An audit procedure is the detailed instruction of the collection of a type of audit evidence that is to be obtained at some time during the audit. A major decision facing every auditor is determining appropriate types and amounts of evidence to accumulate to be satisfied that the components of the client’s financial statements and the overall statements are fairly stated.

Audit Evidence Decision:

A major decision facing every auditor is determining appropriate types and amounts of evidence to accumulate to be satisfied that the components of the client’s financial statements and the overall statements are fairly stated. This judgment is important because of the prohibitive cost of examining and evaluating all available evidence.

The auditor’s decisions on evidence accumulation can be broken down into the following four sub-decisions:

- Which audit procedures to use

- What sample size to select for a given procedure

- Which items to select from the population

- When to perform the procedures

Audit procedures:

An audit procedure is the detailed instruction of the collection of a type of audit evidence that is to be obtained at some time during the audit. For example, the following is an audit procedure for the verification of cash disbursements:

* Obtain the cash disbursements journal and compare the payee name, amount, and date on the canceled check with the cash disbursements journal.

Sample size:

Once an audit procedure is selected it is possible to vary the sample size from one to all the items in the population being tested.

Items to select:

After the sample size has been determined for an audit procedure, it is still necessary to decide which items in the population to test.

Timing:

An audit of financial statements usually covers a period such as a year, and an audit is usually not completed until several weeks or months after the end of the period.

The persuasiveness of Evidence:

The third standard of fieldwork that was introduced in chapter 2 requires the auditor to accumulate sufficient competent evidence to support the opinion issued. Because of the nature of audit evidence and the cost considerations of doing an audit, it is unlikely that the auditor will be completely convinced that the opinion is correct.

The two determinants of the persuasiveness of evidence are competence and sufficiency, which are taken directly from the third standard of fieldwork.

Competence:

Relevance Evidence must pertain to or be relevant to the audit objective that the auditor is testing before it can be reliable. For example, assume that the auditor is concerned that a client is failing to bill customers for shipment.

Independence of provider Evidence obtained from a source outside the entity is more reliable than that obtained from.

Effectiveness of client’s internal controls When a client’s internal controls are effective, the evidence obtained is more reliable than when they are weak.

Auditor’s direct knowledge Evidence obtained directly by the auditor through physical examination observation, computation, and inspection is more competent than information obtained indirectly.

Qualifications of individuals providing the information Although the source of information is independent, the evidence will not be reliable unless the individual providing it is qualified to do so.

Degree of objectivity Objective evidence is more reliable than evidence that requires considerable judgment to determine whether it is correct.

Timeliness The timeliness of audit evidence can refer either to when it is accumulated or to the period covered by the audit.

Sufficiency:

The quantity of evidence obtained determines its sufficiency. The sufficiency of the evidence is measured primarily by the sample size the auditor selects. For a given audit procedure, the evidence obtained from a sample of 200 would ordinarily be more sufficient than from a sample of 100.

Combined Effect:

The persuasiveness of evidence can be evaluated only after considering the combination of competence and sufficiency, including the effects of the factors influencing competence and sufficiency. A large sample of evidence provided by an independent is not persuasive unless it is relevant to the audit objective being tested.

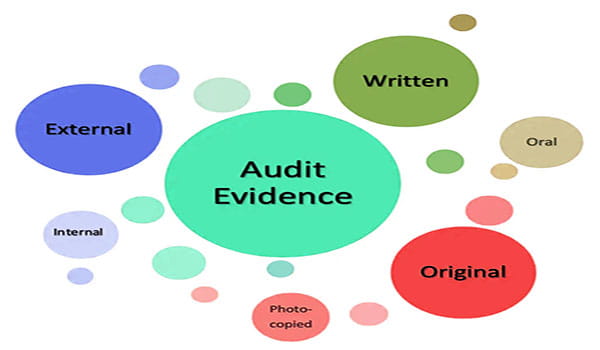

Types of Audit Evidence:

- Physical examination

- Confirmation

- Observation

- Documentation

- Inquiries from the client

- Re performance

- Analytical procedures

Physical examination:

Physical examination is the inspection or count by the auditor of a tangible asset. This type of evidence is most often associated with inventory and cash but it is also applicable to the verification of securities, notes receivable, and tangible fixed assets. The distinction between the physical examination of assets, such as marketable securities and cash, and the examination of documents, such as canceled checks and sales documents, is important for auditing purposes.

Confirmation:

Confirmation describes the receipt of a written or oral response from an independent third party verifying the accuracy of the information that was requested by the auditor. The request is made to the client, and the client asks the independent third party to respond directly to the auditor. Because confirmations come from sources independent of the client they are a highly regarded and often used type of evidence.

Table 7-3: Information Often Confirmed:

| Information | Source |

| Asset: Cash in bank accounts receivable notes receivable Owned inventory cut on consignment Inventory held in public warehouses Cash surrender value of life insurance | BankCustomerMaker

Consignee Public warehouse Insurance company |

| Liabilities Accounts payableNotes payableAdvances from customers Mortgages payable Bonds payable | CreditorLenderCustomer

Mortgagor Bondholder |

| Owners’ Equity Shares outstanding | Registrar and transfer agent |

| Other information Insurance coverageContingent liabilitiesBond indenture agreements Collateral held by creditors | Insurance company bank, lender, and client’s legal counselBondholder

Creditor |

Documentation:

Documents can be conveniently classified as internal and external. An internal document is one that has been prepared and used within the client’s organization and is retained without ever going to an outside party such as a customer or a vendor.

An external document is one that has been in the hands of someone outside the client’s organization who is a party to the transaction being documented, but which is either currently in the hands of the client or readily accessible.

Observation:

Observation is the use of the senses in certain activities. Throughout the audit, there are many opportunities to exercise sight, hearing, touch, and smell to evaluate a wide range of items.

Inquiries of the client:

Inquiry is the obtaining of written or oral information from the client in response to questions from the auditor. Although considerable evidence is obtained from the client through inquiry, it usually cannot be regarded as conclusive because it is not from an independent source and may be biased in the client’s favor.

Re performance:

Re-performance involves rechecking a sample of the computations and transfers of information made by the client during the period under audit. Rechecking computations consist of testing the client’s arithmetical accuracy.

Analytical procedures:

Analytical procedures use comparisons and relationships to assess whether account balances or other data appear reasonable.

Five Types of analytical procedures:

- Compare client and industry data.

- Compare client data with similar prior period data.

- Compare client data with client-determined expected results.

- Compare client data with auditor-determined expected results.

- Compare client data with expected results, using no financial data.