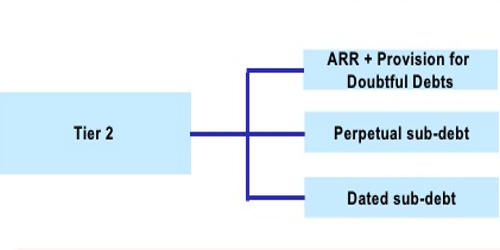

Tier 2 capital includes a number of important and legitimate constituents of a bank’s capital requirement. It is designated as supplementary capital and is composed of items such as revaluation reserves, undisclosed reserves, hybrid instruments, and subordinated term debt. It is the secondary layer of a bank’s capital held as required reserves. These forms of banking capital were largely standardized in the Basel I accord, issued by the Basel Committee on Banking Supervision and left untouched by the Basel II accord. Tier 2 capital is comprised of revaluation reserves, general provisions, subordinated term debt, and hybrid capital instruments. National regulators of most countries around the world have implemented these standards in local legislation. In the calculation of regulatory capital, Tier 2 is limited to 100% of Tier 1 capital. Tier 2 capital is considered less secure than Tier 1 capital, and in the United States, the overall bank capital requirement is partially based on the weighted risk of a bank’s assets. Tier 2 capital is used to determine a bank’s capital adequacy ratio (CAR) – a measure of a bank’s ability to absorb losses.

Undisclosed reserves

Undisclosed reserves are the reserves a company is holding that is not being disclosed on their financial statements. They are not common but are accepted by some regulators where a bank has made a profit but the profit has not appeared in normal retained profits or in general reserves of the bank. These are those reserve which has been passed through profit and loss account and are accepted by bank supervisory authorities. Undisclosed reserves must be accepted by the bank’s supervisory authorities. Many countries do not accept undisclosed reserves as an accounting concept or as a legitimate form of capital.

Revaluation reserves

A typical revaluation reserve is a building owned by a bank. A revaluation reserve is a reserve created when a company has an asset revalued and an increase in value is brought to account. Over time, the value of the real estate asset tends to increase and can thus be revalued. A simple example is a situation where a bank owns the land and building of its head-offices and bought the properties for $100 a century ago. A current revaluation is likely to reflect a large increase in value. The increase would be added to a revaluation reserve.

Revaluation reserve arises in two ways:

- From a formal revaluation carried through the balance sheet.

- Notional addition to the capital of hidden values which arise from the practice of holding securities in balance sheet valued at historic costs.

Revaluation reserve is capital earned when the revaluation of an asset leads to it gaining value compared to its previously determined value. The reserve may arise out of a formal revaluation carried through to the bank’s balance sheet, or a notional addition due to holding securities in the balance sheet valued at historic cost. Basel II also requires that the difference between the historic cost and the actual value be discounted by 55% when using these reserves to calculate Tier 2 capital.