Origin of the Report:

As a part of the Internship Program of Bachelors of Business Administration program requirement, I chose to do my internship in the BRAC Bank Limited (BBL) for the period of 16 weeks starting from 01 March 2006 to 10 May 2006. In BBL I was assigned to the different concerned departments. My organizational supervisor was Ms. Tahniyat A. Karim, VP & Head of Human Resources. My project is ‘Prospect of SME Banking in Bangladesh: The BRAC Bank Perspective’ which was assigned by organizational supervisor of the said bank. My faculty supervisor Mr. Mohammad Mohiuddin, Lecturer, IBA, also approved the project and authorized me to prepare this report.

Objective of the Report:

The objective of the report is to study and evaluate the prospects of BBL in the SME sector of Bangladesh. In the process of doing so, I have assessed the

Scope of the Study:

I have limited the study to the following parameters:

- The total concept SME loan

- BBL’s special focus on SME loan to promote small entrepreneurs all over the country

- Characteristic of SME loan as a sophisticated area of finance.

- Recent performance level of the BBL SME loans in the country.

Methodology:

The study uses both primary data and secondary data. The report is divided into two parts. One is the Organization Part and the other is the Project Part. The parts are virtually separate from one another.

Primary Sources:

For general concept development about the bank short interviews and discussion sessions were taken as primary source. More over a market survey was conducted with a specific questioner. To identify the implementation, supervision, monitoring and repayment practice- interview with the employee and extensive study of the existing file was and practical case observation was done.

Secondary Sources:

The information for the Organization part of the report was collected from secondary sources like books, published reports and website of BBL (www.bracbank.com). For gathering concept of SME loan products of BBL, the Product Program Guidelines (PPGs) were thoroughly analyzed.

Sampling:

For the survey, cluster sampling was thought to be appropriate. The SME clients of BBL can be categorized into four clusters-

- Manufacturing Businesses

- Trading Businesses

- Agro-based Businesses

- Service Businesses

Within the clusters, random sampling was conducted according to advantage of the surveyor and also considering the time factor. The sample frame was the list of existing clients of BBL SME loan facilities and the sample unit was the individual entrepreneur. The sample size for each cluster was determined as per the ratio of the total populations of the clusters. The total sample size was limited to 200.

Limitations

Despite my earnest efforts, there were some limitations that hindered the progress of this report.

- On 26 April 2006, due to an unfortunate accident, the SME department of BBL caught fire. All documents were destroyed and it took many weeks to restore all information from backups. This greatly hindered the information collection process for the report.

- The sample size of the survey conducted was 200 only due to time considerations. However, the diversified nature of the respondents will hopefully make up for this lacking.

- Bank’s policy does not permit to disclose various data and information related to Credit portfolio.

- Most recent data and information were not available. Therefore the timeframe for the report had to be limited to December 2005.

Chapter 02: The Economy and Overall Banking Sector

World Economy- An Overview

As we enter into the new millennium the process of trade liberalization and globalization have presented new challenges as well as greater opportunities. Economic boundaries of nations are being abolished and the world is gradually becoming a global village. In the beginning of the year 1999 the Euro currency started to replace the currency of eleven European Union countries. In the financial service sector profound changes have been taking place globally. E-commerce is becoming the predominant mode of transactions. We are witnessing revolutionary changes in the fields of cost control, retail channels, range and delivery of services, accessibility and reach. These changes have already triggered off reorganization, amalgamation, and takeover of financial institution globally.

The prospect of a faster pace of monetary tightening contributed to a sharp drop in equity prices around the world in early October 2005. Equity markets rebounded strongly since November, boosted by signs of still robust growth in the US as well as announcements of mergers, share buybacks and dividend increases. Japan outperformed most other equity markets throughout this period. Upward revisions in policy rates had a surprisingly muted impact on the prices of emerging market assets. Emerging markets benefited from record inflows of foreign portfolio investment in 2005. As concerns about slowing US growth eased, emerging markets bounced back strongly from their late October lows. By late November, equity and bond prices had returned to their end-September highs and had generally reached record levels by early January 2006. Equity markets have, however, weakened overseas thereafter mainly on account of renewed firmness in global crude oil prices. Corporate credit default swap rates and bond spreads remained more or less unchanged in October although they have widened significantly since November. While long-term interest rates rose in many markets in September and October, they retreated slightly in November, and at the end of December it was still unclear whether the recent rise in yields would prove as ephemeral as previous increases. The increase in longer-term yields mainly reflected upward revisions to interest rate expectations over the near term. Further, the potential for rising energy costs to add to inflationary pressures was a key focus of investors’ attention. The rise in implied volatility also reflected growing uncertainty about the economic outlook. During December 27-30, 2005 yields on 10-year US Treasuries fell briefly below those on two-year notes for the first time since December 2000, inverting in intra-day trading and signaling expectations that interest rates could fall in future that is generally associated with weak growth. This inversion came as analysts were finally anticipating an end to the current tightening cycle and a lower long-term risk premium than in the past. In January 2006, however, the spread has turned positive again. The US dollar appreciated by 3.5% in trade-weighted terms during 2005 and a similar trend continued in January 2006.

Of the major central banks, the US Federal Reserve has raised its policy rate by 25 basis points each on thirteen occasions from 1.0% in June 2004 to 4.25% by December 2005 while recently providing indications of nearing the end of the cycle of measured rise in the policy rate. The Bank of England has kept its rate unchanged at 4.50% since August 2005 in response to slowing domestic growth. The European Central Bank (ECB) has raised its policy rate by 25 basis points in response to rising inflationary expectations, after holding it unchanged at 2.0% since June 2003. Monetary policy has been tightened in several economies in emerging Asia, primarily in response to higher fuel prices and to the measured pace of policy tightening in the US. Bank Indonesia raised its policy rate by 50 basis points to 12.75% on December 6, 2005 which was the tenth successive increase during the year. In Thailand, the 14-day repurchase rate was increased for the seventh time since January 2005 from 2.00% to 4.25% on January 18, 2006. Monetary authorities in Singapore and Hong Kong raised their policy rates by 187 basis points and 200 basis points, respectively, during the year up to December. In Malaysia, the policy rate was hiked to 3.0% in end-November, 2005. In emerging market economies in general, the direction of policy change has been towards either tightening or withdrawal of the accommodative stance.

Economic growth in developing Asia and the Pacific surprised on the upside in 2005. In September last year, the Asian Development Outlook (ADO) 2005 Update forecast aggregate regional growth of 6.6%. The ADO 2006’s estimate of growth is now 7.4%, well above the average rate of growth in the region since 2000. If purchasing power parity weights, rather than weights based on market exchange rates, are used to aggregate over countries, regional growth in 2005 is estimated to have been even faster, at 8.0%. With the release of revised gross domestic product estimates for 2004 in a number of countries, growth in 2004 has now been raised to 7.8%, from 7.4% in the ADO 2005 Update.

On the basis of a broadly favorable outlook for the international economy, the continuing trend toward improved economic management and performance, and apparent resilience to high oil prices, the ADO 2006 revises up its aggregate growth projection for 2006, and, to a lesser extent, for 2007 (Figure 1.1.1). Aggregate regional growth of 7.2% is now expected in 2006, easing to 7.0% in 2007. But risks remain, and could yet unsettle a generally positive outlook. These risks include the possibility of a disorderly unraveling of global payments imbalances (which are still widening), heightened protectionist trade pressures, yet higher oil prices, and the possibility of an antigen shift of the avian flu virus into the human population.

Bangladesh Economy-An over view

The improved political environment in the country, after a delayed period of civil disobedience brought a much-awaited economic stability during the financial year (FY) 2003-2005.

The macro economic development during the year was marked by a healthy GDP growth and moderate inflation. For the second year running bumper rice harvest maintained growth at above 5% and GDP growth during the FY 2004 was at 5.52%. On the other hand, the growth performance in industry was slow with manufacturing growth 3.3% being one of the lowest rates in the recent years. Several unfavorable factors contributed to this situation which included disturbance in the supply of natural gas which in the turn affected the power supply and production activities. Furthermore, labor disputes during the second quarter of the year badly affected the operation of Chittagong port. In the services sector, growth in transportation, storage and communication contributed to about 13% to the total GDP but growth in trade sector was slow due to lower import growth.

During the year some positive initiative were taken in the banking sector with improvements in the legal and regulatory environment to improve loan recovery but unfortunately the high quantum of non performing assets and under capitalization continued to plague the entire banking sector thus causing a major threat to the macro economic stability. The size of classified loans increased significantly which contributed to lower profitability of the banks.

Reserve of gross foreign exchange of the BB stood lower at US$3033.88 million at the end of March,2005 compared to US$3179.41 million at the end of February. This was, however, higher than US$ 2653.50 million at the end of March, 2004. The pressure on foreign exchange reserve continues due to low aid disbursement and sizeable private capital outflow, which amounted to around US$ 120 million. The official exchange rate was devaluated by 4.6% in seven steps in FY 2002 and in two steps during July-August 02 thus raising the cumulative rate of devaluation to 6.7%. The external account declined from over 5% of GDP to less than 3% ( US$ 0.9 million) in FY 02 which was mainly a result of healthy export growth (14%) and a significant increase in remittances from abroad, which in turn was due to stable political environment and a higher rate of contraction in import of food grains and capital goods.

Investment rate in FY 04 showed some increase and the declining trend in private savings was substantially reserved. The national savings rate increased from 11.9% of GDP in FY 03 to 14.6% in FY 04. This was partly due to increased inward remittances, increase in nominal interest rates and lower rate of inflation.

Some key indicators of the economy of Bangladesh are given follows:

- Total revenue collection : The government of Bangladesh collect total revenue during July-March,2004-05 increased by Tk.2351.08 crore or 11.72 % to Tk.20294.60 crore compared to Tk.18165.49 crore during the same period of the preceding year

- Outstanding borrowing of the government: At the end of February,2005 the outstanding borrowing of the government stood at Tk.35031.91 crore, recording an increase of Tk.1543.47 crore or 4.61% over June,2004

- Exports: During July-February, 2004-05 total export of the country stood higher by US$622.86 million or 13.00% to US$5415.60 million compared to US$4792.74 million during the same period of the preceding year

- Import payments: During July-January, 2004-05 total import payment increased by US$1233.70 million or 21.31% to US$7023.50 million compared to US$5789.80 million during the same period of the preceding year.

- Fresh opening of import LCs: During July-February, 2004-05 fresh opening of import LC’s increased by US$1834.58 million or 24.30 % to US$ 9382.84 million compared to US$7548.26 million during the same period of the preceding year

- Total remittances: During July-March,2004-05 stood total remittances of the country higher by US$320.20 million or 12.79 % to US$2823.03 million compared to US$2502.83 million during the same period of the preceding year

- Gross foreign exchange reserves: Reserve of gross foreign exchange of the BB stood lower at US$3033.88 million at the end of March,2005 compared to US$3179.41 million at the end of February. This was, however, higher than US$2653.50 million at the end of March, 2004

- Gross foreign exchange balances: Balances of gross foreign exchange held abroad by commercial banks stood higher at US$397.16 million at the end of March, 2005 compared to US$364.67 million at the end of February, 2005 and US$312.61 million at the end of March, 2004

- The rate of inflation: The inflation rate increased to 6.38 % in February, 2005 from 5.52 % of January, 2005.

Banking Sector in Bangladesh

The Bangladesh banking sector relative to the size of its economy is comparatively larger than many economies of similar level of development and per capita income. The total size of the sector at 26.54% of GDP dominates the financial system, which is proportionately large for a country with a per capita income of only about US$ 370. The non-bank financial sector, including capital market institutions is only 3.22% of GDP, which is much smaller than the banking sector. The market capitalization of the Dhaka Stock Exchange was US$1,025 million or 2.19% of GDP as at mid-June 2002. In contrast, the size of the total financial sector in India, including banks and non-banks as well as the capital market is 150% (March 2002) of its GDP, with commercial banks accounting for 58.3% of GDP.

Access to banking services for the population has improved during the last three decades. While population per branch was 57,700 in 1972, it was 19,800 in 1991. In 2001 it again rose to 21,300, due to winding up of a number of branches and growth in population. Compared to India’s 15,000 persons per branch in 2000, Bangladesh is not far behind in this regard. This indicates that access to the banking system in the country is not a significant problem.

The finance sector remains predominantly bank-based, accounting for 96% of the sector’s resources. While there are sound banks, based on IAS, the banking sub-sector as a whole is technically insolvent. Consolidated data reported tend to have significantly understated provisions. Adjusting partly for the understatements, the financials of the banking sub-sector are characterized by about 32% NPL ratio, US$720 million shortfall in provisions, US$1,106 million shortfall in provisions and capital combined, and losses of US$685 million after adjusting for the shortfall in provisions in mid 2001. The adjustments would possibly be larger if provisioning as followed by major international auditors were applied. National Commercialized Banks (NCBs) also have disproportionately large and unexplained “Other Assets” that include, in particular, jute and other subsidized credits, suspense accounts and various receivables. To what extent these questionable assets have been provisioned remains unclear.

The banking sector of Bangladesh comprises four categories of scheduled banks. As of June 2005, 49 scheduled banks are operating in Bangladesh with a network of 6318 branches. The structure of the banking system in Bangladesh is categorized in the following table.

Table 1: Structure of the Banking System in Bangladesh (March 2005 ) | ||||

Type of Bank | No. | No. of Branches | % of Total Asset | % of Total Deposit |

| NCB | 4 | 3388 | 40.14 | 39.78 |

| NSB | 5 | 1334 | 7.13 | 7.22 |

| PCB | 30 | 1557 | 42.67 | 47.18 |

| FCB | 10 | 39 | 9.46 | 5.82 |

| Total | 49 | 6318 | 100 | 100 |

| Source: Bangladesh Bank | ||||

In addition, one national co-operative bank, one Ansar-VDP Bank, one Karmasangsthan Bank and one Grameen Bank and some non-scheduled banks are also in operation. In order to enhance the overall efficiency of NCBs, decisions have been taken to rationalize bank branches, and up to June 2005, 91 new branches were established and 9 existing branches were closed under the ‘branch rationalization program’.Banks and other financial institutions have been playing a key role in activating the financial sector that in turn infuses dynamism to the economy. Banks are engaged in upgrading the socio-economic status of the country by investing money to productive sectors. However, in the context of globalization and operation of market economy these institutions are facing immense competition with regard to speedy transaction of financial intermediation and as such they are to provide their service as efficiently and effectively as possible. Given this scenario, importance has been attached to the development of the financial market through banking sector.

In order to uphold the rule of banking sector in financial market development the Government has taken a range of measures which include further deployment of bank branches and evaluation of their performance, classification of loans following the international standards assessment of capital adequacy, determination of quality of assets and earning of impressive profit.

Chapter 03: Organizational Overview

Background

BRAC Bank Limited started its journey on the 4th of July 2001 originating from its source BRAC – Bangladesh Rural Advancement Committee. BRAC is known as the one of the most successful NGO in the world. Mainly, BRAC Bank originated due to successful story of BRAC micro finance. The Chairman, Mr. Fazle Hasan Abed believed that until modern, competitive financial services are readily available – including credit in amounts, terms and conditions that small can access, Bangladesh will not be able to create the large middle class that is a prerequisite to social stability. So, the BRAC Bank Limited came into existence due to the need of mass financing, which wouldn’t have been possible with BRAC micro finance itself.

Today BRAC Bank is considered as third generation bank extending full range of banking facilities by providing efficient, friendly and modern fully automated on-line service on a profitable basis. Since its inception, it has introduced fully integrated online banking service to provide all kinds of banking facilities from any of its conveniently located branches.

The Vision

The vision of BRAC Bank Ltd. is -Building a profitable and socially responsible financial institution focused on Markets and Businesses with Growth Potential, thereby Assisting BRAC and stakeholders build a “just, enlightened, healthy, democratic and poverty free Bangladesh”. The BRAC Bank’s vision is thus aligned with those of BRAC

Capital Structure and Equity Partners

BRAC Bank has started with an initial capital of amount BDT 250 million, while the authorized capital is BDT 1,000 million. Over time the bank has increased it capital base because of its steady growth and within three years of operations, it has doubled its capital base to BDT 500 million. The Bank has planned to go public by the last quarter of this year (2006) and raise it’s paid up capital to BDT 1000 million. BRAC Bank originated with Local and International Institutional shareholding including BRAC as promoter with IFC and ShoreCap International, UK. Here is the break-up of BRAC Bank’s shareholdings positions.

Branches and Networks

The expansion of BRAC Bank is growing very fast. Now, in total there are 13 operating branches and more branches will open up in the coming year. To provide a strong network across the country BRAC Bank has 260 unit offices for SME purpose. Market Research Executive (MRE) a position has been created to capture the stronger market share, which will work closely with the Direct Sales Executive. BRAC Bank will open up three Sales Booths in the major area of the city and Kiosk in the shopping malls, which will cater the needs of the customers where branches are not in close areas. These will serve in terms of opening and closing accounts and selling products. In addition, BRAC Bank has also set up three ATM machines in three main areas of the city, keeping a target in mind that within the mid of next year the Bank will set up some more ATM machines.

Highlights of Long Term Planning

Table 2: Highlights of Long Term Planning | ||

Particulars | Actual (2005) | Projected (2009) |

| Num. Of Branch | 14 | 60 |

| No. Of Booth | – | 100 |

| Unit Office | 287 | 450 |

| Staff | 1200 | 4100 |

| Profit Before Tax | 21(crore) | 232(crore) |

| ATM | 7 | 50 |

| PO’s | 50 | 500 |

Chapter 04: Functional Divisions of BRAC Bank Limited

BRAC Bank has a centralized banking structure through online banking system that resembles the ABN·AMRO Model. BBL consisted of four major divisions namely-

Small and Medium Enterprise (SME) Division,

Retail Banking,

Corporate Banking

Treasury Division.

Other important division are Credit Administration, Loan Administration, Trade Fin, IT, HRM, CCU, Internal Control etc, which work to support the major business divisions.

SME Division

The biggest operational division of BRAC bank is the SME (Small & Medium Enterprise) Division. SME is directly related to business of the bank. BRAC Bank extends loans to potential small and medium trading, manufacturing and service enterprises. This loan is able to provide quick and quality banking services to targeted business at any places of the country. Potential women entrepreneurs will also get the facilities of SME loan; this initiation is to play a role in the socio-economic development of the country by expansion of business as well as creation of employment. BRAC Bank was titled to be the fastest growing bank in 2004 & 2005, and it had a profit of 14 crore taka. The profitability of the bank came mostly from the SME sector. SME division is enriched with more than 700 staffs and it has almost 300 unit offices all over the country.

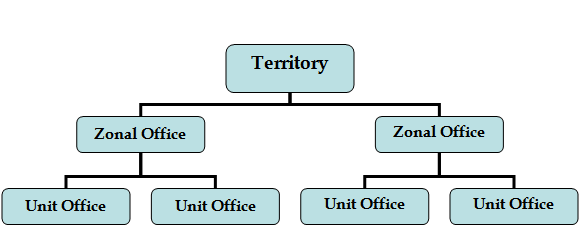

Structure of SME division

- Field Level: In the field level there are three types of designated BRAC Bank staff operates. They are Customer Relation Officer (CRO), Zonal Officer (ZO) and Territory Officer (TM).

- CRO (Customer Relationship Officers): There are about 700 CRO working all over the country in 300 unit offices. CRO are assigned to spot potential entrepreneurs through out the country and motivate them to take loan from BRAC Bank. Each CRO falls under their assigned territory and they have to perform their job within that. They are under direct supervision of the Zonal Officers (ZO). CRO goes to people, identifies their need and according their need, suggest them to avail loan from BRAC Bank. CRO are responsible for evaluating the trustworthiness of the client whether they are capable to repay the loan or not. To provide loan and ensuring loan repayment are the two main tasks done by the CRO.

- ZO (Zonal Officers): There are 36 Zonal Officers. These ZO controls the CRO. They visit the spot that the CRO already located. Each and every enterprise will be visited by ZO. ZO has the authority to sanction loan highest up to taka 3 lakh.

- TM (Territory Manager): There are 4 team Managers. They supervise the ZO.

- QAO (Quality Assurance Officer): There are 12 Quality Assurance Officer. They perform the job of monitoring. They supervise the ZO and TM.

- Head Office Level:

- Credit:

- The Credit limit varies depending on the rank.

- ZO has the authority to sanction up to highest 3 lakh.

- TM has the authority to sanction up to highest 5 lakh

- If the credit limit exceed taka 10 lakh it goes to Credit Committee

- If the credit limit exceeds taka 20 lakh it goes to the Board.

- Credit:

- Loan Admin – The posting is done in the system (MBS) in the Loan Admin. Then Loan Admin sends requisition to Fin Admin.

- Fin Admin: Fin Admin take care of the other expenses.

- Recovery: Recovery Dept. prepares an overdue report and informs the TM. Recovery dept. keeps track of the money. Legal notices are given to the defaulters.

- MIS: MIS dept. keeps the total record of loan from its sanction to repayment.

Retail Banking

Retail Banking is known as general banking where the individual customers get services time to time from the local branches of the larger commercial banks. In BRAC Bank Retail section has been divided into two parts –

- Distribution – Serve the acquired customers

- Sales – Business acquisition.

They both are interdependent and work closely with each other. Retail offers different types of competitive banking products to the customers. The retail division of the BRAC Bank also offers some special types of deposits and loan scheme for the customer attention.

Retail Deposit Products

- Current Account.

- Saving Account (Maximize and Normal Saving Account).

- Deposit Premium Scheme (DPS).

- Short Term Deposit (STD).

- Normal FDR.

- Abiram (A hybrid of Fixed Deposit with pays internal on a monthly interval).

Retail Loan Products

- Salary Loan

- Credit Card Loan

- Life Style Loan

- Unsecured Personal Loan

- Secured Over Draft

- Teachers Loan

- High Flyer Loan

- Premium Term Deposit (PTD)

- Shahaj Loan (For Bank Staff only)

- Ashadharon (For Bank Staff only)

Corporate Division

Like Retail, corporate department has also two different wings – Corporate Banking division & Cash Management.

Corporate Banking Division

Corporate Banking is a specialized area of BRAC Bank, which addresses the diverse financial needs of Corporate Clients.

This division exists to provide banking services and financial partnership with local and foreign business houses (Public and Private Limited Companies), NGO’s, trading houses, joint ventures and various government bodies/corporations etc. As the financial partner of choice for the corporate sector, BRAC Bank wants to be distinguished by its:

- Quality of service

- Value of innovative solutions

- Level of trust with clients

- Customer knowledge

Corporate clients can access a wide range of financial services offered by corporate banking division including:

- Debt Capital

- Equity Capital

- Ongoing relation support

- Financial Markets

- Products: BRAC Bank provides a comprehensive range of innovative corporate financial solutions tailored to suit each company’s needs. This range includes both funded and non-funded facilities. Following are some of the products that BBL offers to its clients:

- Corporate Finance

- Loan Syndication

- Project Finance: Short and Medium term

- Finance/Credit Extension

- Overdrafts

- Demand Finance

- Working Capital Finance

- Receivable Discounting

- Pre and Post Export Financing

- Short-term loan: revolving loans, LATR etc.

- Trade

- Letter of credit: Sight, Unsance etc.

- Guarantee: Performance, Security, Advance Payment etc.

- Lease financing

- Target Market:

- Pharmaceuticals, Toiletries, Chemicals and Pesticides

- Power Generation, oil exploration, Industrial and household gases (Liquid, Petroleum Gases etc.)

- Edible oil, Bulk Trading –Essential Commodities, Industrial Raw Materials, Agricultural Inputs, Cement.

- Garments, Textiles and related backward linkages industries including spinning, Knitting, Yarn, Garment accessories etc.

- Food Processing and Beverage Industries.

- Cable and Cable wire, Information Technology.

- Leasing Companies/Non Banking Financial Institutions.

- Health service Industry, Non Governmental Organizations.

- Importers/dealers of machinery, Industrial, Electrical equipment

- Education Institutions, Bone china, Ceramics, Melamine, plastic products.

- Manufacturing and Trading of Consumer Durables, Telecommunication, and Contractor Finance.

- Ship Breaking, Re-rolling Corrugated Iron (CI) Sheet Mfg and related business.

- Air Lines, Shipping Lines, Freight Forwarders, Testing Inspection agencies, Footwear and Leather.

- Tobacco products and Tea.

- Target Customers Group:

- Leading Domestic Corporate and Trading Houses.

- Local medium and large corporate.

- MNCs’

- NGOs’

- Educational Institutions.

Transaction Sales & Services (TRS)

The major responsibility of BRAC Bank’s TRS Division is to support their Corporate Customer with the combined network covers Dhaka, Chittagong, Sylhet & Savar presently. TRS offer the no cost on line banking facility through 13 branches BRAC Bank. They offer cash deposit and withdrawals, cheque deposits, and money transfer facility, account enquiries, give cheque book requisition and Account Statement with their following type of account:

- Current Account

- Short Deposit Account (STD)

- Fixed Deposit

- Savings Account (for corporate employees)

- Convertible Account

- FC Account

TRS division also has Priority Service System for their Corporate Customer, which manages their business finance and cash resources very conveniently. Priority Service Banking includes the following special services:

- Pick-up & Delivery Services

- Auto fax Report

- Corporate Help Line

- Inward Remittance Information

- Express Payment

Treasury

Treasury division at BBL deals with the fund position. This division calculates and projects the fund requirement to meet day-to-day operation. It has also two wings, one is front office and the other is back office. Front office deals with directly to the money market of the country. Their main job is to lend money to other financial institution on call or short-term basis, if the bank has additional money idle. Or if the bank falls short in liquidity, this division borrows money from other financial institution on the same basis. On the other hand the back office keeps records of the fund position of the bank.

Objective

- Managing mandatory liquidity.

- Maximizing return from fund management.

- Matching Asset and Liability.

- Generating profit from Intermediary functions.

Business Segregation

- Money Market: Money Market is a network of financial institutions linked by telecommunication network to facilitate lending and borrowing of fund for short-term (less than a year).

- Foreign Exchange Market: It is the organizational framework within which, financial institutions and individual’s trade or exchange foreign currencies.

Functions

Money Market:

- Maintenance of Statutory Reserve

- Meeting Branch/ Division fund requirements

- Call Loan taking and placing

- Term taking and placement

- Market analysis

- Foreign Exchange Market:

- Circulation of exchange and interest rate on FX. Deposits

- Maintenance of daily exchange position within the limit

- Nostro funding

- Forward quote

Chapter 05: financial Performance Review

Performance at a Glance

Table 3: Performance of BBL | |||

Particulars | 2005 | 2004 | 2003 |

| Paid up capital | 500,000 | 500,000 | 405,020 |

| Total Capital including general provisions | 988891 | 650,294 | 424,327 |

| Capital Surplus/deficit | 40753 | 73,684 | 157,178 |

| Total Assets | 16876009 | 10,015,936 | 4,542,043 |

| Total Deposits | 13409010 | 8,168,979 | 3,497,303 |

| Total Loan & Advances | 11719312 | 5,819,792 | 2,870,107 |

| Credit Deposit Ratio | 87.94% | 71.24% | 82.07% |

| Classified loans against total loans and advances (%) | 2.25% | 1.97% | 1.06% |

| Profit after taxes & provisions | 192680 | 99,303 | 30,281 |

| Amount of classified loans during current year | 265179 | 114,414 | 30,542 |

| Provision kept against classified loans | 134061 | 84,432 | 8,183 |

| Provisions surplus/deficit | 26862 | 40,841 | 173 |

| Cost of fund | 7.58 | 7.23% | 7.50% |

| Interest earning assets | 16278383 | 9,735,349 | 4,475,543 |

| Non interest earning assets | 597626 | 280,587 | 66,501 |

| Return on Investment (ROI) | 8.54 | 8.57% | 3.73% |

| Return on Assets (ROA) | 1.14 | 0.99% | 0.67% |

| Incomes from investments | 292067 | 166,967 | 94,790 |

| Earnings per share | 38.54 | 23.16 | 12.09 |

Balance Sheet Performance

During the year, BBL has expanded their business rapidly and undertook significant operations in trade finance business (i.e. 750% growth in the year 2004 over last year) along with the same upward trend in SME, commercial and retail lending activities. Propelled by strong growth in both loans and deposits, the Bank’s operating income increased substantially in 2005.

BBL has a 164% growth rate on its deposits in the financial year 2005 comparing to its previous year’s (2004) and the same time it also has a 201% growth arte over its loans and advances. Though the advance to deposit ratio i.e. 71.24% comparatively comedown in 2004 from 2003, it again picked up in 2005 (87%). These upward trends in both deposit and loans, helps the bank to increase its assets by 168% over its previous year’s (2004) assets. BBL has also enjoyed higher growth rate on its fixed and other assets.

Profitability

In the year 2005 the bank has earned an operating profit of BDT 586 million compared to BDT 320 million in the previous year with a stunning growth rate of 183%. This was possible, as BBL has earned a 165% growth on its interest income where as its interest expense growth was 93% from the year 2003. This difference has basically occurred because the cost of fund did not increase to extent of increase in return on loan.

The growth rate of operating expenses has also gone up by 103%, but this trend is acceptable because the bank has earned growth rate of over 100% in all aspects. More over a growth of amount 193% in its profit after tax supports the rationality of such hike in operating expenses earned.

All this upward trends help BBL to increase the Earnings Per Share by almost 165% (from 23.16 to 38.54).

Other Performance Indicator

- Capital Adequacy: Capital adequacy focuses on the total risk weighted capital intended to protect the depositors from the potential shocks of losses that a bank might incur. In the year 2005 BBL has maintained capital adequacy ratio of 10.15% against standard of minimum 9.00% set by Bangladesh Bank. This keeps more options to absorb default loan amount

- Asset Quality: The asset composition of BBL shows a high proportion of loans and advances (87%) in total assets. A high proportion of loans and advances indicate vulnerability of assets to credit risk, since the portion of non-performing assets is significant in our country. But the classified loans against total loans and advances of BBL are only 2.25%. Though this ratio gone up from the year 2004, but compare to 103% increase in loans and advances this upward trend is still in acceptable level.

- Management Soundness: Management Soundness is very difficult to measure, because it requires a qualitative measurement rather than quantitative measurement. Nevertheless ratios such as total expenditure to total income are generally used to measure management soundness. In this regard BBL’s total expenditure to total income ratio is 53%, which shows that more than half of its total income need to be spent for meeting operating expenses.

- Liquidity: At present BBL’s liquidity ratio is 24% out of Bangladesh Bank’s minimum requirement 20%. So the bank may feel comfort but the liquidity statement shows that for short period usually 1-3 months BBL has liquidity gap or in other words, for short period, the bank has a short fall to meet its liquidity

Chapter o6: Environmental Analysis

Macro Environment Analysis

It is very important to carry out a macro environment scanning for the banking industry in order to identify and analyze the external factor that affected the growth and development of the banking sector in Bangladesh. A through analysis of the macro environment in which the banks operate will allow the banks to develop pro-active strategies and navigate the organization in the turbulent ocean of competition.

The financial institutions are always heavily influenced by the macro economic conditions both globally, regionally or locally. The key macro economic indicators like GDP growth rate, inflation, industrial growth rate, expansion of trade and commerce and other factors affects the operations and the pricing strategy of the bank. BRAC Bank Limited (BBL), since its inception has achieved a steady growth rate. However, the present economic downturn or recession is affecting BBL’s operations. The country is now under a deep recession having a major decline in industrial growth rate, galloping inflationary pressure, and decline in international trade with export targets for the fiscal year yet to be achieved and other factors will eventually affect BBL and other banks pricing strategies. Many banks will have to revise the interest rate structure for its various services in order to cope with economic slowdown. However, SME results for BBL is quite satisfactory as they have surprised their stipulated targets despite the economic sluggishness going on in the country.

Demographic Environment

Demography is the study of human populations in terms of size, density, location, age, gender, race, occupation and other statistics. The demographic environment is of major interest to marketers because it involves people and people make up markets. In terms of SME requirements customer is the main part of bank. If there is no client there is no business. According to the location BRAC Bank SME unit offices already has reached in every cities around the country for providing door to door facilities. Some key factors of demographic environment are- urbanization, education, living standard etc. For example-In terms of urbanization, lots of new business and enterprises are growing rapidly in the city or town. So more banks can be aggressive for providing loans in newly developing areas. For having new banks in the city, the standard of living will increase for the people. Education is another major factor for developing a nation. Without literacy standard of living could not come for individuals. So each and every factor is interrelated to each other.

Economic Environment

Factors that affect consumer buying power and spending patterns. SME is very careful regarding economic issues in the country. Customer relation office is always keen to check purchasing materials and leading lifestyle of the client. Because if the economic condition of a client become bad then he/she might not repay the loan. On the other hand if war occurs between the two countries then price of the products will increase and people will loss purchasing power. In this way, organization might affect economically.

On the other hand, A steady growth rate with continues market oriented reforms will contribute positively by expanding the volume of business and profitability of the bank. In an economy, a steady growth means there will be more investment, savings, and consumption in the economy. As a result, bank also get more deposit and more projects for credit disbursement.

After disbursing the loan, if the economic condition of the business is being poor then BRAC Bank regenerate the repayment schedule of the client to repay the loan. On the other hand if the economic condition rise up then client repay the whole amount in favor of BRAC Bank Limited.

Social Environment

As banks are service oriented organizations, they always have to consider the attitude of the customer. Customer now want a speedy service accompanied by attractive and well decorated impressive branches with customer friendly officers providing tailor made services to the customers. SME of BRAC Bank impressive office has already earned a reputation for the bank and has attracted lots of potential customers around the country. In order to match with the customer needs, banks are also increasing varieties of products such as single short products, different short and medium term products and other services. One of the key factors of a social environment is social class growth. It carry out attitudes of various classes of people, such as upper class, middle class, lower class upper lower class, upper lower class, etc. The customer relation officer of BRAC Bank deals with them regarding their social classes.

The clients are accepting the SME loans with knowing the interest rate of 24% ( 2% per month). Client wants fast service rather than paying 24% interest. Some clients are argued about the interest rates which BRAC Bank is now think of to reduce it. BRAC Bank already have 3000 clients and disbursed 100 crore. Next year its projected target is 8000-10000 clients and captures the market in our country. So, SME has a rapid growth in the market.

Political Environment

The political environment consists of law, government agencies and pressure groups that influence and limit various organizations and individuals in a given society. SME of BRAC bank have to abide national laws like festivals, holidays. On the other hand, hartals, strikes, barriers can affect the economic condition of SME of BRAC Bank Limited. Under the latest World Bank recommendation the banking division of the ministry of finance is being abolished a; step further in providing autonomy to Bangladesh Bank. The emergence of SME of BBL and other contemporary banks and the arrival of the foreign banks are all due to the on going reforms in the financial sector of Bangladesh. BBL is restricted to provide loans for the political leaders. Customer services officers of BRAC bank always avoid the political leaders who carry out business. But if any pressure occurs from the political sides to have the loan the top management handles the situation but never give the loan to them.

Technological Environment

BRAC bank of SME division has a strong network in the whole country. The main head office is in the capital city from which it operates with all the unit offices by means of mobile telephone. In the near future, SME might handed over the palmtop computer to all customer services offices to provide accurate and quick service to the clients.

Ecological Environment

Sometimes ecological environment can turnout the business of the clients. Foods, disasters can affect the business after having the BRAC bank loans or fire can burn out the whole business. To protect from these disasters BRAC bank do the insurance policy with the joint names of the client. So that client can get feedback from the insurance policy to run again his business. If client do not get support from the insurance company then BRAC bank give time or generate the client repayment schedule

Micro Environment Analysis

Marketing management job is to attract and build relationship with customers by creating customer value and satisfaction. It depends on other factors in the organization microenvironment- suppliers, customers, competitors, various publics which make up the organization’s value delivery system.

The company needs to study its customer marketer closely in terms of Small and Medium Enterprise of BRAC Bank Limited and their customers group is specified. Their target group is only Small and Medium Enterprise client. The CRO closely monitor and try to build good report with clients. On the other hand corporate clients are different to have the loan. Each market type has special characteristics that call for careful study by the marketer.

In terms of SME, most clients are carrying out trading business rather than manufacturing business. Few clients are attached with service business like pharmaceutical, hospital, homeopath etc. In the trading business clients want loans to meet their working capital requirement. On the other hand, clients want 10-15 for purchasing fixed assets. In our country mostly 35-40 years old clients are carrying out loans regarding the type of their business. The clients who interested to take the loan of SME then they have maintained at least one year running business. It is a policy of this bank because in the mean while client can understand his business and can set a future plan.

The educational qualification of our clients is very poor. Clients are under-graduate but carry out good business. SME support their clients who are carrying out good business and also give suggestions and guidelines to develop their business. If any client has maintained loans with other banks then SME is restricted to provide loans for that clients. The client to have a clearance certificate to get the loan from the BRAC bank.

It has been found out that in our country most clients need small loans to develop their own business. The world is being globalized and modernized. So by think of it client take risks to enhance and develop their business and BRAC bank is a good helping hand to help them.

In our country, clients want more time to repay the loan. BRAC bank gives adequate time for the client to repay the loan whether they can get benefit from it. Clients are very happy to repay the loan by equal monthly installment. Clients know the right time to repay the loan at the right place. But in the pick season, most client wants short fund requirement to carry out good business. Regarding interest rates, clients are not talk about more because clients get the loan at the right time from the BRAC bank. Clients are also happy by the issuance of security preferences because they do not have to provide any collateral security for hypothecation or unsecured loans.

SME of BRAC bank networks has every where in Bangladesh. So clients can have the SME loans wherever his business exists in the country. Also clients get the fast service from the BRAC bank.

The purpose of this loan is the economic development in our country, which might divert the clients mind after having the loans for expansion. Many clients have ambition to expand from trading to manufacturing business to generate more profit.

When a CRO would visit a business, the client must provide the proper and right information and show the right documents for justifying a good client. If any CRO feel bad smell in the business then the CRO reject that client without concerning the management. So clients should be feel comfortable to provide proper information to have the loan.

Regarding the service by the CRO, almost all clients are satisfied by get these quick facilities from them. Though it is pioneer division of this bank, so client should be fully satisfied by having this facility.

Industry Analysis: SME facility of BRAC Bank Ltd.

Threat of New Entrant

In every industry, there is a threat of new entry, which varies according to industry. Similarly, the banking sector of Bangladesh also faces the threat of new entrants. However, the threat comes from two directions. The first threat comes from the arrival of the multinational banks and their branch expansion particularly due to the booming energy sector. For example, Standard Chartered Bank already inaugurate the SME loan. Another threats comes from the emergence of new private commercial banks. For example, Southeast Bank, Dhaka Bank & others, the countries traditional banks are facing the treat of further competition and better quality service. Similarly, the potential banks that may emerge in the next few years will further enhance the intensity of competition and may pose further threat to the existing banks. At the same time, arrival of the foreign banks is posing threat and pressure on the existing banks. At the same time, arrival of the foreign banks is posing threat and pressure on the existing banks. Already Standard Chartered Bank and Hongking Sanghai Bangking Corporation (HSBC) has started to provide small loans to clients and they are also going to start door to door services to clients.

Growth in the Industry

The rivalry among the competitors and the growth in the industry depends upon the intensity of competition. If the industry has a high intensity of competition then the industry will have a high growth rate, as all the firms will try to beat the others in order to grab the market share. Similarly, the banking sector of Bangladesh is growing considerably and at the same time competition is increasing. Currently BRAC bank SME division is a pioneer one and carrying out Digital Technology Management Systems.

Competitors

- Identifying the banks competitors: In terms of world bank advice, most of the private banks are now ready to provide small or micro credit loan facility to the clients because small loans are less risky than the corporate loan. At the recent trend, many banks like Standard Chartered, Islami bank of Bangladesh, Southeast Bank, Datch Bangla Bank Limited etc are going to take many aggressive steps in terms of small loan to clients.

- Determining the competitors objectives: In our country, to provide big loans or long term loans are risky because Bangladesh Bank is carrying out lots of defaulter’s list. So most of the banks are now interested to provide small or micro credit lending in terms of small and medium enterprise buniness. The objective of the competitors is to capture in the market by providing small loans regarding and manufacturing business. But everyone’s common objective is economic development of this country.

- Identify the competitors’ strategy: Standard chartered bank already sent marketing troops surrounding the cities for providing loans and deposits. CITI Bank is going to start retail service business for capturing the market. So competitor’s analysis is important factor to carry out in the long run business for any organizations. Among these banks, many of them have lower interest rates but lots of hidden costs and services.

Chapter 07: Key Aspects Related to the Marketing of SME Products in BBL

Demand Creation

The SME division of BBL basically provides micro credit loans to small and medium enterprises. Because of its unique nature, the demand for SME loans is different in nature to the demand for corporate or retail loans. A huge portion of the target market has traditionally been neglected by the banking sector and hence, is ignorant about banking activities. Thus, awareness building has been, and still is, a vital activity of the demand management process of SME loans. The process flow of demand creation is as follows:

The CROs play a vital role in all the stages of demand creation apart from market identification and product development. They provide door-to-door services for the clients and at the same time are always in search for potential new clients. Because clients are ignorant about banking products that may satisfy their needs, the CROs identify their needs, evaluate their requirements and determine which products are most suitable for them.

The major security of the SME products is building relationship between clients and banks. Demand basically comes from two groups: new customers and repeat customers. Because banks are facing new marketing realities like changing demographics, slow growth economy, more sophisticated competitors etc., BBL cannot afford to lose clients. The key to customer retention is superior value and satisfaction. As BBL recognizes this fact, repeat borrowers of SME products enjoy lots of extra benefits.

Market Segmentation

The market consists of many types of customers, products and needs and the marketer has to determine which segments offer the best opportunity for achieving company objectives. BBL segments the market for banking products into three categories based on the nature of the consumer:

Table 4: Market Segmentation of BBL | |

Segment | Target Market |

| Corporate | Enterprises with loan requirement of Taka 30 lacs or more |

| Small & Medium Enterprise | Enterprises with loan requirement of Taka 2-30 lacs |

| Retail | Individuals with loan requirements for consumer purposes |

By segmenting its consumers into these categories, BBL is trying to serve niche markets where there is ample opportunity for gro

Within SME, the market is further segmented on the basis of the nature of the business as follows:

Target Customers

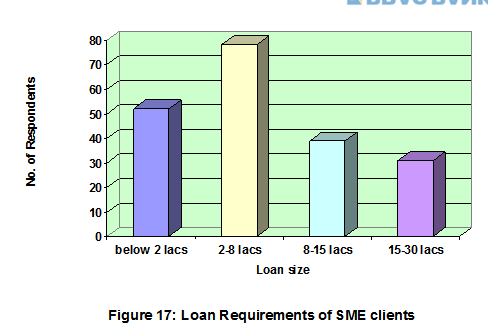

To succeed in today’s competitive marketplace, organizations must be able to hold on to its customers by delivering greater value. In order to do this, an organization must be able to identify the customers who would be benefited from their products. BRAC Bank has targeted the small and medium enterprises that have small loan requirements as the target consumers of their SME products. However, BBL does not finance business startups. The business has to be at least two years old to avail the SME loan facilities offered by BBL. Most of such businesses are sole proprietorships. There are some partnerships as well, but limited companies are rarely seen in this category. The survey that I had conducted brought up the following results as common characteristics of the respondents:

- The mean age of the respondents was 38.71 years and mode was 33 years.

- 71.50% of the respondents did not pursue education after completing their HSC. 44.50% of the respondents did not complete HSC.

- The average working capital requirement of the respondents per month was almost Tk. 28,000.

Thus the target customers can be classified as the entrepreneurs who have little or no formal education, between the age group of 30-40 years and having working capital requirement of around Tk. 30,000.

Market Positioning

Every product must have a unique proposition that will enable it to fulfill the customers’ needs. In case of loans, there are four factors that might influence the clients’ decisions regarding the selection of a loan from a bank:

- Interest Rate

- Collateral

- Time Involved in Acquiring the Loan

- Repayment Scheme and Tenure

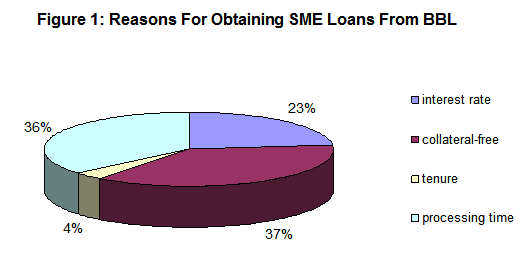

Not all factors influence every segment of the market. In the survey conducted, the following findings were revealed when the respondents were asked about their prime reason for obtaining SME loans from BBL:

From this response, it can be concluded that BBL has been successful in positioning its SME loans as collateral-free and quick to get. In the segment that it operates, these features are the pre-dominant influencing factors in the minds of the clients. This position has enabled BBL to attain the astounding growth that it has already achieved in such a short time.

Developing The Marketing Mix for SME Loans

Product

In order to serve the market more efficiently, BBL has designed various products that will be able to satisfy the needs of the clients. The summary of all the SME loan products of BBL can be found in Appendix III. However, a few important factors are worth mentioning here.

Table 5: Different SME Loan Products of BBL | ||||||

| Anonno | Apurbo | Pathshala | Aroggo | Digun Rin | Supplier Finance | |

| Purpose | Fixed Asset, Working Capital | Fixed Asset, Working Capital | Fixed Asset | Fixed Asset | Fixed Asset, Working Capital | Working Capital |

| Loan Size | 2-8 lacs | 8-30 lacs | 2-3 lacs | 2-3 lacs | 5-30 lacs | 3-30 lacs |

| Repayment Scheme | Single Payment of Principal and Monthly Interest Payment/ Monthly Installment of Full Volume | |||||

BBL has various SME products to satisfy the needs of the different types of clients in the SME market. The different loan sizes are set to attract enterprises of different sizes. Loans are approved on the basis of inventory and total receivables. Usually, up to 75% of the average inventory and receivables is granted as loan.

Price

The price of loans is actually the interest paid for it and the charges, fees or commissions associated with it. In case of BBL, the pricing for SME products are as follows:

Table 6: Pricing of Different SME Loan Products of BBL | ||

Interest | Loan Processing Fee | |

| Anonno | 24% p.a. (22% after regular payment of first time loan) | 1% of loan amount plus VAT |

| Apurbo | 17% p.a. for loan Tk. 8 to 15 lac

16% p.a. for loan Tk. 15 to 30 lac | 1% of the loan amount plus VAT (0.75% after regular payment of first loan) |

| Aroggo | 20% p.a. for loan Tk. 2.00-8.00 lac

17% p.a. for loan Tk. 8.01-15.00 lac 16% p.a for loan Tk. 15.00-30 lac | 1% of loan amount plus VAT |

| Pathshala | 24% p.a. for loan Tk. 2.00-10.00 lac

17% p.a. for loan Tk. 10.01-15.00 lac

16% p.a for loan Tk. 15.00-30 lac | 2% of loan amount for loan Tk. 2-3.5 lacs

1.5% of loan amount for loan 4-7.5 lacs

1% of loan amount for loan Tk. 8 lac and above |

| Digun Rin | Equated Monthly Installment loan facility: 17%

Single Installment Loan facility: 18% | 1.5% of loan amount plus VAT |

| Supplier Finance | 22% p.a. for 3 lacs to 9.5 lacs

17% p.a. for 10 lacs to 15 lacs

15% p.a. for above 10 lacs to 15 lacs | 1% of loan amount plus VAT |

This differentiated pricing method for different amount of loans is designed to attract clients with various requirements.

Place (Distribution)

BBL offers loans to SME clients all over the country. However, loans are processed centrally in the SME Division of the Asset Operations Department. The base unit of the distribution channel of the SME Department is the Unit Office. There are 2-7 CROs in each unit office based on the market potential of that particular unit. The CROs are responsible for the grass-root level distribution of SME loans. At present, there are almost 1050 CRos operating in the country.

The distribution channel of SME loans is as follows:

The country is divided into 7 territories. There are 65 Zonal Offices and 319 Unit Offices in the country. Zonal Officers have the authority to approve loans up to Tk. 8 lacs.

Promotion

Due to the nature of clients, direct marketing techniques are very effective for the promotion of SME loans of BBL. BBL has two main types of promotional activities:

- Door-to-Door Service: The CROs identify potential clients and reach them with loan offerings. Most of these clients are illiterate and do not maintain any financial documents. The CROs help them prepare documents required by the bank for them and provide them with necessary support in activities like account opening, transaction, etc. The CROs also promote the SME loan products to potential clients. Because they have a target to achieve, they do this willingly.

- Flyers & Brochures: For the more educated clients, BBL provides flyers and brochures in the unit offices as well as in the branches. These flyers contain specific features of the product they advertise. However, as this type of promotion is handled by the Marketing Department, it would not be within the scope of this report to discuss more elaborately on this promotional tool.

SWOT analysis

SWOT analysis is an important tool for evaluating the company’s Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and scan the macro environment, which in turn would help organization to navigate in the turbulent ocean of competition.

Strengths

- Company Reputation: BRAC bank has already established a favorable reputation in the banking industry of the country particularly among the new comers. Within a period of 5 years, BBL has already established a firm footing in the banking sector having tremendous growth in the profits and deposits. All these have led them to earn a reputation in the banking field.

- Investors: BBL has been founded by a group of eminent entrepreneurs of the country having adequate financial strength. The shareholders of the bank are all institutions themselves, which adds to the financial strength of the bank. This is one of the main reasons why BBL has been able to overcome the huge setup cost of the SME loan distribution channel and also the huge running cost of the SME Department.

- Facilities and Equipment: BBL has adequate physical facilities and equipments to provide better services to the customers. The bank has computerized and online banking operations under the software called MBS banking operations. This has shortened the loan processing time considerable. At the same time, BBL can utilize the distribution channel of its major investor, BRAC to operate in the rural regions of the country.

Weaknesses

- Advertising and Promotion of SME Loan: This is a major set back for BBL and one of its weakest areas. BBL’s adverting and promotional activities are satisfactory but its SME loans are not advertised well. It does not expose its SME product to general public and are not in lime light. BBL does not have neon signs or any other type of advertisement for SME loans in the city. As a result people are not aware of the existence of this bank.

- Unsatisfactory Remuneration Package: The CROs are not entirely satisfied with the compensation package they receive. There is no target-based bonus system in the bank, although the CROs have to meet targets. Although the CROs are provided with motorcycles and mobile phones, it is not enough to motivate them.

- Huge Operating Cost: Because of the current structure, the operational cost of SME loans is high. This has reduced considerably the profit from this business unit.

Opportunities

- Diversification: BBL can pursue a diversification strategy in expanding its current line of business. The management can consider options of starting merchant banking or diversify in to leasing and insurance. By expanding their business portfolio, BBL can reduce their business risk.

- Product Line Proliferation: In this competitive environment BBL must expand its product line to enhance its sustainable competitive advantage. As a part of its product line proliferation, BBL can introduce new, more segment-oriented products in the SME sector.

- Use of ATM in Disbursement Process: ATMs and POS machines can be used to disburse with loans more efficiently. If each unit office is provided with a POS machine, it would be easier for clients to repay loans. Also, it would reduce the pressure on the CROs.

Threats

- Multinational Banks: The emergence of multinational banks and their rapid expansion poses a potential threat to the new growing private banks. Due to the booming energy sector, more foreign banks are expected to arrive in Bangladesh. Moreover, the already existing foreign banks such as Standard Chartered are now pursuing an aggressive branch expansion strategy. This bank is establishing more branches countrywide and has already launched its SME operations. Since the foreign banks have tremendous financial strength, it will pose a threat to local banks.

- Upcoming Banks: The upcoming private local banks can also pose a threat to the existing private commercial banks like BBL. It is expected that in the next few years more local private banks may emerge. If that happens the intensity of competition will rise further and banks will have to develop strategies to compete against an on slaughter of foreign banks.

- National Specialized Banks: NSBs pose the major threat to BBL in the SME sector. At present, they hold the major portion of the SME market. If these banks begin to think aggressively about financing the SME sector, they may prove to be BBL’s prime competitor

Chapter 08: Analysis of SME Loans in BBL: Present Scenario

Definition of SME

There are a lot of confusions regarding the definition of SME within the banking sectors. For example, BBL defines SME as enterprises with loan requirements of Tk 2-30 lacs. In Standard Chartered Bank, however, SME starts from Tk. 50 lacs. Again in the NCBs, SME includes even smaller enterprises with loan requirements of Tk. 50,000 or less. However, for the context of this report, SME will be counted as enterprises with loan requirements of Tk. 2-30 lacs.

Investments in the SME Sector by the Banking Industry

Category-wise Market Share

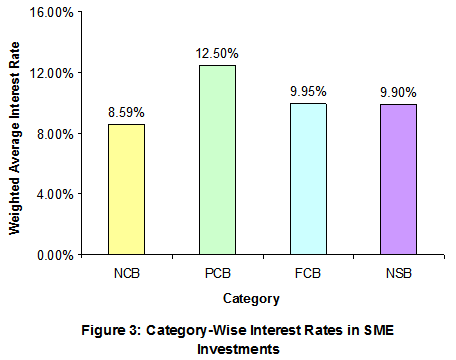

The market of SME loans is dominated mainly by the NCBs with a market share of 53.37%. The total size of the market is Tk. 45.652 billion. Category-wise distribution of SME loans in the banking industry is shown in the following table:

Table 7: Bank Category-wise Distribution of the Volume of SME Loans | ||

Figures in ‘000,000 BDT | ||

Volume | Percentage | |

| NCB | 23,294 | 53.37% |

| PCB | 11,125 | 25.49% |

| FCB | 2,450 | 5.61% |

| NSB | 6,778 | 15.53% |

| Total | 43,647 | 100.00% |

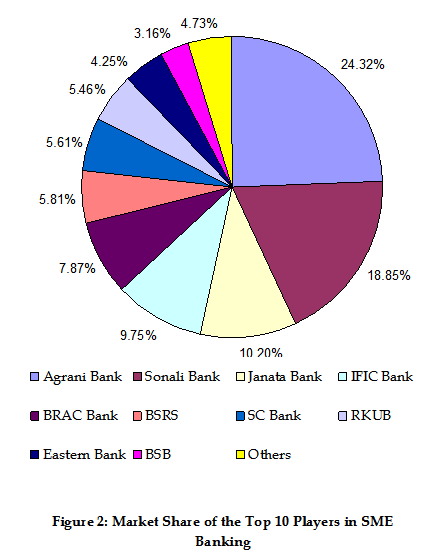

The top ten market players in the SME banking sector and their market share are shown below:

Reasons Behind the Dominance of NCBs

There are various reasons behind the dominance of NCBs in the SME sector. Unfortunately, NSBs, which are supposed to support the SME sector, could not make such a dominant presence in the industry. The reasons behind the dominance of NCBs in the SME sector are discussed below:

- Interest Rates: The NCBs invest in the small and medium industry at a very low interest rate. The average interest rate for SME loans in the different categories are compared below:

The lowest interest rate is in Agrani Bank which has an average interest rate of 7.50% only. The highest interest rate is in BBL, which is 17.05%.

The lowest interest rate is in Agrani Bank which has an average interest rate of 7.50% only. The highest interest rate is in BBL, which is 17.05%.- Network: The NCBs have a much better network in terms of branches established throughout the country. As a result, their contact is also far-reaching. The nature of SME clients is such that in order to reach them, a bank must have access to rural areas. As all transactions must be done through branches, it gives the NCBs a distinct advantage in the SME sector. The average branch size of the different banks in Bangladesh (category-wise) is shown in the following table:

Table 8: Category-wise Branch Strength of Banks

Category

No. of Branches

Average Branch Size

NCB

2904

968

PCB

2077

67

FCB

18

18

NSB

1335

267

- Government Assistance: Bangladesh Bank provides financial assistance to NCBs and NSBs to invest in the SME sector. This allows them to operate, even with a loss, at a lower price than the other banks. This is one of the main reasons why the interest rates in the NCBs are so low and thus, attractive for the clients.

Growth in SME Financing by the Banking Industry

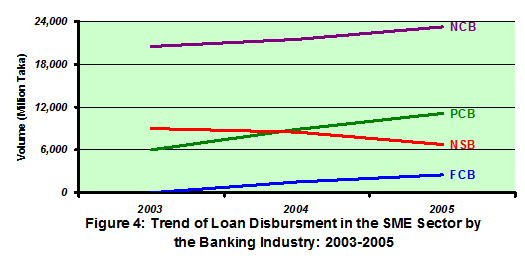

Investments in the SME sector have experienced an upward sloping curve in the

last three years. From Figure 4 we can see that the NSBs have actually suffered negative growth in the year 2005. The growth rate for the PCBs is the highest at 83.61% over the period. The volume of loans in the NCBs increased at 13.20% and in the FCBs at 60%.

Comparison of the Growth Rate of the Major Players

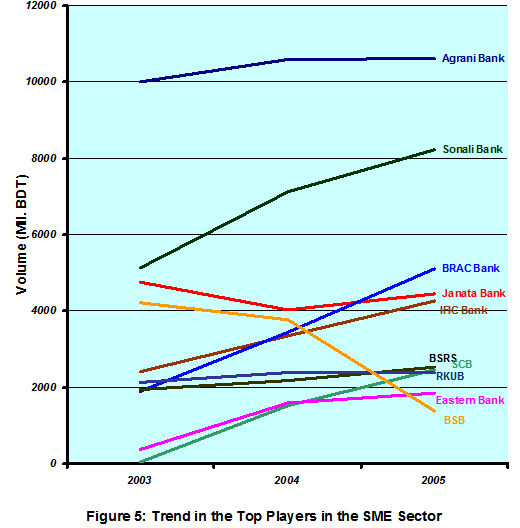

The trend for the top ten market share holders is as follows:

This figure depicts the rather poor condition of the NSBs. The NCBs have experienced stagnant or negative growth during these three years. BBL and IFIC Bank have grown at a consistent rate during this period. Standard Chartered Bank has also made remarkable progress during this period. Janata Bank and RKUB have experienced negative growth in one year during this period while BSB had a constantly negative growth rate.

The growth rate in 2004 and 2005 of the top ten SME investing banks are as follows:

Table 9: Growth Rate for the Top Ten SME Investors | ||

Bank | 2004 | 2005 |

| Agrani Bank | 5.84% | 0.23% |

| Sonali Bank | 38.36% | 15.63% |

| Janata Bank | -15.06% | 10.31% |

| IFIC Bank | 38.85% | 26.49% |

| BRAC Bank | 81.75% | 48.62% |

| BSRS | 12.31% | 15.85% |

| SCB | 3542.86% | 60.13% |

| RKUB | 12.12% | -0.25% |

| Eastern Bank | 328.65% | 16.83% |

| BSB | -10.51% | -63.38% |

In both 2004 and, the highest growth rate was achieved by Standard Chartered Bank- 3542.86% and 60.13% respectively. However, as the bank has started SME banking only in 2004, this growth rate is expected. Same is the case for Eastern Bank Limited, which has experienced a growth of 328.65% in 2003. The growth rates for the NCBs are less because of the following reasons:

- Huge Volume: The NCBs are the market leaders in the SME banking segment. Because of the huge volume of SME loans they have already achieved, it is impossible for them to sustain the same growth rate.

- Existence for a Longer Period: The NCBs have started SME banking in the 1990s. It is impossible to maintain a high growth rate for such a long time. The SME market has almost reached the maturity stage for the NCBs.

- Aggressive Marketing by the PCBs: After their emergence in the SME sector in the early 2000s, the PCBs have adopted an aggressive strategy in marketing their SME products. This has enabled them to snatch away a considerable portion of the SME market from the NCBs. As they could not compete with the interest rates, they provided other facilities like minimum collateral and shorter processing time.

SME Banking in BBL

Contribution of the Major Business Divisions

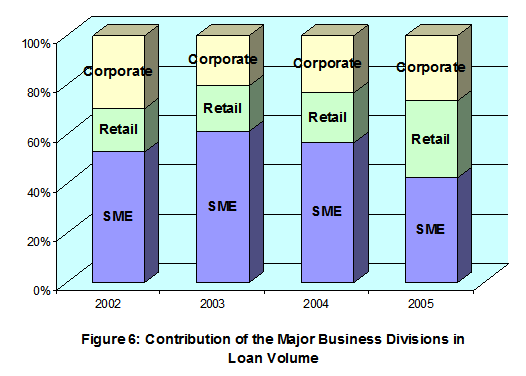

As is shown from Figure 2, BBL is one of the major investors in the SME segment of Bangladesh’s economy with a market share of 7.78%. Even within the bank, SME consists of a major portion of the total loan portfolio. The bank policy requires that at least 50% of the total loan portfolio should be allocated to SME. The contribution of SME loans in BBL’s loan portfolio is shown in Figure 6.

The contribution of SME in the overall loan portfolio was highest in 2003 at 61.14%. However, in 2005, the contribution has decreased to 42.45%. This is mainly due to the management’s concentration on retail loan products, the share of which has increased from 17.55% in 2002 to 31.19% in 2006.

The total loan portfolio of BBL in the years 2002, 2003 and 2004 is shown in the following table:

Table 10: Division-wise Loan Portfolio of BBL | ||||

Figures in Million BDT | ||||

2002 | 2003 | 2004 | 2005 | |

| SME | 331 | 1,890 | 3,435 | 331 |

| Retail | 110 | 578 | 1,229 | 110 |

| Corporate | 184 | 623 | 1,405 | 184 |

| Total | 625 | 3,091 | 6,069 | 12,027 |

Growth in the Business Divisions of BBL

The growth rate in the business divisions of BBL are as follows:

Table 11: Growth in the Business Divisions of BBL | |||

| 2003 | 2004 | 2005 |

| SME | 470.72% | 81.76% | 48.61% |

| Retail | 426.41% | 112.72% | 205.10% |

| Corporate | 237.95% | 125.33% | 125.76% |

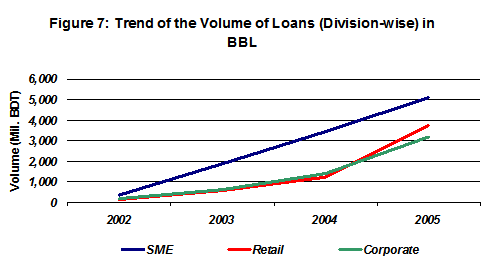

The year 2003 brought about huge growth in all the divisions of BBL. As the bank began its operations in late 2001, this was expected. Although the growth rate declined in the subsequent years, the bank still managed to sustain at least a 100% growth rate in the retail and corporate division. But the growth in the SME division continued to decline drastically through the years 2004 and 2005. This scenario is clearly depicted in the trend analysis of the loan volumes in the different business divisions of BBL.

Figure7 shows that SME has maintained a steady slope over the years, whereas the slope for retail and corporate has begun to become steeper after 2005. This indicates that retail and corporate are experiencing a greater growth than SME from 2004.

Product-wise Breakdown of SME Loans in BBL

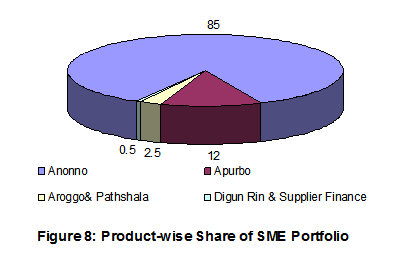

The first product introduced in SME banking by BBL in 2001 was Anonno loan, which was an any-purpose loan with a range of Tk. 2-8 lacs. This loan still remains the most dominant product with a share of almost 85% of the SME loan portfolio. After the success of Anonno, Apurba was introduced with a range of Tk. 8-30 lacs. This product also became quite popular and now has a share of 12%. Aroggo and Pathshala were introduced in 2004 to capture specific segments of the SME market, namely the health-care and education sector. These loans have a combined portfolio share of 2.5%. The most recent loans, Digun Rin and Supplier Finance, have not made significant progress yet, and have a combined portfolio share of 0.5%.

Investment Sector-wise Breakdown of SME Products of BBL

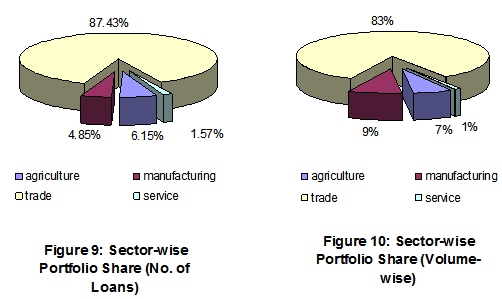

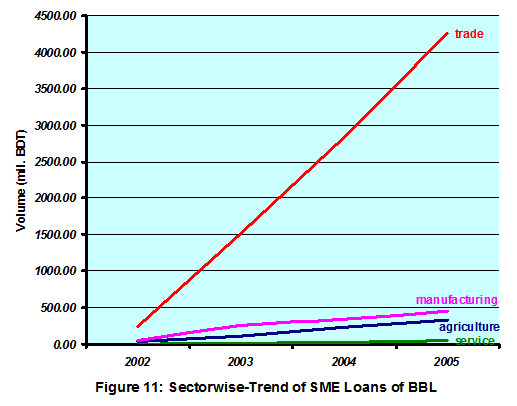

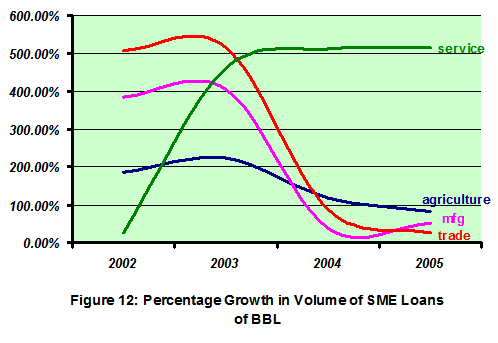

Based on investment sector, BBL has segmented the SME market into 4 categories: Trade, Manufacturing, Agriculture and Services. The portfolio share in each of the segments is shown in Figure 9 and 10.

Performance of SME Loans of BBL

The performance of a loan is determined by the repayment status of that loan. A loan has two statuses which determine its performance:

- Regular Loan: When the repayment of a loan is made on time it is considered to be a regular loan. A loan is performing as long as the installments of that loan are paid on time.

- Irregular Loan: A loan becomes irregular when the installments are not paid on time or when installments are missed. The number of irregular accounts reflects the overall credit quality of a loan portfolio because it is the point from where loan accounts tend to move towards being defaulted. Therefore the actual recovery efforts by the bank start here.

Performance in Comparison to Other Business Divisions

To analyze the performance of loans, BBL maintains records of overdue installments. In some cases, clients pay partial installments and in such situations, the installment is counted as per the proportion of paid amount to installment amount. There are two measures of performance evaluation in BBL.

- Portfolio at Risk (PAR): The percentage of the total outstanding amount of irregular loans is known as Portfolio at Risk (PAR). PAR is the total amount outstanding of the irregular portion of the loan accounts expressed as a percentage of the outstanding amount of total loan portfolio. It is so called because the chance of its becoming Bad Debt is more than the regular accounts and hence, this portion of the portfolio is deemed to be at risk. The performance of loans in the different business divisions of BBL as on December 31 2005 is shown in the following table:

Table 12: Performance of Loans in BBL | |||

Figures in BDT 000 | |||

Retail | SME | Corporate | |

| Outstanding (31 Dec 05) | 4,094,181 | 4,806,200 | 2,875,300 |

| Overdue 6 Installments & Above | 17,110 | 29,812 | 2,116 |

| Overdue 5-5.99 Installments | 10,355 | 29,495 | 1,645 |

| Overdue 4-4.99 Installments | 17,153 | 33,609 | 5,801 |

| Overdue 3-3.99 Installments | 29,592 | 36,609 | 2,693 |

| Overdue 2-2.99 Installments | 106,382 | 58,981 | 97,676 |

| Overdue 1-1.99 Installments | 287,690 | 79,733 | 150,854 |

| Total Overdue | 468,282 | 268,239 | 260,785 |

| PAR | 11.44% | 5.58% | 9.07% |

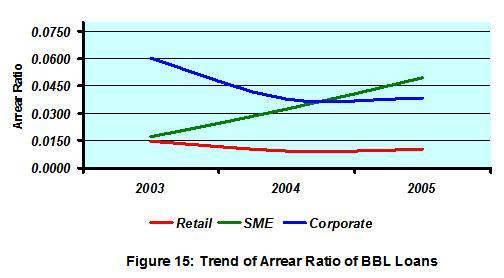

| Arrear-Outstanding Ratio | 0.0085 | 0.0497 | 0.0385 |

An analysis of the above table will reveal that in case of retail and corporate loans, most loans are irregular for one or two installments. The case is different with SME, though. In SME, the CROs pursue clients for repayment right from the first installment date. Therefore, the chances of irregularity are minimal. However, in case of larger SME loans, irregularity exists because the installment amounts sometimes become too big for the clients and they find it difficult to pay. In comparison with retail loans and corporate loans, the PAR is very low for SME loans.

- Arrear-Outstanding Ratio: The arrear amount of an overdue loan is the total amount of the installments that have been missed. The performance is calculated by dividing the total arrear amount by the total outstanding amount. The lower the ratio, the better is the performance of a particular loan or loan segment. The above table shows that the arrear-outstanding ratio of SME loans is higher than that of both retail and corporate loans. This can be explained by the following factors:

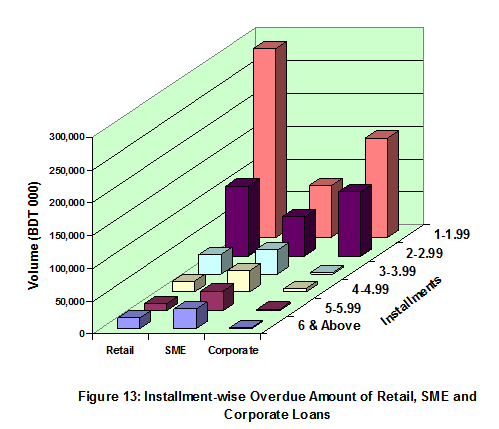

- In both retail and corporate loans, the volume of irregular loans in the 1-1.99 installments category is proportionately much higher than that of the other categories. In retail loans, this consists of 61.44% of the overdue volume, and in corporate loans this figure is 57.85%. As a consequence, the total arrear amount is also very low. Also, in case of SME loans, there is a uniformity of overdue volume in each category, where as in the other two divisions, the volume gradually goes down as the installments increase. This fact is better reflected in Figure 13.

- The loan size of SME and Corporate loans are larger than that of Retail loans. As the tenure is more or less the same for all types of loans, the installment size in retail is much smaller than those of SME and corporate. Hence, the arrear amount is also smaller.

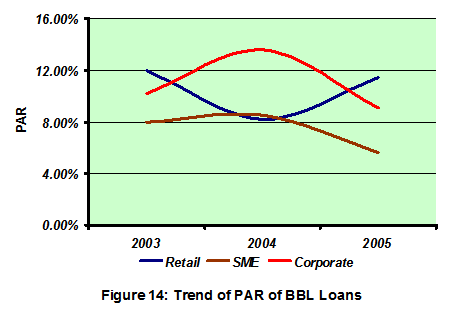

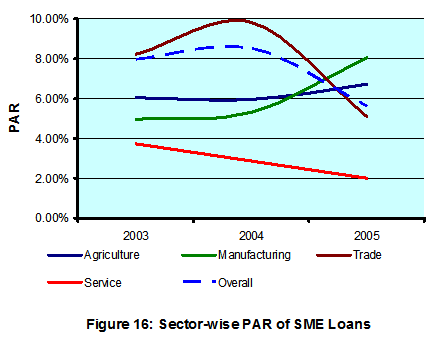

Performance of SME Loans Over The Last Three Years