Variable costing is a cost concept in managerial accounting. It is a methodology that only assigns inventory variable costs. Manufacturing overhead is incurred during the production of a product using this method. This method entails charging all overhead costs to expense in the period in which they are incurred, while direct materials and variable overhead costs are charged to inventory. This addresses the issue of absorption costing, which allows income to rise in tandem with production.

Management can use an absorption cost method to shift costs to the next period when products are sold. This artificially inflates profits during the production period by incurring fewer costs than would be incurred under a variable costing system. Variable costing is not commonly used for external reporting. Under the Tax Reform Act of 1986, income statements must use absorption costing to comply with GAAP.

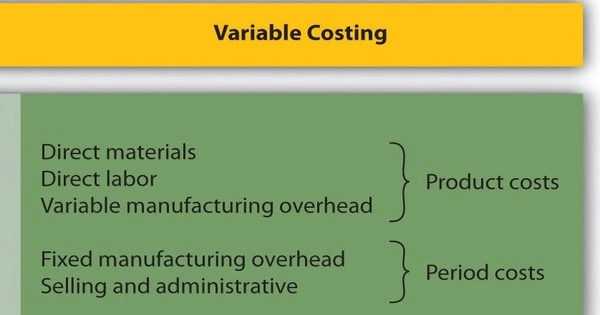

Variable costing is a costing method that includes only variable manufacturing costs in unit product costs (direct materials, direct labor, and variable manufacturing overhead). In contrast, absorption costing allocates the fixed manufacturing overhead to the products produced. Variable costing is not permitted in financial reporting under accounting frameworks such as GAAP and IFRS.

Management frequently employs variable costing to aid in making a variety of decisions. For example, a breakeven analysis could be used to determine the sales level at which a company earns no profit. Another option is to use it to determine the cheapest price at which a product can be sold. Another application is to convert internal financial statements into a contribution margin format (which must be adjusted before they can be issued to outside parties).

A variable cost is a business expense that varies according to how much a company produces or sells. Variable costs rise or fall in relation to a company’s production or sales volume, rising as production increases and falling as production decreases. Variable costs include the costs of raw materials and packaging for a manufacturing company, as well as credit card transaction fees and shipping expenses for a retail company, which rise and fall with sales. A variable cost is distinguished from a fixed cost.

Variable Costing in Financial Reporting

Although accounting frameworks such as GAAP and IFRS prohibit the use of variable costing in financial reporting, managers frequently use this costing method to:

- Conduct a break-even analysis to determine the number of units required to begin earning a profit.

- Calculate the contribution margin for a product to better understand the relationship between cost, volume, and profit.

- Make decision-making easier by excluding fixed manufacturing overhead costs, which can cause issues due to how fixed costs are allocated to each product.