Executive Summary

Through This Dissertation report an attempt has been made to assess the “Performance Evaluation of Al-Arafah Islami Bank Limited (AIBL).”

Bangladesh is one of the largest Muslim countries in the world. The people of this country are deeply committed to Islamic way of life as enshrined in the Holy Qur’an and the Sunnah. Naturally, it remains a deep cry in their hearts to fashion and design their economic lives in accordance with the precepts of Islam. The establishment of Al-Arafah Islami Bank Limited on June 18, 1995, is the true reflection of this inner urge of its people, which started functioning with effect from September 27, 1995. This Bank is a third generation fast growing bank in this country which is trying to actualize its slogan “A rare combination of Islamic Shariah and Modern Banking”. It is committed to conduct all banking and investment activities on the basis of interest-free profit-loss sharing system. In doing so, it has unveiled a new horizon and ushered in a new silver lining of hope towards materializing a long cherished dream of the people of Bangladesh for doing their banking transactions in line with what is prescribed by Islam. With the active co-operation and participation of Islamic Development Bank (IDB) and some other Islamic banks, financial institutions, government bodies and eminent Islamic personalities of Bangladesh, Al-Arafah Islami Bank Limited has by now earned a remarkable position of a leading private commercial bank in Bangladesh.

This paper has been produced as a part of field study on the topic titled “ Performance Evaluation of Al-Arafah Islami Bank Limited (AIBL)”, a leading private limited Financial Organization (Bank). AIBL assesses their needs for Performance Evaluation with the company’s organizational goals. Banking is a system of intermediation. Modern commercial banks since their early days had been doing two main functions. These are acceptance of deposits from the public and lending money to the people.

In addition, they also involved themselves in investment. Apart from the principal function, they also have to render various services to the people. The ever-changing demands of the society, business and industry have led the banks to undertake such services for enhancing their utility to the society at large. Based on nature of these services, they may be classified as under (a) agency services: collection and payment of cheques, payment on behalf of customers , purchase and sale of stocks, acting as trustees, acting as agency (b) General services : opening letter of credit , safe custody, dealing in foreign exchange, providing credit reports, underwriting of loans, providing remittance facilities, complete services in foreign trade .

The structure of the banking system has changed substantially over the last few years. NCBs’ role has gone down. Their share in total assets went down from 54 percent in 2004 to 40 percent in 2008. On the other hand, PCBs’ share went up from 27 percent in 2004 to 43 percent in 2008. The change reflects adoption and implementation of new policies for the banking sector.

One important challenge that the banking sector is facing is the introduction of information technology in the banking system in an aggressive manner.This is required to improve management efficiency, reduce operational cost, improve customer services, and increase transparency.

The earning and profitability of the banking sector have also improved in recent years and it is generally measured by Return On Assets (ROA) and Return On Equity (ROE).

Hence, the banking sector would play a vital role in the development of the country and efficient and sound banking management would led the country to reach at the highest peak of success.

AIBL aims at maintaining effective relationship with the customers, marketing of credit products, exploring new business opportunities etc. AIBL takes well calculative business risk while safeguarding it’s capital, financial resources and profitability from various risk.

Presently, Al-Arafah Islami Bank Ltd. has got 50 branches and a total of 1080 employees working in AIBL (as of December 2008). Its authorized capital is Taka 2500 million and the paid-up capital is Taka 1383.81 million.

The bank conducts its business on the principles of Musharaka, Bai-Murabaha, Bai-Muajjal and Hire Purchase transactions approved by Bangladesh Bank. Naturally, its mode and operations are substantially different from those of other conventional commercial banks. There is a Shariah Council in the bank who maintains constant vigilance to ensure that the activities of the bank are being conducted on the precepts of Islam.

The Al-Arafah Islami bank has an Asset Liability Committee (ALCO) that reviews liquidity requirement of the bank, the maturity of assets and liabilities, deposit and lending pricing strategy and the liquidity contingency plan. The prime objective of the ALCO is to monitor and avert significant volatility in net profit income, investment value and exchange earnings. AIBL strives hard to optimize profit through conduction of transparent business operations within the legal and social framework with malice to none and justice for all.

To evaluate the performance of AIBL, its deposit, investments, recovery, net profit, EPS, ROA are analyzed by applying source madding statistical tools such as Time Series Analysis, Growth Rate, Acceleration Rate, Correlation and Regression Analysis of the different variables used in the Bank. After evaluation of the performance of AIBL, it has been found that though AIBL shouts a good progress since it’s due to its sound management and better officers in its organization, yet there are many reasons to improve the performance of AIBL. AIBL can achieve its dynamic efficiency though proper communication with its depositors and borrowers, providing a range of innovative financial services to the depositors (savers) and borrowers, promoting strategies that seek to provide ongoing financial services to the optimum customers, supporting government polices that promote growth of thrust sectors and potential savers, recognizing that in many cases finance may not be the tool for the earning profit in the teeth of default culture and mismatch between asset-liability.

1.1 Introduction of the Report

Financial sector of Bangladesh, like most developing countries, is dominated by banking enterprises. Banks at early stages of history of Bangladesh were nationalized and there was mismatch between assets and liabilities.

Currently, the banking sector comprises of 4 nationalized commercial banks (NCBs), 5 government-owned specialized banks (SBs) dealing with development finance in specialized sectors, 30 private commercial banks (PCBs) and 10 foreign commercial banks (FCBs)

The structure of the banking system has changed substantially over the last few years. NCBs’ role has gone down. Their share in total assets went down from 54 percent in 2004 to 40 percent in 2008. On the other hand, PCBs’ share went up from 27 percent in 2004 to 43 percent in 2008. The change reflects adoption and implementation of new policies for the banking sector.

One important challenge that the banking sector is facing is the introduction of information technology in the banking system in an aggressive manner. This is required to improve management efficiency, reduce operational cost, improve customer services, and increase transparency.

The earning and profitability of the banking sector have also improved in recent years and it is generally measured by Return On Assets (ROA) and Return On Equity (ROE).

Hence, the banking sector would play a vital role in the development of the country and efficient and sound banking management would lead the country to reach at the highest peak of success.

1.2 Objectives of the study

The Dissertation is aimed at the following objectives:

- To evaluate financial affairs of the Bank.

- To diagnosis the key financial problem areas of AIBL.

- To visualize the quantitative and qualitative aspects of AIBL.

- To evaluate the over all performances of the employees of AIBL.

- To evaluate the over all Financial Performances of AIBL.

- To identify policy recommendations for further improvement.

1.3 Scope of the study

The scope of the study is limited to the analysis of the employee performances and financial performances of ‘Al-Arafah Islami Bank Ltd’. The paper briefly focuses on different quantitative aspects of the financial statements of funds borrowed & disbursed, trends of growth of equity, assets, profits, retained earnings, dividend, earning per share and in other activities and the over all activities as well as performances of the employees of the organization.

Different comparative analysis of several years’ data has been made on the different components of financial statements, employee perfoemances to critically compare their financial as well as employee status in different years.

1.4 Methodology of the study

For smooth and accurate study every one has to follow some rules & regulations . The study impute were collected from two sources:

(a) Primary sources:

(i) Practical desk work

(ii) Face to face conversation with the officers

(iii) Direct observations.

(b)Secondary sources:

(i)Annual reports of AIBL

(ii) Files & Folders.

(iii) Memos & Circulars.

(v) Websites,

(vi) Different circulars sent by Head Office and Bangladesh Bank.

The report is mainly based on secondary data that I have collected from various sources. The major source of information is the Annual Report of the Bank. The other sources include Internet and the very helpful sites that have provided me with the exact nature of information that I was looking for.

I have also collected information from newspapers, magazines, periodicals and other pertinent articles. The details of all the sources being used in this report are shown in the bibiliography.

Limitations of the study

It is actually very tough to some extent to learn and cover all the components of the financial management issues and to analyze those within this short period of time. Generally, access to internal data source of the company is prohibited to some extent. The major limitations of the study are as follows:

- All the concerned personnel of the bank have not been interviewed.

- Lack of in-depth knowledge and analytical ability for writing such report.

- Another limitation of this report is bank’s policy of not disclosing the facts.

- Some data and information are not available for obvious reason, which could be very much useful.

- Lack of enough experience in analyzing data.

- The report would be much more fruitful if allowed some more time.

- All the financial statements are not correct but the analysis is done based on the figures available in the financial statements.

1.5 Time Schedule

The Dissertation has been made during the following time schedule:

SL No | Name of Work | Time |

1. | Data Collection | 20 Days |

2. | Data Analysis | 15 Days |

3. | Report Preparing | 30 Days |

4. | Report Checking | 20 Days |

5. | Report Binding | 5 Days |

Total | 90 Days. | |

Profile of the Organization

Introduction:

Bangladesh is one of the largest Muslim countries in the world. The people of this country are deeply committed to Islamic way of life as enshrined in the Holy Qur’an and the Sunnah. Naturally, it remains a deep cry in their hearts to fashion and design their economic lives in accordance with the precepts of Islam. The establishment of Al-Arafah Islami Bank Limited on June 18, 1995, is the true reflection of this inner urge of its people, which started functioning with effect from September 27, 1995. This Bank is a third generation fast growing bank in this country which is trying to actualize its slogan “A rear combination of Islamic Shariah and Modern Banking”. It is committed to conduct all banking and investment activities on the basis of interest-free profit-loss sharing system. In doing so, it has unveiled a new horizon and ushered in a new silver lining of hope towards materializing a long cherished dream of the people of Bangladesh for doing their banking transactions in line with what is prescribed by Islam. With the active co-operation and participation of Islamic Development Bank (IDB) and some other Islamic banks, financial institutions, government bodies and eminent Islamic personalities of Bangladesh, Al-Arafah Islami Bank Limited has by now earned a remarkable position of a leading private commercial bank in Bangladesh.

2.0 Background of the organization:

2.1 History:

Still in the year 1900 banking activities were in the basis of capitalistic interest based banking. Somebody felt that it became imbalanced and made a large gap between rich and poor. Which affects thought that interest is strongly prohibited by Islam even all religion also prohibited the same. Leader of the Muslim community named Mohammad (sm) started interest free business which was also at the very beginning of Islam. Business in Islam is implemented through buying and selling /and under shirkat.

As a result Muslim scholar tried era/years together to build a new arrangement as an alternative banking. In 1930 some Islami scholars wrote some books about Islamic banking system. In 1940 the demand for establishing Islamic banking become more stronger in the several muslim countries.

In 1962 at Malaysia a corporation was established mamed Pilgrimmed Savings Corporation for helping pilgrims which was recognized as a bank. But the first Islami Bank was established at Mitgamar in Egypt. Dr. Ahmed Al Nazzar established the same named savings bank.

In 1969 the first government Islamic bank was established at Malaysia which was operationed successfully.

In 1970 former King Faisal approached to the Muslim countries to form the banking sector with a view to Islamic shariah. Upon this idea in 1973, 18th December a decision was accepted for establishing a Islamic Development Bank (IDB) involving in Muslim countries. In 1974 resulation was signed in the conference of financial ministers of Islamic countries and on 20th October 1975 the bank (IDB) was established at Jeddah, KSA.

As per motivation of OIC different Muslim countries’ Govt. approved Islamic Banking and established some Islami Banks in several countries. Bangladesh is one of the largest Muslim countries in the world. The people of this country are deeply committed to Islamic way of life as enshrined in the Holy Qur’an and the Sunnah. Naturally, it remains a deep cry in their hearts to fashion and design their economic lives in accordance with the precepts of Islam. Under the Company Act, 1913 Islami Bank Bangladesh Ltd. first got registration on 13, March 1983 in Bangladesh which started functioning with effect from March 30, 1983. Formal inauguration of the bank was on 12th August 1983. But for the huge muslims of the country it was very much insufficient than actual demand. At last some commited muslim personalities of the country established Al-Arafah Islami Bank Limited in 1995. On June 18, 1995 it started its journey to meet up the demand of the people is the true reflection of this inner urge of its people, which started functioning with effect from September 27, 1995.

2.2 Vision of AIBL:

To be a pioneer in Islami Banking in Bangladesh and contribute significantly to the growth of national economy.

2.3 Mission of AIBL:

Achieving the satisfaction of Almighty Allah both here & hereafter.

Proliferation of Shariah Based Banking Practices.

Quality financial services adopting the latest technology.

Fast and efficient customer service.

Maintaining high standard of business ethics.

Balanced growth.

Steady & competitive return on shareholders’ equity.

Innovative banking at a competitive price.

Attract and retain quality human resources.

Extending competitive compensation packages to the employees.

Firm commitment to the growth of national economy.

Involving more in micro and SME finance.

2.4 Objectives of AIBL:

- All activities are conducted on interest free system according to Islamic Shariah Principles.

- Investment is made through different modes as per Islamic Shariah.

- Investment income of the Bank is shared with the Mudaraba depositors according to Islamic Shariah.

- An agreed upon ratio ensuring a reasonably fair rate of return on their deposits.

- Aims to introduce a well fare oriented banking system and also to establish equity.

- Justice in the field of all economic operations.

- Extend socio-economic and financial services to individuals of all economic activities

- Backgrounds with strong commitment in rural uplift plays a vital role in human resources development and employment-generation. Particularly among the unemployed youths.

- Portfolio of investment policy have been specially tailored to achieve balanced growth and equitable development through diversified investment operations particularly in the priority sector

2.5 Goals of AIBL:

- Establishment of Adl(Justice), to attain Hasana(good) and Falah(welfare)

in this life and the life hereafter.

- To establish Ihsan (gracious conduct or kindness) in economic affairs.

- Establishment of Maroof (proper and good acts, institutions) in economic life.

- Elimination of Munker (Evil, wrong of injurious practices) from economic life.

- Achieve maximum economic growth.

- Maximize employment to ensure maximum distribution of wealth in society.

- Achieve universal education.

- Encourage Co-operation in society.

2.6 Functions of AIBL:

The functions of Al-Arafah Islami Bank Limited are as under:

- To maintain all types of deposit accounts.

- To make investment.

- To conduct foreign exchange business.

- To extend other banking services.

- To conduct social welfare activities through Al-Arafah Islami Bank Foundation.

2.7 Organizational Culture of AIBL:

It is operated within chart/ organogram. Relation to each other is excellent. Business like investment in trade, project and small & medium entrepreneurship are handled here. It has relations with mass population as the bank open A/c with minimum balance and Established Al-Arafah Islami Bank Foundation for helping poor and meritorious students. It also provides sewing machine to distressed women, rickshaw to poor labour, and distribute cow, goat to the poor people. It has educational program like as Al-Arafah English Medium Madrasah and helps in health sector establishing charitable dispensary. It also provides Tube-well and sanitary latrine to the unhealthy area of poor inhabitants. From the operation and culture of the bank, client/ society and bank itself benefitted.

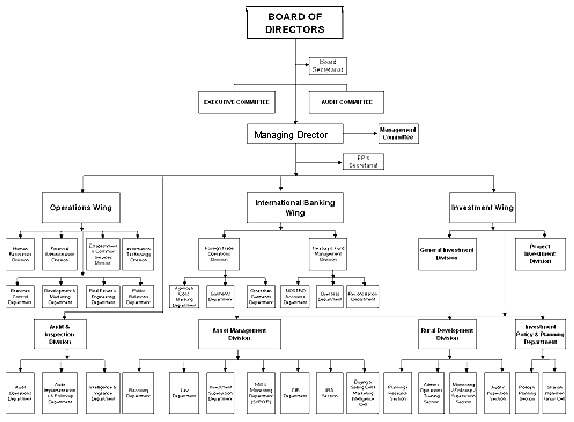

2.8 Structure of the Organization of AIBL:

2.9 Departmentalization of AIBL:

The organization has a “Pyramid Structure”. The Managing Director is the top. Under him there are one Additional Managing Director and two Deputy Managing Director who are individually head of three wings. Under each wing there are several divisions/departments. Hierarchy is well defined and follow specific chain of command. The wings head and divisional head reporting directly to the Managing Director. The activities of various wings are described below:

- Operations Wing: Headed by Additional Managing Director, this wing is responsible for all General Banking operations and control to the Branches.

- Investment Wing: Headed by a Deputy Managing Director, this wing processes Investment proposals received from different branches, analyze them and get approval from the competent authority. This wing also responsible for monitoring the Bank’s Investment portfolio.

- International Banking Wing: Headed by a Deputy Managing Director, this wing processes foreign transaction, foreign exchange, foreign remittance etc.

There are many departments under different divisions headed by Executive Vice Presidents

- Audit Division: This division is responsible for overall Audit & Inspection of the Bank.

- Human Resources Division: This division is responsible for recruitment, training, posting, promotion of employees and also for pays and perks.

- Financial Administration Division: This division is responsible for keeping books and accounts of the Bank.

- Establishment and Common Services Division: All Establishment and engineering works, common services and development works are done by this division.

- Departmentalization at branch level: It is a group job on the basis of product or customers flow. In my organization group job practice are being done in every department for example in general banking there are different group like

T.T section , D.D section , P.O section, O.B.C section, Cash section, Accounts section and IT section.

A group of officers has been working in every section, they have been working like a team and every member works towards its goal.

2.10 Hierarchy of AIBL:

In AIBL there is a system of hierarchy like top management to lower level officers i.e officers or positions are organized in hierarchy each lower one is being controlled and supervised by the higher one. In every division and department every official has an office order in order to perform his duties and which is duly supervised by his superior. The hierarchy may be mentioned as, board of directors, Managing Director, Divisional Heads, Departmental Heads etc.

2.11 Job Analysis of AIBL:

It means the number of subordinates a manager can manage efficienly and effectively in our organization. Every department has yearly man power plan which plan are overviewed by the management and if justified yearly man power plan approved by the management, work-load, daily s, proposal received and disposal trend assesses its man power needed.

2.12 Job Specification of AIBL:

Job specification involves employee’s skill abilities and others credentials need to do the job. In our organization every employees have job specification. Bbefore preparation of office order manager of respective division /department go through employees abilities, performance, experience etc. and decided job specification of employees who are working in his division /department.

2.13 Span of Control of AIBL:

In our bank various rank/designation is maintained. Including name of the Honorable director of the board are mentioned as under:

2.14 Designations of Employees of AIBL:

Executives of the Bank:

- Managing Director (MD)

- Additional Managing Director (AMD)

- Deputy Managing Director (DMD)

- Executive Vice President (EVP)

- Senior Vice President (SVP)

- Vice President (VP)

- Assistant Vice President (AVP)

Officials of the Bank:

- Senior Principal Officer

- Principal Officer

- Senior Officer

- Officer

- Junior Officer

- Assistant Officer

Sub Staffs of the Bank:

- Messenger Cum Guard (MCG)

- Driver

- Tea Boy

- Godown Supervisor

- Godown Guard

- Cleaner

Literature Review:

Our socio-economic as well as business world is dynamic, uncertain and affected by multiplicity of causes. There is hardly a field of human endeavor in which variables are not interrelated.

To analyze widely the performance of the bank we need to incorporate various statistical tools viz. Time Series Analysis, Growth Rate, Acceleration Rate, Correlation and Regression Analysis of the different variables used in the Bank.

These techniques undoubtedly provide a real picture of the bank and it help the general investors and stakeholders to review the quantitative and qualitative aspects of AIBL. To have a good grip of the aforesaid statistical tools we need to outline widely it’s importance and prospects.

Employees’ performances mean the quality of the job that the employees have done and how it has contributed to their organization’s goal achievement.

On the other hand financial performances mean what quality of the finance related products are produced by the organization and how they are satisfying their customer needs through the following criterion:

Growth Rate indicates the changes in the level of the variables over the period of time in relative term. With the help of the growth rate, we can forecast the value of a variable for a specific time in future.

Trend indicates the changes in the level of the variable in absolute term i.e. in original units of measurements. Moreover, trend indicates whether the variables are changing over a period of time.

Acceleration Rate is the average growth rate of the growth rates. It indicates the future trend of the growth rate.

Correlation Analysis is the study of the relationship between variables. It measures the strength of the association between two variables.

Regression Analysis is the statistical tool with the help of which we are in a position to estimate the unknown values of one variable from known value of another variable. It measures the relationship in absolute term.

To evaluate the performance of the AIBL properly, we need to focus on the following variables, which are lined below:

- Human Resources

- Deposits

- Investments

- Recovery

- Net Profit

- Earning Per Share (EPS)

- Total Assets

- Number of Branches

- Reserve Fund

- ROA

Analysis and Findings

4.1 Analysis of the study:

4.1.1 Employees’/Human ResourcesPerformances Evaluation:

In today’s business environment where technology plays a dominant role the importance of skilled human resources are ever increasing. The bank is fully committed to ensure a perfect fit between the right person for the right job and assist them to develop their core competencies and technical skills. A good working environment and people related policies generate team spirit and promotes a high level of loyalty, commitment and devotion on the part of its employees.

AL-ARAFAH ISLAMI BANK LTD. particularly stressed the need of training and sent a number of executives for various trainings and seminars abroad in 2004 to 2008. The Bank’s training institute conduc bank related various aspects of training and work-shops every month

4.1.2 Objectives:

The formal performance evaluation system is designed to:

- To maintain or improve each employee’s job satisfaction and morale by letting him/her know that the supervisor is interested in his/her job progress and personal development.

- To serve as a systematic guide for supervisors in planning each employee’s further training.

- To assure considered opinion of an employee’s performance and focus maximum attention on achievement of assigned duties.

- To assist in determining and recording special talents, skills, and capabilities that might otherwise not be noticed or recognized.

- To assist in planning personnel moves and placements that will best utilize each employee’s capabilities.

- To provide an opportunity for each employee to discuss job problems and interests with his/her supervisor.

- To assemble substantiating data for use as a guide, although not necessarily the sole governing factor, for such purposes as wage adjustments, promotions, disciplinary action, and termination.

4.1.3 Responsibilities:

- The Director of Human Resources has the overall responsibility for the administration of the Performance Evaluation Program and will ensure the fairness and efficiency of its execution:

1. The distribution of proper forms in a timely manner. - Ensuring completed forms are returned for file by a specified date.

- Reviewing forms for completeness.

- Identify discrepancies.

- Ensuring proper safeguard and filing of completed forms.

- Immediate Supervisor (Evaluator) is the employees’ “evaluator” and has the responsibility for:

- Developing Evaluation Support Form in concert with each employee.

- Continuously observing and evaluating an employee’s job performance.

- Holding periodic counseling sessions with each employee to discuss job performance.

- Completing Performance Evaluation Forms as required.

- Immediate Supervisor (Evaluator) is the employees’ “evaluator” and has the responsibility for:

Reviewing Official: The Reviewing Official is the “Evaluator’s” supervisor and has

the responsibility for:

1. Reviewing the evaluation for accuracy and objectivity.

2. Investigating and resolving any disagreement(s) between the

supervisor and the employee.

Directors: Within their respective areas will:

Ensure the proper and timely distribution of forms.

Ensure that any conflicts identified have been resolved in a fair and equitable manner in accordance with existing regulations.

4.1.4 Procedures :

Evaluation Support Form: An Evaluation Support Form will be completed for each employee. This is a joint effort between the employee and his/her immediate supervisor. Evaluation Support Forms will be completed for all new employees within five working days from date of employment. A copy will be given to the employee. The original will be retained by the immediate supervisor. This form should be reviewed annually and revised as necessary to indicate any significant changes in duties and/or responsibilities. The support form is designed to increase planning and relate performance to assigned responsibilities through joint understanding between the immediate supervisor (evaluator) and the employee as to the job description and major performance objectives.

Counseling Sessions between immediate supervisors and employees will be scheduled periodically. During these sessions, an open dialogue should occur which allows the exchange of performance oriented information. The employee should be informed of how well or how badly he/she has performed to date. In the case of derogatory comments, the employee should be informed of the steps necessary to improve performance to the desired level. Counseling sessions should include, but not be limited to, the following: job responsibilities, performance of duties and attendance. A memorandum for record will be prepared following each counseling session and maintained by the supervisor.

Upon receipt of the evaluation form, the following actions will be accomplished:

A. The Immediate Supervisor will:

Complete the evaluation form as promptly as possible. Note that any area evaluated as Inadequate, Minimally Meets Requirements, or Exceptional must be discussed in Comments section of the evaluation form. Describe why performance is not satisfactory and specify how performance can be improved, or explain why performance is outstanding.

Discuss evaluation with the employee emphasizing strong and weak points in job performance. Commend the employee for a job well done if applicable and discuss specific corrective action if warranted. Set mutual goals for the employee to reach before the next performance evaluation. Recommendations should specifically state methods to correct weaknesses and/or prepare the employee for future promotions.

Allow the employee to make any written comments he/she desires. Have employee sign the evaluation form and initial after supervisor’s comments.

Forward the original copy of the evaluation form in a sealed envelope, marked Personal-Evaluation Form to the appropriate reviewing official. Retain a copy of the completed form for the department and the employee.

Subsequent to the completion of this evaluation by the supervisor, and review by the employee, revisions must be discussed by both parties. In addition, if changes in the form are made after the employee has signed the form, the level of authority making the changes must notify the immediate supervisor and give the employee and supervisor copies of the revised evaluation.

- The Reviewing Official upon receipt will:

- Review the evaluation form for objectivity and accuracy. If the employee has stated that he/she disagrees with the evaluation, the Reviewing Official will attempt to resolve these disagreements prior to forwarding the evaluation form. Comments as to conflict resolutions are required.

- Forward the original evaluation form to the appropriate Director/Dean in a sealed envelope marked, Personal-Evaluation Form.

C. The Director will:

- Review each form to ensure proper actions have been taken to resolve any identified conflicts.

- Account for all evaluation forms in his/her area of responsibility.

- Forward all original forms together as a group to the Office of Human Resources in a sealed envelope marked Personal Evaluation Forms.

- Upon Human Resources’ receipt of the completed evaluation form, it will be reviewed for completeness and accuracy. Any unresolved problems will be brought to the attention of the next line of authority. The completed form will be placed in the employee’s permanent Personnel File.

New Employees will be evaluated during the fifth month of employment. On the first working day of the fifth month of employment, the Human Resources Office will send the new employee’s supervisor a Probationary Evaluation Form (ETSU Form 12). The evaluation form will be processed as outlined above. If job performance is judged to be unsatisfactory, a memorandum recommending termination will be forwarded with the completed Probationary Evaluation Form.

4.1.5 Traits to be evaluated

The following is a guideline which can be used in evaluating an employee’s overall performance:

Support Staff

- Knowledge of work – How well does the employee know his or her job? In order to successfully complete the duties and responsibilities of this position, what level of technical knowledge does the employee demonstrate?

- Quantity of Work – Is employee’s rate of production adequate? How does employee’s production compare with that of others? Does employee display efficient use of time?

- Quality of Work – Does the employee make frequent mistakes? Does employee’s performance require constant supervision in order to ensure accuracy? Does employee take pride in his/her work and strive for excellence?

Initiative – Does employee volunteer for new assignments and responsibilities? Does the employee require a great deal of supervisory guidance regarding initiative? Does employee initiate new methods or techniques?

Dependability/ Responsibility – Does employee consistently fulfill responsibilities? How much follow-up is required? How reliable is this employee?

Quality of Interpersonal Relationships – Does employee create resentment in fellow employees? How tactful is employee when communicating with fellow employees? Does employee promote teamwork? Is employee cooperative with fellow employees and supervisors?

Attendance – How often is employee absent or late? Does the employee notify his/ her supervisor promptly when absence or tardiness occurs? How does the employee’s attendance record compare with others?

Punctuality – Is the employee consistently prompt? Is there an impact on his/her job performance?

Supervisory Ability – Does employee exert a positive influence on others? Does employee demonstrate fair and equal treatment of subordinates? Does employee demonstrate the ability to make sound feasible decisions? Does the employee attempt to resolve problems at the local level?

Professional Non-faculty and Administrative

Professional Non-faculty and Administrative employees should be evaluated on predetermined and predefined goals and objectives. The supervisor should identify projects, tasks and special assignments important to the employee’s performance. In addition, the employee will be rated in the following areas:

- Job Knowledge – Possesses the technical knowledge necessary to accomplish all job requirements. Understands the facts and information related to work assignment

- Accomplishment of Objectives – Contributes to goals of department/division.responsible.

- Quality of Work – Consider the thoroughness, accuracy and dependability of results of work.

- Productivity – Meets deadlines, adapts to changes, uses resources efficiently. Uses good judgment in establishing priorities.

- Initiative and Creativity – Self-motivated, develops new methods and procedures.

- Interpersonal Relationships – Motivates and develops others. Builds teamwork. Communicates with peers, subordinates and others. Cooperates with persons outside of department.

- Supervisory Skills – Develops sound, practical solutions. Makes prompt decisions, accepts responsibility, resolves disputes.

- Dependability – Follows through to meet schedules. Makes sound decisions. Makes positive contributions. Consider reliability.

- Professional Contribution – Contributions made on the part of the employee to the staff, students, university, community and state or region.

4.1.6 Pitfalls in making Performance Evaluations:

A. The Isolated Incident

A rating should not be based on a few isolated performance incidents. When this is done, the rating is unfairly influenced by non-typical instances of favorable or unfavorable performances.

B. The “Halo” Effect

The “Halo” effect occurs when one factor influences ratings on all factors. Examples: An employee’s work is of good quality, therefore, other ratings (such as those on promptness or work quantity) are higher than normal. Another employee is frequently absent, with the result that the ratings on other factors are usually low.

The “Cluster” Tendency

The tendency to consider everyone in the work group as above average, average, or below average. Some raters are considered “tough” because they normally “cluster” their people at a low level. Others are too lenient. “Clustering” overall ratings usually indicates that the rater has not sufficiently discriminated between high and low levels of performance.

D. Rating the Job and Not the Individual

Individuals in higher-rated jobs are often considered superior performers to those in lower-rated jobs. This normally means that confusion exists between the performance appraisal and how the job has been evaluated.

Length of Service Bias

There is a tendency to allow the period of an individual’s employment to influence the rating. Normally, performance levels should be higher as an individual gains training and experience, but this is not always the case.

Personality Conflicts

Avoid judgments made purely on the basis of personality traits. Effective, efficient employees do not necessarily agree with everything a supervisor believes in or states.

4.1.7 Sugestions:

- Consider the entire appraisal period. Try to enumerate high points and low points in performance, then assign a rating that typifies the individual’s normal performance. Do not attempt to assign a rating to a performance indicator and then create justification to support it. Be able to explain the reason for each rating.

- In a group of people in similar jobs, performance is likely to be spread over most performance categories. Review your own record as a rater. Check the tendency to be either “too tough” or “too lenient” in your appraisals.

- Consider how an individual is performing in relation to what is expected. Rate the person’s performance, not importance of the job.

- Recognize that some people may never achieve top ratings, regardless of length of service. Watch closely the progress of newcomers and be ready to recognize superior performance if it is achieved.

4.1.8 Training & Motivation :

a. The Executives/Officers and concerned officials shall have to be trained intensively and extensively regarding the rules, procedures and modalities of Musharaka Investment so that no lapses occur at sanction and post sanction stage Moreover the supervision and control shall also have to be ensured at all stages to ensure end use, prevent diversion and generate income.Apart from the above training programmed for motivation and clear conception of Client shall have to be arranged before disbursement and after disbursement.

4.2 Financial Performances Evaluation:

The financial performances of the various tools/ products of AIBL can be summerised as following:

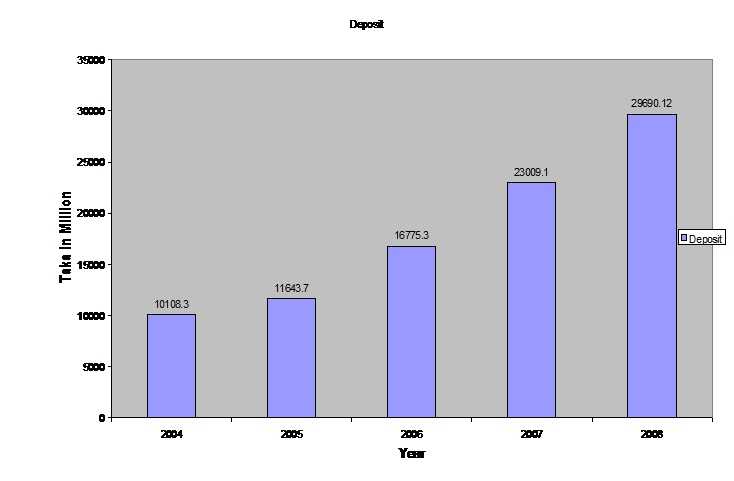

4.2.1 Deposit:

A sum of money left within a bank or financial institution for safe-keeping or to earn interest on it. It is the prime sources of bank’s investment, which allowed the bank to generate profit against the investment. Hence the deposit scenario of AIBL stands in the following manner:

From the above chart we can arrive at a conclusion that the deposit scenario of AIBL shows a consistent growth over the years . The deposit figure shows an increasing trend since its inception

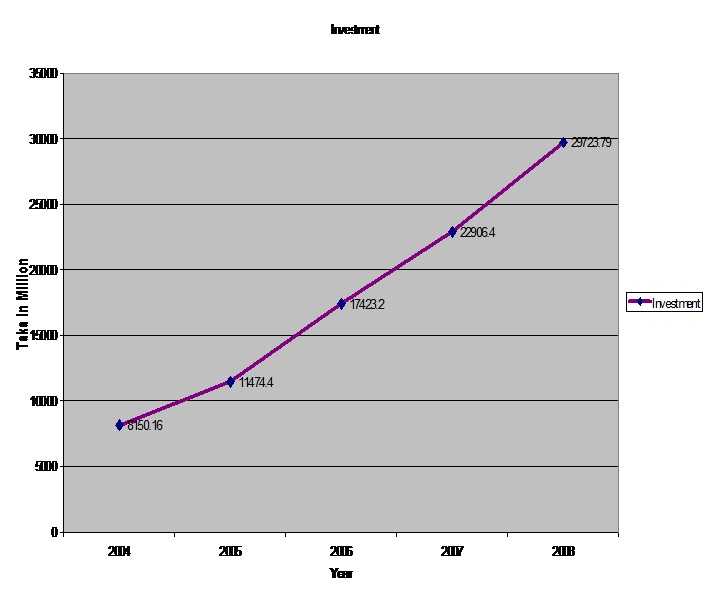

4.2.2 Investment:

The main source of income of the bank is investment and the main source of investment is depositors money.

The above chart reveals the facts that there is an inconsistent growth in the investment scenario. In the recent year the figure look brilliant compare to the past.

4.2.3 Bai-Murabaha or simply Murabaha:

The terms “Bai-Murabaha” have derived form Arabic words Bai and Ribhum. The word “Bai” means purchase and sale and the word ‘Ribhum’ means an agreed upon profit. So Bai-Murabaha means sale for an agreed upon profit. It may be defined as a contract between a Buyers and a Seller under which the seller sells certain specific goods permissible under Islamic Shariah and the word Law of the land to the Buyer at a cost plus and agreed upon profit payable today or on some date in the future in lump-sum or by installments. The profit may be either a fixed sum or based on a percentage of the price of the goods.

4.2.4 Musharaka:

The word Musharaka is derived from the Arabic word Sharikah meaning partnership. Islamic jurists point out that the legality and permissibility of Musharakah is based on the injunctions of the Holy Qura’n, Sunnah and Ijma (consensus) of the scholars.

Musharaka transaction may be conducted in the following manner:

One, two or more entrepreneurs approach an Islamic Bank to request the financing required for a project. The bank, along with other partners, provides the necessary capital for the project. All partners including the Bank have the right to participate in the project. The profit is distributed according to an agreed ratio. However, losses are shared in exactly the same proportion in which the different partners have provided the finance for the project.

4.2.5 Mudaraba:

The term Mudarabah refers to a contract between two parties in which one party supplies capital to the other party for the purpose of engaging in a business activity with the understanding that any profits will be shared in a mutually agreed upon. Losses, on the other hand, are the sole responsibility of the provider of the capital. The first party provides capital and the other party provides the expertise with the purpose of earning lawful profit (approved by Islamic law) which will be shared in a mutually agreed upon proportion.

4.2.6 Bai-Muajjal:

The term ‘Bai’ and ‘Muajjal’ are derived from the Arabic words ‘Bai’ and ‘Ajal’ where ‘Bai’ means purchase and sale and ‘Ajal’ means a fixed time or a fixed period. So Bai-Muajjal is a sale for which payment is made at a future fixed date or within a fixed period. In short, it is a sale on Credit. It is basically a contract between a buyer and seller under which the seller sells certain specific goods, permissible under Shariah and law of the country to the buyer at an agreed fixed price payable at a certain fixed future date in lump-sum or in fixed installments.

4.2.6 Bai-Salam:

The term Bai-Salam is used to define a sale in which the buyer makes advance payment, but delivery is delayed until some time in the future. Usually the seller is an individual or business and the buyer is the bank.

4.2.7 Bai-Istisna’a (Pre-shipment Finance):

The Istisna’a sale is contract in which the price is paid in advance at the time of the contract and the objective of sale is manufactured and delivered later. The majority of the jurists consider Istisna’a as one of the divisions of Bai-Salam. The definition can be stated as “It is contract with a manufacturer to make the something” and “ It is a contract on a commodity on liability with the provision of work”.

4.2.8 Qard-E-Hasana (Benevolent Loans):

It is a contract in which one of the parties (the lender) places into the ownership of the other party (the borrower) a definite parcel of his property, in exchange nothing more than the eventual return of something in the same value of the property loaned. Qard-E-Hasana loans are granted compassionate basis and no service charges are imposed on the borrower

4.2.9 Causes of Overdues and Procedures to be followed for recovery of irregular/stuck-up/overdue investment and time barred:

Irregular/stuck-up/over-due investment in a Bank increases at a faster rate and the same ultimately jeopardize the interest of the Bank. In this connection we append below the causes of irregular/Stuck-up and overdue investment for immediate attention of the concerned officials so that the trend in this regard can be arrested.

A) General causes of overdues :

01.00 Selection of the Client:

While selecting investment clients Branches do not give due weightage in this regard. As such clients having bad track record are also inducted for allowing investment. Selection of client should always be made strictly on the basis of criteria given in short as under:

a) The client should be an honest man of active habits with firm commitment. His honesty and integrity must be undisputed.

b) He must be a good businessman having sufficient experience in the related line of trade. He should also have good track record of repaying bank investment.

c) He must deploy his own capital in the business and capacity to bear the loss as well as to run the business. He must have foresight for predicting future market conditions.

d) He should deal in such commodities which have social utilities and Shariah permissibility.

02.00 Violation of Discretionary Power:

Investments are often allowed violating Discretionary Power of the Branch Manager which ultimately result in irregularities. Under no circumstances Discretionary Power should be exceeded. In case any investment is allowed due to emergencies of circumstances beyond Discretionary Power with prior permission of Head Office over telephone that should be got confirmed in writing and formal approval should be obtained without delay.

Command Area:

The Client must have business establishment within Bank’s command area. Some times branches make investment in remote/distant place beyond the command area of the branch. As a result branch can not ensure effective supervision and control over the investment. Therefore, while making investment, branches should ascertain that the business establishment of the investment client is within the command area or within reasonable distance for ensuring easy and effective supervision and control as well as constant follow-up for timely recovery of investment.

04.00 Net-worth of the party:

The net worth of the party must be ascertained properly. Nevertheless, the investment in business, cash flow and liquidity position are also to be ascertained. In fact Bank takes decision for making investment among others on the net-worth of the party. If the net-worth is not ascertained properly bank interest may be jeopardized subsequently.

05.00 Market report and confidential report :

Market report and Bank’s confidential report are not obtained. The means and standing of the party as well as performance with the previous/ present banker is to be obtained, checked and verified.

06.00 Cash flow :

Party’s own investment in business both in cash and kind should be properly ascertained. In addition cash inflow and outflow in business should also be examined by referring to statement of account.

07.00 Proper purchase & sale :

Proper purchase and sale of goods must be done correctly and possession of commodity shall be obtained. In this connection price, quantity and quality must be properly ascertained. Purchase memo/cash memo, shall be obtained in the name of the Bank.

08.00 Proper documentation :

Disbursement of investment are made before completing documentation formalities and obtaining proper securities. Proper charge documents in respect of collateral securities relating to property offered as collateral must be obtained. Original title deeds of mortgaged property, via deeds, C.S., S.A., R.S./B.S. and mutation parcha up to date rent receipt, non encumbrance certificate with charge fee receipt, Memorandum of deposit of title deeds, affidavit etc must be obtained.

Legal opinion on the title deed shall also be obtained from bank’s panel lawers.. Registered mortgage of property shall be obtained on execution of deeds drafted by legal advisor.

B)Causes of overdues of Musharaka Investment:

01.00 Quality and Quantity:

The quality and quantity of Murabaha goods are to be properly verified and checked at the time of purchase and storing. The Murabaha Goods should also be verified at regular interval to ensure that the quality is not deteriorating. While receiving the goods in the godown, the Officers concerned should verify the quality and quantity and ensure receipt of the goods in good conditions.

02.00 Over Pricing:

Goods should be purchased at the whole sale market price. Overpricing should always be avoided to avert possible shortfall. The price trend of the commodities for the last one year should be kept in view and accordingly percentage of cash security should be fixed-up so that Bank’s interest is not jeopardized due to fluctuation.

03.00 Slow Moving Items:

Murabaha Investment against slow moving/obsolete/hazardous/less demandable items should always be avoided

4.00 Control and Supervision of Godown:

Overnight watch and ward arrangement of godowns are to be made. Some times Godown Staffs are utilized for office works of the Branch which should be avoided. Godown Staffs must be deployed in godown for proper control and supervision of Murabaha Stock.

05.00 Inspection:

Authorized Officials must inspect the Godown at least once in a month and certificate in this regard must be kept in Branch record. The duties and responsibilities of Godown Staffs must be spelt out in clear terms. Branch must also ensure that the Godown Staffs are discharging their duties properly.

06.00 Excess Delivery:

Excess delivery and delivery without receiving payment result in unadjusted shortfall which is a gross irregularity and tantamount to defalcation. Therefore, it must be ensured that excess delivery or delivery without receiving payment does not occur.

07.00 Handling of the Keys of Godown:

Some times keys of the Godown are not properly handled and the same is delivered to the party. This is not only a great lapse but also fraught with great risk. Under no circumstances Godown Keys should be handed over to the party or any unauthorized person other than the Bank’s Officials.

08.00 Storing of Goods:

Very often Murabaha Goods are stored haphazardly and piled-up position . As a result the actual position of goods can not be ascertained. Goods must be stored in countable manner with due care so that the quality and quantity can be determined at any time.

09.00 Bank Signboard:

Bank signboard is not displayed in and outside the Murabaha Godown which must be invariably displayed.

10.00 Stack Card:

Stack Card should be displayed with up to-date information on each consignment for easy counting and identification.

11.00 Delivery Orders:

Delivery Orders should be issued properly filed in with necessary posting in Stock and Delivery Register.

12.00 Insurance:

Comprehensive Insurance covering value of entire stock + 10% above the cost should be obtained from enlisted Insurance Company.

13.00 Routation of Murabaha Stocks:

Some times the stock of goods against Murabaha/MPI remains stored for years together. Branch Managers should not allow the stocks to continue for a longer period to avoid damage, pilferage, licking and fall in demand/price.

C) Causes of overdues of Bai-muajjal Investment:

01.00 Party must have shop :

Bai-muazzal investment should not be allowed to any one who does not have own shop. The shop must be visited by the responsible official to ascertain his over all business position.

02.00 Assessment of investment need :

Since Bai-muazzal investment amounts to cash loan therefore the need of Baimuazzal Investment shall be carefully determined, Baim. Investment should not be more than 30% of own investment of the client.

03.00 Supervision :

Bank’s officials must pay regular visit to the shop of the investment clients so that the investment client feel obliged to make regular transaction in current account as well as repay investment in time.

04.00 Stock in business :

Stocks in Business are not verified by obtaining Stock Report at regular intervals. Monthly stock-report should invariably be obtained from the clients.

05.00 Proper and adequate collateral :

Proper adequate and easily saleable collateral securities are to be obtained. Value of the collateral security is to be properly assessed and forced sale value thereof should be ascertained correctly.

06.00 Insurance :

Insurance shall have to be obtained covering risk of fire RSD etc. on hypothecated stock which many branches don’t obtain.

07.00 Follow-up :

Follow-up and frequent contact before due date and constant persuasion on or before due date are to be made by the branches for timely adjustment and to avoid over dues.

D) Causes of overdues of Hirepurchase under Shirkatul Melk Investment :

01.00 Abstention of equity :

Equity as per norms and practice is not being recovered before disbursement of HP(SM) investment. Proper and adequate equity should invariably be obtained supported by collateral security for the rest amount.

02.00 Model and Make:

Machinery and Vehicle of recent model and make shall have to be procured. Before procuring machinery and vehicle, it’s technical feasibility must have to be ascertained. From the experience it is observed that unless machinery and vehicle, is found technically viable the investment client cannot repay the investment as per schedule. In case of vehicle it must be get registered in Bank’s name only and insurance cover note, road permit, tax token must be obtained in Bank’s name.

03.00 Supervision :

The vehicle/machinery must be inspected at least once in a month so that the same cannot be shifted elsewhere/another route/place without Bank’s knowledge.

04.00 Taking of possession :

In the event of party’s failure to pay 3(three) consecutive installment the vehicle/machinery shall have to be taken into Bank’s possession, if necessary, with the help of law enforcing authority.

05.00 Renewal of insurance :

On expiry of previous insurance fresh insurance cover shall have to be obtained.

E)Procedures to be followed for recovery of irregularities/stuck-up/overdue and time barred investment:

To regularize/recover irregular/stuck-up/overdue investment and in order to overcome the situation all concerned shall adhere to the following procedures for recovery of aforesaid investments. In this regard a brief definition of irregular/stuck-up/overdue investment is also given.

01.00 Definition of irregular/stuck-up/over due investment:

i) Irregular Investment:

An investment is said to be irregular when regular repayment is not made as per schedule of repayment, improper documentation leads to non-repayment and when value of security falls down/security become obsolete or security available does not patch the investment outstanding.

ii) Stuck-up Investment:

An Investment is said to be stuck-up when repayment is stopped as a result of closing of business, death of Investment Client and for any other unforseen circumstances rendering the investment client unable to pay.

iii) Overdue Investment:

An Investment is said to be overdue when repayment does not come within the period of investment or expiry of the limit and in case of bills repayment is not received on due date.

02.00 Producers to be followed for recovery of irregular/stuck-up/ overdue investment:

i) Contacting the investment client in writing and meeting personally:

In order to ensure timely recovery of investment, supervision at all stage shall be ensured. This will include supervision from the date of disbursement to total repayment. In case repayment as per schedule does not come the Manager shall personally enquire about the causes of non repayment. If he is convinced that the difficulty is temporary in nature and is likely to overcome shortly he should discuss the situation with the investment clients and obtain reasonable definite repayment schedule under intimation to Head Office.

Apart from the above as and when any investment becomes irregular/stuck-up/ likely to be overdue, the Branch Manager apart from contacting the borrower in writing shall also consult discuss with the investment clients about his/their difficulties in regularization/ repayment thereof. If necessary the Manager will give suggestion in consultation with Head Office for overcoming the difficult situation. He will personally pursue in such a manner with the investment client so that investment can be realized without hindering good relationship with the investment clients. If necessary he will utilize the influence of the local elites to insist the party to make repayment.

ii) Sending Resume of Investment to Head Office:

Branch Manager will send the Resume of Investment Vide F-87 mentioning therein the latest position of investment, security, irregularities occurred and the efforts made in the meantime for regularization/recovery of the investment as well as suggesting future action.

iii) Issuance of Registered Notice:

If persuasion does not bring any fruitful result he will issue a final registered demand notice impressing upon the client concerned to repay within 15 days time from the date of receipt of the letter with acknowledgement due.

iv) Legal Notice to be issued:

If the investment client does not come forward to repay within a reasonable period, legal notice is to be served through panel lawyer of the Bank with copy endorsed to Head Office. The reaction of legal notice is also to be brought to the knowledge of Head Office with comments of the Branch Manager for further instructions.

v) Suit to be filed:

If filing of suit is allowed by Head Office the same should be filed against the debtor/client concerned and the Guarantor if any under Civil Procedure Code 9 for specific performance to be deemed as breach of contract. In case the investment is not covered by collateral security suit is to be filed with attachment of assets before judgment. On the other hand if the investment is secured by Mortgage of Property Title Suit is to be filed. The copy of plinth as well as copy of written statement submitted by dependent is to be submitted to Head Office for record.

vi) Disposal of Murabaha Stock:

In case where the investment is secured by pledge of stock it should be mentioned in the Registered Notice that in case the party fails to lift Murabaha goods on making repayment, the Bank shall dispose off the same by inviting open tender through National/Local daily.

vii) Inviting Tender for Disposal of Stock:

In spite of the above if the client does not come forward to lift the goods, tender notice shall be published in two National/Local daily on obtaining Head Office approval. The goods shall be delivered to the highest tendered on obtaining Head Office approval and money/title suit as the case may shall be filed for short fall (if any). For minimizing the cost of advertisement, Tender/Sale Notice of several clients shall be published through one Tender/sale Notice.

viii) Criminal Suit for Recovery of Vehicle/Machineries:

In case of Hire Purchase Investment, criminal suit under section 406/420 read with section No.98 or 100 CRPC for breach of contract as well as issuance of search warrant for recovery of immovable/movable that is transport/machineries shall be filed in case the investment client fails to repay the installment as per schedule and also do not surrender the assets. After taking possession of the assets, the same shall be sold by inviting tender and Money Suit under section 9 of the Civil Procedure Code for specific performance to be deemed as breach of contract if not backed by Mortgage of property or Title Suit/Mortgage suits for realization of money by selling the mortgaged property wherein mortgagor also can purchase the auctioned property under Civil Procedure Code.

03.00 Difficulties faced while Suit is filed and after filing of Suit:

As and when money suit/title suit is filed Bank may face the following difficulties:-

i) Service of Demand/Legal Notice:

The 1st difficulty is that demand/legal notice can not be served for lack of proper and correct address. Therefore, while opening the Account and initiating investment the residential address and permanent address of investment clients and guarantor shall be correctly recorded and accordingly final/legal notice shall be served.

ii) Non-availability of Property Particulars:

Apart from the above the full particulars of assets of investment clients must be obtained while allowing investment so that simultaneously with the filing of Money Suit, attachment of asset before judgment can be made and subsequently decree can be executed on the available assets of the judgment debtors.

04.00 Steps to be taken after filing of Suit:

After filing of suit the following steps shall be taken:

i) Branch shall follow-up the progress of the suit effectively with the legal advisor by constant touch with him for speedy disposal of cases/ suits.

ii) Quick service of Summons on the dependant shall be ensured. In case normal service of Summons is not possible, arrangement shall be made for substitute service i.e by way of publication of Summons on the daily newspaper.

iii) Steps shall be taken for attaching the assets of investment clients before judgment so that Bank’s interest remains secured/ safeguarded.

iv) Steps shall be taken for issuance of decree by the court at the earliest. As soon as the decree is given by the court certified copy shall be obtained and true copy shall be sent to Head Office. A copy of the decree shall also be sent to the judgment debtor impressing to payoff as per terms of decree.

v) It shall be ensured that payment by the judgment debtor is made as per terms of decree. In case of default execution case shall be filed without delay unless otherwise advised by Head Office & decrial amount shall have to be recovered on auctioning the property of the judgment debtor.

vi) After filing suit if any compromise prayer is done by the dependent, the terms and conditions of compromise petitions shall be sent to Head Office prior to filing/ submitting the same in the court.

vii) If any prayer for amicable compromise is made by the investment client at any stage, the same shall be sent to Head Office with comments and observation of the Branch Manager for consideration of Head Office.

viii) When there is no chance for recovery of any irregular/stuck-up/over due investment even by taking legal action the investment shall be treated as “Bad” . It may be mentioned that an investment becomes bad for the following reasons:

a) The financial condition of investment clients turns out poor and his business is collapsed and there is no realizable asset.

b) Borrower is not traceable and all efforts to find him out fail.

c) Investment becomes timbered for taking legal action.

Considering the above points if the Manager is convinced that the investment should be written off he shall seek permission form Head Office for submitting write off proposal in this regard.

05.00 Time barred by limitation :

i) Responsibility of time barred:

If any investment becomes time barred by limitation it will be the personal liability of the Branch Manager as well as investment-in-charge if any.

In this connection the procedure for computation of time barred by limitation & steps for regularization is appended below.

ii) Limitation is for three years if debt is not backed by mortgage of property and twelve years if backed by mortgaged property:

If the Bank’s investment is not backed by any mortgage of immovable property it becomes time barred after 3 (three) years from the date of initiation. In case of investment secured by Mortgage of Property the limitation for filing suit is 12 years form the date of initiation.

iii) Computation of limitation if debt is acknowledged in writing or by signing the deposit pay-in-slip:

Provided further that before expiry of the above period if the investment client acknowledge in writing signed by himself or by his duly authorized agent or any payment made by respective borrower by deposit slip signed by him or his authorized agent, a fresh period of limitation shall be computed from the time and date when acknowledgement of debt is signed by him authorized agent or part payment of debt is made by him under his signature or his authorized agent. The deposit of profit if specifically mentioned in the pay-in-slip will, however, not save the limitation.

iv) Signing of Blank Charge Forms including Balance Confirmation shall be treated as acknowledgement debt:

The signing of fresh demand promissory note, letter of continuity or balance confirmation slip by the borrower or by his authorized agent before the expiry of above prescribed period of limitation may be treated as an acknowledgement of debt so as to compute the fresh period of limitation from the date thereof.

v) Mere receipt of Demand Notice or Legal Notice do not constitute acknowledgement of debt:

In this connection, it may be mentioned that mere receipt of the demand notice or legal notice by the borrower or by his duly authorized agent by signing the acknowledgement receipt thereof can not be treated to be an acknowledgement receipt of debt because the acknowledgement receipt bears the testimony of the receipt of the letter and not the contents of the letter i.e. do not testify the acknowledgement of debt by the borrower. The mere reply of bank’s notice without specific admission of debt can not also be treated to be an acknowledgement of debt.

vi) After becoming time barred only abstention of acknowledgement of debt in writing with promise to repay in writing shall save limitation:

But if after the expiry of the above prescribed period of limitation, i.e. three years in case of money suit and twelve years in case of mortgage suit, from the date of initiation of investments, the borrower or his duly authorized agent makes any such acknowledgement of debt or any part payment of his debt or profit as mentioned above the dues shall not be saved from the limitation or the dues shall not get a fresh lease of life unless the borrower or his duly authorized agent along with his acknowledgement of debt in writing also promises in writing to repay signed by him or his duly authorized agent to pay the balance of outstanding dues.

vii) Limitation shall expire as on the last day of the year instead of any date within the year as per calculation:

Provided further that if the account is current, open and mutual where there has been reciprocal demands, between the parties, computation period of limitation shall commence from the date of last credit entry and will extend up to the calendar year, i.e. , if the last date of credit entry is 02-10-1996 limitation shall expire on 31-12-1997 and not on 01-10-97

4.2.10 POSITION IN THE STOCK MARKET:

Bank’s share sustained a steady strong position throughout since its inception at Dhaka and Chittagong Stock Exchange in 1998. In Dhaka Stock Exchange the face value of Taka 100 of the share was traded at Taka 588.75 highest in 2008. The market trend of the bank’s share in Dhaka Stock Exchange between January 2008 to December 2008 is stated below:

| MONTH | HIGHEST | LOWEST | CLOSING |

| January | 450.00 | 390.00 | 395.00 |

| February | 415.00 | 375.00 | 379.50 |

| March | 405.00 | 343.25 | 374.50 |

| April | 404.00 | 368.00 | 396.00 |

| May | 466.00 | 355.00 | 394.71 |

| June | 588.75 | 437.25 | 489.75 |

| July | 505.00 | 405.00 | 410.00 |

| August | 464.00 | 390.00 | 437.75 |

| September | 445.75 | 415.00 | 426.75 |

| October | 448.00 | 411.00 | 415.25 |

| November | 458.00 | 410.75 | 421.00 |

| December | 460.00 | 416.00 | 444.25 |

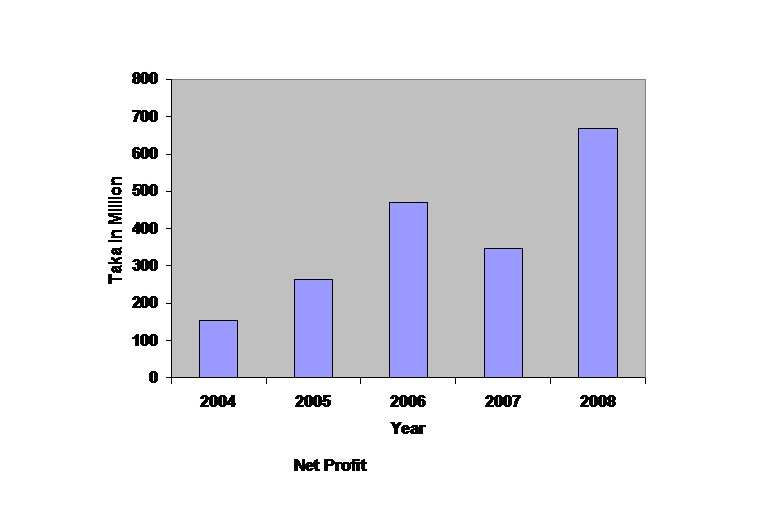

4.2.11 Net Profit:

Net profit is the profit of an organization when all receipts and expenses have been taken into account. It is an important indicator for measuring the success altitude of any organization. Thus the net profit scenario of AIBL sets in the following fashion:

The net profit scenario follows the similar trend in the earlier years except in the year 2007, where it performs a lower growth in terms of net profit. The current year’s performances would undoubtedly favors the stakeholders of AIBL. The current year’s success of the bank would certainly prove the fact that the performance of the bank showing a good progress.

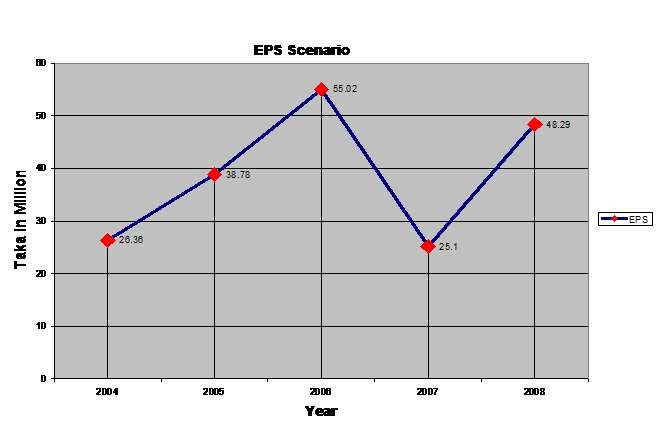

4.2.12 Earning Per Share (EPS):

The profit in pence attributable to each ordinary share in a company based on the

consolidated profit for the period, after tax and after deducting minority interests and

preference share dividends. This profit figure is divided by the number of equity shares in issue that rank for dividend in respect of the period. The EPS scenario of AIBL stands at the following way:

From the above graph, we can conclude that EPS growth shows an inconsistent trend. Over the years, the results show unexpected growth in certain years. Moreover, it rises and falls throughout the time period. In addition the EPS figure looks quite brilliant in the current year.

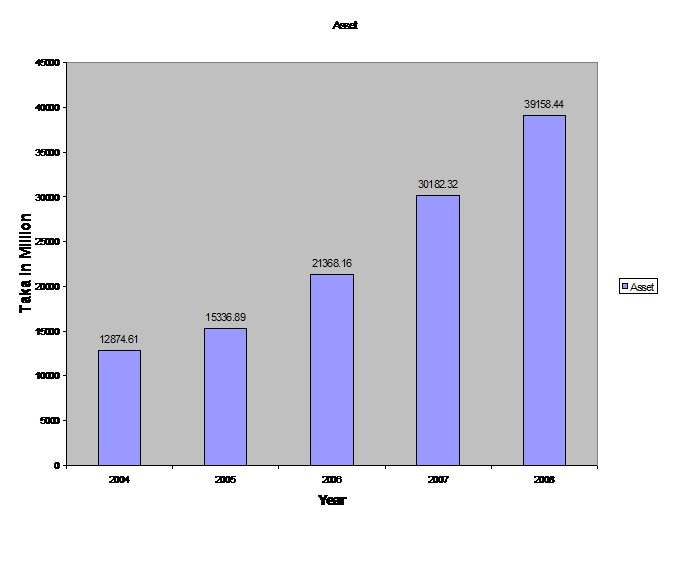

4.2.13 Assets:

Any object, tangible or intangible, that is of value to its possessors. It is used for creating the value of the organization. An asset is liquid if it can be disposed of quickly with relatively small price changes. The practice of an asset is an important needle for judging the dynamics of any organization. The asset position of AIBL is shown below:

From the above chart we can conclude the asset position of AIBL always look to grow gradually over the years. In the year 2007 and 2008, the assets figure look brilliant which itself states the progress of the bank.

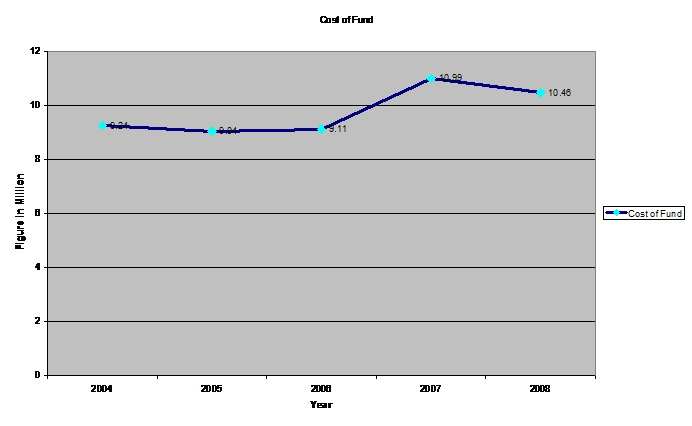

4.2.14 Return on Assets (ROA):

An accounting ratio expressing the amount of profit for a financial year as a percentage of the assets of the company. ROA is an important measure of a company’s profitability. ROA measures the return of assets. The ROA of the AIBL positions in the following manner:

In the earlier years the ROA of AIBL were poor compare to the recent years performance. It also reveals that from the year 2007 ROA rises alarmingly and a slight fall in the year 8

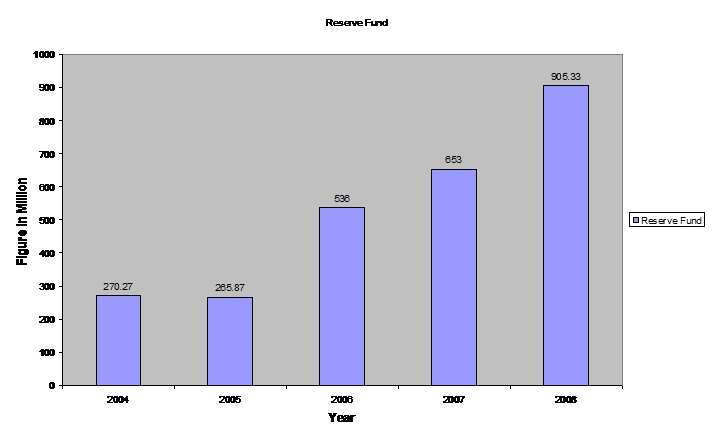

4.2.15 Reserve Fund:

It is the part of the company other than the share capital largely arising from the retained profit or from the issue of share capital at more than its nominal value. Reserves are surpluses not yet distributed and in some cases not distributable. The AIBL reserve fund stand at a following trend:

The chart shows gradual increase in the reserve fund since it’s inception. Moreover, AIBL tends to reserve a rich portion of their profit in the reserve fund in the recent years. Whereas, in the earlier years the reserve fund were pretty low. Hence we can conclude that AIBL have the wider opportunity to go for investment from its internally generated fund in the recent years.

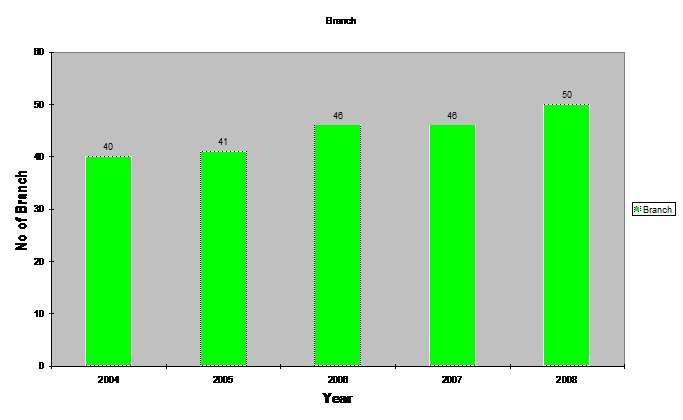

4.2.16 Branches :

The branch represents the number of outlets of an organization countrywide where the services are being provided to the customers. The branch growth of AIBL can be shown in the following table

From the above chart we can conclude that the number of branches operating over the country were relatively constant excluding the earlier few years. The bank started its operation with 20 branches but as the year passes by AIBL prefer to increase the number of branches to fulfill the need of the customers.

Growth Rate

Variables | Remarks |

Deposits | During the period 2004 to 2008, the deposits of AIBL increased at a rate of 29.04% per year. |

Investment | From the period 2004 to 2008, the investments of AIBL increased at a rate of 29.76% per year. |

Net Profit | During the period 2004 to 2008, the Net Profit of AIBL increased at a rate of 92.40% per year. |

EPS | From the period 2004 to 2008, the EPS of AIBL increased at a rate of 92.39% per year. |

Assets | During the period 2004 to 2008, the Assets of AIBL increased at a rate of 29.74% per year. |

Branches | From the period 2004 to 2008, the Branches of AIBL increase at a rate of 8.70% per year. |

Reserve Fund | During the period 2004 to 2008, the Reserves of AIBL increase at a rate of 38.59% per year. |

ROA | From the period 2004 to 2008, the ROA of AIBL increase at a rate of 5.72% per year. |

4.3 Findings of the Study:

This section of the report contains findings of the study. The findings are the outcome of the syntheses of the analyzed data as well as analysis of the Performance Evaluation collected from various sources like different mannuals, annual reports, circulars, practical knowledge etc. The presented data is analyzed and interpreted to dig out the major salient features of the Performance Evaluation of AIBL practiced at present. Synthesis of the analyzed primary as well as secondary data covering different qualitative variables of the study, reviewing of a number of printed documents and oral discussion with the employees resulted in a series of findings as follows :

- Performance Evaluation procedures of Al-Arafah Islami Bank Limited are more or less like other banks.

- Performance Evaluation procedures of AIBL may be adopted with current procedures of other Banks.

- Current Data oriented questions may be introduced in the Evaluation procedures.

- Business related subject may be preferred for performance evaluation in AIBL.

- Scientific methods are to be followed for Performance Evaluation Procedures.

4.3.1 Comments of Bangladesh Bank:

Audit & Inspection Report:

In 2008, the Inspection team of Bangladesh Bank has inspected the branches of the bank. The inspection reports have been presented and discussed in the meeting of the Audit Committee of the Board of Directors. Necessary corrective measures have been taken against repetition of the lapses according to the minutes of the meeting. The lapses/irregularities find out by Bangladesh Bank are comparatively less than previous years.

Rating Report:

As per Bangladesh bank’s guidelines the Credit Report Information Services Ltd. (CRISL) in 2007 the long term and short term grading were BBB+ and ST-3 respectively.

Conclusions:

Banking is a business encompassing their employees and the broader communities, as well as their shareholders and customers. They believe that shareholder value is driven by the satisfied and loyal customers. They achieved good success last years, there were number of challenges as they move forward. We hope that the bank will continue to successfully deliver excellent results, meeting their financial and operations objectives-as well the needs of their customers and their people. May the Almighty Allah give them dedication, patience and fortitude to serve the cause of Islam and to go ahead with their mission to run the Bank as per the principles of Islamic Shariah.

Recommendations:

In recommendations we would like to cite some problems and suggestions thereagainst in achieving its goal as well as the prospects of the bank.

From our above all the analysis, we can stand at a fact that AIBL shows a good progress since its inception. Although it started slowly in the initial years but due to sound management and better efficiency in the operation have resulted its performances to upfront in the coming years.

After analyzing all the selected variables under study, it seems to deliver somewhat the similar result i.e. in the recent years the performance of the bank was up to the mark and it represents the dynamic efficiency of AIBL.

In addition, we believe that AIBL could progress further if they better utilize their reserve funds and go for some calculated risky projects. Moreover, the better management and efficient operation would undoubtedly lead the bank to reach at the highest peak of success and to stand at a better place compare to other private commercial banks.

So, my specific suggestions in this regard are:

- There are acute shortage of qualified employees. So, more highly qualified performance oriented eployees should be appointed.

- All of the technologies of the bank are not latest. More latest technologies should be adopted.

- Management policies of the bank is poorer ; they should be more satisfactory, justified and stronger.

- Performance evaluation procedures of the bank are not up to the mark; they shoud be upgraded.

- The evaluation procedures must be result oriented and cost effective.

- Financial statements of the bank should be prepared on the basis of current data.