Statistical finance is the application of econophysics to financial markets. It is a method of collecting and analyzing numerical data. Instead of the normative roots of much of the field of finance, it uses a positivist framework including exemplars from statistical physics with an emphasis on emergent or collective properties of financial markets. In particular, they are quantitative tools widely used in the areas of economics and finance. The starting point for this approach to understanding financial markets is the empirically observed stylized facts. Knowledge of modern probability and statistics is essential to develop economically and finance theories and test their validity through the analysis of empirical real-world data.

Stylized facts

- Stock markets are characterized by bursts of price volatility.

- Price changes are less volatile in bull markets and more volatile in bear markets.

- Price change correlations are stronger with higher volatility, and their auto-correlations die out quickly.

- Almost all real data have more extreme events than suspected.

- Volatility correlations decay slowly.

- Trading volumes have memory the same way that volatilities do.

- Past price changes are negatively correlated with future volatilities.

Research objectives

Statistical methods are mathematical formulas, models, and techniques that are used in the statistical analysis of raw research data. Statistical finance is focused on three areas:

- Empirical studies focused on the discovery of interesting statistical features of financial time-series data aimed at extending and consolidating the known stylized facts.

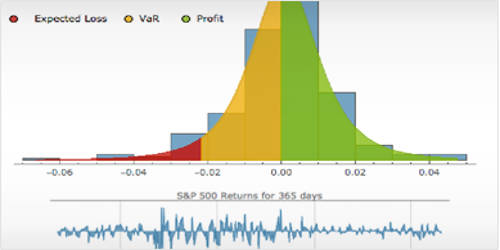

- The use of these discoveries to build and implement models that better price derivatives and anticipate stock price movement with an emphasis on non-Gaussian methods and models.

- The study of collective and emergent behavior in simulated and real markets to uncover the mechanisms responsible for the observed stylized facts with an emphasis on agent-based models.

Financial econometrics also has a focus on the first two of these three areas. The application of statistical methods extracts information from research data and provides different ways to assess the robustness of research outputs. However, there is almost no overlap or interaction between the community of statistical finance researchers and the community of financial econometrics researchers. Financial statistics are different things. The financial statistics are organized and presented in formats designed to show financial flows among the sectors of an economy and corresponding financial asset and liability positions.