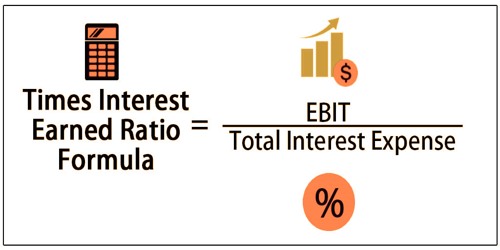

Times interest earned (TIE) ratio or interest coverage ratio is a calculation of the willingness of a company to satisfy its debt obligations on the basis of its current sales. It may be calculated as either EBIT or EBITDA divided by the total interest expense. An effect is a number that indicates how many times a firm with its pretax earnings will cover its interest charges. TIE ratio refers to the group of solvency ratios because disbursement usually emerges on a long-term basis (e.g., coupon payments on bonds outstanding), so it will be treated as fixed expenses. Thus, the time’s interest earned ratio measures the solvency of a corporation within the future.

The time interest ratio is called a solvency ratio in certain ways since it calculates the willingness of a company to make interest and debt service payments. A better TIE number means that a firm has enough cash to continue investing in the company after paying its debts. The formula of times interest earned ratio is expressed as follows:

Times Interest Earned (TIE) Ratio = EBIT or EBITDA / Interest Expense × 100%

At the point when the premium inclusion proportion is littler than one, the organization isn’t producing enough money from its activities EBIT or EBITDA to meet its advantage commitments. The Company would then need to either go through money close by to have the effect or get reserves. Since these intrigue installments are normally made on a drawn-out premise, they are regularly treated as a continuous, fixed cost. Nonetheless, the TIE proportion means that an organization’s relative opportunity from the imperatives of obligation. It is easier to create enough cash flow to continue investing in the company than just getting enough money to stave off the bankruptcy.

For purposes of solvency analysis, interest payments and income taxes are also listed separately from the usual operating expenses. The capitalization of a company is the amount of money it earned by selling stock or debt and those options have an effect on its TIE ratio. Businesses calculate the cost of stock and debt capital and use the cost to make decisions. The ratio of interest received times shows to what extent profits are available to cover interest payments.

A higher premium earned proportion is positive since it shows that an organization has enough income to pay its advantage cost. Along these lines, this proportion is a significant measurement for leasers of an organization. When in doubt, organizations that create predictable yearly profit are probably going to convey more obligation as a level of complete capitalization. If a lender has a history of steady earnings production, a better credit risk would be considered for the company. A lower number suggests a firm has insufficient profits in the long term to satisfy its debt obligations.

Utility companies, as an example, generate consistent earnings. Their item isn’t a discretionary cost for buyers or organizations. Some service organizations raise 60% or a greater amount of their capital by giving obligations. The TIE proportion demonstrates how often an organization could pay the enthusiasm with it’s before charge salary, so clearly the bigger proportions are viewed as more good than littler proportions. The real estimation of TIE proportion ought to likewise be contrasted and that of different organizations working in a similar industry.

In comparison, start-up companies and businesses that have volatile earnings collect much or all of the capital they use by issuing stock. In other words, a ratio of 4 means that a corporation receives enough money to pay 4 times more than the overall interest cost. Saying another way, this company’s profits for the year is four times higher than its interest cost. If a firm sets a track record of delivering reliable earnings, it can also start raising capital through debt offerings.

Information Sources: