Executive Summery:

The strategic direction of the bank is reviewed periodically by the Marketing Division as well as senior management. At the time of preparing deposit procurement, financing plan and budget, priority is given on bottom up information sharing process. The Board of Directors approves the budget at the Board Meeting and evaluates monthly performance in the Board Meeting for ensuring proper budgetary control and provide guidelines to the management for overcoming lapses identified. In keeping with mission and vision of the Bank, the strategic direction of the Bank has been clearly identified and laid down in the corporate plan and the budget. The corporate plan and budget of the bank, prepare each year on a rolling basis, spell out the goals and objectives for each major strategic business unit of the Bank such as corporate banking, treasury, general banking, retail banking etc. and the detailed action plans for the achievement thereof along with specific time frame is evaluated in the weekly marketing meeting. Undoubtedly, the corporate plan and the budget has immensely contributed in achieving the target across the Bank and leading to higher performance for achieving its pre-eminent position.

Objective of the Report:

The specific objectives aimed for this report is:

1. To fulfill the partial requirement of the course under the guidance of the coordinator.

2. To gain experience and knowledge of analyzing the financial ratios from the real life which will help me in the practical working environment.

3. To find out the financial situation of X Bank Limited.

4. Identify the problem area

5. Giving suggestion to overcome those problems

6. Finally comment on the result from investor and creditor’s point of view.

Vision of X Bank:

To establish X Bank limited as a role model in the Banking sector of Bangladesh.

To meet the needs of our Customers, provide fulfillment for our people and create shareholders value.

Mission of X Bank:

To constantly seek to better serve our Customers.

Be proactive in fulfilling our social responsibilities.

To review all business lines regularly and develop the Best Practices in the industry.

Working environment to be supportive of teamwork, enabling the employees to perform to the very best of their abilities.

Background of the Bank:

The name ‘X Bank’ is derived from the insight and long nourished feelings of the promoters to reach out to the people of all walks of life and progress together towards prosperity in a spirit of one ness.

The Bank is pledge-bound to serve the customers and the community with utmost dedication. The prime focus is on efficiency, transparency, precision and motivation with the spirit and conviction to excel as X Bank in both value and image.

X Bank limited is a private commercial bank incorporated with the Registrar of Joint Stock Companies under the companies act 1994. The Bank commenced banking operation on 14 July 1999 by obtaining license from Bangladesh Bank on 02 July 1999 under section 31 of the Bank Companies act 1991. As per the provisions of Bangladesh

Bank license, the Bank has offered initially its shares to public by pre-IPO and subsequently sold share to the public through IPO in the year 2003. The shares of the Bank are listed with both Dhaka Stock Exchange Ltd and Chittagong Stock Exchange Ltd. The number of branches of the bank was twenty three (23) as on December 31, 2006.

Resources & Facilities:

Total full time regular employee strength had increased to 300 by the year-end. Excepting for the new inductees, the remaining employees are all skilled banking professionals with varying degrees of experience and exposure, recruited from the leading local and foreign banks.

The Bank has a strong focus on imparting training towards enhancement of the skills and competencies of the employees. During the year a total of forty-seven training for the employees were organized, both at home and abroad.

Management of the Bank, on a continuous basis, undertakes in-house training initiatives towards raising awareness among the Bank employees with respect to Bank’s policies and instructions and directives of the various regulators so as to ensure that the employees are well informed and empowered towards providing customer services within the framework of laid-down regulatory requirements.

The Bank offers a competitive compensation package towards successfully attracting, retaining and motivating its work force.

Bank’s Operation:

Financial Review:

The process of reforms in the Banking industry is still being continued. This has immensely contributed to the improvement in profitability performance for almost all the

banks. The single largest beneficiaries of the process apparently are the Private Sector Banks in the country. The interest rate for both deposits and leading continues to exhibit upward trend. The fiscal policy framework is that of restraining inflationary tendencies in the economy and therefore credit contraction prescription continuous to be advocated by the regulators.

Overall performance of X Bank Limited during the year 2006 has been quite satisfactory, given the available framework of operation during the period under review.

Interest income:

Interest income of the Bank grew by 41.41 percent and reached to taka 2,157.12 million during the current year compared to taka 1,525.48 million for the previous year.

The growth in income was derived from both Loans and Advances and other income. Interest expense was Taka 1,758.70 million as compared to taka 1210.21 million for 2004 thus growing by 45.32 percent, reflecting the increased cost of deposit acquisition. Interest paid on deposits, particularly term deposits exhibited a sharp upward turn.

The net interest income registered a growth of 26.37 percent at taka 398.42 million during 2006 as against taka 315.27 million for 2005.

Towards providing for Stationary Liquidity requirements, the Bank continued to invest in Government Treasury Bills. In addition the bank has also invested in shares of other legal entities. Interest income from such investment increased to taka 285.71 million during the year compared to taka 132.26 million in 2006, which is a growth of 116.02 percent over the pervious year.

Commission, Exchange and Brokerage income:

Earnings from Commission, Exchange and Brokerage increased by 23.56 percent to taka 377.81 million compared to taka 305.77 in 2005.

Other Operating Income:

Other operating income increased by 51.00 percent to reached at taka 65.20 million during 2006 as compared to taka 43.18 million for the pervious year.

Total Operating Income:

Thus total operating income at taka 1127.13 million registered an impressive increase of 41.52 percent, compared to taka 796.47 million during 2005.

Operating Expenses:

Total operating expenses at taka 452.42 million for the current year compares with taka 310.06 million for 2005, an increase of 45.91 percent.

Operating Profit:

The bank has earned an operating profit before provision and tax of taka 674.72 million compared to taka 486.41 million in the 2005, an increase of 38.71 percent.

Provision against Loans and Advances:

The Bank’s loan portfolio remained under periodic and classification measures were adopted as and when necessary. Classified loans represent 1.44 percent of the Bank’s total loans and advances.

Net Profit:

After providing for provision and taxes the net profit of the Bank for the year 2006 was taka 346.84 million, compared to taka 302.41 million in the previous year an increase of 14.69 percent. After transfer of taka 118.59 million to Stationary reserve from the net profit.

Thus, together with previous year’s retained earning of taka 15.09 million, total amount available for distribution to shareholders is taka 243.35 million. On December 31, 2006 the capital of the Bank was 10.03 percent of the Risk Weighted Asset.

Balance Sheet:

As on December 31, 2006 total asset of the bank was taka 23.14 billion compared to taka 20.10 billion for 2005. The growth thus recorded was 15.12 percent. Major asset’s components were Loans and Advances followed by investments. Deposits constituted the major portion of the Bank’s liability which is 87.51 percent. Contingent liabilities were taka 8.03 billion against taka 7.03 billion for the previous year.

Balance Sheet (As at 31 December 2006)

| 2006 | 2005 | 2004 |

| Taka | Taka | Taka |

| 132 | 71 | 74 |

| 1548 | 1339 | 925 |

| 1680 | 1410 | 999 |

| 1160 | 1379 | 583 |

256 | 301 | 162 |

| 1416 | 1680 | 744 |

| – | 30 | 400 |

| 2591 | 1941 | 991 |

| 730 | 224 | 238 |

| 3321 | 2165 | 1229 |

| 14483 | 12651 | 8752 |

| 1198 | 1200 | 861 |

| 15681 | 13851 | 9613 |

| 246 | 179 | 147 |

| 462 | 452 | 236 |

| 337 | 337 | 53 |

| 23143 | 20105 | 13420 |

| 761 | 193 | 969 |

| 2516 | 2224 | 1273 |

| 161 | 149 | 73 |

| 803 | 562 | 393 |

| 16773 | 15095 | 9177 |

| 20253 | 18030 | 10915 |

| 610 | 596 | 552 |

| 21624 | 18819 | 12436 |

PROPERTY AND ASSETS

Cash

Cash in hand

Balance with Bangladesh

Bank and it’s agent’s Bank

Balance with other banks and financial institutions:

In Bangladesh

Outside Bangladesh

MXy at call on short notice:

Investment:

Government

Others

Loans and Advances:draft etc.

Bills purchased and discounted

Fixed assets including premises, furniture and fixture

Other assets

Non banking assets

Total property and assets

LIABILITIES AND CAPITAL:

Liabilities

Borrowing from other banks, financial institutions and agents

Deposits and other accounts:

Current accounts and other accounts

Bill payable

Savings bank deposit

Term deposits

- Other liabilities

- Total Liabilities

| 2006 | 2005 | 2004 |

| Taka | Taka | Taka |

| 888 | 807 | 690 |

| 381 | 262 | 168 |

| 4 | 15 | 9 |

| 7 | ||

| 151 | 81 | 117 |

| 89 | 121 | |

| 1519 | 1286 | 984 |

| 23143 | 20105 | 13420 |

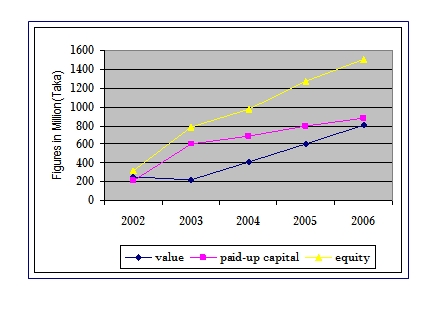

Capital / Shareholder’s equity:

Paid-up capital

Statutory Reserve

Surplus in profit and loss account

Revaluation reserve for HTM Securities

Proposed bonus share

Proposed cash dividend

Total Shareholder’s Equity:

Total Liability and Shareholder’s Equity:

Asset and Liability Management:The Bank’s Asset Liability Committee is entrusted with the responsibility of managing short term and long term liquidity and ensuring adequate liquidity at optimal funding cost.

Financial Analysis:

Financial Ratios:

Financial Ratio is an index that relates two accounting numbers and is obtained by dividing X number by another .There are two types of comparison:

1.Internal Comparison

2.External Comparison

Ratio Analysis:

Ratio analysis involves methods of calculating and interpreting financial ratios to assess the firm’s performance. Ratio analysis of a firm’s financial statements is of interest to shareholders, creditors and firm’s own management. Ratio analysis is the starting point in developing the information desired by the analyst. Ratio analysis provides only a single snapshot, the analysis being for X given point or period in time. In ratio analysis it is possible to compare the company ratio with a standard X. Ratio analysis can be classified as follows:

1. Liquidity ratio

2. Activity ratio

3. Profitability ratio

4. Debt-coverage ratio

5. Owner’s Ratio

Several types of ratios are discussed below:

Liquidity Ratios:

Current Ratios:

It shows a firm’s ability to cover its current liabilities with its current assets.

Current =

Current Assets divided by Current Liabilities

Liquidity Ratio Comparisons:

| Year | X Bank | Industry |

| 2006 | 1.06 | 1.13 |

| 2005 | 1.06 | 1.0 |

| 2004 | 1.07 | 0.98 |

Industry average is stronger than the Ratio.

Current Ration – Trend Analysis Comparison:

Leverage Ratios:

It shows the extent to which the firm is financed by debt.

Debt-to-Equity =

Total Debt/

Shareholders’ Equity:

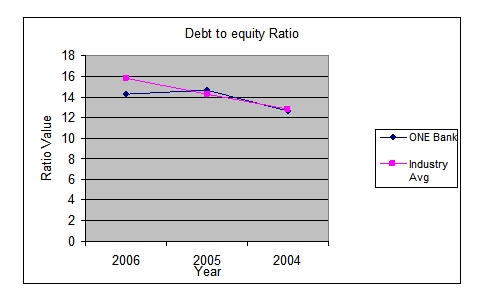

Financial Leverage Ratio Comparisons:

Debt-to-Equity Ratio

| Year | X Bank | Industry |

| 2006 | 14.24 | 15.8 |

| 2005 | 14.63 | 14.27 |

| 2004 | 12.64 | 12.76 |

X Bank has average debt utilization relative to the industry average.

Debt to Equity — Trend Analysis:

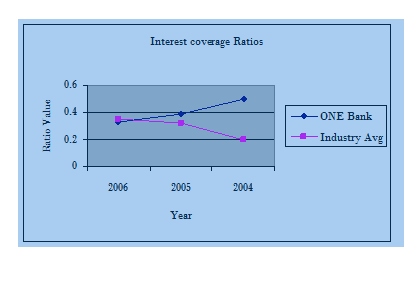

Coverage Ratios:

It indicates a firm’s ability to cover interest charges.

Interest Coverage=

EBIT/

Interest Charges:

Coverage Ratio Comparisons:

Interest Coverage Ratio:

| Year | X Bank | Industry |

| 2006 | .33 | .35 |

| 2005 | .39 | .32 |

| 2004 | .50 | .195 |

Interest coverage ratio of X Bank is increasing than industry Average.

Coverage Ratio — Trend Analysis Comparison:

Profitability Ratios:

Indicates the profitability on the assets of the firm (after all expenses and taxes).

Return on investment:

Return on Investment=

Net Profit after Taxes/

Total Assets

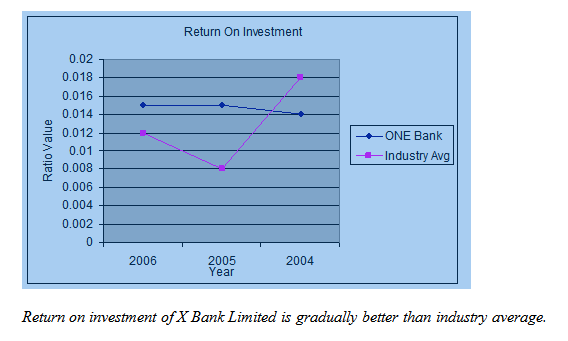

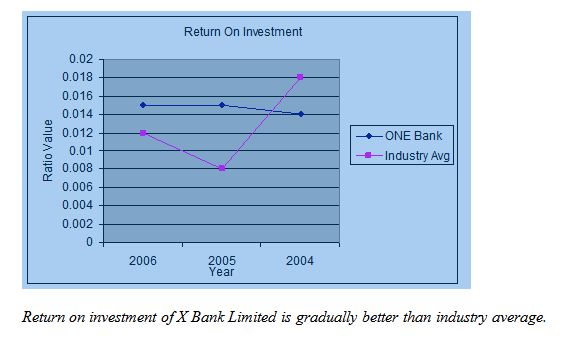

Profitability Ratio Comparisons

Return on Investment:

| Year | X Bank | Industry |

| 2006 | .015 | .012 |

| 2005 | .015 | .008 |

| 2004 | .014 | .018 |

Return on Investment –Trend Analysis Comparison:

Return on Equity:

Indicates the profitability to the shareholders of the firm (after all expenses and taxes).

Return on Equity:

Net Profit after Taxes/

Shareholders’ Equity

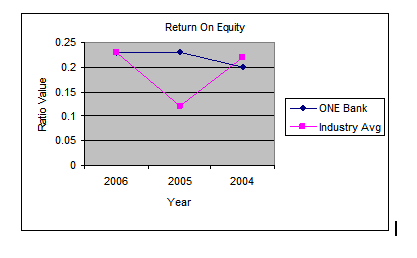

Profitability Ratio Comparisons

Return on Equity:

| Year | X Bank | Industry |

| 2006 | .23 | .23 |

| 2005 | .23 | .12 |

| 2004 | .20 | .22 |

X Bank has good Return On Equity than Industry Average.

Return on Equity –Trend Analysis Comparison:

Return on Equity of X Bank Limited is good than Industryl Average

Conclusion:

In this report we have discussed about different ratio of X Bank Limited. Our main job was to determine the financial position of this Bank whether it is running good or not. As we are very new in finance course, we face some problem while doing this assignment. But we have tried hard to complete this assignment successfully. From the over view of three years data we find that the Bank face some problem in different sector in 2004. Other wise everything is tolerable but they must try hard to increase their net income again to create a good impact on investor.