Shipping Industry of Bangladesh Concerning MGH Group

Despite Bangladesh has glorious history & heritage as a shipbuilding nation since ancient time, shipbuilding has been in focus only from the last couple of years. The optimism about this industry arose from the success attained by a number of local entrepreneurs who brought the name and fame to Bangladesh as a country with great potentials in shipbuilding by building and handing over some ocean-going vessels to overseas buyers. Since then, the shipbuilding in Bangladesh did not have to look back and now new opportunities are knocking at the door to flourish this industry further. However, due to global nature of this industry, an assessment of suitability to modern shipbuilding in terms of global standard is of prime importance. This paper focuses on studying some crucial competitive factors like labour skill, labour availability, labour man-hour, labour cost & productivity for local shipbuilding which are the inherent part for expansion of this industry. The analysis also focuses on the existing access to the resources like materials, knowledge and capital for shipbuilding. Comparison of these parameters with other nations have been made qualitatively and quantitatively to find the level of our shipbuilding. On the basis of existing condition and future vision, some recommendations have been made which might be useful for accelerating the development of this sector.

Bangladesh Shipping Industry:

Bangladesh is a maritime nation with 1, 66,000 sq. km area of sea, abundance with living and non-living resources (Alam, 2004). There are more than 200 rivers all around the country, with a total length of about 22,155 km, which occupy about 11% of total area of the country. Here rivers and water transports play a vital role for economic and commercial activities in Bangladesh. Major export and import of Bangladesh (about 85%) is also travelled by sea (CPA, 2007). At present more than 5,000 inland/coastal ships have been playing all over the country, which carry more than 90% of total oil product, 70% of cargo and 35% of passengers. More than 1, 00,000 skilled workers and 150,000 semi-skilled workers are employed in this labourintensive industry (Hossain and Zakaria, 2008). All inland ships are constructed and repaired in local shipyards. Bangladesh harbours the second largest ship breaking industries in the world.

They are the prime source of raw material including plate, frame, stiffener, longitudinal, pipe, old engine/generator, and even auxiliary machinery, for most of the local private shipbuilding yards. Those are used as raw material in manufacturing and repairing inland shipping fleet.

Industry structure and Performance:

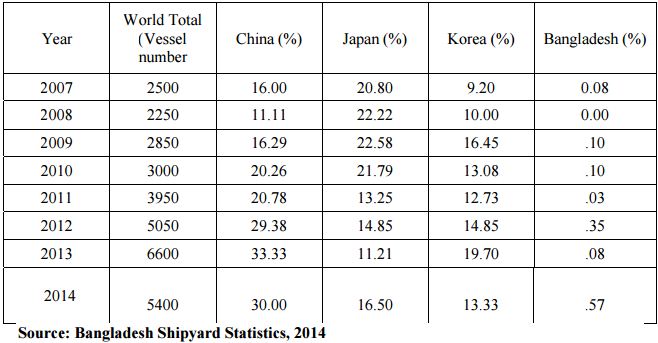

At the present time some 40 ship breaking and recycling yards are in operation in Bangladesh. In the past decade, the number of ship recyclers has typically fluctuated between 30 and 40. Some 8-10 of these are larger, diversified companies, which are integrated upstream into oxygen plants and downstream into re rolling mills. Ship breaking yards are in close proximity to both larger and smaller re-rolling mills that produce steel rods, bars, angles, and channels, principally for use the construction industry. In addition, other goods from ships from furniture to electrical generators are recycled and used intensively in Bangladesh, perhaps to a greater degree than in the other south Asian countries. Table 1 shows year-wise contract for number of vessels in world shipbuilding market and the share received by some major shipbuilding countries and Bangladesh during 2001 to 2008. The table shows how China and Korea takeover Japan after 2004. Bangladesh got a jump in receiving orders in 2007 and got a little slack afterwards due to the world recession.

Type and Sizes of Ships being built in Bangladesh:

A number of diversified types of vessels are built in various Bangladeshi shipyards around the country, such as: multipurpose vessel, fast patrol boat, container vessel, cargo vessel, tanker, dredging barge, ro-ro ferry, passenger vessel, landing craft, tourist ship, tug, supply barge, deck loading barge, pleasure craft/yatch, crane boat, speed boat, deep sea trawler, self propelled barge, inspection vessel, cargo coaster, troops carrying vessel, double Decker passenger vessel, hydrographic survey boat, pilot boat, hospital ship, water taxi, pontoon etc. A considerable number of classed vessels have been built in Bangladesh so far.

Market Analysis:

Traditional market leaders of world shipbuilding industry are over-booked mainly for construction of large ships and they are not interested in building small scale ships leaving a golden opportunity for countries like Bangladesh which can make ships up to 12,000 DWT (dead weight tonnage). High speed Shipbuilding and Engineering Company Ltd, the country’s oldest shipbuilder, will sign the deal with Groningen-based Hollander Scholtens (HS) to build 9,000 tones capacity eight ships by April 2012. High speed Shipbuilding and Engineering Company Ltd. the country’s oldest shipbuilder specialized in building small riverine cargo and passenger vessels will be the third company to join the boom in ocean-going shipbuilding industry. Ananda Shipyard and Slipways Limited based at Meghnaghat and Western Marine in Chittagong have already bagged export orders worth $280 million since the country emerged as a new global destination of shipbuilding last year. The latest export order came, as Bangladesh has become a new destination for construction of small sea vessels, with an annual market of $400 billion, as traditional shipbuilding nations such as South Korea, Japan and China now focus on large vessels. An expert said the latest order proves that the country is very much on the path to become a major ship-builder.

Market Player:

According to shipyard industry sources, there are some 70 shipbuilding firms in Bangladesh. The main market players are below:

- Western Marine Shipyard

- Ananda Shipyard and shipways Limited.

- Narayanganj Engineering and Ship Building

- Khan Brothers, Karnaphuli Shipyard,

- High Speed Shipbuilding and Engineering Company Ltd, and

- Meghna Group

Weaknesses:

Bangladesh is a very new entrant in the international shipbuilding. There are weaknesses which must be overcome by appropriate steps to meet challenges and be competitive. A glimpse of weaknesses is pictured below:

- Scarcity of capital

- High financing cost

- Backwardness in technology

- Inadequate electric supply

- Weak diplomacy

- Inadequate management pool for expanding shipbuilding industries

- Lack of basic design abilities

- Longer lead time in material mobilization

- Lack of comprehensive skill development in various shipbuilding traders

- No policy body for advising government on shipbuilding

- Subsidies/ support in various shipbuilding countries

Opportunities:

A number of shipyards in Bangladesh have the capacity to build vessels for international markets. Western Marine and Ananda Shipyard & Shipways have been leading the way in production for overseas buyers. At the moment, they can produce ships of about 10,000 tons and they are working to expand their facilities to build bigger vessels. The industry is aiming to win orders of more than $2billion in the next five years. If that happens, it is expected to create many thousands of jobs. Bangladesh has more than 100 shipbuilding yards, with most of them serving the domestic market.

Experts say nearly 70% of the country’s cargo and 90% of total oil products are transported by small ships, cargo vessels and tugs through its coastal and inland waterways. Hundreds of thousands of people use ferries and steamers to travel from one part of Bangladesh to another, and most of these vessels are built in the country.

Labor cost comparison:

Cost of labor is about 20-30 percent of the cost of shipbuilding (Shenoi, 2007). Workers in US shipyards receive about US$ 18 per hour, whereas the hourly wage is about US$ 5.00 in some Chinese shipyards; US$ 8 in South Korean yards, and US$ 16 in Italian yards. Only Japan’s hourly wage of US$ 25 exceeds U.S. labor costs.

Many of the shipyards in neighboring counties like India and Vietnam are fully occupied with medium and large ship orders. Bangladesh has still got rooms for building small and medium categories ships for international market.

Competitive Parameters Analysis of Local Shipbuilding:

Analyzing the competitiveness of shipbuilding from the viewpoint of access to main resources or production factors is crucial and in this paper, the following resources are primarily highlighted:

- Manpower input, skill & employment

- Wage costs

- Raw materials -steel & Components

- Knowledge

- Capital

Manpower input, skill & employment:

The availability of (skilled) manpower is an important factor in determining the competitiveness of the shipbuilding industry. Fortunately, the presence of shipyards in particular for long time with large pool of workforce is the main strength of Bangladesh shipbuilding industry.

Bangladeshi workforce is acclaimed to be disciplined, diligent, hard working, obedient and quick learner and comparatively cheaper than any other country in the world. Also availability of white colour skilled manpower in maritime field is an added advantage. Management professionals, electronic, electrical, information technology and communication engineers of the country are capable of performing the assignment in relation with shipbuilding. Also, presence of technical institutes with 35,512 intake capacity of producing skilled manpower with regard to shipbuilding industry is very useful to support this industry. In addition to this capacity, presently Khulna

Shipyard Limited is producing 100 skilled persons per year and Western Marine Shipyard Ltd. Is conducting training course in order to produce international standard welders, painters, foremen, etc. every year for quality ship production. When taking a look at the skill levels in different shipyards, similar patterns exist although there are clear differences among different countries.

The total workforce in Bangladeshi shipbuilding can be broken down in management & administration (7-10%), graduate engineers (3-6%), technical & skilled workers including diploma engineers, foreman, certified welders (13-18%) and remaining portion belongs to semiskilled, unskilled workers at different categories. Although Bangladesh has a strong base for the production of workforce, but the alarming picture is that skilled workforce drain out every year and the rate is very high. For the case of naval architects, the situation is even worse. As a result, shipyards are facing difficulties to carry out job of ship production taking the engineers from other backgrounds. The only positive side of drain out is that every year about 10, 000 skilled shipbuilding workers are contributing to country’s economy by sending remittance. Shipbuilding related remittance is about 2-4% of total remittance sending from abroad to Bangladesh.

Wage costs:

Wages have a major impact on the competitiveness of a shipyard: labour accounts for a large part of the costs of a ship. The labour share in total production cost strongly depends on the wage levels and the labour intensity of the production process. Figures on this vary between 40-50%, while other sources state a percentage between 21-23% in Europe and Japan and 19% in Korea.

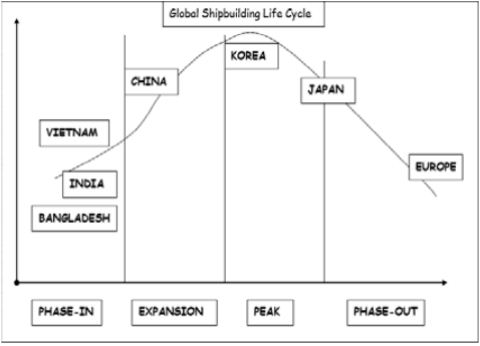

Indian shipbuilding labour costs are estimated at 8-10% of the total shipbuilding costs. As a result of labour cost competition, shipyards in high labour cost countries are trying to reduce the man-hours required to build the ship. This can be done by improving facilities, systems and labour productivity. Automation is important, but improved organization, systems and product development may all play a part. The competitive price advantage gained from plentiful cheap labour played a significant role in the lifecycle development of shipbuilding industry (as shown in Fig.) and it will likely to continue to do so for the foreseeable future.

Presently, the industries manufacturing row ferries, tug boats, fishing trawlers, inland oil tankers, etc. are catering to local demand. With the ship-breaking industry flourishing in Chittagong, availability of steel plates boosted the inland shipbuilding in the early nineties and various shipyards started to emerge in this sector. As of today, about 200 locally-built cargo vessels from 500 DWT to 2000 DWT – are now operating, and one thousand vessels with a 1000 passenger capacity are plying on our inland riverine routes.

Figure: Shipbuilding Lifecycle around the world

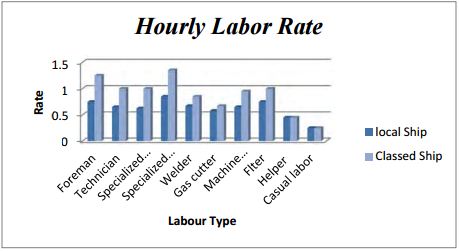

The competitive price advantage gained from plentiful cheap labour played a significant role in the lifecycle development of shipbuilding industry (as shown in Fig. 1) and it will likely to continue to do so for the foreseeable future. Below Figure shows the hourly labour charge for local shipbuilding in Bangladesh and the graphical presentation is:

Figure: Hourly Labour Charge (in USD) for shipbuilding industry in Bangladesh

Access to raw materials- Steel & components:

For the shipbuilding sector, access to cheap raw materials is very important in order to keep down input costs of vessels. The main raw material – one that determines the price of a vessel to a large extent – is steel. Unfortunately, entire amount of steel for class building has to purchase from outside country although few local companies are producing limited class steel plates in the recent time. On the other hand, despite Bangladesh has a long experience in shipbuilding, the component and service suppliers/manufacturers for shipbuilding have not grown in an organized manner and not up to the quality required for class vessels except for few cases. For export oriented ships, the proportion for components/services required for classed vessel is very insignificant and at present it is only 5-10%. The concerned shipyards, some local steel companies together with some local marine component manufacturers are now entertaining the small orders that have been placed in Bangladesh. Because of non availability of organized component and service supply manufacturer for export oriented ship, they have either procured from abroad (as shown in Figure 5) or have been engaged themselves for manufacturing of the same. On the other hand, almost entire amount of the components /services as well as steel plates, structural items required for construction of inland/coastal vessels are manufactured & supplied by various SME & ship breaking yards. In the recent year, Govt. is showing special interest for export oriented shipbuilding, by waving custom duties on import of raw materials and components used in shipbuilding, green channel status etc.

Knowledge:

R&D and Innovation Knowledge, R&D and innovation are of strategic importance for the competitive position of shipbuilding sector in the long run. Bangladesh shipbuilding industry is one of few industrial sectors that have gained international reputation and the industry experienced a process from domestic oriented industry to international-based industry in last few years. Today’s shipbuilding industry has been gradually transformed into technology driven industry from labor intensive one due to the growing needs to meet environmental regulations on ship operators, increased technological requirements of the clients and extremely enlarged sized of the vessel. The global market becomes severely competitive to late comers armed with cheap labor cost and expanded facilities. Under these circumstances, shipbuilding companies are seeking effective ways to strengthen competitiveness in quality, cost and delivery thus ultimately benefiting the customers. In this context, not only resources on high value-added ships, but also much R & D efforts on production automation and optimization of logistics are being conducted in order to derive high level functionality, improve performance, reduced cost and easy maintenance in ship operation.

Access to capital – ship financing & Govt. Support:

Shipbuilding financing cost in Bangladesh is very high. Lack of adequate working capital loan, high rate of interest on industrial and working capital loan shipbuilding, high bank guarantees and bank commissions, all lead to a very harsh environment for the future nourishment of this industry. That is why Govt. is presently taking a plan to formulate the following policy regarding shipbuilding;

- a) Provide shipbuilding with loans on advantages terms

- b) Exemption of export taxes and land rent

- c) Covers up to 50% of working capital

- d) Incorporate shipbuilding expansion plan as strategic development program of the country.

Prospects of Shipping Industry in Bangladesh:

The sea borne cargo growth is increasing 6-8% per year and demand of new shipbuilding is increasing at the rate of 3-4% per year (Khan, 2013). But the existing ship building industries are not in a position to handle this additional pressure. At the same time traditional ship building nations are burdened and as the rate of demand is increasing day by day, they have become selective in building new ships. They are not interested to build small ships of 25,000 DWT or less. So the ship owners, who are interested to build small ships of less than 25,000 DWT, had to look for alternative markets. For these reason, Bangladesh is a prospective market for international community. Considering the world market and internal market, it is assumed that Bangladesh has a bright future to elevate herself as a shipbuilding nation in the world market and surely that factor should encourage more Bangladeshi entrepreneurs to come forward in this business. The shipbuilding industry here hopes that if the global economy recovers, then it offers tremendous potential. Experts say more than 50% of the world’s ships are more than 20 years old and need replacing. More importantly, they say countries such as Japan, South Korea and China are building very big, specialized and hi-tech ships, and they are not interested in constructing smaller vessels. Globally, this small and medium-sized ship market is worth around $200 Billion.

If Bangladesh can get 1% of this market, then it amounts to $2 Billion. Even though several problems are involved, with the convenient geographical advantage together with availability of less expensive technical personnel, abundance of skilled and semi-skilled workforce and long past heritage, Bangladesh has a very good opportunity to become a shipbuilding nation by 2016.

In Bangladesh, the long coastline and mouths of rivers falling to the sea offer excellent geographical endowment for development of shipyards and shipbuilding zones. For these reason Japanese shipyard companies have huge opportunities to business in Bangladesh. Bangladesh`s shipbuilding sector is deemed competitive because a favourable business environment.

SBRI Analysis-Profitability and Competitiveness:

Essential to an assessment of the SBRI’s competitiveness is analysis of its profitability under the prevailing environmental and occupational health regulatory regimes. The estimates used in the analysis here are based on reviews, updates, and assessments of previous economic, econometric, and financial studies. The estimates generated are, however, subject to some degree of uncertainty. For the sake of cross-country comparison, all calculations are based on a “sample” ship.

Revenues:

Steel— the most crucial recyclable output in terms of volume and revenue. This steel is either reheated and re-rolled or melted down and re-processed.

Other recyclable items— including non-ferrous scrap, machinery, furniture and fixtures, and ropes and cabling. Virtually, all items that can be recovered from a ship are recycled in some form.

Costs:

- Purchase of ship

- Investment costs (for equipment and civil works such as cranes, forklifts, storage, and housing)

- Financial costs

- Labor costs

- Consumption of utilities (e.g., oxygen, LPG, diesel and electricity)

- Taxes, tariffs and duties (e.g., import taxes)

- Rents (e.g., for land use)

- Other costs (e.g., for handling hazardous waste).

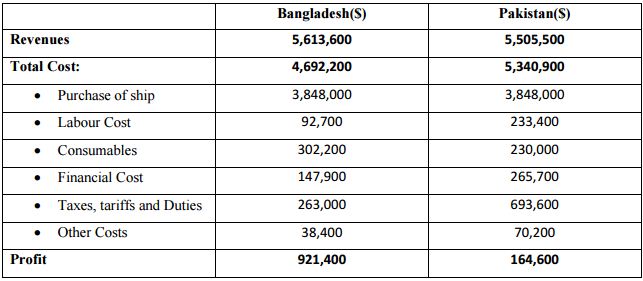

Following Table shows the Overview of revenues, main costs, and profit for a sample ship in Bangladesh and Pakistan, mid-2014 (in dollars):

Organization Overview:

The company I worked with started its journey in 1992 with Contract Logistics Management of Gillette in Bangladesh. We were importing various Gillette SKUs, Customs Clearance, Central & Regional Warehousing, Sales, and Distribution to the outlets all across the Country.

Today, MGH has core investments into Contract Logistics, Supply Chain Solutions, Ocean Carriers, and Airlines GSA representations, Cutting-Edge IT Solutions, Inland Container Terminal Management, Food & Beverage Retail, FM Radio, Cable Television Network, Tea & Rubber Plantation, Commercial, & Retail Banking, Computer Reservation System (CRS) Distribution, Internet Booking Engine, and Inventory of Premium Land Bank respectively.

Born in Bangladesh, now Head Quartered out of Singapore, MGH owned operations span all across India, Pakistan, Sri Lanka, Nepal, Myanmar, Vietnam, Mauritius, Madagascar, Qatar, Kuwait, Egypt, the United Arab Emirates, and Kazakhstan.

With 770 talented associates in majority recruited straight from various campuses of the world transformed into effective thinkers, innovators, team players, leaders form the driving force, and has been the growth-engine of the group.

Ocean Carriers General Agency Representation:

MGH Represents World leaders in Ocean transportation in Bangladesh & Myanmar:

Yang Ming Line, Taipei, Taiwan, Republic of China (2609TT): The National Shipping Line of Taiwan is represented by Transmarine Logistics Ltd in Bangladesh. Yang Ming Line, ranked 15th globally on June 2011, has 66 services all across the world with 3,398,42 TEUs operating capacity, and major alliances with China Ocean Shipping Company (COSCO), K-Line, and Hanjin.

China Shipping Container Lines, Shanghai, PRC (HK2866 601866): The largest Container Shipping line of the Peoples Republics of China is represented by Total Transportation Ltd in Bangladesh.

China Shipping Container Lines, ranked 10th in the world on June 2011, by operating container capacity of 5,60,000 TEUs with 80 services across the world, raced to global leadership in containerized transportation in just 13years.

Emirates Lines, Hong Kong, SAR: Emirates Shipping Line DMCEST, registered in Dubai Maritime City of United Arab Emirates, is a new generation containerized shipping company having niche services to, and from the Middle East, South Asia or India Sub-Continent, IntraAsia and the African Continent, respectively.

Compania Sudamericane de Vapores (CSAV) is a Chilean publicly traded shipping company, based in Santiago, presently the largest in Latin America. CSAV, one of the oldest shipping companies in the world, was founded in 1872, operating across five continents. CSAV NORASIA is the result of the integration of CSAV and Norasia.

CSAV NORASIA is committed to deliver reliable, efficient, and seamless shipping solutions that will allow focusing individual’s core business. It has truly global connections and operates in over 50 countries worldwide, with representation in more than 300 locations including Bangladesh where Peninsular Shipping Services Ltd represent the agency.

It has recently reported that among the top 20 carriers in the Shipping Industry, CSAV achieved the best on-time scheduling percentage (69.1%) in the first quarter of 2011. CSAV clinched 8th position world ranking in the month of June 2011, with 546,617 TEUs out of 100 top carriers.

Orient Express Lines (Singapore) Pte Ltd, which is part of Transworld Group of Companies, with the international head quarters at Dubai and a regional headquarter at Singapore. It has expanded its network in feedering in Indian Sub-continent with hub ports at Singapore, Malaysia, Colombo and the Arabian Gulf covering all major feedering corridors in these regions including Bangladesh where Peninsular Shipping Services Ltd. represents the agency. OEL has won the Enterprise 50 award 5 years in a row in Singapore.

Hubline Bhd is a major regional instra-Asian shipping line, based in Malaysia currently operates a fleet of 40 vessels viz., container vessels, dry bulk carriers, and tugs and barges are currently deployed to provide services between ports in Malaysia, South-East Asia including Bangladesh where Total Transportation Ltd represents the agency.

Non-Vessel Operating Common Carriers (NVOCC) Representations:

BLPL Logistics (Singapore) Pte Ltd. is a small NVOCC based in Singapore, which is a part of Transworld Group of Companies focusing the business mostly in Indian subcontinent, Middle East, Indonesia and few ports of China. Bangladesh Agency is represented by Peninsular Shipping Services Ltd.

Sitara Shipping Lines is a small NVOCC based in Mumbai, India who are handling exclusively special equipments, project cargo including OOG from Indian ports to/from Bangladesh and the agency is represented by Peninsular Shipping Services Ltd.

Balaji Shipping Lines FZCO is a part of multi-dimensional Transworld Group of Companies and span more than 50 offices in the Indian Subcontinent, Middle East and Persian Gulf, Red Sea, CIS, South East Asia, Far East, South and East Africa, UK, Europe and USA including Bangladesh where Peninsular Shipping Services Ltd represents the agency.

Ocean Carriers:

MGH provides shipping line services and has close liaison with the National Shipping Line of Taiwan, Yang Ming Line which is now represented by Transmarine Logistics Ltd in Bangladesh, and by Transmarine Logistics Asia Pte Ltd in Myanmar. Yang Ming Line is ranked globally on June 20011, has 66 services all across the world with 3,398,42 (twenty equivalent units) TEUs operating capacity, and major alliances with China Ocean Shipping Company (COSCO), K-Line, and Hanjin. Transmarine Logistics Ltd (a concern of MGH Group) represents China Shipping Container Lines which is largest Container Shipping line of the Peoples Republics of Chinaranked ranked 10th in the world on June 2011, by operating container capacity of 5,60,000 TEUs with 80 services across the world, raced to global leadership in containerized transportation in just 13 years. MGH also venders carrier services of Emirates Shipping Line DMCEST– a new generation containerized shipping company having niche services to, and from the Middle East, South Asia or India Sub-Continent, Intra-Asia and the African Continent, respectively. Along with these shipping lines, MGH also represents Compania Sudamericane de Vapores, Orient Express Lines (Singapore) Pte Ltd, BLPL Logistics (Singapore) Pte Ltd.Sitara, Shipping Lines, and Balaji Shipping Lines FZCO.

IT solutions:

Jaatra.net is an outcome of continuous delves of MGH Group in the aviation industry for last one decade. It is a complete solution for both online and traditional travel agencies looking for an Internet Booking Engine (IBE) in order to become an online travel agent (OTA) without any development and with minimum cost. It facilitates flight searching, booking and even ticketing over internet through agency‟s personalized website. Jaatra.net drives incremental revenues as it offers „round the clock‟ online self driven travel planning and reservation for travel agent‟s both B2B as well as B2C customers. It provides complete freedom to the Travel Agents to configure the sectors, airlines and GDS according to their business need. Jaatra.net IBE also provides seamless integration with Jaatra.net Back Office system, so that travel agents can have complete visibility of their business from one single point. Precisely, Jaatra.net is a trusted online travel solution provider which opens the opportunity around the globe.

Food & Beverage Retail:

MGH Restaurants Pte. Limited is the Master Franchisee of Nandos in Bangladesh, and in Nepal. With the first 550 square meter sprawling Flag Ship Store opened in Dhanmondi, Dhaka, MGH opened the second 550 square meter store in Gulshan in 2009, the Premium Suburb of Bangladesh. MGH is also the master franchisee of Barista Lavazza with the objective to provide an authentic Italian coffee drinking experience in a warm, friendly, no pressure environment. We began operations in the year 2008 as we felt the time was right for the Bangladeshi consumers to experience a café that provided a third space, away from work and home, where the guest could relax and unwind.

Achievements

MGH has also had numerous internal achievements such as achieving target efficiency improvements and reaching milestones in annual revenues. Despite the credentials, MGH continues to strive to provide the very best for its loyal and satisfied customers. In accordance with the MGH mission to go beyond boundaries, the company has managed to make a presence in the global supply-chain market. MGH is the number 1 customer of the Chittagong International Airport based on passenger and cargo volume. Furthermore, twelve percent volume share of export air freight is managed by MGH’s aviation team. In 2005, the shipment from C&A via Transmarine Logistics Ltd. (TML), a concern of MGH, increased beyond 5000 TEUs. That year, TML experienced a growth of thirty percent, courtesy of their fast transit, guaranteed space and proactive coordination. Klaus Peter Beermann, Manager, Overseas Transports Logistics, stated that MGH has been providing error-free information flow on time with 99 percent accuracy during the regular yearly vendor conferences (January, 2006).

Believing in social liability, MGH is affiliated with several CSR activities, focusing on eradication of child labor and provision of guidance and direction to help the lives of the underprivileged children. MGH has been involved with various agencies such as, Shunshanto Sutrodhor, Bangladesh Society for Child Neurology, Development and Disability (BSCNDD), Legal Aid Society for the Unfortunates (LASUF) and so on since 2008.

Brand value:

By offering consolidated 360-degree customized solutions to the partners, MGH has managed to link the complex worldwide network into an innovative and simple logistics solution. MGH covers air freight, ocean freight, warehousing, trucking, import clearance, distribution and custom brokerage, alongside Container Freight Station (CFS) / Inland Container Depot (ICD) services for its global customers. Over the years, MGH has successfully brought in significant benefits to its rich portfolio of clientele from the FMCG, automobile and RMG sectors among others through its value oriented services. The company’s alliances with renowned brands such as CMA CGM, Emirates Shipping Line, UASC, Senator Lines, MCC Transport and others in South Asia signify its success and highlight the edge that it provides.

Promotion

As a market leader in logistics, MGH understands the different needs of customers and provides unique services to each one of them. MGH’s logistics divisions ensure that no customer is left unattended. The key values of MGH, keeping customers at the center of decision-making and assurance of delivery consistency, have allowed them to open its door to all types of customers across the world. Understanding the importance of information technology in relation to global presence, MGH has carved out web portals that assist customers and MGH alike in various fields. By using common platforms such as myshipment.com, MGH improves efficiency and delivers top notch logistics services. Myshipment.com allows real time tracking to customer; thus, making the process transparent and within hands’ reach throughout the supply chain.

MGH’s very own Container Freight Stations assist in providing customized services to customers on warehousing, inspection and staffing. MGH operates the largest Inland Container Depot in South Asia, Portlink Logistics. The company’s work operations are seamlessly linked to online SAP based visibility system. With similar innovations and the goal to exceed clients’ expectations, MGH stands as one of the best global network partners in delivering one point solutions in the relevant field. MGH also delivers CFS/ICD services to its global customers.

Research on Factor influencing Employee Satisfaction:

The research has been done to assess satisfaction level of the employees at MGH Group and it is partial fulfilment of my BBA program. In order to succeed in the long run, it is imperative to know what the employees think about the organization. Thus, in this report I try to conduct a research on employee satisfaction.

MGH Group is one of the largest conglomerates in Bangladesh. Rooted in Bangladesh, the company is now Head Quartered out of Singapore and has operations in all across India, Pakistan, Sri Lanka, Nepal, Myanmar, Vietnam, Mauritius, Madagascar, Qatar, Kuwait, Egypt, the United Arab Emirates, Kazakhstan, and Nigeria. It was established in the year 1992 as a distributor for Gillette, by Mr. Anis Ahmed and soon spread out to have core investments into Contract Logistics, Supply Chain Solutions, Ocean Carriers, and Airlines GSA representations, Cutting-Edge IT Solutions, Inland Container Terminal Management, Food & Beverage Retail, FM Radio, Cable Television Network, Tea & Rubber Plantation, Commercial, & Retail Banking, Computer Reservation System (CRS) Distribution, Internet Booking Engine, and Inventory of Premium Land Bank respectively.

Objective of the Study:

This project has been designed to accomplish an objective. From my point of view, it is very important for a company to find out the level of satisfaction of its employees as the success of a company mainly depends on them. Through this study, I have tried to find out the ―Factors Influencing Employee Satisfaction.

By correlate those question I tried to generate some understandings of employee satisfaction which may help to shed light on what is important to the employee and also suggest the important factors, on which the companies need to furnish more emphasize.

Methodology:

Types of Population and Nature:

For convenience, I have collected data from the employees who are currently working here. The project has followed the simple random sampling method. The number of the respondent will be 25.

Data collection method:

Primary Source:

The primary data has been collected through questioner survey. The data collection process has followed structural method.

Secondary Source:

To successfully accomplish the research, I tried to take some help from past research works, news reports, different articles and journal.

Observations:

MGH Group is one of the largest group of companies in Bangladesh with core businesses in freight forwarding. However, the very nature of businesses is as such that they need constant improvements to meet the dynamic business environment of today. There are undoubtedly scopes for further improvement that can be brought about in the company. The following are few of the concerns that can be brought under consideration-

- Since the CRM follows a rigid structure of procedures that have to be followed every time, it is often monotonous for an employee to be doing repetitive work which often leads to the following spill- over effect

- No employee training for software SAP use

- High employee turnover resulting from stagnant career growth and low incentives Poor work allocation

- Technical problems in SAP systems which hinders work flow

- Frequent miscommunications regarding shipment payments with suppliers‟ agents

- No standard procedure to realize late payment from suppliers

Recommendations:

The retention of skilled employees is a vital part of any organization’s long term successstarting from the initial period, proper employee training must be provided to new comers to save time during work as well as increase productivity. The organizational hierarchy as well as the payment structure must be revised periodically and employee evaluation should be prioritized during promotion/bonus/benefits assessments. Job descriptions should be clearly communicated between supervisors and subordinates to be clear about who does which part of the work.

For a company like MGH Group which is heavily dependent on the SAP software, an efficient IT department with members specializing in the SAP system software is of utmost importance. Frequent system updates for reliable SAP communication must be ensured for smooth work flow.

In order to close the gap between employees’ perception and expectation it should improve its employee benefit scheme such as: performance bonus, festival bonus and medical allowance as these allowances can motivate employees.

Moreover, it should create more career development opportunities to make their employees well prepared to cope up with the change and also should have more career growth opportunities so that the performance of an individual employee’s gets recognized both financially and nonfinancially.

Conclusion:

The future for MGH Group is fruitful. The company is a pioneer in the freight forwarding industry in Bangladesh and has diversified its investment to make a strong portfolio. MGH Group plans on further expansion of its restaurant business in the near future and has already taken considerable attempts to open a learning and development department in the company to aid employee training by spotting training needs and arranging them periodically. Although employee turnover rates have recently increased, such issues are being taken into consideration to improve future employee retention. The experience of spending my internship period as a management trainee in MGH Group has been rewarding and very fulfilling. The organization has given me a scope of functioning as a member of a highly active team of professionals catering to the need of various global brands and has added to my capabilities of working under pressure and adequately maintaining all aspects of work environment. I have been given a great opportunity of developing a professional attitude which would undoubtedly act on my benefit in my future career endeavours.