Today Squarespace S-1 filing has been released by well-known software and hosting provider for SMB websites. The company listed directly on the New York Stock Exchange, or NYSE. It will trade under the ticker symbol “SQSP”. The company’s financial results paint a picture of a fast-growing company with a history of profitability. Squarespace lists the financial results that include, among other things, some partial conversions.

Its pro forma results assume that “all shares of our converted preferred stock were automatically converted” into a variety of common shares. Pro Forma results include a personal placement and the recent acquisition of Talk. It will take some time to unspool the specific knot. Now we will be without that entanglement in the historical results of Squarespace by 2020; if you plan to buy shares of the company, you will want to understand the more complex math. For now, let us focus on Squarespace’s own metrics.

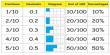

Squarespace had revenue of $484.8 million in 2019, resulting in a profit of $402.8 million, operating income $31.33 million dollars and net income of $58.2 million. In 2020, these numbers changed to $622.1 million, gross profit of $521.2 million, operating income of $40.2 million and net income of $30.6 million. Squarespace’s revenue grew by just over 28% in 2020 compared to 2019.

For reference, 2020 Pro Forma results include modest revenue of $644.2 million, total profit of $30,530.5 million, operating loss of $246.4 million and a net loss of a $267.7 million. Squarespace has a history of cash generation, within $102.3 million in 2019 and $150.0 million operator cash flow in 2020. The company’s cash flow data explains why Squarespace is not following traditional traditional IPOs. As Squarespace can self-fund, it does not need to sell shares in its public offering.

Turning to squarespace-specific metrics, the company’s “unique subscriptions” increased from $2.974 million in 2012 to million in 2020 $3.656 million its annual recurring revenue (ARR) increased from $549.2 million in 2020 to $705.5 million. Squarespace’s ARR grew by close to 28.5% in 2020, a pace faster than its GAAP earnings. According to the company’s SEC filing, the company “has completed its Class A fair price estimate as a common stock for the purpose of financial reporting with a weight-average of $ 63.70 dollars for shares approved before March 11, 2021.” This will help form a reference measurement stick for the time being.