SWOT Analysis of the IFIC Bank:

Strengths:

IFIC bank has already established a favorable reputation in the banking industry of the country. It is one of the leading private sector commercial bank in Bangladesh. The bank has already shown a tremendous growth in the profits and deposits sector.

IFIC Bank Ltd. has a long-term reputation in the banking industry as it is one of the oldest players here. So, their enduring good will in the field works as a vital strength.

IFIC bank has an interactive corporate culture. The working environment is very friendly, interactive and communicate provides as a great motivation factor among the potential customer.

It has excellent Management.

It has high commitment of customer, qualified and experienced Human Resource.

It has sophisticated automated banking system in most of its branches which foster the overall banking activity.

Weakness:

Lack of motivation among the workers.

Heavy dependency on Head Office in decision making sometimes slower the work process.

Lack of extrinsic and intrinsic reward & incentives for the employees from management sometimes result to job burn out.

High dependency on ‘word of mouth’ strategy instead of obtaining any marketing strategy.

Absence of teamwork between branches.

Opportunity:

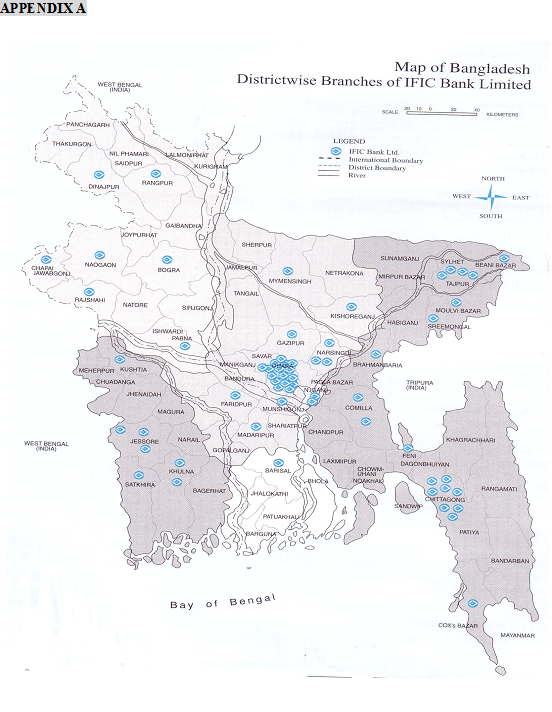

Other unexplored district where branches can be set up.

High awareness among all level of people to deposit money in the banks.

Increasing the demand of customer finance.

Investment potential of Bangladesh.

Relationship Management.

Threats:

Some commercial/ Foreign Bank as well as private bank are increasing

Similar type of retail banking products, such as insurance company, stock exchange, financial institution etc.

Frequent changes in rules and regulations from Bangladesh Bank.

Customer awareness of pricing and service.

Recommendation

Rectify the Existing Problems:

As there is no classified loan, branch should monitor the loans & advances closely to avoid classification in future.

Dhanmondi Branch should extend with their all out effort to increase the credit portfolio and to procure more low cash deposit, increase non funded business so as to minimize dependency on interest earning from IFIC Bank general account and to improve overall business performance of the branch to maintain earning.

Dhanmondi Branch should set up more CC camera in the branch to hold more control of manager in the branch. It can install CC camera in accounts department and clearing department as it is an important past of the branch and it is not always possible for the manager to visit all departments which has become important.

Dhanmondi Branch can contact with the existing customers to make the dormant accounts operative.

When a joint stock company comes to open an account if it’s an existing one, the account opening officer should ask the copies of the Balance Sheet and Income Statement. These will reflect the financial growth of the company and its soundness but in practice bank do not do this. If they have all these that will help them to examine money laundering risk.

There are numbers of new private banks and some have already activated with their extended customer service pattern in a completely competitive market. Where as IFIC Dhanmondi branch is far behind. They are not competitive in customer service because the officers do not behave in professional manner in fort of customer. Some time they are late in there service, which ultimately disturbs the respective customer.

Dhanmondi branch personnel should train up about all sort of information regarding SWIFT and its service. Due to lack of proper knowledge about the operation procedures and services provided to the customers by SWIFT, certain customers are facing problem, as they have to wait for certain time to get service as there was one officer know about the procedure of SWIFT. He is not fully independent of handling SWIFT. Official training is the solution to this problem. For customer’s convenience in Foreign Exchange Department of IFIC Bank Ltd. should provide more personnel to deliver faster services to their honorable customer.

Now a day conventional banking concept is outmoded. Now banks are offering more ancillary services like credit card, online services and many others. IFIC Bank Ltd. should differentiate its services through adopting the modern facilities and implementing in the branch level.

To deliver quality service top management of this breach should try to mitigate the gap between customer’s expectation and employee’s perception and customer’s convenience should give priority.

Administrative cost of this branch is on the high side, which has a major impact on profitability. Te manager should bring down the administrative cost and take all effective steps, strategy and action plan to reduce the cost at the desired level.

IFIC Bank should always monitor the performance of its competitors in the field of Foreign Trade.

Without proper knowledge in different laws, rules which set by Bangladesh Bank efficiency of employees cannot be optimize. Bank can arrange training program on these subjects and can test its employees which will improve their qualities.

IFIC Bank Ltd. should focus on their promotional activities. They should also focus on the marketing aspects to let customers know about their products and offerings and more promotion is should be given to attract new customer.

IFIC Bank Ltd. must develop electronic banking system to moderate the service. Technological advantage of a bank ensuring its competitive edge in the market place which can only be achieved by improved technology, efficient manpower and better services. If bank get more market share through all these than it will reduce operating cost and generate new revenue. The bank can offer to its customer better service if all of its departments are computerized and incorporated under local area network (LAN).

Without using modern technology no bank can even think of remaining in the business in near future. So the bank must decide right now how it can equip its branches with modern technology. Use of modern technology in one sense can increase cost but another sense it increase higher productivity and it attract big clients. It can introduce ATM service again in all branches which will bring speed in banking services.

Bank is providing both internal and external training for the officers but bank should be scrupulous about the training facilities so that officials can implicate this in their job. People are very choosy about environment now a day, so bank premises should be well decorated and IFIC Bank Ltd. should look into the matter very seriously as well. Side by side it will give customers better felling about the bank.

Implementation:

Some other important factors that should be focused on the development process:

- Time consumed at service level should be minimized at optimum level.

- Evaluate customer’s needs from their perspective and explain logically the shortcomings.

- Customer’s convenience should receive priority over other.

- Improve office atmosphere to give customers better feeling.

- Use of effective management information systems.

- Use appropriate techniques in evaluating customer need professionally.

- To deliver quality service top management should try to mitigate the gap between customer’s expectation and employee’s perception.Comments:

The bank can offer to its customer better service if all of its departments are computerized and incorporated under local area network (LAN).

At the entry position the bank should enroll more expertise people to augment quality services.

Now a days-conventional banking concept is outmoded. Now banks are offering more ancillary services like credit card, on line services and many others. IFIC Bank Ltd. should differentiate its services adopting the modern facilities.

Bank is providing both internal and external training for the officers but bank should be scrupulous about the training facilities so that official can implicate this in their job.

People are very choosy about environment now a day, so bank premises should be well decorated and IFIC Bank Ltd. should look into the matter very seriously.

Bank should provide advances towards the true entrepreneur with reconsidering conventional system of security and collateral, moreover, the whole process should be completed within an acceptable time.

DEPOSITE RATIO:

| 2009 | 2008 | 2007 |

| 65.41% | 61.42% | 60.26% |

| 2009 | 2008 | 2007 |

| 12.62% | 14.51% | 16.02% |

LOAN & ADVANCES RATIOS:

| 2009 | 2008 | 2007 |

| 50.77% | 52.11% | 57.56% |

| 2009 | 2008 | 2007 |

| 49.23% | 47.89% | 42.44% |

| 2009 | 2008 | 2007 |

| 65.81% | 73.92% | 72.35% |

| 2009 | 2008 | 2007 |

| 79.33% | 77.94% | 80.13% |

| 2009 | 2008 | 2007 |

| 36.47% | 39.50% | 43.44% |

| 2009 | 2008 | 2007 |

| 35.36% | 36.29% | 32.03% |

| 2009 | 2008 | 2007 |

| 58.39% | 70.81% | 75.26% |

| 2009 | 2008 | 2007 |

| 293.34% | 275.44% | 208.76% |

INTEREST PAID OR COST OF SERVICES:

| 2009 | 2008 | 2007 |

| 0.41% | 0.50% | 0.84% |

| 2009 | 2008 | 2007 |

| 30.36% | 29.16% | 26.04% |

| 2009 | 2008 | 2007 |

| 0.35% | 0.40% | 0.66% |

| 2009 | 2008 | 2007 |

| 4.91% | 5.57% | 5.47% |

| 2009 | 2008 | 2007 |

| 6.57% | 6.75% | 10.77% |

| 2009 | 2008 | 2007 |

| 93.43% | 93.25% | 89.23% |

REVENUES:

| 2009 | 2008 | 2007 |

| 14.29% | 10.75% | 10.25% |

| 2009 | 2008 | 2007 |

| 2.49% | 4.34% | 5.02% |

| 2009 | 2008 | 2007 |

| 85.52% | 72.93% | 73.48% |

| 2009 | 2008 | 2007 |

| 14.48% | 27.07% | 26.52% |

INTEREST PAID VS CHARGED:

| 2009 | 2008 | 2007 |

| 4.94% | 6.55% | 10.82% |

| 2009 | 2008 | 2007 |

| 414.89% | 243.86% | 248.53% |

| 2009 | 2008 | 2007 |

| 4.22% | 4.78% | 7.95% |

| 2009 | 2008 | 2007 |

| 60.07% | 66.01% | 65.92% |

| 2009 | 2008 | 2007 |

| 75.17% | 97.05% | 100.54% |

| 2009 | 2008 | 2007 |

| 444.04% | 261.52% | 278.52% |

| 2009 | 2008 | 2007 |

| 64.29% | 70.78% | 73.88% |

TURNOVER RATIOS & PERODS:

| 2009 | 2008 | 2007 |

| 103.73% | 97.62% | 96.81% |

(days)

| 2009 | 2008 | 2007 |

| 347.0385562 | 368.7751834 | 371.8537269 |

PROFITABILITY / EFFICIENCY RATIO:

| 2009 | 2008 | 2007 |

| 2.18% | 1.79% | 1.58% |

| 2009 | 2008 | 2007 |

| -0.36% | 0.66% | 0.71% |

| 2009 | 2008 | 2007 |

| 1.82% | 2.45% | 2.30% |

| 2009 | 2008 | 2007 |

| -4.14% | -4.96% | -5.04% |

| 2009 | 2008 | 2007 |

| 6.09% | 6.14% | 6.06% |

EXECUTIVE SUMMARY:

The internship report is prepared with respect to the three months internship program in IFIC Bank Limited. The internship program helped me a lot to learn about the practical environment and situation of a financial institution and also make up a bridge between the theoretical and practical aspects and also to implement my theoretical knowledge in to the practical and realistic work environment

This report is composed of six chapters, which are further divided into different parts. In the first chapter the introductory portion have been presented along with rationale of study and the scope of the study and the overview, products and prospects of IFIC Bank Limited has been discussed in chapter two. Chapter three deals with the General Banking of IFIC bank Limited along with details about credit activities.

In chapter four, I have highlighted the Loan and advance of the project which includes different types of loan. Chapter five deals with the descriptive analysis of the variables along with empirical analysis for determining why interest rate differs from client to client. The empirical analyses that have been used are correlation analysis and regression analysis. In chapter Six, I tried to give a summary and conclusion along with my findings and recommendation.

I tried to bridge up all the findings based on analysis and discussions. While preparing the report I always tried my best level to make it authentic and at the same time easily understandable. For this, I came up with a number of reference books and journals to get the theoretical backup. In spite of my heart and soul effort there may be some mistakes and unforeseen errors, which may arise due to my naive or inexperience state.

Bibliography:

In this report the overall considerations of IFIC Bank Limited has been discussed. I have collected this information from the following sectors:

S.N. Maheshwari, 2006, “Kalyani’s Banking Law and Practices”- (11th Edition), Xpress Grafics.

Roger LeRoy Miller, David Van House, “Money, Banking and Financial Markets” – (2nd Edition), Thomson south-western

Scott Besley, Eugene F. Brigham, “Essential of Managerial Finance”- (13th edition), the Dryden press, a division of Harcourt Collage Publishers

Eugene F. Brigham, Michael C. Ehrhardt, “International Financial Management” – (10th Edition), Thomson south-western

Ministry of Finance (MOF), Government of Bangladesh (GOB). (1998-99, 1999-2000), Activities of Bank Financial Institutions.

Bank Company law”, 1991, Bangladesh Bank.

Annual Report of Bangladesh Bank 2005-2009

Annual Report of IFIC 2005-2009

Comparative Banking Lecture Sheet.

Table of contents

SL

| Particular Items | Page No | |