Single-entry bookkeeping, also known as single-entry accounting, is a bookkeeping method that relies on a one-sided accounting entry to keep financial records. It is a straightforward bookkeeping method in which each transaction is recorded as a single entry in a journal. The cash book, which is similar to a checking account register except that all entries are allocated among several categories of income and expense accounts, is the primary bookkeeping record in single-entry bookkeeping.

Petty cash, accounts payable and receivable, and other relevant transactions such as inventory and travel expenses are kept in separate accounts. This is a cash-based bookkeeping method that keeps a journal of incoming and outgoing cash. To save time and avoid the errors of manual calculations, single-entry bookkeeping can be done today with do-it-yourself bookkeeping software.

Double-entry accounting frequently necessitates time and effort that most sole proprietors cannot afford or are not interested in. It is common for these types of businesses to only keep records of bill payments and cash received during the course of the business. Nonetheless, there is some level of record-keeping because these businesses keep track of their income and expenses. As a result, the practice of keeping partial records of business transactions that fall outside the scope of double entry bookkeeping is known as “single-entry accounting” / “Accounting for incomplete records.”

How does this system work –

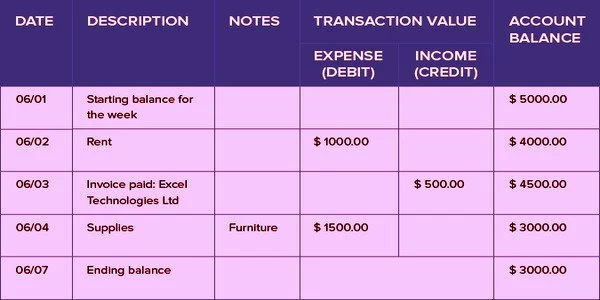

In single-entry bookkeeping, you keep a cash book in which you record your income and expenses. Begin with your existing cash balance for a given period, then add your income and subtract your expenses. After accounting for all of these transactions, you calculate the cash balance at the end of the period.

A typical cash book will have the following information:

- Date: The date on which the transaction takes place

- Description: A brief note on the transaction

- Transaction value: The value can be either incoming (debit) or outgoing (credit)

- Balance: Running total of how much cash you have in hand

Double-entry bookkeeping is used by most businesses to keep track of transactions. Many smaller businesses, on the other hand, use single-entry books to record the “bare essentials.” Only cash, accounts receivable, accounts payable, and taxes paid may be kept in some cases. A professional accountant can usually compile this type of accounting with additional information into an income statement and a statement of affairs.

Bookkeeping is essential for keeping accurate financial records. However, many small businesses struggle to implement it effectively. Bookkeeping can assist you in preparing a budget, ensuring tax compliance, evaluating your business’s performance, and making decisions. We’re sure you’ve considered setting up all of these operations for your company.