A term loan is a type of loan that is typically paid back over a fixed period of time, usually in regular installments (such as monthly, quarterly, or annually). It is a loan with a specific repayment term and interest rate, and the borrower is required to pay back the loan amount plus interest within the specified time period.

A term loan is a loan from a financial institution with a maturity of more than a year. A term loan is a contract in which a borrower agrees to make a series of interest and principal payments over a set period of time. Term loans typically have maturities ranging from 5 to 10 years. Term loans, on the other hand, can have maturities of two years or more. Term loan funds are typically used to finance permanent working capital, pay for fixed assets, or repay other loans.

The borrower and lender sign a formal term loan agreement. It specifies the maturity period, payment date, interest rate, restrictive provisions, collateral, and so on. The repayment terms for a term loan can vary depending on the lender and the borrower’s creditworthiness. Some term loans may have fixed interest rates, while others may have variable rates that change over time. Generally, term loans with longer repayment periods will have higher interest rates than those with shorter repayment periods.

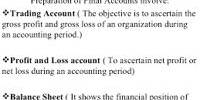

Advantages of Term Loans

Term loans have some distinct benefits over public offerings. It can be raised in a relatively short period of time because term loans are negotiated directly between the lender and the borrower, with minimal documentation. However, the public offering of long-term securities is a time-consuming process. Another benefit of a term loan is flexibility. Term loan terms and conditions can be revised by mutual agreement between the lender and borrower. Another advantage of term loans is that they have lower issuance costs. Firms can avoid flotation costs such as underwriting fees, commissions, certificate printing charges, advertisement costs, and so on.

Types of term loans

If you decide you want a term loan, you can apply for a short-term, intermediate-term or long-term loan.

- Short-term loans

These are loans you can take out for smaller amounts, with shorter repayment periods – generally one or two years. Short-term loans are good for day-to-day working capital expenses. However, since these loans are more convenient and easier to apply for, you can expect to pay higher rates.

- Intermediate-term loans

Intermediate-term loans are the happy medium between short- and long-term loans. The repayment terms are typically two to five years, and you can access up to $500,000. These loans are a good option for businesses looking to open a new location or hire more people. This type of funding can help you expand your business operations and begin generating more revenue.

- Long-term loans

Long-term loans offer the highest amounts and the longest repayment terms. You can access millions of dollars in funding, and the repayment terms can be up to 25 years. A long-term loan is a good option for an established business with excellent credit and a solid financial record. You may consider one to fund long-term growth strategies for your business.

Application

Term loans are commonly used by businesses to finance large capital expenditures such as equipment purchases, real estate acquisitions, or other long-term investments. They can also be used by individuals for large purchases such as a home or car.

Individual term loans are available, but they are most commonly used for small business and midsized corporate loans. The ability to repay over a long period of time is appealing for new or expanding businesses because it is assumed that profits will increase over time. Term loans are an excellent way to quickly increase capital in order to expand a company’s supply capabilities or range. For example, some new businesses may use a term loan to purchase company vehicles or rent additional office space.