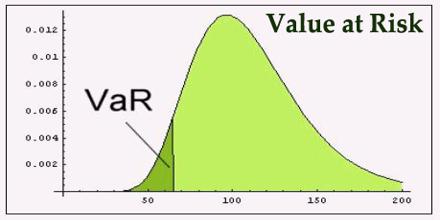

Value at Risk is a measure of market risk, and is equal to one standard deviation of the distribution of possible returns on a portfolio of positions. It is commonly used by security houses or investment banks to measure the market risk of their asset portfolios. It is widely applied in finance for quantitative risk management for many types of risks. It is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses. It is sometimes taken to refer to profit-and-loss at the end of the period, and sometimes as the maximum loss at any point during the period.

Value at Risk