1.1 Origin of the Report

I am lucky to say that, Stamford University, Bangladesh, assigned me the report on “foreign Exchange operations of selected banks”. The data required for preparing this report has been collected from the annual reports of most recent years.

DBBL, NCC, NBL & South East Banks that perform most of the standard banking services and investment activities on the basis not only profit sharing but also social partnership. This study attempts to analyze the nature of modern banking activities and performance of selected banks. Its performance was reviewed and analyzed through the annual reports, and internal records of the bank.

This thesis report covers:

ð An Overview on foreign exchange operations of MBL

ð Financial Performance of the Bank

ð Export and Import Performance.

The objectives of the study are as follows:

General Objectives:

The general objective of the report is the evaluation of foreign exchange operation of selected banks and compare with its competitor.

Specific Objective:

ð To apply theoretical knowledge into practical area.

ð To be familiar with the banking management system.

ð To attain practical knowledge on the foreign exchange operations performed by selected banks.

ð To evaluate the performance of General Banking division.

ð To know the banking operational guideline of a bank.

ð To get a brief idea about operational procedure.

ð To analyze the financing systems of the bank and find out whether the bank needs any improvement to be done and make greater contribution towards the country’s economy.

ð To familiarize different rules and regulations of Bank’s formalities.

ð To familiarize the working hours, values and environment of the bank.

ð To adopt with the everyday banking activities.

ð To find out the contribution of private commercial banks for the economic development of the country.

ð To attain practical knowledge on the foreign exchange operations performed by MBL.

ð To have better direction to identify and suggest the scope of enhancement in foreign exchange operations to fulfill the requirement of the internship program.

ð L/C Opening.

ð To learn about the benefits and incentives provides to the export proceeds.

ð To know the collection process of export proceeds.

ð To detect the problems involved and to obtain solutions.

The main objective of the study is to obtain a clear idea about the Foreign Exchange business of our banking operation i.e. how the L/C is opened and how the import & export is done

To meet the objectives of the study, I realized that a single method would not be effective. Formal & oral discussion, direct observation, questioning clients & printed papers of the Banks were found useful. To collect the necessary and meaningful information, the following methods were applied. Both primary and secondary sources were used here.

1.5.1 Research Design

Exploratory research has been conducted for gathering better information that will give a better understanding on different financial data. Both primary and secondary sources of data collection procedure have been used in the report. Primary data has been collected mainly through the writer’s observation of the approval process and monitoring techniques, informal interviews of executives, officers and employees of selected banks.

To make the Report more meaningful and presentable, two sources of data and information have been used widely.

Figure 1.1 Sources of data

Both primary and secondary data sources were used to generate the report. The information incorporated in this report has been gathered from primary and secondary sources. Apart from this, a review of related circular and office circular as well as face-to-face interview of the executives, officials and clients were carried out.

1.6.1 Primary Sources

ð Face to conversation with the respective officers and stuffs of the banks.

ð Discussing with my supervising teacher and manager.

ð In-depth study of selected cases.

1.6.2 Secondary Sources

ð Annual Report of the banks.

ð Website of the banks.

ð Several books and periodicals related to the banking sector.

ð Bangladesh Bank Report.

ð Various documentary file of the banks.

ð Prior research report.

2.1 Banking System of Bangladesh

The Jews in Jerusalem introduced a kind of banking in the form of money lending before the birth of Christ. The word ‘bank’ was probably derived from the word ‘bench’ as during ancient time Jews used to do money -lending business sitting on long benches.

First modern banking was introduced in 1668 in Stockholm as ‘Svingss Pis Bank’ which opened up a new era of banking activities throughout the European Mainland.

In the South Asian region, early banking system was introduced by the Afgan traders popularly known as Kabuliwallas. Muslim businessmen from Kabul, Afganistan came to India and started money lending business in exchange of interest sometime in 1312 A.D. They were known as ‘Kabuliawallas”.

The number of banks in all now stands at 49 in Bangladesh. Out of the 49 banks, four are Nationalised Commercial Banks (NCBs), 28 local private commercial banks, 12 foreign banks and the rest five are Development Financial Institutions (DFIs).

Sonali Bank is the largest among the NCBs while Pubali is leading in the private ones. Among the 12 foreign banks, Standard Chartered has become the largest in the country. Besides the scheduled banks, Samabai (Cooperative) Bank, Ansar-VDP Bank, Karmasansthan (Employment) Bank and Grameen bank are functioning in the financial sector.The number of total branches of all scheduled banks is 6,038 as of June 2000. Of the branches, 39.95 per cent (2,412) are located in the urban areas and 60.05 per cent (3,626) in the rural areas. Of the branches NCBs hold 3,616, private commercial banks 1,214, foreign banks 31 and specialized banks 1,177.

Bangladesh Bank (BB) regulates and supervises the activities of all banks. The BB is now carrying out a reform programme to ensure quality services by the banks.

Bangladesh Bank (BB) has been working as the central bank since the country’s independence. Its prime jobs include issuing of currency, maintaining foreign exchange reserve and providing transaction facilities of all public monetary matters. BB is also responsible for planning the government’s monetary policy and implementing it thereby.

The BB has a governing body comprising of nine members with the Governor as its chief. Apart from the head office in Dhaka, it has nine more branches, of which two in Dhaka and one each in Chittagong, Rajshahi, Khulna, Bogra, Sylhet, Rangpur and Barisal.

A commercial bank (or business bank) is a type of financial institution and intermediary. It is a bank that provides transactional, savings, and money market accounts and that accepts time deposits.

2.4.1 Service

Accounts, Current, FDR, PDS & Deposit Scheme

2.4.1.1 Current Account

Generally this sort of account opens for business purpose. Customers can withdraw money once or more against their deposit. No interest can be paid to the customers in this account. If the amount of deposit is below taka 1,000 on an average the bank has authority to cut taka 50 from each account as incidental charge after every six months. Against this account loan facility can be ensured. Usually one can open this account with taka 500. One can open this sort of account through cash or check/bill. All the banks

2.4.1.2 Saving Bank Account

Usually customers open this sort of account at a low interest for only security. This is also an initiative to create people’s savings tendency. Generally, this account is to be opened at taka 100. Interest is to be paid in June and December after every six months. If money is withdrawn twice a week or more than taka 10,000 is withdrawn (if 25% more compared to total deposit) then interest is not paid. This account guarantees loan. Almost all the banks follow the same rules in the field of savings account, except foreign banks for varying deposit. On an average, all the banks give around six percent interest.

2.4.1.3 Special Service

Some Banks render special services to the customers attracting other banks.

2.4.1.4 Internet Banking

Customers need an Internet access service. As an Internet Banking customer, he will be given a specific user ID and a confident password. The customer can then view his account balances online. It is the industry-standard method used to protect communications over the Internet.

To ensure that customers’ personal data cannot be accessed by anyone but them, all reporting information has been secured using Version and Secure Sockets Layer (SSL).

2.4.1.5 Home Banking

Home banking frees customers of visiting branches and most transactions will be automated to enable them to check their account activities transfer fund and to open L/C sitting in their own desk with the help of a PC and a telephone.

2.4.1.5 Electronic Banking Service for Windows

Electronic Banking Service for Windows (EBSW) provides a full range of reporting capabilities, and a comprehensive range of transaction initiation options.

The customers will be able to process all payments as well as initiate L/Cs and amendments, through EBSW. They will be able to view the balances of all accounts, whether with Standard Chartered or with any other banks using SWIFT. Additionally, transactions may be approved by remote authorization even if the approver is out of station.

2.4.1.6 Automated Teller Machine (ATM)

Automated Teller Machine (ATM), a new concept in modern banking, has already been introduced to facilitate subscribers 24 hour cash access through a plastic card. The network of ATM installations will be adequately extended to enable customers to non-branch banking beyond banking.

2.4.1.7 Tele Banking

Tele Banking allows customers to get access into their respective banking information 24 hours a day. Subscribers can update themselves by making a phone call. They can transfer any amount of deposit to other accounts irrespective of location either from home or office.

2.4.1.8 SWIFT

SWIFT is a bank owned non-profit co-operative based in Belgium servicing the financial community worldwide. It ensures secure messaging having a global reach of 6,495 Banks and Financial Institutions in 178 countries, 24 hours a day. SWIFT global network carries an average 4 million message daily and estimated average value of payment messages is USD 2 trillion.

SWIFT is a highly secured messaging network enables Banks to send and receive Fund Transfer, L/C related and other free format messages to and from any banks active in the network.

Having SWIFT facility, Bank will be able to serve its customers more profitable by providing L/C, Payment and other messages efficiently and with utmost security. Especially it will be of great help for our clients dealing with Imports, Exports and Remittances etc.

2.5 Money and Banking sector review

2.5.1 Monetary & Credit Policy

The monetary and credit policy for the financial year that ended in June,2000 was formulated with the objective of full utilization of domestic resources and rapid economic growth through priorities for agriculture, industry, export, and expansion and strengthening of the private sector, at the same time keeping inflation within tolerable limits. A modern expansionary monetary and credit policy was adopted in order to make good the losses to agriculture, industry, and infrastructure by the devastating floods of 1998. After the flood the economy remained sluggish in the first quarter of 1999-2000 and the private sector demand for credit shrank. In view of this, the Annual Development Programmed (ADP) was expanded and development activities in the private sector were geared up. As a result, the public sector absorbed credit at an accelerated rate. Though credit to the private sector picked up towards the end of the year, the overall annual growth was smaller than programmed, although gross domestic credit expanded a little faster than projected. Money supply increased by 15.3% in 1999-2000 compared to the expansion of 8.6% in the preceding year.

2.5.2 Narrow Money

Narrow Money increased by Tk. 2,631.90 crores or 15.3% to Tk.19,881.30 crores in 1999-2000. Of the components of Narrow Money, currency outside banks went up by Tk.1,489.40 crores or 17.2% to Tk.10,176.00 crores, and demand deposits went up by Tk.1,142.50 crores or 13.3% to Tk.9,705.30 crores.

2.5.3 Broad Money

Broad Money increased by Tk.11,735.70 crores or 18.6% to Tk. 74,762.40 crores in 1999-2000 compared to the increase of 12.8% in the preceding year. Of the components of Broad Money, Narrow Money increased by 15.3% and time deposits rose by 19.9% compared to the increase of 8.6% in Narrow Money and 14.5% in time deposits in the preceding year. The shares of currency outside banks, demand deposits and time deposits in Broad Money stood at 13.6%, 13.0%, and 73.4% respectively on 30th June, 2000 compared to 13.8%, 13.6% and 72.6% respectively on 30th June, 1999.Expansion of credit to the private sector, government sector (net), public sector, and other assets (net), along with a surplus in net foreign assets contributed to the expansion of Broad Money.

2.5.4 Reserve Money

Reserve Money increased by Tk.2, 321.80 crores or 15.7% to Tk.17,064.50 crores in 1999-2000 compared to the increase of 8.3% during the preceding year. Of the components of Reserve Money, currency outside banks increased by Tk.1,489.40 crores or 17.1% compared to the increase of Tk.533.30 crores or 6.5% during the preceding year. Scheduled banks balances with the Bangladesh Bank increased by Tk.770.90 crores or 15.3% in 1999-2000 compared to the increase of Tk.488.20 crores or 10.8% in the preceding year. Their cash in tills increased by Tk.61.50 crores or 6.0% as against the increase of Tk.103.60 crores or 11.2% in the preceding year. The increase in Bangladesh Bank’s credit to the government (net) by Tk.1,738.10 crores and net surplus in the foreign sector by Tk.1,262.40 crores played the main role in exerting expansionary influence on the Reserve Money. However the decline of Tk.333.60 crores and Tk.44.90 crores in the borrowings by the scheduled banks and other financial institutions respectively along with the fall of Tk.300.20 crores in other assets (net) partly offset the expansionary impact of those sectors.

2.5.5 Domestic Credit

Total domestic credit increased by Tk.8, 581.20 crores or 13.6% to Tk. 71,489.00 crores ( including adjustment of bonds issued by the government) in 1999-2000 as compared to the increase of Tk.7,267.60 crores or 13.1% in the preceding year. Expansion of credit to the government, private, and public sectors to the extent of Tk.3,524.30 crores (31.3%), Tk.4,906.10 crores (10.7%), and Tk.150.80 crores (2.5%) respectively contributed to the expansion in total domestic credit in 1999-2000. Credit to the government and private sector had increased by 21.3% and 13.8% respectively, while credit to the public sector declined by 3.7% in the preceding year.

2.5.6 Bank Credit

The outstanding level of bank credit (excluding foreign bills and inter-bank items) increased by Tk.5, 123.30 crores or 10.3% to Tk.54, 646.10 crores in 1999-2000 as compared to the increase of 12.4% in the preceding year. Of the components of bank credit, advances increased by Tk.4, 892.70 crores or 10.3% and the bills purchased and discounted went up by Tk.230.60 crores or 11.3%.

2.5.7 Bank Deposit

Bank deposits (excluding inter-bank items) increased by Tk.11,044.70 crores or 18.6% to Tk.70,278.70 crores in 2009-2010 compared to the increase of 14.2% in the preceding year. Of this increase , time deposits went up by Tk.9,103.80 crores or 19.9% to Tk.54,881.10 crores, government deposits by Tk.723.60 crores or 14.8% to Tk.5,615.20 crores and demand deposits by Tk. 1,142.50 crores or 13.3% to Tk.9,705.30 crores. On the other hand, restricted deposits increased by Tk.74.80 crores in 2009-2010.

![]()

3.1 Profile of Southeast Bank Limited

The emergence of Southeast Bank Limited was at the juncture of liberalization of global economic activities. The experience of the prosperous economies of the Asian countries and in particular of South Asia has been the driving force and the strategic operational policy option of the Bank. The company philosophy – “A Bank with Vision” has been precisely an essence of the legend of success in the Asian countries.

Southeast Bank Limited is a scheduled commercial bank in the private sector, which is focused on the established and emerging markets of Bangladesh. In Dhaka, the first branch was launched in 1995 and the bank has been growing ever since. Southeast Bank Limited has 22 branches throughout Bangladesh and its aim is to be the leading bank in the country’s principal markets. The bank by concentrating on the activities in its area of specialization has achieved good market reputation with efficient customer service. The Bank is committed to providing continuous training to its staff to keep them up to date with modern practices in their respective fields of work. The Bank also tries to fulfill its share in community responsibilities. By such measures the Bank intends to grow and increase shareholders’ earning per share. Southeast Bank Limited pledges to maximize customer satisfaction through services and build a trusting relationship with customers, which has stood the test of time for the last nine years.

3.1.2 Vision of Bank

ð To stand out as a pioneer banking institution in Bangladesh

ð To contribute significantly to the national economy.

3.1.3 Mission of Bank

ð High quality financial services with the help of latest technology.

ð Fast & accurate customer service.

ð Balanced growth strategy.

ð High standard business ethics.

ð Steady return on shareholders’ equity.

ð Innovative banking at a competitive price.

ð Deep commitment to the society and the growth of national economy.

ð Attract and retain quality human resource.

3.1.4 Social Responsibility

An organization cannot move along. Organization needs people to generate its activities & people needs organization to get some kind of services. Southeast bank is an organization that is concerned to maximize its profit along with maintaining some kind of social responsibilities. It is fully devoted to fulfil the needs for its customer’s satisfaction as well as it is involved socio-economic development activities. Objectives of the banks are:

ð Creating employment opportunities within the bank through expanding its network

ð Cooperating with organizations such as Gramen Bank which are helping the poor through micro credit and other facilities.

ð It finances the small scale industries to help them survive.

3.1.5 Management Team

To achieve the mission, a set of efficient drivers is mandatory. Commercial banks in Bangladesh are now in a hard competition. This is because of continuous growth of similar service oriented local bank along with special service providing foreign bank due to globalization.

In this respect, Southeast bank enjoys a team of sound professionals. It is managed by a team of professionals having long experience in the banking industry. While the board sets the management objectives and policies, the management is instrumental in providing the inputs and implementing the strategies set by the board. The bank maintains a continuous policy of developing its human resources. It believes that, the professionals are the key forces behind the achievement of success in banking business at the face of prevailing rigorous competitive market situation.

3.1.6 Management Information System

South east bank uses PC Bank/M a branch banking software developed by leads Corporation- developed on SQ: on windows platform. The head office and branches use the software for book keeping, automatic interest calculation, daily transaction listing and audit trials, auto maturity and auto renewal of FDRS, automatic integration of customer’s ledger and general ledger, printing of general ledger position including balance of subsidiaries, monthly income and expenditure position etc.

3.1.7 Service & Products

SEBL always try to provide best services and products to their clients to acquire their satisfaction. The bank provides the following the products and services to consider client’s demand

| Locker Services | Yearly Charge | Security Deposit | Service Available at | |

| Small | Tk. 750/- | Tk.2, 50/- (Refundable) For all types of lockers. | Gulshan Branch |

Medium | Tk. 1,250/- | Dhanmondi Branch | ||

Large | Tk. 2,000/- |

| ||

Table: 3-1

Deposit Schemes | Deposit Rate (D.R.) (Effective from April 01,1997) |

| Savings (SB) | 7.50% |

| Special Notice Deposit (STD) | 6.00% |

| Fixed Deposit |

|

| 30 Days | 7.00% |

| 60 Days | 7.50% |

| 3 (Three) Months | 8.25% |

| 6 (Six) Months | 8.50% |

| 1 (One) Year | 9.00% |

| 2 (Two) Years | 9.50% |

| 3 (Three) Years | 10.00% |

Table: 3-2

3.1.2 Deposit

SEBL always try to collect deposits from their clients by providing high interest against the deposits. The bank provides the following deposits to consider client’s demand

Customer Friendly Deposit Schemes

| Customer Friendly Deposit Schemes | Monthly Install- ment Size (Tk.) | Amount built up after 5 years (Tk) | Amount build up after 10years (Tk.) |

| Pension Savings Scheme (P.S.S.) | 500.00 | 40,000.00 | 1,08,000.00 |

1,000.00 | 80,000.00 | 2,16,000.00 | |

| E Education Savings Scheme (E.S.S) | 500.00 | 40,000.00 | 1,08,000.00 |

1,000.00 | 80,000.00 | 2,16,000.00 | |

| Marriage Savings S Scheme (M.S.S) | 500.00 | 40,000.00 | 1,08,000.00 |

1,000.00 | 80,000.00 | 2,16,000.00 |

Table: 3-3

Savers Benefit Deposit Scheme

| Deposited Amount: 50,000.00 | Term | Size of deposited Amount with interest after completion of the term (T.K.) |

| 1st Year | 45,000.00 | |

| 2nd Year | 59,000.00 | |

| 3rd Year | 65,000.00 | |

| 4th Year | 72,000.00 | |

| 5th Year | 79,500.00 | |

| 6th Year | 89,000.00 |

Table: 3-4

Loan Schemes:

| Loan Schemes | Lending Categories | Lending Rates (L.R.) |

| Agricultural Scheme | Loan to primary Producers | 12.00% |

| Loan to agricultural Input v traders and fertilizer dealers/ distributors | 13.00% | |

| Commercial Lending | Jute Trading | 15.00% |

| Other Commercial Lending | 15.00% | |

| Working Capital | Jute | 14.00% |

Other than Jute | 15.00% | |

| House Building Loan | 15.00% | |

| Special Programmers | P.C. Loan Scheme for Educational and Other Training Institutions | 15.00% |

| Other Loans | Educational Loan Scheme | 15.00% |

| Consumer Credit Scheme | ||

| Small/Cottage Industry | Term Loan | 13.00% |

| Large/Medium Scale Industry | Term Loan | 15.00% |

| Loan against | Jute Goods Exports | 7.00% |

Table: 3-5

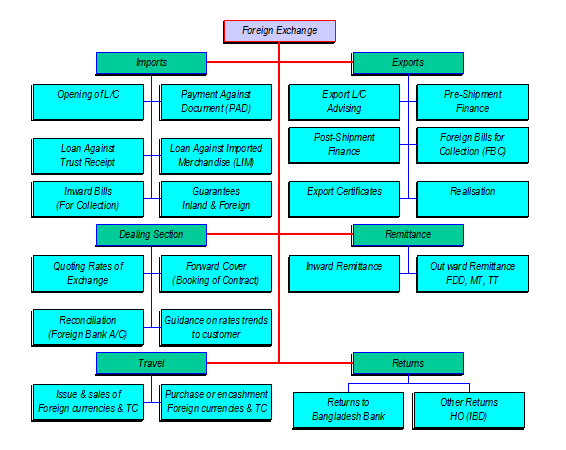

3.1.3 Foreign Exchange Division

Foreign Exchange Department is international department of Bank. It deals globally. It facilitates international trade through its various modes of services. It bridges between importers and exporters. If the branch is authorized dealer in foreign exchange market, it can remit foreign exchange from local country to foreign country. This department mainly deals in foreign currency. This is why this department is called foreign exchange department.

Some national and international laws regulate functions of this department. Among these, Foreign Exchange Act, 1947 is for dealing in foreign exchange business, and Import and Export Control Act, 1950 is for Documentary Credits (UCPDC – 1993 revision & International Chamber of Commerce Publication no – 500) is also an important law for settlement of terms and conditions between exporter and importer in international trade. Governments’ Import &Export policy is another important factor for import and export operation for banks.

3.1.4 Functions of Department

Import Operation

Import section helps business and other people to import goods. In international environment, buyers and sellers are often unknown to each other. So seller always seek guarantee for the payment for his goods exported. Here is the role of bank. Bank gives export guarantee that it will pay for the goods on behalf of the buyer. This guarantee is called Letter of Credit. Thus the contract between importer and exporter is given a legal shape by the banker by its ‘Letter of Credit’.

When a buyer goes to import some goods from a foreign buyer, he request his bank makes payments to the exporter of goods. And the bank recovers the amount from the importer.

| Foreign Bills Purchased (FBP) | This loan is given to the exporter. When local exporter gets a Usance bill of exchange, he has to wait until the maturity of the bill for receiving payment. Sometimes he cannot wait until maturity and request the bank to purchase it. If bank decides to purchase it, then it makes payments to the exporter against the bill of exchange. Upon maturity, banks present it to the drawee of the bill for encashment. Bank purchases it at discount. |

| IP Loan | When L/C opener has no sufficient fund to purchase Foreign Exchange to open L/C, then bank provides him credit to purchase necessary foreign exchange under the WES/SEM. This loan is called Import Loan under WES/SEM or IP loan. |

Export Operation

Bangladesh exports a large quantity of goods and services to foreign households. Readymade textile garments (both knitted and woven), Jute, Jute-made products, frozen shrimps, tea are the main goods that Bangladeshi exporters exports to foreign countries. Garments sector is the largest sector that exports the lion share of the country’s export. Bangladesh exports most of its readymade garments products to U.S.A and European Community (EC) countries. Bangladesh exports about 40% of its readymade garments products to U.S.A. Most of the exporters who export through SBLare readymade garment exporters. They open export L/Cs here to export their goods, which they open against the import L/Cs opened by their foreign importers.

Export L/C operation is just reverse of the import L/C operation. For exporting goods by the local exporter, bank may act as advising banks and collecting bank (negotiable bank) for the exporter.

a. As an advising bank: It receives documents from the foreign importer and hands it over to the exporter. Sometimes it adds confirmation on the L/C on request from the Opening Bank. By adding confirmation, it assumes the responsibility to make payment to the exporter.

- b. As Negotiating Bank: It negotiates the bills and other shipping documents in favor of the exporter. That is, it collects the proceeds of the export-bill from the drawee and credits the exporter’s account for the same. Collection proceed from the export bill is deposited in the bank’s NOSTRO account in the importer’s country. Sometimes the bank purchases the bills at discount and waits till maturity of the bill. When the bill matures, bank presents it to the drawee to encase it.

In our country, Export and Import operation of bank is very much related with one another because of use of Back to Back and maturity of payment for Back-to-Back L/C is set in such that it can be paid out of export proceeds. So export and import sections works as one unit. These two operations can hardly be separated from one another in the branch.

Foreign Remittance Department

This bank is authorized dealer to deal in foreign exchange business. As an authorized dealer, a bank must provide some services to the clients regarding foreign exchange and this department provides these services. The basic function of this department are outward and inward remittance of foreign exchange from one country to another country. In the process of providing this remittance service, it sells and buys foreign currency. In such transactions the foreign currencies are like any other commodities offered for sales and purchase, the cost (convention value) being paid by the buyer in home currency, the legal tender.

Miscellaneous Services by this Department:

| Student File | Students who are desirous to study abroad can open file in the bank. By opening this file, bank assures the remittance of funds in abroad for study. |

| NRIT Account | ‘Non –resident Investors’ Taka Account is account Non-resident Bangladeshi can deposit foreign currency for investment in security of stock exchanges. For such accountholders, 5% of primary shares are reserved. |

| F.C. Account | Foreign Currency accounts opened in the names of Bangladeshi nationals or persons of Bangladeshi origin working or self-employed abroad can now are maintained as long as the account holders desire. |

| NFCD | Stands for Non-resident Foreign Currency Deposit Eligible persons may open such accounts even after their return to Bangladesh, within six months of their arrival. |

Table: 3-6

Analysis of this Department

Types of Account | No. Of Accounts | Amounts (In Taka.) |

1.1.1.1.1.1 FCD-Foreign Currency Deposit | 217 | 7968816.00 |

| NFCD | 7 | 2998707.05 |

| RFCD | 12 | 1554297.75 |

| Export Cash Credit – ECC | 3 | 23010432.43 |

Table: 3-7

Number of Different Accounts Maintained by this Department

|

Number of Different Accounts Maintained by this Department

| |

Fig. 3.2

|

Amount Deposited and Advanced in Different Accounts Maintained |

Fig. 3.3

3.1.5 Banks Performance

The bank’s overall objective is to have a higher\profitability than that of the weighted average of other banks

Capital and Reserve

The authorized capital of the bank was Tk. 3,500.00 million and paid-up capital was Tk. 2,852.20 million as of December 31, 2008. The capital and reserve of the banks in 2008 stood at Tk. 7,657.01 million compared with Tk. 6,468.36 million of the previous year showing an increase of 18.38%

The capital and reserve position of the Bank as on 31-12-2005 is appended as:

| Taka in Million | |

(a) CORE CAPITAL (Tier-I Capital): | |

Paid –up Capital | 2,852.20 |

Shares Premium A/C | 485.93 |

Statutory Reserve | 1,975.25 |

General Reserve | 247.65 |

Retained Earnings | 542.79 |

(a) Total Core Capital: | 6,103.82 |

(b) SUPPLEMENTARY CAPITAL (Tier-II Capital): | |

Provision for Unclassified Advances | 641.31 |

General Provision on off Balance Sheet Exposures | 313.03 |

Assets Revaluation Reserves | 590.68 |

Revaluation Reserves of HTM Securities | 3.96 |

Exchange Equalization A/C | 4.20 |

(b) Total Supplementary Capital: | 1,553.19 |

Total Capital & Reserves (Capital:) (a+b) | 7,657.01 |

Table: 3-8

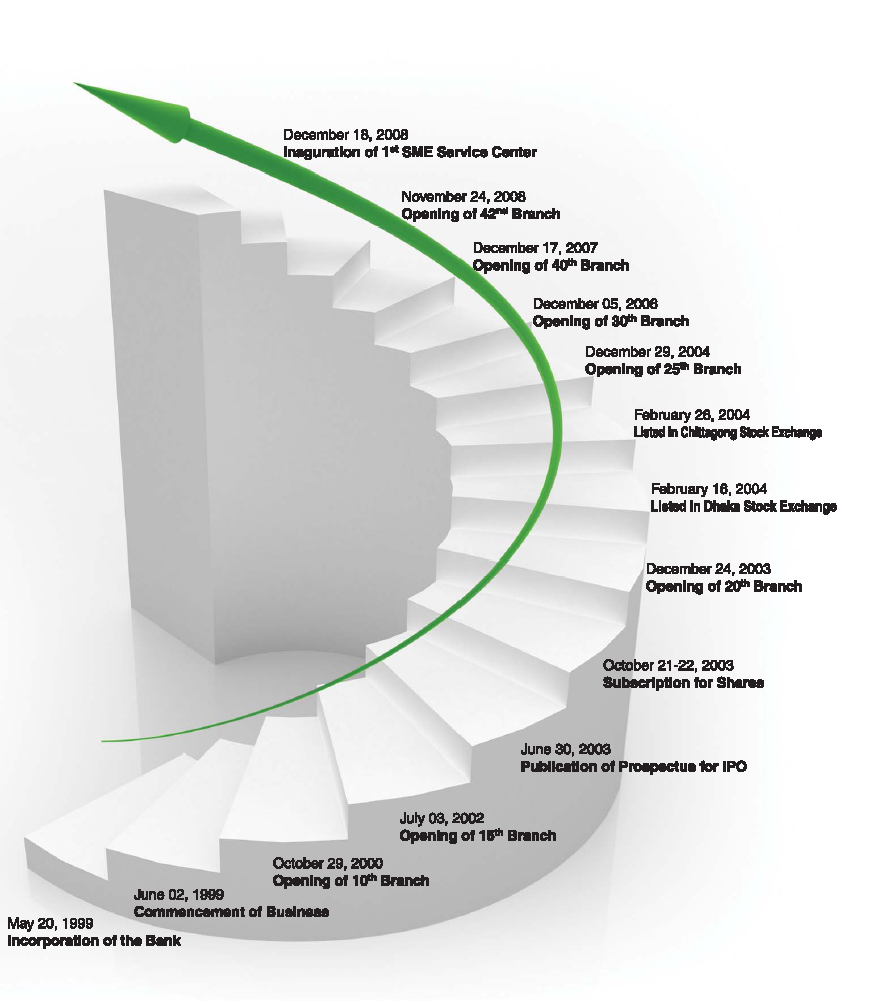

3.2 Profile of Mercantile Bank

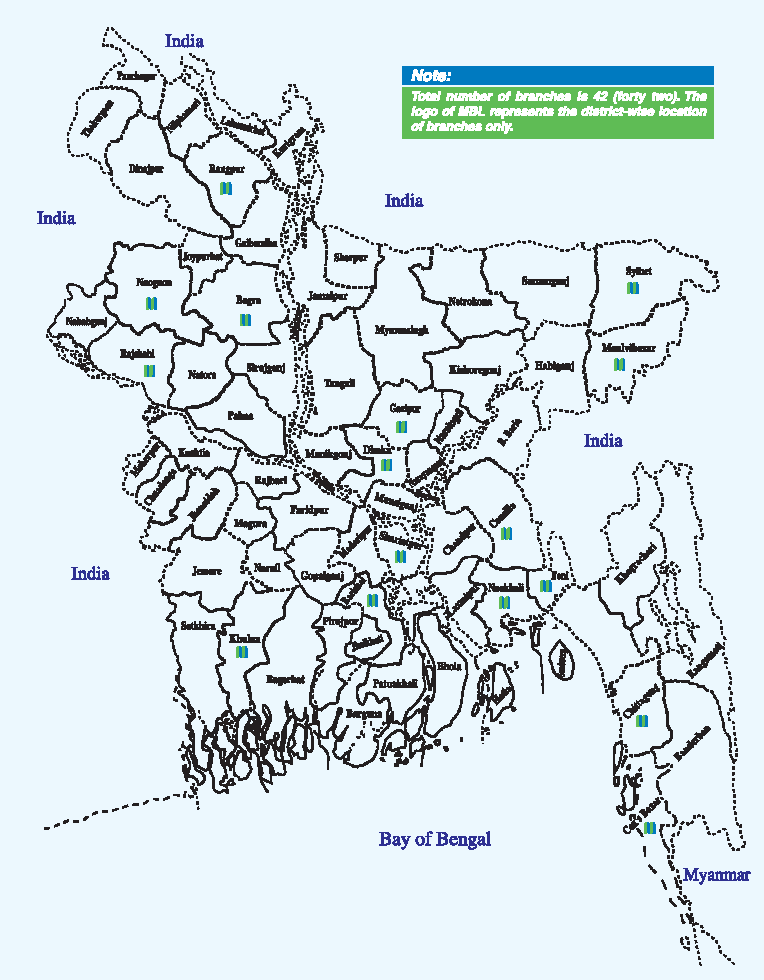

Mercantile Bank Limited, a private commercial Bank with head office at 61 Dilkusha C/A, Dhaka Bangladesh started operation on 2nd June, 1999. The Bank has 45 branches spread all over the country with assets of Tk. 44,940.54 million and more than 1000 employees, the bank have diversified activities inertial banking, corporate banking and international trade.

3.2.1 World Economy

The year 2008 reminds us the worst financial meltdown since the 1930’s. It is argued that the meltdown of the financial system was “made in America” because it relaxes rules of providing loans to the people with no income for buying houses, called “sub-prime housing loans” amounting to about $2.1 trillion. Furthermore, US regulators did not monitor the way in which the banks were providing loans during the housing-boom period. The regulatory bodies in the US ignored warning signs of a financial storm since August 2007 and believed that the free market system would take care of it. But free market could not prove its effectiveness in avoiding the financial crisis. As a result, almost every country of the world faced the ongoing world economic crisis.

World growth is expected to fall to 0.5% in 200, its lowest rate since World War 2. The US economy, the world’s largest and the epicenter of the Financial Tsunami would shrink to 1.3% in 2009. Output in the advanced economies is now expected to contract by 2% in 2009, first contraction during the post war period. Growth in emerging and developing economies is expected to slow sharply from 6.25% in 2008 to 3.25% in 2009. China, the fastest growing economy in the world is expected to slow down to 7.5% in 2009 from a double-digit growth rate over the past several years, while India’s deceleration would be less steep to 5.0% from 6.2% and the economy of Japan would shrink to 1.2% in 2009.

Sluggish real activities and lower commodity prices resulted from tiny demand caused by the current economic meltdown have dampened inflation pressures. In the advanced economies, headline inflation is expected to decline from 3.5% in 2008 to a record low of 0.25% in 2009, before edging up to 0.75% in 2010. In emerging and developing economies, inflation is also expected to subside to 5.75% in 2009 and 5% in 2010, down from 9.%% in 2008.

3.2.2 Bangladesh Economy

Bangladesh Economy recorded satisfactory growth in FY2008 in spite of experiencing two consecutive floods and devastating cyclone Sidre, price hike of oil and other commodities in the world market. Governments growth generating and poverty reduction programs coupled with the prudent monetary policy of Bangladesh Bank lead to achieve 6.2% growth in FY2008, slightly lower than 6.4% of FY2007. Nearly all sectors contributed to the GDP growth, particularly significant were the growth of export-oriented sectors, inflow of remittances and some service sector like transport and communication.

3.2.3 Background of MBL

Banking system occupies an important place in an economy. A banking institution is indispensable in modern society. It plays a liberalization of economics policies in Bangladesh. Mercantile Bank Limited emerged as a new commercial bank to provide efficient banking service with a view to improving the socio-economic development of the country.

Mercantile Bank Limited has been incorporated on May 20, 1999 in Dhaka, Bangladesh as a Private limited company with the permission of the Bangladesh Bank; Mercantile Bank Limited commenced formal commercial banking operation from the June 2, 1999. The bank stood 45 branches all over the country up to December, 2008.

There are 28 sponsors involved in creating Mercantile Bank Limited. The sponsors of the bank have a long heritage of trade; commerce and industry. They are highly regarded for their entrepreneurial competence. The sponsors happen to be members of different professional groups among whom are also renowned banking professionals having vast range of banking knowledge. There are also members who are associated with other financial institutions like insurance companies, leasing company etc.

3.2.4 Vision

Would make finest corporate citizen.

3.2.5 Mission

- Will become most caring,

- Focused for equitable growth based on diversified deployment of resources, an

- Nevertheless would remain healthy and gainfully profitable Bank.

3.2.6 Objective

v Strategic Objectives:-

Æ To achieve positive Economic Value Added (EVA) each year.

Æ To be market leader in product innovation.

Æ To be one of the top three Financial Institutions in Bangladesh in terms of cost efficiency.

Æ To be one of the top five Financial Institutions in Bangladesh in terms of market share in all significant market segments they serve.

v Financial Objective:-

Æ To achieve a return on shareholders’ equity of 20% or more, on average.

3.2.7 Core values

v For the customers:-

Providing with caring services by being innovative in the development of new banking products and services.

v For the shareholders:-

Maximizing wealth of the Bank.

v For the employees:-

Respecting worth and dignity of individual employees devoting their energies for the progress of the Bank.

v For the community:-

Strengthening the corporate values and taking environment and social risks and reward into account.

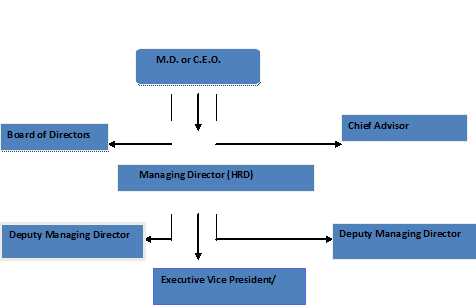

3.2.8 Hierarchy of Positions in Mercantile Bank Limited

3.2.9 Organ gram

3.2.10 Coverage of MBL

3.2.11 Function of MBL

A bank has a lot of function in different ways. A Bank means an institution, which borrows money from the surplus unit of the society and lends money to the deficit unit for earning profit. The deposits are mainly accepted by the banker through current and saving account that is withdrawal by cheques. A bank includes a body of person’s weather incorporated or not who carry on business of banking. Thus a bank is a profit intuition which deals in money and credit.

The functions of Commercial banks are now wide and varied. However, the functions of Commercial Banks may broadly be classified under the following two categories:

Æ Primary Function

Æ Secondary Function

3.2.11.1 Primary Function:

The Primary functions of Commercial Bank/MBL are as follows-

ü Accepts Deposits:

The first primary functions of bank are to accept deposits of money from the public

or sever group. The total deposits held by the banker are broadly classified as-

ü Demand Deposit: Demand deposits are withdrawn able on demand and thus no prior notice is needed. Deposits in Current Account and Saving Account fall in this category.

ü Time Deposit: Time deposits are repayable on the expiry of a fixed period of time only. Fixes deposit Accounts, recurring Deposit Accounts and deposit payable at specified

Lends Money:

Banking system essentially involves lending. Depending on the requirements of the borrower, banks lend money in the forms following:

ü Loans: In case of loan, the entire amount is paid to the borrower in lump sump, either in cash or way of transfer to his account. The borrower can withdraw the amount at any time. Interest is calculated and charged on the debit balance usually with quarterly rests. A loan once repaid in full or in part cannot be withdrawn further. Thus, no cheque book is issued against the loan account.

ü Overdraft: Overdraft is usually a temporary arrangement where the customer is allowed to withdraw money exceeding the credit balance of the current account up to an agreed limit. Interest in charged only for the amount drawn.

ü Cash Credit: A cash credit is an arrangement where the customer is allowed to withdraw money up to the sanctioned limit. Unlike overdraft this is a permanent arrangement and usually used to meet the working capital needs of business housed, industries etc. in cash credit account withdrawals and deposits may be effected frequently. Interest is charged on the daily balanced. Cash credit arrangement is usually made against pledge or goods but this could also be extended against personal security.

ü Bill Discounted and Purchase: Another mode of advancing money is discounting of the issuance bill of exchange. The banks buy the bill before its maturity at a price less than the face value. The amount, which the bank deducts from the face value of the instrument, is actually the interest calculated up to the date of maturity of the bills.

ü Creates Credit: The creation of credit is one of the important functions of Commercial Bank. The bank accepts deposits from the public and lends money to its customers. When a bank extends loan, it does not pay the amount in the bank account of the borrower and allow withdrawing the required amount by cheques. In this way the bank creates credit or deposit which is regarded as money and can be used for the purchase goods and services and also for the payment of debt just like currency notes.

Creates medium of Exchange: Commercial bank usually issues cheque which circulates like money in the society and creates the medium of exchange.

3.2.11.2 Secondary Function

Modern commercial bank like MBL, besides performing the primary functions, cover a wide range of financial and non-financial services to meet the growing needs of the time. Some of the services are available only to the customer while others are available to the public in general. The subsidiary services provided by a modern banker may be classified into the following two groups:

q Agency Services:

In many cases the Commercial Banks acts the agent of the customers. As agents the banks provide the following services:

ü Collection of cheque, draft, bill of exchange, promissory note, dividends, salaries, pension, rent etc. on behalf of the customer.

ü Acting as correspondent and representative of its customers, other banks, and financial institutions.

ü Conducting stock exchange transaction i.e. purchase and sale of share and securities for the customers.

ü Functioning as trustee, executor or administrator of estate of a customer.

q General Utility Services: Commercial banks provide a variety of general utility services to the customers. They are given below:

ü Issue letter of credit (L/C)

ü Accepts valuables for safe custody

ü Conducts in foreign exchange business

ü Lease financing

ü Provides Internet banking services

ü Provides specialized advisory services

ü Issues debit and credit cards

ü Underwrites of share and securities

ü Merchant Banking

ü Serving as a referee as to the financial standing business reputation and respectability of their customers

3.2.12 Foreign Exchange business

A commercial Bank/MBL is involved in financing foreign trade apart from financing internal credit requirement in the economy. This involves handling of import business through opening L/C and handling of export business. As banking has become very keenly competitive, banks find it convenient to involve in foreign exchange business as a lucrative source of earning income and profit.

Apart from financing foreign trade, Commercial Banks also provide guarantees of various types to their clients. While these facilities clients to undertake jobs assigned to them by various corporations and organization, this enables the bank to earn commission.

A commercial Bank also provides the facilities of remittance to its clients for transfer of funds to various traded centers within the country and also outside the country in keeping with the foreign restrictions of the Central Bank.

3.2.13 Lone Products

| Credit Schemes | |

|

Consumers Credit Scheme

Objectives:-

- Help fixed-income people for buying house hold durable.

- For the amount up to Tk. 1, 00,000 the period is two years.

- Interest rate will be charged quarterly rest.

Terms & Conditions:-

- Interest Rate 16.00%

- Risk Fund 1.00%

- Supervision Charge (per year on outstanding balances) 0.25%

- Application Fee BDT 200.00

Special Feature:-

- The loan amount is directly credited to the customer’s account.

CAR LOAN Scheme

| Objectives:- | ||

|

Doctors’ Credit Scheme

| Objectives :- |

| Æ Help new F.C.P.S. or post-graduate doctors for setting up chambers and buying medical equipment. Æ Help experienced doctors for refurbishing chambers and buying medical equipment. Æ Assist private clinics for acquiring modern medical equipment. Æ Interest rate will be charged at quarterly rest. |

3.3.1 Profile of the Organization

Sponsored by some dynamic and reputed entrepreneurs and eminent industrialists of the country and also participated by the Government, UCB started its operation in mid 1983, company act 1962 and has since been able to establish the largest network of 85 branches as on 031.12.2006 among the first generation banks in the private sector.

With its firm commitment to the economic development of the country, the Bank has already made a distinct mark in the realm of Private Sector Banking through personalized service, innovative practices, dynamic approach and efficient Management. The Bank, aiming to play a leading role in the economic activities of the country, is firmly engaged in the development of trade, commerce and industry thorough a creative credit policy. It has resulted in great success in all areas of operation with a view to improve the socio-economic development of the country. The high profitability track record underpins value that the shareholders derive from investing in the shares of United Commercial Bank. In doing business, United Commercial Bank follows the fundamental principles of Corporate Governance Accountability, Responsibility and Transparency. United Commercial Bank Limited will uphold its business motto of “people come first” and strive to provide the best banking products and services to its customers. In the process of reform and development, the bank is trying to improve its management capabilities and service standards through hard work and innovation. And such efforts have helped it gain a good reputation from its customers.

3.3.2 Vision of the Bank

To be the best Private Commercial Bank in Bangladesh in terms of efficiency, capital adequacy, asset quality, sound management and profitability having strong liquidity.

3.3.3 Mission of the Bank

- To build United Commercial Bank Limited into an efficient, market driven, customer focused institution with good corporate governance structure.

- Continuous improvement in our business policies, procedure and efficiency through integration of technology at all levels.

3.3.4 Strategic Statement

To have sustained growth, broaden and improve range of products and services in all areas of banking activities with the aim to add increased value to shareholders investment and offer highest possible benefits to our customers.

3.3.5 Objectives of the Bank

To build up strong pillar of capital, To promote trade, commerce and industry, To discover strategies for achieving systematic growth, To improve and broaden the range of product and services, To develop human resource by increasing employment opportunities, To enhance asset of shareholders, To offer standard financial services to the people, To keep business morality, To develop welfare oriented banking service, To offer highest possible benefit to customers.

3.3.6 Corporate information of UCBL

Name of the bank : United Commercial Bank Ltd

Status : Private Limited Company

Date of Incorporation : June 23, 1983

Authorized Capital : Tk.350.00 Crore

Paid-up Capital : Tk.171.375 Crore

Numbers of Branches : 85 (Eighty Five)

Proposed Branches : 15 (Fifteen)

Chairman : Mr.Md.Jahangir Alam Khan

Company Secretary : Mr. Mahmud Rafiqur Rahman

Managing Director : Mr. M. Shahjahan Bhuiyan

Number of Employees : 2500

Credit Rating : Long Term: A3 (Adequate Safety)

Short Term: ST-2

Registered Office : Federation Bhaban (4th through 6th Floor)

60, Motijheel Commercial Area, Dhaka-1000.

Bangladesh G.P.O- Box: 2653

PABX: +88-02-955075-77, 9568690-93

Fax: +88-02-9560587

Email: iinfo@ucbl.com

Web site: WWW. Ucbl.com S.W.I.F.T: UCBLBDDH

3.3.7 Capital and Reserve

During the year under report authorized capital of the bank remained unchanged at tk.1000 million and the paid up capital stood s at tk.230million.The reserve fund of the bank increased by 33% to Tk-1045 as against Tk-783 million in the previous year. The capital fund of the bank stood at Tk. 1943 million in 2008 against Tk.1389 million of 2007 recording an increase of Tk.39.88%. Core capital increased by TK.492 million and stood at Tk.1735 million while supplementary capital increased by Tk.62 million and stood at Tk.208 million. Total capital fund is equivalent to 9.72% of risk weighted Assets.

3.3.8 Risk Management

Risks involved in different operational area are under control of the management. The bank has taken appropriate measures to enforce and follow all approved risk manuals /guidelines covering the following risk area in order to control and minimize the business as well as financial risks at an acceptable level.

- Policy guidelines on asset liability management

- Policy guidelines on credit management

- Policy guidelines on foreign exchange risk management

- Policy guidelines on money laundering prevention

- Policy guidelines on internal control and compliance

The bank has formed a management committee (MANCOM) to review proper implementation and regular monitoring of core areas of risk management.

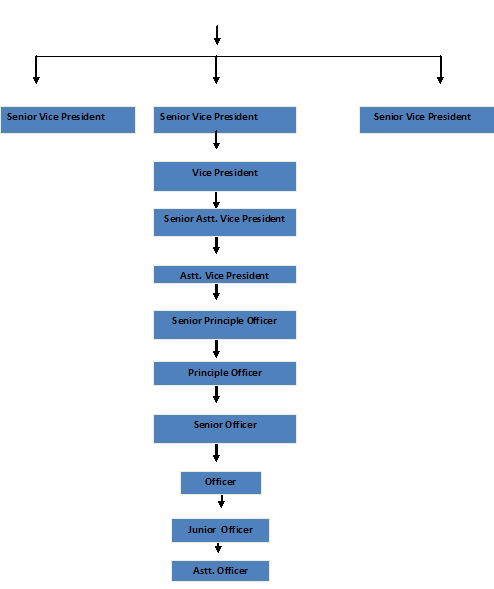

3.3.9 Hierarchy of Positions in UCB Bank Limited

3.3.10 District –Wise Branch Distribution

Dhaka Division

| 1.Bangshal Branch | 2.Bhulta Branch | 3. Dhanmondi Branch | 4.Elrphant Road Branch | 5.Faridpur Branch |

| 6.Foreign Exchange Branch(AD) | 7. Gulshan Branch | 8. hasnabad Branch | 9.Islampur Branch | 10.Kawran Bazar |

| 11.Madhabdee | 12.Malibag | 13.Mirpur | 14.Mohakhali | 15.Mohammadpur |

| 16.Moulvibazar | 17. Mymensigh | 18. Narayangonj | 19. Narsingdi | 20.Nawabpur |

| 21. Nayabazar | 22.North Brook Hall Road | 23. Paglabazar | 24.Principal Branch | 25. Tangail |

| 26.Uttara Branch | 27. Zinzira Branch |

Chittagong Division

| 1. Agrabad | 2. Anderkilla | 3.Bahaddarhat | 4.Brahmanbaria | 5. Chandpur | 6.Chawkbazar |

| 7.Chowmuhani | 8. Comilla | 9. Cox’s Bazar | 10. Dhohazari | 11. Fatickchari | 12. Chokoria |

| 13Feni Branch | 14.Gohira | 15.Jubilee Road | 16. Kadamtoli | 17. Kamal Bazar | 18.Khatungonj |

| 19.Lakshmipur | 20.Lohagara | 21. Madunaghat | 22. Maizdee Court | 23.Muradpur | 24. Nazirhat |

Rajshahi Division

| 1.Bogra | 2.Chapainawabgonj | 3. Dinajpur | 4. Naogaon |

| 5.Natore | 6. Pabna | 7.Rajshahi | 8. Rangpur |

| 9. Searajgonj |

Khulna Division

| 1.Chuadanga | 2. Jessore | 3. Jhenaidah | 4. Khan Jahan Ali Road |

| 5.Khulna | 6. Kushtia | 7.Noapara Bazar |

Barisal Division

| 1.Barisal Branch |

Sylhet Division

| 1.Amborkhana | 2.Barolekha | 3.Beani Bazar | 4. Biswanath |

| 5.Goala Bazar | 6.Nabiggonj | 7. Sherpur | 8.Shibgonj |

| 9. Sylhet | 10.Zinda Bazar | 11.Shahjalal Upashahar |

3.3.11 Product and Service

- UCB Multi Millionaire

- UCB Money Maximizer

- UCB Earning Plus

- UCB DPS Plus

- Western Money Transfer

- SMS Banking Service

- Online Service

- Credit Card

- One Stop Service

- Time Deposit Scheme

- Monthly Savings scheme

- Deposit Insurance Scheme

- Inward & Outward Remittances

Balance Sheet as at 31st December 2010

United Commercial Bank

Balance Sheet

As at 31st December, 2010

| Particulars | 2010 | 2009 |

| Property & Assets | ||

| Cash | 2812.472 | 2178.45 |

| Cash in hand(including foreign currencies) | 661.34 | 652.13 |

| Balance with Bangladesh Bank & Sonali Bank(including Foreign currencies) | 2151.12 | 1526.31 |

| Balance with others banks and financial institutions | 2100.01 | 623.50 |

| In Bangladesh | 1841.8 | 253.97 |

| Outside Bangladesh | 258.17 | 369.53 |

| Money at Call and short notice | 100.00 | 1670.00 |

| Investments | 6100.77 | 2877.478 |

| Govt. | 5954.187 | 2706.89 |

| Others | 146.586 | 170.58 |

| Loans and Advances | 26110.09 | 20210.64 |

| Loans, cash credit, overdraft etc. | 24200.03 | 20065.17 |

| Bills purchased and discounted | 2024.77 | 1327.21 |

| Fixed assets including premises, furniture and fixtures | 291.20 | 277.54 |

| Other assets | 1123.00 | 974.96 |

| Non banking assets | – | – |

| Total Assets | 38547.62 | 28812.59 |

| Liabilities& Capital | ||

| Borrowing from other banks, financial institution & agents | 264.69 | 89.2 |

| Deposits & others accounts | 33015.84 | 24559.33 |

| Currents accounts & other accounts | 4876.15 | 4488.85 |

| Bills payable | 581.00 | 541.59 |

| Saving bank deposit | 7655.76 | 6861.99 |

| Term deposits | 19902.91 | 12666.88 |

| Bearer certificates of deposits | – | – |

| Other liabilities | 2944.98 | 2509.46 |

| Total liabilities | 36225.52 | 27077.72 |

| Capital/ Shareholders’ equity | ||

| Paid-up capital | 230.15 | 230.15 |

| Statutory reserve | 898.79 | 689.89 |

| General reserves | 363.56 | 358.08 |

| Surplus in profit & loss account | 829.58 | 459.72 |

| Total Shareholders’ Equity | 2322.09 | 1734.86 |

| Total Liabilities & Shareholders’ Equity | 38547.62 | 28812.59 |

Source: Annul Report of UCBL during year 2010

Table: 3-9

Profit & Loss account (Income Statement) for the year ended 31st December 2010

| Particulars | 2010 Tk. | 2009 Tk. |

| Operating income | ||

| Interest income | 2303987311 | 1721378600 |

| Interest paid on Deposits & Borrowing | (1195364906) | (971684083) |

| Net interest income | 1108622405 | 749694517 |

| Income from investment | 215152384 | 242857269 |

| Commission, Exchange & Brokerage | 552266846 | 478710061 |

| Other operating income | 116577443 | 109185330 |

| Total Operating Income A | 1992619078 | 1580447177 |

| Operating Expense | ||

| Salary & allowance | 583011961 | 502619152 |

| Chief Executive salary Fees | 3457500 | 2685000 |

| Rent, Taxes, Insurance, Lighting etc | 81512694 | 69418169 |

| Legal Expense | 5122133 | 3238667 |

| Postage, stamp, Telegram, telephone etc | 23413092 | 20107259 |

| Stationary, printing etc | 18496793 | 11428313 |

| Directors fees & other Expense | 1225328 | 1798936 |

| Auditors Fees | 1645000 | 145000 |

| Depreciation and repair of fixed assets | 56899102 | 52750930 |

| Other Expense | 65381462 | 59033895 |

| Total operating Expense B | 840165065 | 723225321 |

| Profit before Provision | 1152154013 | 857221856 |

| Provision for loans & advances | 300000000 | 231154000 |

| Provision for diminution in value of investments | – | – |

| Other Provision | – | – |

| Total Provision (D) | 300000000 | 231154000 |

| Total profit/loss before Income Tax | 852454013 | 626067856 |

| Provision for Income Tax | 435357685 | 457716712 |

| Current Tax | 430702971 | 457716712 |

| Deferred Tax Expense | 4654714 | – |

| Net profit / LOSS AFTER Income Tax | 417096328 | 168351144 |

| Appropriations | ||

| Stator Reserve | 170490802 | 125213571 |

| General Reserve | 16447918 | – |

| Dividends | – | – |

| Retained Surplus | 230157608 | 43137573 |

| 417096328 | 168351144 | |

| Earning per ordinary Share(EPS) | 181.22 | 73.15 |

Source: Annul Report of UCBL during year 2010

Table: 3-10

What Is Foreign Exchange

Every country has certain natural advantages and disadvantages in producing certain commodities while they have some natural disadvantages as well in other areas. As a result we find that some countries need to import certain commodities while others need to export their surpluses. Foreign trade brings the fruits of the earth to the homes of the humblest among the countries. These transactions are the basis upon which international trade is made.

As more than one currency is involved in foreign trade, it gives rise to exchange of currencies which is known as Foreign Exchange. The term ‘Foreign Exchange’ has three principal meanings:

Firstly it is a term used referring to the currencies of other countries in terms of any single one currency. To a Bangladeshi, Dollar, Pound Sterling, etc. are foreign currencies and as such foreign exchanges.

Secondly, the term also commonly refer to some instruments used in international trade, such as bill of exchange, drafts, traveler’s cheque and other means of international remittance.

In terms of section 2(d) of the Foreign Exchange Regulations-1947, as adopted in Bangladesh foreign exchangemeans foreign currency and includes any instrument drawn, accepted, made or issued under clause 13 of article 16 of the Bangladesh Bank Order, 1972, all deposits, credits and balances payable in any foreign currency and draft, travelers cheque, letter of credit and bill of exchange expressed or drawn in Bangladesh currency but payable in any foreign currencies.

In exercise of the powers conferred by sec. 3 of the Foreign Exchange Regulations-1947, Bangladesh Bank issues license to scheduled banks to deal with foreign exchange. These banks are known as AuthorizedDealers (AD). Licenses are also issued by Bangladesh Bank to persons or firms to exchange foreign currency instruments such as T.C., Currency notes and coins. They are known as Authorized Money Changers.

4.1 International Trade and Foreign Exchange of MBL

International Trade forms the major business actively undertaken by Mercantile Bank Limited. The Bank with its worldwide network of correspondents and close relationship with key financial institutions provides an extensive trade services network to handle the transactions efficiently. International trade is an important constituent of the business portfolio of the Bank.

The import business of the Bank decreased to Tk. 40,380.10 million in 2007 from Tk. 42,442.80 million in 2006 and export bills decreased to Tk.32, 670.10 million in 2007 from Tk.34, 592.10 million in 2006. Remittances handled by the Bank increased and reached Tk. 3,510.40 million and Tk. 2,989.10 million respectively in 2007 and 2006 It was tk. 679.10 million in 2005.

The number of foreign correspondents is 584 as of December 31, 2007. Efforts are being continued to further expand the Correspondent Relationship to facilitate Bank’s growing foreign trade transactions. The Bank is using SWIFT communication system for fast and accurate handling for foreign trade. The Bank is connected to REUTERS also for up-to-date information on the foreign exchange markets.

To have crystal clear idea about the Foreign Exchange of MBL Critical analysis of the following are essential

Credit policy of the Bank

Credit sanctioning Authority of MBL and

Credit Monitoring / Supervision of Cell

Import section helps business and other people to import goods. In international environment, buyers and sellers are often unknown to each other. So seller always seek guarantee for the payment for his goods exported. Here is the role of bank. Bank gives export guarantee that it will pay for the goods on behalf of the buyer. This guarantee is called Letter of Credit. Thus the contract between importer and exporter is given a legal shape by the banker by its ‘Letter of Credit’.

When a buyer goes to import some goods from a foreign buyer, he request his bank makes payments to the exporter of goods. And the bank recovers the amount from the importer.

Sections:

Foreign exchange department of MBL, Main Branch is divided into two sections:

L/C Operation

Foreign Remittance

4.1.2 L/C OPERATION

Letter of Credit (L/C) can be defined as a “Credit Contract” whereby the buyer’s bank is committed (on behalf of the buyers) to place an agreed amount of money at the seller’s disposal under some agreed conditions. Since the agreed conditions include amongst other things, the presentation of some specified documents, the letter of credit is called Documentary letter of credit.

The Uniform Customs and Practices for Documentary Credit (UCPDC) published by International Chamber of Commerce (1993) publication no 500 define Documentary Credit:

a) Any arrangement however named or described whereby a bank (the issuing bank) acting at the request and on the instructions of a customs (the Applicant) or on it’s own behalf,

b) Is to make a payment to or to the order of a third party(the beneficiary) or is to accept and pay bills of exchange(Drafts)drawn by the beneficiary or

c) Authorize another bank to effect such payment or to accept and pay such bills of exchange (Drafts).

d) Authorize another bank to negotiate against stipulated documents provide that terms and conditions are complied with.

4.1.3 Types of Documentary Letter of Credit

Documentary letter of credit, basically, can be classified into two segments:

a) Revocable letter of credit

b) Irrevocable letter of credit

a) Revocable Letter of Credit:

This type of letter of credit can be revoked or cancelled at any time without consent of, or notice to the beneficiary. As per article 8 (a) of UCPDC-500 “A revocable credit may be amended or cancelled by the issuing bank at any moment and without prior notice to the beneficiary”.

In case of seller (beneficiary), revocable credit involves risk, as the credit may be amended or cancelled while the goods are in transit and before the documents are presented, or although presented before payments has been made. The seller would then face the problem of obtaining payment on the other hand revocable credit gives the buyer maximum flexibility, as it can be amended or cancelled without prior notice to the seller up to the moment of payment buy the issuing bank at which the issuing bank has made the credit available. In the modern banking the use of revocable credit is not widespread.

b) Irrevocable Letter of Credit:

An irrevocable credit is a documentary credit, which cannot be revoked, varied or changed/amended or cancelled without the consent of all parties- buyer (Applicant), seller (Beneficiary), Issuing Bank, and Confirming Bank (in case of confirmed L/C).

As per Article 9(a) of UCPDC 500, an irrevocable credit constitutes a definite undertaking of the Issuing Bank, provided that the stipulated documents are presented to the Nominated Bank or to the Issuing Bank and that the terms and conditions of the credit are complied with. Irrevocable Credit gives the seller greater assurance of payments, but he/she remains dependent on an undertaking of a foreign bank.

4.1.5 Documents Used in L/C Operation

The most commonly used documents in foreign exchange are:

i. Bill of Exchange

ii. Bill of Lading

iii. Commercial invoice

iv. Certificate of origin

v. Inspection certificate

vi. Packing list

vii. Insurance document

viii. Pro Forma Invoice (PI)/Indent

BILL OF EXCHANGE:

Bill of exchange is one of the important negotiable instruments in the mercantile world and used as a vital document facilitating settlement of payments between buyer/importer and seller/exporter at home and abroad. A bill when accepted by the drawee, gives evidence of the claim as made by the drawer as well as testimony to the acceptance of the debt by the drawee. The payment is done either in accordance with the terms of sale contract or under a L/C opened by the buyer/importer in favor of the seller/exporter.

BILL OF LADING:

A bill of lading is a document that is usually stipulated in a credit when the goods are dispatched by sea. It is evidence of a contract of carriage, is a receipt for the goods, and is a document of title to the goods. It also constitutes a document that is, or may be, needed to support an insurance claim.

The details on the bill of lading should include

ü A description of the goods in general terms not inconsistent with that in the credit.

ü Identifying marks and numbers.

ü The name of the carrying vessel.

ü Evidence that the goods have been loaded on board.

ü The ports of shipment and discharge.

COMMERCIAL INVOICE:

A commercial invoice is the accounting document by which the seller charges the goods to the buyer. A commercial invoice normally includes the following information:

ü Date

ü Name and address of buyer and seller

ü Order or contract number, quantity and description of the goods, unit price and the total

ü Price

ü Weight of the goods, number of packages, and shipping marks and numbers

ü Terms of delivery and payment

ü Shipment details

CERTIFICATE OF ORIGIN:

A certificate of origin is a signed statement providing evidence of the origin of the goods.

INSPECTION CERTIFICATE:

This is usually issued by an independent inspection company located in the exporting country certifying or describing the quality, specification or other aspects of the goods, as called for in the contract and/or the L/C. The buyer who also indicates the type of inspection he wishes the company to undertake usually nominates the inspection company.

PACKING LIST:

This is a unique document and not combined with other document. This is a listing of the contents of each package, cartoon etc. and other relevant information.

INSURANCE DOCUMENT:

Insurance is a contract whereby the insurer is undertaking to indemnify the assured to the agreed manner and extent against fortuitous losses. Insurance document generally contains the following information:

- The name of the insurer or his agent

- The name of the ship/carrier

- The name of assured

- The subject matter of insurance

4.2 Functions of Foreign Exchange Department of (UCBL):

Foreign Exchange Department performs many functions to facilitate the foreign exchange transactions. These are:

v Facilitating Import Trade

v Facilitating Export Trade

v Providing Funded and Non-funded Credit Facility.

v Provide Non Commercial Remittance

v Foreign Currency Accounts

v Selling of Foreign Currency Bond

v Preparation and Submission of Statements

The International Division placed at the United Commercial Bank’s head office at Motijheel is the backbone of all international transaction that is conducted through the various branches of the bank. A total of 85 branches of United Commercial Bank have the license to carry out international trade functions. Each of these AD branches have foreign exchange department whose sole purpose is to carry out cross border transaction demanded by the customers. The functions of such Foreign Exchange Department can be divided into three sections:

v Import Section

Import is the flow of goods and services purchased by economic agent staying in the country from economic agent staying abroad.

We can simplify Import as a means purchase of goods and services from the foreign countries into Bangladesh. Normally consumers, firms and Government of Bangladesh import foreign goods to meet their various necessities. Import section of the Foreign Exchange Department helps business and other people to import goods. So seller always seeks guarantee for the payment for his goods exported. Here is the role of bank. Bank gives export guarantee that it will pay for the goods on behalf of the buyer. This guarantee is called Letter of Credit. Thus the contract between importer and exporter is given a legal shape by the banker by its ‘Letter of Credit’. When a buyer goes to import some goods from a foreign buyer, he request his bank makes payments to the exporter of goods. And the bank recovers the amount from the importer.

4.2.1 Letter of Credit:

Letter of Credit is a guarantee or undertaking or commitment to the beneficiary/exporter for making payment issued by the issuing bank on behalf of the importer upon fulfillment of some conditions. Central Banks, therefore assure these things to happen simultaneously by opening Letter of Credit guaranteeing payments to seller and goods to buyer. By opening a Letter of Credit on behalf of buyer in favor of seller, commercial banks undertake to make payments to a seller subject to submission of documents drawn on in strictly compliance with Letter of Credit terms giving title of goods to the buyer. It is a conditional guarantee. The Letter of Credit thus constitutes one of the most important methods of financing foreign trade. In the Import Policy Order 2003-2008 Letter of Credit denoted as – ‘“Letter of Credit” means a letter of credit opened for the purpose of import under this Order’ The expression “Documentary Credit(s)” and “Standby Letter(s)” means any arrangements, however named or described, whereby a bank (“the issuing bank”) acting at the request and on the instruction of a customer (the “Applicant”) or on its own behalf,

v Is to make a payment to or the order of a third party (“the Beneficiary”), or is to accept and pay bills of exchange (Draft’s) drawn by the Beneficiary, Or

v authorizes another bank to effect such payment, or to accept and pay such bills of exchange (Draft(s)),Or

v authorizes another bank to negotiate,

v Against stipulated document(s), provided that the terms and conditions of the Credit and complied with.

On the other hand Letter of credit can be defined as a “Credit Contract” whereby the buyer’s bank is committed (on behalf of the buyers) to place an agreed amount of money at the seller’s disposal under some agreed conditions. Since the agreed conditions include amongst other things, the presentation of some specified documents, the letter of credit is called Documentary letter of credit. The uniform customs and practices for documentary Credit (UCPDC) published by international Chamber of Commerce (1993) revision, publication no 500 define Documentary Credit:

v Any arrangement however named or described whereby a bank (the issuing bank) acting at the request and on the instructions of a customs (the Applicant) or on it’s own behalf,

v Authorize another bank to effect such payment or to accept and pay such bills of exchange (Drafts)

v Authorize another bank to negotiate against stipulated documents provide that terms and conditions are complied with.

4.2.2 Types of Letter of Credit:

There are many types of Letter of Credits that are used in different countries of the world. But International Chamber of Commerce (ICC) vides their UCPDC- 500, which denotes only two types of LETTER OF Credits; mentioned:

- Ø Revocable Letter of Credit

A revocable credit may be amended or cancelled by the issuing bank at any moment and without prior notice to the beneficiary. That is to say, this type of letter of credit can be revoked or cancelled at any time without consent of, or notice to the beneficiary.

In case of seller (beneficiary), revocable credit involves risk, as the credit may be amended or cancelled while the goods are in transit and before the documents are presented, or although presented before payments has been made. The seller would then face the problem of obtaining payment on the other hand revocable credit gives the buyer maximum flexibility, as it can be amended or cancelled without prior notice to the seller up to the moment of payment buy the issuing bank at which the issuing bank has made the credit available. In the modern banking the use of revocable credit is not widespread.

In this case the issuing banks must perform the following two roles:

• Reimburse another bank with which a revocable Credit has been made available for sight payment, acceptance or negotiation – for any payment, acceptance or negotiation made by such – prior to receipt by it of notice of amendment or cancellation, against documents which appear on their face to be in compliance with the terms and conditions of the Credit;

• Reimburse another bank with which a revocable Credit has been made available for deferred payment, if such a bank has, prior to receipt by it of notice of amendment or cancellation, take up documents which appear on their face to be in compliance with the terms and conditions of the Credit.

- Ø Irrevocable Letter of Credit

An irrevocable credit is a documentary credit, which cannot be revoked, varied or changed/amended or cancelled without the consent of all parties- buyer (Applicant), seller (Beneficiary), Issuing Bank, and Confirming Bank (in case of confirmed Letter of Credit). Irrevocable Credit gives the seller greater assurance of payments, but he/she remains dependent on an undertaking of a foreign bank. In the issuance of Irrevocable Letter of Credit both the Issuing and Conforming Bank have some liability, mentioned bellow, as per UCPDC -500: The following types of Letter of Credits are used in the UCBL, Mohammadpur Branch:

- Ø Cash Letter of Credit

Payment made form cash foreign exchange not from export proceeds; there is not export L.C. which backs the import Letter of Credit Payment term is at sight.

- Ø Deferred Letter of Credit

The only difference between cash Letter of Credit and deferred Letter of Credit lied in the terms of payment. Payment under deferred Letter of Credit is made after certain days of presentation of the export bill. Letter of Credit the differed payment basis may be opened for the following cases:

- Ø Items Period

Back to Back Imports Maximum 180 days

Agricultural Industrial Raw Materials (For own use) Maximum 180 days

Implements & Chemical Fertilizer Maximum 180 days

Capital Machinery Maximum 360 days

Coastal Vessel Maximum 360 days

Life Saving Drugs Maximum 90 Day

- Ø Back to Back Letter of Credit

The back to back credit is a new credit opened on the basis of an original credit in favor or another beneficiary. Under back to back concept, the seller as the beneficiary of the first credit offers it as security to the advising bank for the issuance of the second credit. The beneficiary of the back to back credit may be located inside or the out side the original beneficiary’s country.

- Ø Anticipatory Credit

The anticipatory credits make provision for pre-shipment payment to the beneficiary in anticipation of his effecting the shipment as per L/C conditions.

4.2.3 General Conditions of Import of Goods:

- Import Trade Control Schedule Number For import purpose, use of ITC Number (H.S. Code) with at least six digits corresponding to the classification of goods as given in the Import Trade Control Schedule 1988, based on the Harmonized Commodity Description and Coding System, shall be mandatory. The seven Digit H.S. Code published by Bangladesh Bureau of Statistics may also be mentioned in the Letter of Credit. Form, Letter of Credit and other relevant paper within a bracket in addition to normal H. S. Code as mentioned above. No bank shall issue Letter of Credit Authorization form or open Letter of Credit without properly mentioning I. T. C. number (H. S. Code) thereon.

4.2.4 Parties of a Letter of Credit:

- • APPLICANT FOR THE CREDIT: The importer or buyer on whose request and on whose behalf the letter of credit is opened is called the applicant.

- • ISSUING BANK/ OPENING BANK: The bank that opens a Letter of Credit, at the request of the importer, is known as Issuing Bank. The Issuing Bank is the buyer’s bank and is also called opening bank.

- • BENEFICIARY: The party, normally the supplier of the goods, in whose favor the Letter of Credit is opened is called beneficiary. The seller, after shipping the goods as per terms of the credit, presents the documents to negotiating bank/conforming bank for negotiation.

- • ADVISING BANK: The bank is the exporter’s country, usually the foreign correspondent of the importer’s bank; through which Letter of Credit is advised to the supplier is called the ‘advising bank’.

- • CONFORMING BANK: If the advising bank also adds its own undertaking to honor the credit while advising the same to the beneficiary, it becomes the conforming bank. The conforming bank, in addition, becomes liable to pay for documents in conformity with the Letter of Credit terms and conditions.

- • NEGOTIATING BANK: The Bank, which negotiates the bill (draft) of the exporter drawn under the credit, is known as negotiating bank. If the advising bank is also authorized to negotiate the bill (draft) drawn by the exporter it itself becomes the negotiating bank.

- • ACCEPTING BANK: A bank that (as specified in the Letter of Credit) accepts time or usance drafts on behalf of the importer is called the accepting bank. The Letter of Credit issuing bank can also take on the responsibility of an accepting bank.

- • PAYING BANK: The bank that effects payment to the beneficiary (as named in the Letter of Credit) is known as paying bank/drawee bank.

- • REIMBURSING BANK: If the issuing bank does not maintain any account with THE

NEGOTIATING bank an alternate arrangement is made to reimburse it for the amount payable under a credit form some other bank. The later bank is termed as reimbursing bank. An authority to debit his account is sent to the bank with whom the account is maintained to honor the claims placed by a negotiating bank.

4.2.5 Preparation of Proposal and submitting it to the Competent Authority for Obtaining Permission of Opening Letter Of Credit:

Before opening Letter of Credit the applicant must take permission from the competent authority. Whether the authority has to be taken form the Branch or from the Head Office depends on the amount of Letter of Credit and the percentage of margin. A proposal for obtaining permission for opening Letter of Credit generally contains the following points:

- • Name and address of the importer;

- • Name and address of the Guarantor if any;

- • Particular of Merchandise to be imported along with name of the item Harmonized System (H.S.) Code, country of origin, quantity, unit price and purpose of import.

- • Particulars/ Terms of LC along with name and address of the beneficiary, tenor of payment, port of loading and discharge, shipment validity and expiry date etc.;

- • Landed cost of the goods;

- • Market price of the goods at Dhaka and Chittagong (if applicable);

- • Name of the previous banker with outstanding liability (if any);

- • Number of CD accounts and transaction performance through this account;

- • Present liability position with the bank;

- • Present liability position of allied/sister concerns with the bank

- • Letter of Credit performance of the party during the year/previous year;

4.2.6 Steps for Import L/C operation:

Step 1: Registration with CCI & E:

- For engaging in international trade, every trader must be first registered with the chief Controller of Import and Export.

- By paying specified registration fees to the CCI & E. the trader will get IRC/ERC to open L/C with Bank, this IRC is must.

Steps 2- Determination terms of credit: