notice Account and Mudaraba Special Notice Account as per Islamic Shariah.

Islami Bank Bangladesh Limited, being encouraged by the success of the Mudaraba deposit accounts has, therefore, introduced yet another savings scheme namely ‘Mudaraba Muhor Savings Scheme’.

Muhor is wealth, which a husband is to pay his wife, upon marriage. As per Islamic shariah, it is compulsory for husband to pay this to his wife. But there is a good number of married men from all walks of life in our society who did not pay total Muhor to their wives. Many of them are not aware about the necessity of payment of the deferred amount of Muhor so that wives have been remaining deprived of their fundamental right of Muhor. The wives are to forgive even the claim of the same. Although some of them are aware about it but they are not getting much opportunity to realize it from their husbands.

Eligibility

This Scheme has been designed for all classes of people married particularly the professionals & service holders creating an opportunity for them to save in monthly installments according to their capability for rectifying their marriage life and to protect the human right of the women.

Objectives:

- To help the people raising awareness about Muhor, a basic Islamic principle.

- To help the women protecting their basic rights determined by Allah.

Term:

The scheme may be of 2(two) different terms:

5 years

10 years

Amount of deposit installments:

Accounts under this Scheme may be opened for monthly deposits of Tk.500/-, Tk1,000/-Tk.2,000/-, Tk.3,000/-,Tk.4,000/- and Tk.5,000/- only. The deposit will be received on Mudaraba principle.

Opening of account:

- Any married bonafide citizen of the country with sound mind may open account in his wife’s name under MMSS by application in Bank’s printed application form to be designed for this purpose.

- Account under the Mudaraba Muhor Savings Account shall only be opened in the name of wife.

- The applicant shall have to be introduced by a bonafide account holder of the Branch where he intends to open account or any client of any Branch of the Bank or any respectable person known to the Bank.

- 2(two) passport size photographs will be required to open this account.

- Account may be transferred from one branch to another of the Bank at the written request of the account holder.

- Separate account number shall be allotted for each account.

- At the time of opening of the account the client has to give his specimen signature in a separate card.

- Account may be also opened by thumb impression in case of illiterate woman. In such a case the introducer has to submit a suitable declaration to this effect in a form to be prescribed for this purpose.

- No Cheque Book shall be issued to the account holder before full deposit of Muhor money.

- If the address of account holder as well as the depositors is changed that must be informed to the Bank immediately.

- Installment must be deposited within 6th to 25th of each month. If the 25th of any month is a Govt. holiday then installment may be deposited on the preceding working day.

- The depositor shall be allowed to fix the monthly installment of deposit at the rate of his choice from the options as mentioned above (i.e. Tk.500/-, Tk.1, 000/-, Tk.2, 000/-, Tk.3,000/-,Tk.4,000/- and Tk.5, 000/-) so that it covers the payment of total Muhor within the scheduled period of time.

- 12 (twelve) installments of deposit shall be counted for a year. As such, there will be 60 (sixty) installments for 5 (five) years, 120 (one hundred twenty) installments for 10 (ten) years.

- Monthly statement, signed by the Manager or by Authorized Officer on his behalf, shall be given to the depositor showing progressive balance of the respective account.

- Installment may be also deposited by cheque. In such case proceeds against the cheque must be collected within the 25th day of the month. If the cheque is dishonored then the cheque shall be returned to the depositor observing due formalities and the installment shall be treated as overdue.

- Advance Installments may be allowed to be deposited.

- The depositor may issue written standing instruction for monthly transfer of installment amount from any other account maintained with the same branch for credit to his MMSS account. In that case the client must ensure sufficient credit balance in her Savings or Current account and she has to pay a charge of Tk.5/- only for each such transfer.

- If any husband wants to pay the Muhor before fixed term, he may be allowed to deposit the rest amount of money at a time.

- If the deposited amount and the profit given by the Bank stands insufficient, at the end of the term, to pay the total amount of the Muhor it can be paid by depositing the rest amount at a time.

- The amount of Muhor may be determined more by the husband or less by the wife than the amount mentioned in the Kabin Nama for opening MMSS Account.

- The amount of installment and the duration of Account can not be changed or returned.

Profit sharing and weight age:

The Mudaraba Muhor Savings Scheme account holders shall share income derived from investment made out of the Mudaraba funds in economic activities permitted by Islamic Shariah. This includes profit, dividend, capital gains, rent and any other income derived from investment.

The account holders under this scheme along with other Mudaraba depositors shall get minimum 65% of the income derived from the deployment of Mudaraba Fund in the investment during any accounting year according to their proportion in the total investment on daily product basis applying weight age of 1.10 for 5 (five) years term and 1.30 for 10 (ten) years term. Benefits of full weight age with yearly accumulation of profit shall become payable if withdrawn on maturity.

If the account is matured before declaration of annual final rate of profit for the relevant year the profit shall be paid to the concerned account as per provisional rate and then the surplus amount of profit, if any, shall be paid after declaration at the written request of the account holder (wife).

Mudaraba savings bond scheme:

Savings play an important role in capital formation, income-generation and creation of employment opportunities and contribute towards the increase in wealth of the individual and nation through profitable investment.

The people generally try to save a portion of their income with a view to protecting themselves from future financial hardship and also to enhance their earnings for their own benefit and the benefit of their family and the nation as a whole. Bangladeshi wage earners living abroad and the retired service holders desire to invest their earnings and retirement benefits in safe and profitable investment schemes. Many a people, however, cannot deploy their fund in business for various reasons. The people of Bangladesh are deeply religious and committed to Islamic way of life and determined to conduct their economic activities in accordance with the tenets of Islamic Shariah. Naturally they want to avoid interest in transaction and business which is forbidden by Islam.

Islam encourages savings, which is the prerequisite for any sustainable economic development. The saying of Holy Prophet (PBUH) is that poverty leads to unbelief and therefore, people have been encouraged to save a portion of their earnings to protect themselves from future financial setback. Islam emphasizes in the cycling of surplus capital by investing such funds in productive economic activities that will pave the way for employment, development and progress.

The people of Bangladesh reluctantly invest in interest bearing schemes. The religious Muslims, however, avoid such investments and the idle funds are mostly being consumed to meet the avoidable family demands. Thus the major portion of savings remains out of the production process. Islami Bank Bangladesh Limited, has therefore, introduced the savings deposit accounts viz. Mudaraba Savings Account, Mudaraba Term Deposit Account, Mudaraba Hajj Savings Account, Mudaraba Special Notice Account and Mudaraba Special Savings (Pension) Scheme as per Islamic Shariah. Mudarabah Special Savings (Pension) Account has also been introduced recently. Islami Bank Bangladesh Limited, being encouraged by the success of the Mudaraba deposit accounts has, therefore, introduced yet another savings scheme namely “Mudaraba Savings Bond Scheme”.

Eligibility

Person(s) aged 18 years and above shall be eligible to purchase Mudaraba Savings Bond(s) in single name or in joint names.

Educational Institutions, Clubs, Associations and other non-trading and non-profit Socio-economic Institutions shall also be eligible to purchase Bond(s) in the name of the Institutions.

Guardian(s) shall be allowed to purchase Bond(s) jointly with a minor mentioning the age of the minor. Payment against such Bond(s) shall be made on the basis of joint signature after the minor attains majority.

Father/Mother/Legal Guardian shall be eligible to purchase these Bonds on behalf of one or two minors mentioning the name and age of the minor(s) and also instructions regarding payment encashment.

Denomination

Mudaraba Savings Bond shall be available in Tk. 1,000.00, Tk. 5,000.00, Tk. 10,000.00, Tk. 25,000.00, Tk. 50,000.00, Tk. 1, 00,000.00, Tk. 5, 00,000.00 and Tk. 10, 00,000.00 denominations.

Purchase ceiling

Purchase ceiling of Mudaraba Savings Bond is minimum Tk. 1,000.00. Any amount of Bonds can be purchased subject to availability.

Purchase Procedure

Eligible purchaser(s) shall be entitled to purchase Mudaraba Savings Bonds in single or in joint names or in the name of Institutions from the Branch of the Bank. The purchaser(s) shall have to apply in prescribed form of the Bank and fulfill the terms and conditions in this respect.

Period of Maturity

5 (five) years

8 (eight) years.

Profit sharing & weight age

The Bondholders shall share income derived from investment i.e. income from the use of the funds in economic activities permitted by Islamic Shariah. This includes profit, dividend, capital gains, rent and any other income derived from investment

Bondholders shall get minimum 65% of the income derived from the deployment of Mudaraba fund in the investment during any accounting year according to their proportion in the total investment applying the following weight ages:

Type of Bonds Weight age

8 years Mudaraba Savings Bond : 1.25

5 years Mudaraba Savings Bond : 1.10

Encashment

For encashment of Mudaraba Savings Bonds, the Bondholder(s) or their nominee(s) [in case of death of the purchaser(s)] shall have to present the Bond(s) and the related papers in original duly discharged as per rules, to the Branch of the Bank where from the Bonds were purchased. The concerned Branch shall verify the signatures and other particulars and if found in order, then make payment with profit to be calculated on the basis of period covered at the time of encashment.

Other benefits

Mudaraba Savings Bonds can be purchased in single name or joint names and there shall be provisions for nominating nominee(s).

Photographs shall not be required with application for purchase of the Bonds.

Mudaraba Savings Bond shall be acceptable as security.

If original Bonds are lost or damaged due to theft, fire etc. there shall be arrangement for issuance of duplicate Bonds after due verification.

Mudaraba Savings Bond holders along with other Mudaraba depositors shall get preference in the matter of investment of their deposits over the Bank’s equity and other cost free funds.

Income derived from the investments during the accounting year shall at first be allocated to the Mudaraba deposits and cost free funds (including Bank’s equity) according to their proportion in the total investment as per principles of distribution of profit to Mudaraba depositors.

Mudaraba foreign currency deposit scheme (Savings):

Islami Bank Bangladesh Limited has introduced a new deposit product titled ‘Mudaraba Foreign Currency Deposit Scheme (Savings)’ under Mudaraba principle and endeavoring to invest the foreign currency funds in profitable way through its Foreign Correspondent Banks under Shariah Principle so as to enable the Bank to pay profit to its FC/PFC depositors, who will intend to open/maintain Mudaraba Foreign Currency Deposit (MFCD) Account particularly in US Dollar. This Scheme offers investment opportunities to wage earners and other private Foreign Currency Account holders who do not like to keep their funds in interest bearing deposit accounts or invest in interest bearing schemes. To encourage savings in Foreign Currency by offering a safe and profitable opportunity to the savers/investors by way of sharing a portion of the profit out of the investment of their funds as per principles of Shariah and to extend the Banks Deposit Scheme for mobilization of remittance of Bangladeshi expatriates to increase the opportunity for their income generation and increase in the wealth of individuals and of the nation through profitable investment as per Shariah principles are the special features of the Scheme.

Objectives

To offer investment opportunity to the Wage Earners and other private Foreign Currency account holders who do not like to keep their funds in interest bearing deposit accounts or invest in interest bearing schemes.

To encourage savings in Foreign Currency by offering a safe and profitable opportunity to the savers/investors by way of sharing a portion of the profit out of the investment of their funds as per principles of Shariah.

To extend the Bank’s Deposit Scheme for mobilization of remittance of Bangladeshi expatriates to increase the opportunity for their income generation and increase in the wealth of individual and of the nation through profitable investment as per Islamic Shariah Principles.

Eligibility of the Persons/Firms for opening MFCD A/c(s)

Bangladeshi nationals residing, working and earning abroad.

Foreign nationals residing in Bangladesh and also Foreign Firms registered abroad and operating in Bangladesh.

Foreign missions and their expatriate employees.

Opening of the Account (Currency, Type and withdrawal)

Account may be opened in US Dollar, Pound Sterling or other eligible currencies at the option of the account-holder (However, at the moment Deposit in such account will be accepted only in US. Dollar).

Types of account will be “Mudaraba Foreign Currency Deposit Account”.

Payment of profit

Initial Deposit must be USD=1000/- In case the balance falls below USD=1000/-, no profit will be paid.

- Withdrawal is allowable twice in a month and each withdrawal must not exceed ¼ of the credit balance. Withdrawal exceeding the said limit will require 7 days notice.

- Balance will carry profit only if it remains for one month or above.

- Profit will be on average monthly balance.

- Islami Bank Bangladesh Limited will try to invest such funds profitably in Foreign Investment as per Islami Shariah through their Foreign Correspondent Banks.

- Minimum 65% of the gross investment income derived from Mudaraba Foreign Currency Deposit (MFCD) funds shall be distributed to these account-holders on half yearly basis.

- If there will be no available opportunity for Foreign Investment as per Shariah, Profit will not be given to the account holders.

- Procedure/Requirement for opening of MFCD A/c

- Foreign Currency (Current) Account may be opened with any Authorized Dealer (AD) Branch of the Bank. But for availing the facility of profit, the MFCD Account should be maintained with under-mentioned A/D branches of the Bank.

- Related Account opening form duly filled in along with Specimen Signature Card and signed by the account-holder.

- In case of nomination, Signature of the nominee in the account opening form and Signature Card be attested by the account-holder.

- Photocopy of passport (up to VISA pages).

- Passport-size photographs 2 copies.

- Nominee’s Photographs 2 copies (if there be any) duly attested by the account holder.

- Service contract/selection letter/Appointment letter/VISA and other relevant papers regarding occupation.

Mudaraba waqf cash deposit account:

Mudaraba Waqf Cash Deposit Account Cash Waqf is the latest product in the realm of our banking sector particularly in Islamic economics and finance and it provides a unique opportunity for making investment in different religious, educational and social services. It has been decided to introduce a new deposit scheme/product in the name of ‘Mudaraba Waqf Cash Deposit Account MWCDA, through which savings made from earnings for the purpose of Waqf by the well-off and the rich people of the society, can be mobilized and the income to be generated there from may be spent for different benevolent purposes. Through the Scheme the Bank will be able to contribute to popularize the role of Waqf in the country including Cash Waqf which will be instrumental in transferring savings of the rich to the deprived member of the public, in financing various religious, educational and social services in Bangladesh. Cash Waqf can work as supplement to the financing of various social investment projects.

Objectives

• To provide banking services as facilitator to create Cash Waqf and to assist in the overall management of Waqf

• To assist mobilization of social savings by creating Cash Waqf with a view to commemorating alive or deceased parents, children and to strengthen the integration of the family relationship of the well-off people and the rich.

• To increase social investment and to transform the social savings into capital.

• To benefit the general public, especially the poor sections of the people out of the resources of the rich.

• To create awareness among the rich regarding their social responsibilities to the society.

• To assist in developing capital market.

+ To assist in overall development efforts of the country and to make a unique integration of social security and social peace.

Term

Waqf to be done in perpetuity and the account shall be opened in the title to be decided by the Waquif.

Ceiling of deposit

Deposits/Cash will be received as endowment on Mudaraba principle. The Bank will manage the Waqf Fund on behalf of the Waquif. Waquif will have the right/opportunities to create Cash Waqf at a time or he/she may start with a minimum deposit of Tk. 50,000/- (Taka fifty thousand) only and the subsequent deposit shall also be made in thousand or in multiple of thousand taka. If necessary, foreign currency may be accepted on complying with relevant rules/formalities. Cash Waqf shall be accepted in specified Endowment Receipt Voucher and a certificate for the entire amount shall be issued as and when the declared amount is built up in full.

Profit sharing & weight age

• The Waquif himself may be the beneficiary of a nominal portion of the profit to be earned from the Waqf Fund.

• The Waquif or the beneficiary under this Scheme shall get the share of minimum 65% of the investment income or the percentage the Bank decides from time to time derived from the deployment of all categories of Mudaraba fund in the investment during any accounting year according to their proportion applying the highest rate of weight age (1.35 at present stage)

• The Waqf amount may not remain intact as the Fund is operated as per Mudaraba principle. As per Mudaraba principle if any loss is incurred in course of business the loss is to be covered to the debit of the Waqf deposit. To be mentioned that the profit amount only will be spent for the purpose(s) specified by the Waquif. Unspent profit amount will automatically be added to Waqf amount and earn profit to grow over the time.

• Profit under this Scheme shall be payable to the respective sector(s)! Institution/project (s)/person(s) determined by the Waquif on Annual basis i.e. after declaration of final rate of profit of the Bank.

Opening of the Account

• Any bonafide adult citizen of Bangladesh with sound mind (capable to enter into contract) may open this Account with any of the Branches of the Bank.

• Account under the Mudaraba Waqf Cash Deposit Account shall only be opened in the title selected by the Waquif.

• The applicant shall have to be introduced by a bonafide Account holder of the Branch where he/she intends to open this Account or any client of any Branch of the Bank. or any respectable person known to the Bank may also introduce the Waquif.

• 2 (two) passport size photographs of the Waquif will be required to open this Account.

• No Cheque Book shall be issued against this Account.

• If the address of the Waquifs is/are changed that must be informed to the Bank immediately Deposit of Installment.

• Waquif will have the right to create Cash Waqf at a time or he/she may start with a minimum deposit of Tk.50,000/- (Taka fifty thousand) only and the subsequent deposit shall be made by installment(s) in thousand taka or in multiple of thousand taka. In that case he/she will be given Endowment. Receipt Voucher against depositing of every installment. But Waqf Certificate shall be issued at a time after depositing the full Waqf Amount.

• Installment may also be deposited by cheque. In such case, proceeds against the cheque will be deposited after collection. If the cheque is dishonored then the cheque shall be returned to the Waquif observing due formalities and the installment shall be treated overdue.

Other Term.

• A Waqf Management Committee at Head Office level will manage the Waqf Fund. Moreover, if any dispute/objection is raised by the Waquif in connection with the mismanagement of the Waqf Fund or for other causes, in that event the issue will be referred to the said Committee and the decision of the Committee will be final.

• The Waquif will issue written standing instruction for yearly transfer of profit amount to MSA/AWCA maintained by the beneficiary(ies)/institution(s)/project(s)/person(s) or the concerned Branch may pay the profit amount directly to the beneficiary(ies)/institution(s)/project(s)/person(s) as determined by the waquif.

• In case of installment basis Cash Waqf, if the Waquif fails to continue depositing the installment(s), the amount accumulated so far throughout the period shall be counted for profit to be given to that Account. Next year, the Waquif will get the opportunity to deposit his installment again. Mentionable that, one particular Waquif will not be entitled to repeat non- depositing of installment (s) more than five times.

• In the event of death of the Waquif the profit of that Waqf Account will be spent as per option given by the Waquif and a Certificate in this regard will be issued for the amount so far deposited by the Waquif and this shall be handed over to the successor of the Waquif. If the successor is willing to pay the shortfall amount to cover the declared amount of Waqf then after getting such amount a Certificate for the full amount may be issued.

In case of the failure of the Waquif to deposit the installment any more to build up the declared amount, the Waquif may request in writing to the effect that he is unable to deposit the rest amount to cover the declared Cash Waqf. Thereby, he may be issued Cash Waqf Certificate considering the amount so far deposited as the declared amount after obtaining approval from the branch incumbent.

If the goal/purpose of Waqf is ended/destroyed, where the income/profit of the Waqf A/c will be spent must be mentioned as a special indication at the time of opening of the Account. If it is not mentioned or if there arise any contradiction, the Committee’s (Waqf Management Committee) decision in this regard shall be final.

Special Instructions:

• The Waquif will have the right to choose the purposes to be served either from the list of choices determined by the Bank for this purpose or any other purposes permitted by the Islamic Shariah.

• The Waquif shall also have the right to give standing instruction(s) to the Bank for regular realization of cash Waqf at a rate specified by him/her from any other A/c maintained by him/her with the concerned Branch.

• Bank reserves the right to regret opening of any Account without showing any reasons thereof.

• Waquif may also instruct the Bank to spend the entire profit amount for the purpose specified by him/her.

ATM services »facilities

Automated Teller Machine (ATM), has unveiled the horizon of Electronic Banking of 21st Century. Through ATM, customers can avail non-stop online teller service without going to the specific branch of the member bank. They can withdraw or deposit cash or cheque as well as pay utility bills like BTTB, Grameen, AKTEL, City Cell Phone, DESA, WASA, TITAS etc. with the help of this modern computer controlled machine. The service is now offered by ETN and eleven member banks including Islami Bank Bangladesh Limited.

Facilities

ATM Card holders can withdraw cash from ATM at any time.

Customers can make transactions from any of the machines with logo ‘E-cash’ installed at different places in the city.

In course of time utility bills like WASA, TITAS and DESA etc can be paid through ATM.

Now BTTB, Grameen, AKTEL, City Cell Phone bill can be paid through ATM.

Now IBBL E-cash cardholders can be paid their monthly installment of Mudaraba Hajj Savings, MSS (Pension), Mudaraba Muhor Savings and HDS schemes of IBBL through ATM.

The machines are located in convenient places where customers usually deal with money matters. Therefore, they can easily avoid the risk of cash carrying by using ATM Card.

Customers may know their present balance at any time from the machine.

In course of time, POS (Point of Sale) can be used.

Getting an ATM card from IBBL

A customer having a deposit account with the designated branch of Islami Bank Bangladesh Limited can get an ATM card. Interested customer would collect ATM Account Opening Form from the concerned branch and submit it along with the Card Fee of Tk.500/= (Taka five hundred) only. After 7 (seven) days from the date of application, the customer would collect the PIN and Card separately from the designated Officials of the concerned branch and then after 48 (forty-eight) hours, customer can use his Card at any ATM with logo ‘E-cash’. Customers can withdraw any amount multiplied by Tk.1000/- per instance subject to fulfillment of the above conditions i.e.Tk.1000/=(Taka One thousand),Tk.2000/=(Taka two thousand), Tk.3000/=(Taka three thousand) and maximum Tk.5000/=(Taka five thousand) per instance and maximum withdrawal limit Tk.20,000/- per day.

Procedure for cash withdrawal ATM

Go to any of the ATMs located anywhere within Dhaka / Sylhet / ChittagongCity.

Insert your card into the ATM and type PIN –press ENTER.

Select the ‘Cash Withdrawal’ option by pressing > key

Press the > key against your required amount

Collect the money along with receipt

If you want another transaction, press YES or press No to end transaction.

Locker service

Secured Locker Service is provided in some branches of the Bank. Customers may avail this service and secure their valuables.

| Locker size | Yearly Charge (Tk.) | Security Deposit (Tk.) |

| Small | 700.00 | |

| Medium | 1000.00 | 500.00 (refundable) |

| Large | 1500.00 |

Secured Locker Service is available in the following branches:

| Branch | No. of Lockers | Branch | No. of Lockers |

| Head Office Complex Branch | 2 | Gulshan Branch | 1 |

| Farmgate Branch | 1 | Dhanmondi Branch | 1 |

| New market Branch | 3 | Uttara Branch | 1 |

| Kawran Bazar Branch | 1 | VIP Road Branch | 1 |

| Sylhet Branch | 1 | Khulna Branch | 1 |

| Rajshai Branch | 1 | Agrabad Branch | 2 |

| Elephant Road | 1 | Chawkbazar | 2

|

| Cox’s Bazar | 1 | Mouchak | 1 |

| Anderkilla Branch | 1 | CDA Avenue Branch | 1 |

| Chiringa Branch | 1 | Feni Branch | 1 |

Special schemes

Special Schemes | |

| Household Durable Scheme | |

| Housing Investment Scheme | |

| Real State Investment Program | |

| Transport Investment Program

| |

| Car Investment Scheme

| |

| Investment Scheme for Doctors

| |

| Small Business Investment Scheme

| |

| Agriculture Implements Investment Scheme | |

| Micro Industries Investment Scheme | |

| Mirpur Silk Weavers Investment Scheme | |

FINDINGS OF THE STUDY

Everybody wants to earn a higher rate of return. Investment is the key point of earning higher rate of return. To invest money it is essential to look into the financial strength, efficiency and effectiveness of the company. Whether a project is acceptable or not, profitable of non-profitable, financially solvent or insolvent are easily determined by means of study about investment mechanism. So study about investment mechanism helps the management to plan, control, and co-ordinate and take proper decision. The growth and expansion in the areas like net profit, total income, total expenditure, total income, total assets, total fixed assets, employee, branches, deposit etc, and the banking sector has also given rise to many problems. We also measure the modes of investment of IBBL. After the analysis we found that the Bai-murabaha & hire Purchase under Sherkatul Melk was greatly contribution on investment which was more favorable for IBBL.

Problems

Many of these problems are affecting healthy growth of the sector and eating up the potentials the economy as well. Major problems of the banking sector are as follows;

Adequacy of capital: It is a big problem of the banking sector pertains to the inadequacy of capital. As against a capital requirement of 8 percent equal to the risk weighted assets of the banks