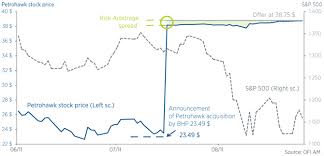

In theory arbitrage is actually riskless, however, the entire world in which many of us operate offers few of these opportunities. Despite these types of arbitrage being to some degree risky, they will still be relatively low-risk investing strategies which money managers and list investors alike may employ. Risk arbitrage is an investment or investing strategy often associated with hedge funds. Risk arbitrage gives some properties with other designs of arbitrage for example relative value, volatility arbitrage, convertible arbitrage, and statistical arbitrage, but it’s also an example of the event driven technique.

Risk Arbitrage