Comprehensive Analysis of Tri-Star Toothbrush and Company’s Supply Chain

With the passage of time, supply chain management has become very crucial for companies ranging from small local to large MNCs. The overwhelming impact of supply chain management on creating value for companies has become a cynosure of all industrial & management research. And when it comes to FMCG companies, the impact is even larger. As far as Tri star & Co’s supply chain is concerned, it demands considerable attention given the value it is creating for the particular company. Given their initial strategy to become responsive, they are now actually focusing more on efficiency driven by the intense price competition forged by the low priced local products. Given the driver specific strategy of Tri star & Co, it maintains efficiency in case of facility, pricing and information. Among all these three drivers the company is able to maintain staggering level of efficiency in managing it facilities. In case of the rest of the drivers the company is already very responsive. At present in transporting their products they want to become highly responsive which consequently incurs high cost for them. Therefore, going for a milk run based distribution system for its different zonal product distribution will help them to reduce costs while maintaining high level of responsiveness in terms of reduction in lead time. As Tri star & Co is an FMCG company, it has to push its product anticipating customer demand from time to time and market response. So, it’s more like a push based view for Tri star’s supply chain.

Introduction

Tri-star toothbrush & Co. is a company which operates with FMCGs, in particular their mother product is Toothbrush. In the FMCG industry almost every month toothbrush has a turnover of almost 10 crore tk. Toothbrushes are produced locally and also being imported from china and India. But majority of the demand is fulfilled by the local companies like Tri-star toothbrush & Co, Matador, Anwar Brush Company (ABC), J.K enterprise (sole producer of Unilever Bangladesh), Alpha toothbrush Co., MGH Group (Oral B). These five toothbrush companies are actually capturing the major market share in the industry. This is around 90% of the toothbrush market.

There are also some importers or other companies both local and multinationals like Trisha the Switcher land base company, MGH Group (Oral-B), Aroma are either outsourcing/subcontracting or importing from their other facility in China or in India. Also some sole enterprises are importing toothbrush from China at a very low price than the local manufacturer. These importers are covering almost 10-15% of the market shares of toothbrush.

So, both of these local manufacturers and importers are capturing the total market share of toothbrush industry.

Objective of the report

The primary objective of this report is to fulfill the requirement of the BUS 400 (Internship) course. It is a mandatory part of this program. Every student has to submit a report based on their three months experience in an organization.

Secondary objectives are-

- To understand the supply chain activities of Tri-Star Toothbrush and Co.

- To relate the academic knowledge with practical world.

- To find out how a manufacturing organization operates in the market.

- To show the defective supply chain or the bottlenecks in Tri-Star Toothbrush & Co.’s supply chain for which the company is losing market position

Methodology

The report will contain both qualitative and quantitative data within. All the quantitative data are not in actual form they are being manipulated for the sake of confidentiality of the company. Different supply chain theories and tools have been used here to make the report. So, most of the methods are supply chain related like strategic- fit analysis, MRP (material requirement planning) production schedule, demand forecasting, aggregate planning, cycle inventory related tools, chase Vs. level strategy etc.

All these tools and methods are used for better understanding of Tri-Star’s supply chain functions and to figure out at different given situation and market condition what is and will be the correct actions of the supply chain manager working in an FMCG company and here it is Tri-star toothbrush & Co.

So, in short following methods were used:

- Observations are the first and strongest source of collecting information. This 12 weeks window gives me a perfect opportunity to understand its supply chain activities.

- Interview with managers of several departments.

- Discussion with employees of the organization.

- Relevant documents were studied as provided by the officers concerned.

Sources of data

Most of the data are primary data collected from the company. Some secondary data are also used from other sources about the market, competitors and other factors affecting the overall supply chain to become competitive.

Comprehensive Analysis of Tri-Star Toothbrush & Co.’s Supply Chain

Supply chain structure of the company:

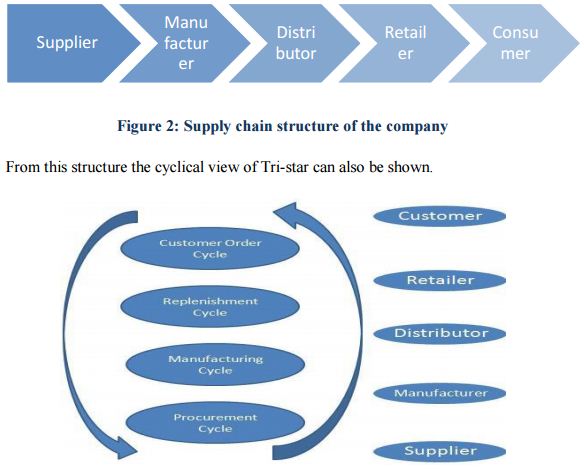

The supply chain structure of the company is the most traditional structure we usually observe in manufacturing industries. The SC structure is given below.

This Supply chin structure and cycle view can precisely show us the overall roles and responsibilities of each member of the chain and the desired outcomes from the process. Cycle view is very useful while considering operational decisions.

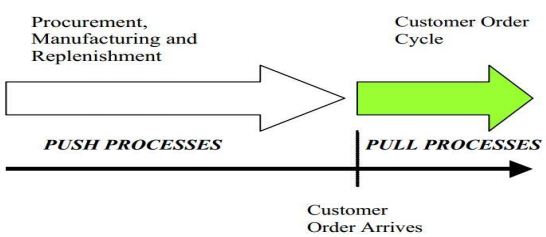

Another point of view is the Push & Pull view of the supply chain process. As a FMCG manufacturing company Tri-star is mostly Push process based company. We know there is no such organization which has full push or full pull process supply chain.

Tri-star is Push process based because they always has to anticipate the consumer demand through their past sales data, experiences, economic situation, seasonality, data from sales representatives or sales team which gives more accurate picture of the demand. The Push vs. Pull process of Tri-star is shown below.

Competitive strategy:

To be competitive the company focuses on end user by ensuring higher quality products and trying to attract them through attractive packaging and bundle offer. So, the target consumers are by default more quality oriented rather than price sensitive.

But in recent they are facing problems to align this competitive strategy with the supply chain strategy.

Supply chain strategy:

Determines the nature of material procurement, transportation of materials, manufacture of product or creation of service, distribution of product. Consistency and support between supply chain strategy, competitive strategy, and other functional strategies is important.

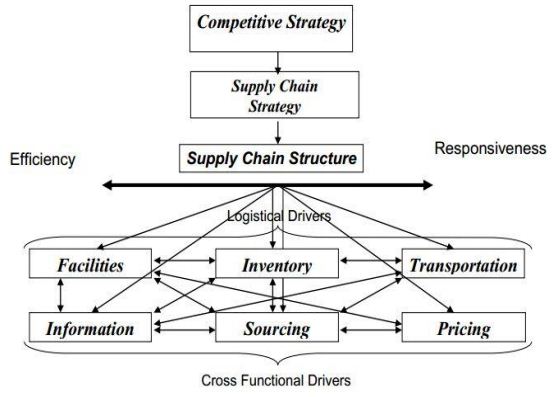

Explanation: of strategic fit

The strategic fit of the supply chain shows the overall situation of the company that in which area the company usually operates. it shows the responsive and efficiency spectrum of the company. It’s pretty obvious that any company has to tradeoff between cost and responsiveness because as the company makes it more responsive, more cost incurs and make it less efficient. Here, Tri-star Co, is at somewhat Responsive spectrum because it believes in providing best quality product with a greater variety and availability to its customer. The further explanation of this strategic fit is given throughout the supply chain framework and Six-Driver analysis of the company.

But as I have connected and communicated with the top management of the company it seems like that they are trying to become more efficient to become market leader once again. And that future expected point in the strategic fit is shown in the above figure.

Supply chain Framework of Tri-star Toothbrush & Co:

The goal of a supply chain strategy is to strike the balance between responsiveness and efficiency that fit with the competitive strategy. To reach this goal, Tri-star Co must structure the right combination of the three logistical and three cross functional drivers. For each of the individual drivers, Tri-star must make a trade-off between efficiency and responsiveness based on interaction with the other drivers. The combine impact of these drivers will then determine the responsiveness and the profit of the entire supply chain. The overall responsiveness and efficiency of Tri-star’s supply chain drivers are described below, that will give the insight about the supply chain structure of the company’s current supply chain strategy.

Supply chain drivers of Tri-star:

Inventory:

In supply chain inventory rolls in the form of raw materials, work in progress and finished goods. As we know the Total Cost of Inventory= cost of materials+ ordering/set up costs + holding costs. TC= CD+ (D/Q)S+ (Q/2)hC. So, inventory plays a pretty big role in the whole supply chain. Because of the fund, information and product flow in both ways within the supply chain. Let’s see what the inventories that Tri-star keeps are.

Raw materials:

PP (polypropylene): is used as the main raw material in this industry this is actually known as plastic powder to mass people. It is mainly used to make the core body or handle of the toothbrush. There are different versions of polypropylene. PP is used in daily basis for production and it is purchased from the local supplier. Tri-star needs daily 15 bags of PP on an average, in different combination and they use the good quality food grade plastic which is not harmful for gum and teeth. In a bag there is 25 kilos of PPs which costs approximately 4000tk. which is used in Blister packs, recycled powder costs 2200 tk. per bag which is used in hanger toothbrushes, PPCP costs 5100tk used in transparent or semi-transparent bendable handle. K-resin/Q-resin costs 8000-10000 tk. per bag which is used in Crystallized and full transparent handles.

Rubber: is used on the handles of toothbrushes and they are imported directly from the supplier in china and Tiwan. It is purchased in tons. On an average 3 tons of rubber is purchased/ imported at a time and this supports around 2 months. So, 30 kilos of rubber is used in production per day.

Filament: is imported from “DuPont” Chinese facility. This is used in the tufting purpose and around one ton of filaments are purchased at a time. Filament is use on an average 28 kilos per day. And one ton filament supports around 1.5 months production. So, filaments have to be ordered within 15 days cycle. Mono filament is around 9.5-10 USD per kilo and Herrox filament is around 11-12 USD per kilo. Tapered filament is 13-14 USD per kilo.

Packaging board: is used for packaging and printing purpose. It is purchased regular basis according to demand. There are 5-6 categories of boards known as PVC sheet or plastic sheets used for packaging in hanger and blister packs. On an average 4-5 rolls PVC sheet is used daily for packaging. Along with PVC sheets the printing boards are also purchased which afterward goes for printing according to different brand.

Aluminum wire: Is used in tufting also and usually stocked for 6 months.

Lacquer: The glue used for packaging/gumming or pasting. Lacker is purchased / imported from India. On average 5-6 drums of lacker is purchased at a time. These lackers supports around 3 months.

These are all the raw materials are used to manufacture a finished toothbrush.

Work in process & finished goods:

Using all these raw materials and labor, machines, mold design, water, electricity as inputs a final toothbrush is produced. So, as work in progress first come the handle, than the grips and rubbers are added to the handle according to design, than the filament is added to the handle, than it goes for trimming and final check for defaults, than it goes for packaging, than packaging has got some steps which are outsourced and finally the finished good comes in hand.

Facility:

Facility in the supply chain is mainly divided into 2 parts production facility and warehousing facility. The location, capacity, manufacturing methodology, warehousing methodology mainly constructs the facility of a supply chain. Let’s see how Tri-star maintains their manufacture, use capacity, use warehouse, and location.

(i) Production facility:

The production facility of Tri-star is owned by the owners and it purchase at the year of 1992. This is around 15,000 SQ feet in terms of space. At present Tri-star has been able to amortize the investment of the production facility. Now at present condition they do not show any rent or any charge under the heading production facility. They don’t actually bother to keep any fund in respect to the facility charge or rent for the purpose of future expansion of the production facility.

Capacity: at present condition this production facility has 6 injection molding machines, 4 Vertical machines, 6 tufting machines, 2 sealing and packing machines. This present machineries can produce around 320 Grush toothbrushes per day if the current combination of machines and capacity is combined with labor force. But currently Tri-star is producing 250-280 grush per day on demand basis.

Machine hours: Tri-star runs 2 shifts a day each consists 8 hours. So, total 16 hours per day these machines could run this is optimal because if each machine runs more than 8 hours per shift it creates heavy pressure on them and machines get hot. So, to maintenance purpose Tri-star usually run these machines 16 hours a day.

Labor hours: Tri-star has more than 100 labors on an average who are working as full time in 2 different shifts. The wage of per labor is on average 5000 taka. Overtime wage twice as basic according to labor law.

Utilization: currently Tri-star is using around 66.666% of the capacity in terms of machineries and space. Because as they are producing 250-280 grushes per day and they can still introduce 5-6 new machineries which will be able to produce 400-420 grushes per day. Here they are not utilizing 34% or more of their current capacity.

Product verity: there are 48 types of toothbrushes Tri-star produces under their different brand names. (appendix-list of products)

Idle time: as the machineries are using a 4 hours gap after each shift which goes for total 8 hours of idle time in the capacity.

Quality loss: toothbrush is a plastic intensive industry where both quality control and wastage control is much more easy than other FMCGs. Here loss due to defective products usually doesn’t occur but still there is a slight amount of wastage on total production which is 1% only.

Cost of fuel monthly 90,000 taka, electricity 300,000 taka, maintenance 30,000 taka etc.

(ii) Manufacturing Process:

Injection Modeling:

At first they put PP powder (Polypropylene powder) in the Injection Molding Machine which is almost like a small plastic ball. These plastic balls are of crystal color. According to the design of the brush they add different color to make the body of the toothbrush. The pressurization of the Machine of plastic balls in 40 degree Celsius is used to shape the body of the brush. Within 20 to 40 second these machine produce the shape of the body of a tooth brush. It can produce 8 toothbrushes at a time. In the injection modeling machine there is some dice which help to design the brush. They have five injection Modeling machine in their factory.

Vertical Machine:

It adds rubber to design the toothbrush. At first they put eight brushes at the middle of the machine and the brushes are held for 5 seconds to put grip and rubber on the brush. That means whatever work is remaining in the stage of injection modeling machine, is been completed in this vertical machine. Moreover, in total it needs approximately 20 seconds to add a logo. They have 3 particle machines to make their production faster.

Tufting Machine:

After the completion of the job of vertical machine, next step is done by Tufting Machine. Main job of Tufting machine is to adjoin bushels on the head of tooth brush. They use the silver ware to weave the filaments at the head of the brush which help to attach the filaments strongly with the brush.

The machine takes one minute to attach filaments on the five brushes. Whatever the color or design they want to add on the filaments they set on the machine, which is controlled by the PRM-850 programming system. For each design they have particular software to command the machine. They have 5 Tufting Machines in their factory. In one minute they can adjoin 25 pieces of brushes. In this production section one people control each machine. According to them this machine holds the highest price among the entire machineries they have. These machines are kept in the air conditioned room as this task is controlled by computer programming.

Finishing Machine:

Tufting machine has some limitation like brushes of toothbrush may not be in same size or may be filaments are not in same line. For that reason to ensure the quality, finishing machine do the final touch. They have two finishing machines for that purpose and each machine sizing the filaments. These machines are able to size 100 filaments within one minute. However if machines do defect for any reasons they continue their production by manually. They have 6 workers for this department.

PVC (polyvinyl chloride) forming machine:

For the packaging purpose at first they prepare plastic cover. Previously they collected plastic cover from their supplier which incurred huge cost and ultimately reduced profit. To solve this problem, recently they start to produce plastic cover by themselves. Tri-Star purchases the bundle of the plastic paper. At first they put the plastic paper into the PVC forming machine in 24 degree Celsius and after the 20 second it divides the paper into 8 brush shapes plastic cover. They have only one PVC forming machine.

Blister Packaging Machine:

After the tasks of finishing machine here comes the packaging part. For that purpose, they use two Blister Packaging Machines, which help to package the toothbrush. To packages the brush they first lay down the plastic cover page.

Then keep eight brushes on that shaped plastic paper and upon those brushes they put a paper which is labeled by their company name and logo. Then through the system, they send those brushes to the middle of the machine. In this process the upper side of the machine put pressure on that. And after that a package of 8 brushes comes out through the Blister packaging machine. In total it takes nearly 5 seconds to package 8 brushes.

They let us know that, the logo papers are outsourced from different computer and graphic shop. They have not any fixed suppliers for that, rather they go for bargaining option to reduce cost. They let us know that if any packaging machines run out of operation or for load shedding they go for manual production. For that packaging department they have 20 workers.

(iii) Storage/Warehousing facility:

The other facility which is only allocated for warehousing the SKUs (stock keeping units) is situated in ChwakBazar. Tri-star’s sales and distribution office is also situated out there within that warehouse facility.

- Capacity: the warehousing facility has a capacity of keeping 350-400 grushes of toothbrush at a time. The facility is around 2500 SQfeet in size.

- Labor: in this facility around 4/5 labor are needed daily basis to load and unload the products and their average wage is 3500 taka per month

- Cost: cost of the capacity is 23500 taka per month.

Transportation:

The role of transportation in Supply chain becomes much more critical when it is dealt with FMCGs. Transportation covers 70% of the logistics cost on an average. Decision regarding the distribution channels, modes of transportation, third-party or in-house transportation, infrastructure, consumer segments and distances etc. affects the supply chain and make the supply chain either responsive or efficient in terms of the competitive strategy of the company. Overall success is closely linked to the appropriate use of transportation.

Being a FMCG manufacturing company Tri-star makes its transportation in a mixed way. Their transportation cost is 2% on the monthly turnover. They have got their own fleet, but they mainly use the Courier service companies to distribute their product to the distributors who are scattered within the country. So, Tri-star has 2 phases of transportation system. Mostly they use the Road which is most convenient and cheap.

Own-fleet:

Tri-star has got 2 delivery vans of its own to deliver products from factory to the distribution center/ sales office locate in Chwak Bazar. These 2 delivery vans are just used for this purpose which doesn’t much of a cost on transportation. For fuel, driver and other maintenance purposes these delivery vans costs around 15000-20000 taka monthly.

Third-party service:

After delivering the products from factory to DC, Tri-star sent these products to its distributors through courier service or third party transportation service. This thirdparty transportation service costs around 2% of the turnover; this cost around 300,000 taka monthly.

Marketing monitoring transportation costs:

15 area managers, 108 sales representatives and marketing manager gets allowance as TA (travel allowance) which eventually goes under transportation cost.

Sourcing:

Sourcing decision is related to purchasing and raw material procuring and even outsourcing some of firm’s own processes to become efficient or responsive according to the competitive strategy of the firm. Here we will see how does Tri-star source, outsource, make or buy its products.

As a manufacturing company Tri-star Co mostly goes for manufacturing its own product in its own facility.

Procurement:

- Polypropylene the major raw material for production is procured from local market which is actually imported from Saudi Arabia or China. K-resin and Qresin is also purchased from local market those are more expensive than PP. usual plastic powder is quite available in the local market that’s why Tri-star doesn’t need to panic on this issue. But Q-resin & K-resin is a very high demanded plastic in the market because it is used in RMG sector to make buttons, that’s why these 2 PPs gets out of the market within a very short time. This scenario makes the price of Q-resin & K-resin much volatile and high in the market (8000-13000) per bag. These PPs can be purchased either on cash or on credit and eventually purchasing in cash saves around 50-60 taka per bag. Supplier is fixed but varies if supplier fails.

- Rubber is imported from china at 290 taka per kilo and at 350 taka per kilo from India. Most of the time, Tri-star tries to procure rubber from China. The problem is Chinese Rubber is more efficient than Indian ones but it takes much more time which make the chain efficient but looses the responsiveness. So, what does Tri-star does is procure mostly from China when the demand for rubber griped toothbrushes are stable. But when the demand for rubber griped brushes are volatile they procure it from India at higher price within very short period of time. Here the SUPPLIER is quite fixed. 33% duty has to be paid on customs.

- Filament comes from “DuPont” China. 1100 kilos or around one ton filament is purchased at a time Tri-star mostly uses “Mono-filament” which is good in quality.

- Packaging board is purchased from local market and there are 2 kinds of board “white pack” and “Duplex” used for packaging. These board are purchased daily basis according to demand. Daily 20-25 packet of packaging boards are used in the factory, per packet consist 100 pieces of sheets and the costing is 2200-2800 taka per pack.

- Commission, Customs, C&F agent: before purchasing from the company through via media Tri-star contacts with the supplier and place order and again through that via media Tri-star gets the products. As a result the via media consultant gets 1% commission for each transaction. Customs duty also increases the price of the raw materials which varies from product to product but on an average it takes 33% duty per consignment.

- Supplier selection and contract negotiation: There is actually no specific selection process for the supplier like using different kinds of auction. But tri-star does used Via medias and own linkages to track down the low cost suppliers around the market for PP and rubber. But no compromise is made in sourcing the Filament which is the most costly and critical element in the toothbrush. So, Tri-star always buy from Dupont the fixed supplier for filaments.

Outsourcing:

In recent times Tri-star has gone for outsourcing some of the handles those are costly to make because of the design of “Mold” is costly and not available to Tri-star. But because of the market demand Tri-star sometimes outsource just those specific handles from other companies according to written deed. Each of these molds will cost 10-15 lac to Tri-star if they want to make it in house. So, the outsourcing company usually gets 1-1.5 taka per brush, over the production price. These outsource handles are mainly used in pick seasons to support the demand.

Pricing:

Pricing determines how much a firm will charge for goods and services that it makes available in its supply chain. Pricing affects the behavior of buyers, thus affect the performance of supply chain. The greater the price above the production cost a firm can charge the higher the supply chain surplus it gets. The customer segment Tri-star targets is the quality conscious customer who are usually responsive in nature. But at present Matador’s and other imported toothbrushes are available at Tri-stars or less than Tri-star’s pricing. As the consumers want responsiveness in terms of quality and speed and also always focus on the less costly products. If Tri-star can’t make the order in time before the competitors it becomes tough for them to sell at their current price.

Price is also a lever which matches the supply and demand. The economies of scale is also directly relate to the pricing of products. At present the industry pricing of toothbrushes are from 60-584 taka per dozen and Tri-star’s is also selling at this price.

They are getting 15-18% net margin on average. It’s good enough for them because of the bulk quantity sale. Their breakeven price is on average 90-95 lacs taka monthly. Components of pricing decision: there are mainly 2 types of components for pricing decision. One is Fixed price VS. Manu price, another is Everyday Low price VS. High-Low pricing.

Fixed price VS. Menu price:

Tri-star uses menu pricing because it has around 48 types of products with different quality and features like gripper, extra head, cap, super flex etc. that’s why Tri-star cannot go for fixed pricing. The beauty of menu pricing is for different combinations of raw materials used the company can take different prices. This gives them the leverage to change the pricing from time to time easily. For example: the powder, board, filament used in Hanger brushes are not used in Blister pack brushes.

Everyday Low price VS. High-Low pricing:

Here the company is using EDLP (every day low price) strategy. Tri-star’s MRP starts from 10-c85 taka per brush. That means this pricing usually doesn’t change unless any unavoidable circumstances occurs. It gives the customers a vibe that in every season they will get Mr. cleans’ toothbrush at a fixed price. For example: mass people go to the shop with (30-40) taka ask the shopkeeper to show some toothbrushes within this range. EDLP strategy helps to retain the customers.

Information:

Information is the biggest driver in the supply chain. This is the one and only driver which can simultaneously affect both the responsiveness and efficiency of the drivers of supply chain.

For FMCGs collecting and manipulating these information on supplier, competitors, customer, external factors, policies etc is a must. Due to these internal and external factors can affect and change the overall scenario of the business. Tri-star & Co, does try to collect more information on market, competitors, customers behavior etc. but one thing is very important for these type of companies is to push their products to the retailers basket before the competitors. For this they always keep contact and try to collect more and more information on this stuffs which enables them to place and push products to the shelf of retailers before the competitors can.

As Tri star & Co is a very little company they obviously doesn’t use any ERP or SAP module for order placement, tracking and scheduling their SKUs.

These material schedule planning and entrepreneurial resource planning softwares cost a lot to implement and maintain too and its directly related to information driver.

SWOT analysis

Strength

- Customized product for B2B

- Strong distribution channel

- Brand awareness

- Achived experience curve and economies of scale

Weakness

- Struggling to build brand equity and brand loyalty

- Limited promotional activities due to budget constraints

- Limited CSR activities

Opportunity

- Industry expansion possibilities

- Building a loyal customer base

- Try to achieve horizontal diversificationa and vertical integration

Threats

- Slump in the economy restricting customers spending

- Political instability e.g. Strikes

- Established MNCs realizing the demand of untapped tooth brush market

Porter’s Five Forces

The 5 forces that affect a business are bargaining power of customers, bargaining power of suppliers, threat of substitutes, threats of new entrants and rivalry as shown in the figure below.

The different forces influence the activities of the business in different ways and they are:

Bargaining power of customers: The bargaining power of the customers is medium because customers would always have an opinion about the price of the product. Then again this business would provide them quality product so, customers would not have too much of an upper hand for bargaining.

Bargaining power of suppliers: Tristar would be highly dependent on the supplies of the raw materials. The suppliers would have high bargaining power because they would be well aware of the fact that the business is heavily dependent on them for both economies of scale and quality.

Threat of substitutes: The threat of substitutes is high for this business because this business is offering toothbrush and definitely customers can find substitutes of it from any other competitors. Moreover, this business is mainly emphasizing on quality so it is not compromising with the price. So it is possible that some customers are ready to shift to the cheap and compromised quality toothbrush.

Threat of new entrants: This is an untapped and profitable business and this would definitely lure other businesspeople and MNCs to attempt for this business. This means that there are high chances for new entrants to enter into the business.

Rivalry: There are two major competitors in the toothbrush industry already so, the threat from competitors is also high. The competitors include Matador and Alpha etc. They would surely give tough competition to this business

The analysis above shows that the bargaining power of the suppliers, threat of substitutes, rivalry and threat of new entrants is high. If the business wants to survive and make profit in the long-run, then, Tristar would surely have to maintain a competitive edge and a very strong image among its current and potential customers.

All in all Tristar has to get loyal customers through excellent quality toothbrush with attractive packaging and design also a certain level of personal touch to it so that customers can feel that they are being valued properly by Tristar Toothbrush & Co.

Findings & comprehensive analysis of Supply chain drivers of Tri-star

Findings on Inventory:

It can be said that inventory management of Tri-star is quite responsive. It incurs cost more because they always procure the best materials from the best suppliers, for example DuPont for Filaments.

Findings on Storage/Warehousing facility:

Overall facility of Tri-star is efficient because the production facility that the owners of Tri-star Co own by themselves has been amortized. A huge cost for factory rent doesn’t incur anymore. But cost of labor, machines, fuel, electricity etc. are incurring all the time. In this case these variable & fixed costs become less as the production increases. The warehouse facility is centralized that’s why it has lessened the cost of maintaining different distribution centers through the country. These all attributes has made the facility much more efficient.

Findings on Transportation:

Alternative transportation system: milk run project initiating Delivery Van. At current situation Tri-star has total 108 sales representatives that incurs around (108*3000)= 3,24,000 taka per month for their travel allowance. There is another huge gap receiving order happens. Every sales representative receives or cuts orders to its assigned belt for 13 working days and supplies products another 13 days, totaling 26 working days. So, a huge gap is out there in terms of receiving orders and delivering it. This happens because every sales representatives doesn’t have any transport of its own or given from the company to deliver the products.

Bottom line is A) monthly 324,000 taka is getting out of cash for transportation. B) a 13 day sales loss is incurring.

Findings on Sourcing:

Sourcing driver is also responsive for Tri-star Co. Tri-star Co sources its raw materials from best suppliers and in case of emergency sources from nearest markets which also make them responsive but incur a bigger cost. They can’t procure some critical items at bulk that incurs a pretty big cost if purchased in small amounts. The negotiation with supplier is done through via media and sourcing cost also rises because of some other issues like customs commission, commission to buyer. All these issues are not helping them to be more efficient.

Findings on Pricing:

Tri-Star can endure to sustain in the market share and retain customers. It creates efficiency to the end customers. Make the demand easier to forecast and plan aggregately. Tri-star has a pretty efficient strategy for the pricing of their products. As Tri-star is using EDLP as their pricing strategy they has to maintain the least price

Findings on Information:

Being a local company Tri star & Co has very little chances to add value to make the information driver more responsive. It is quite impossible for them to use updated softwares and sophisticated IT tools to facilitate flow of information. That’s why Tri star’s information management is way more efficient in terms of costing.

Findings & comprehensive analysis of bottlenecks of Tri-star’s Supply chain and possible recommendations

Volatility of Raw Materials:

Q-resin & K-resin plastic powders are used in premium products, to produce some specific types of handles. These plastic powders are very costly and their purchasing prices are quite volatile in the market which varies within 7000- 13000 taka per bag.

Solution: as a premium product these items are slow so, here the Bulk amount purchasing approach will not be much of a help. What they should do is they have to set the TP (trade price) at the highest point where the raw material cost will be highest for a given period. So, if the price falls or rise it will not affect the supply chain surplus of the company.

Weight issue of Handle :

Per handle average weight is around 16-18 grams. But other toothbrushes which are selling at the exact same price are in average weighted 10-12 grams per handle.

Solution: Tri-star also has to reduce its toothbrushes’ weights which are in average 4-5 grams higher than the competitors. If weight is reduced Tri-star can diversify its products between Hanger and Blister packages. Lower weighted toothbrushes are easy to manipulate between Hanger and Blister pack. It will save in average .80- 1.00 taka per brush. This is huge in terms of batch production cost.

Filament related cost:

Another finding is the message or tapered filament which is much skewed, itchy, not that much good for teeth and costly but has higher demand than the other types of filaments which are less costly and soft and good for teeth and gum.

Solution: in Bangladesh most of the consumers are price sensitive so, while producing low products for lower end customers the good filaments have to be used which are less costly. And while producing the premium products which are more costly and has special features will be using the tapered/ message filament. This shift will help to curtail production costs.

Responsiveness loss due to advanced machinery:

Currently there is only one machine which has the technology of both the Injector Molding & Vertical machine. So, this machine can reduce one labor who is handling the vertical machine.

Solution: This machine is energy consuming and highly productive. For example: the current machines have 8 cavity molds but these machines have 12-14 cavity molds. Which is 1.5 times productive or faster, the working efficiency is achieved through reducing the transfer time to the Vertical machine. So, bottom line is Tri-star should go for purchasing these machines more. Initially it will incur huge cost but if the production can be increase drastically the economies of scale will be achieved.

1% of wastage is incurring at present:

At present 1% wastage arise while molding the handles, some amount of plastics get wasted which can be recycled and reused, but not as a fresh powder. It is used at lower price toothbrush because this type of recycled powder is low in quality which is available at 2200 taka in market. So, the overall 1% is wastage according to the factory manager.

Solution: no solution at present because it happens when the electricity is gone or voltage fluctuates. This is an infrastructural problem which needs to be solved by the government.

Less product portfolio compared to the market leaders:

At present Tri-star have only got general and child segments for their consumers. And low end customer and premium products for high end customers. And the overall portfolio of the company is comparatively lower than the competitor like Matador.

Solution: Tri-star can make another Lady’s segments naming super slim or some other fancy name with different famine color and shape with specific bundles. Apart from that the overall portfolio is also needs to be enlarged through adding other necessary commodities which go with the name Mr. Clean.

Sales lost due to less push ability to retailer.

Retailers have got more bargaining power. because when any sales representative if Tri-star goes to any retailer with only toothbrush they has got less bargaining power with the retailers. The SRs can’t push products to the retailer.

Solution: is simple has to increase the SKUs.

Big difference between TP & MRP

A big difference between TP and MRP is around 50-95% per toothbrush which is given to the retailer. For example: the TP of Doremon toothbrush is 19.5 taka per brush but the MRP is 30 taka which is 64% higher than the TP. This is true for the whole industry each and every manufacturer is bound to give this unorthodox amount of margin to the retailer.

Solution: Tri-star is using the same old molds and designs for toothbrushes for so long. This is lessening their bargaining power over the retailers. So, if Tristar can introduce 5-6 new design in the market (one design named Mr. Clean ICE is already in progress) this will give them begriming power over the retailer.

Conclusion

Tri-star toothbrush & Co is one of the emerging companies in the toothbrush industry in Bangladesh. Though they are now market challenger in this industry, they have huge opportunity to become market leader within next few years. For example they have recently introduced “Doremon” branded tooth brush for children, and it is expected to grab a huge market share. Now they produce three thousands units of brushes with 20 plus modern machine in every hour and in future they are thinking that they will expand their operation by introducing more modern technology like their competitor. Throughout out their 136 distributors, they reached their product to end users around all over the Bangladesh. They have good relation with their competitors which may help them to retain their current market share. As they target mostly on rural area so they have probability to get competitive advantage over competitors. In future they want to introduce more differentiated product line by focusing on customer group by introducing popular and innovative brands. They also want to introduce more quality brush like foreign established brands (Oral-B, Colgate) in near future. They are more committed to ensure and maintain quality which helps to create trusts among consumers. Therefore if the production facile it is maintained properly they will be able to reduce cost and to reach high profit and ultimately become market leader by introducing innovative product.