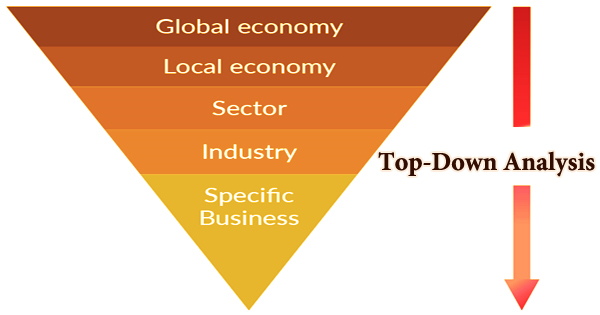

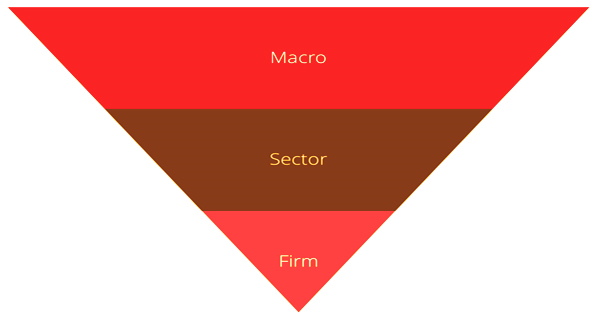

Top-down analysis begins with macroeconomic statistics and progresses to a more detailed sector examination. It’s all about looking at the broad picture when it comes to the sectors or industries where investors want to put their money. Top-down investment differs from bottom-up investing, which begins with a company’s fundamentals, where the majority of the focus is placed, and then works its way up through the structural hierarchy, with macro-global economic variables being considered last, if at all.

After the recognizable proof of stocks and areas, the subsequent stage includes noticing the inside and out data just as fiscal reports to settle on an official conclusion for speculation. A hierarchical methodology will consistently begin at the most elevated level, that is, figuring out which nation has the best speculation environment. Gross domestic product, or GDP, is a widely used metric at this level. This metric is a useful way to compare different nations.

Bottom-up investment, on the other hand, is concerned with the performance and fundamentals of individual firms. Many investors use GDP because it is a comprehensive indicator of economic growth. While GDP is an essential element to examine, an investor must also consider other factors. Hierarchical contributing can assist financial backers with conserving on the time and consideration they need to apply as a powerful influence for their speculations, however can likewise pass up conceivably beneficial individual ventures.

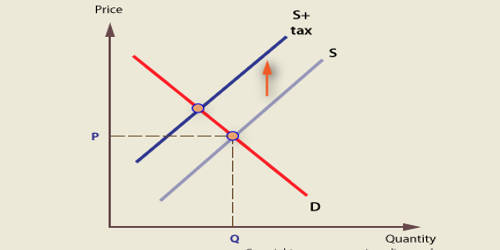

Industries that fit under those macro trends are evaluated, and then individual companies within those sectors or industries are chosen. Before deciding to invest in a country, global investors should analyze its political climate. Although a rapidly rising economy might result in fast-growing businesses, the securities sector may require a significant amount of capital.

The objective is to discover specific mechanical areas that are gauge to beat the market. Any financial backer who selects hierarchical examination starts with an investigation of worldwide patterns. To find out the monetary soundness of the economy, the financial backer can allude to the total national output of created just as creating economies. Plus, investors must recognize if the organization has any international dangers implied.

Rather than evaluating and betting on particular firms, top-down investors allocate assets from efficient, diversified asset allocations. All marketing activities will be more effective if you keep that average consumer in mind. Not only did it allow for the estimate of a prospective market; it also made the process extremely easy and efficient. A country’s economy may be largely reliant on a single industry, such as agriculture or energy.

You won’t obtain the high returns if you diversify your assets across other industries that aren’t performing well, as you would if you focused on the thriving industry. Top-down investing can make better use of an investor’s time and attention to relevant data because it focuses on large-scale economic aggregates and publicly available data and involves selecting from a small number of broad regions or sectors rather than the entire universe of individual company stocks.

On the off chance that the GDP of a country is continually developing, it demonstrates its great presentation. In the event that, the financial backer needs to put resources into a particular area, then, at that point the individual might utilize the worldwide investigation for restricting between countries falling in that area. Utilizing hierarchical investigation requires a lot of examination. You must compare not just the economics of various nations, but also the economies of different sectors within the chosen state. This indicates that the chances of picking a firm that is on the decline are slim, lowering your investment risk.

Hierarchical investigation, thinking about the specialized examination, offers bits of knowledge on the costs of protections differing from bigger time span to more limited ones. Since each hierarchical examination starts with a worldwide standpoint of the economy, it’s profoundly far-fetched for financial backers to be surprised by disturbances. This method, in theory, demands an investor to stay current on global concerns as well as whole economies. Given the wealth of knowledge, these investors have about global events and interconnected networks, predicting trends in many industries is simple.

However, by excluding whole industrial sectors or nations from consideration, even firms inside them that outperform the overall market, it may lose out on a significant number of potentially profitable possibilities. In summary, when investors perform a top-down study, they first get a comprehensive view of the economies and industries they wish to invest in. It implies they evaluate the economic growth rates of various countries throughout the world. Top-down portfolios often consist mostly of index funds that follow certain regions or industrial sectors, with some commodities, currencies, and individual stocks thrown in for good measure.

Information sources: